Most major global markets, except for China, where companies have been caught between the likelihood of regulatory intervention from both China and the US, recorded gains in March. This despite ongoing inflation fears, a seemingly relentless rise in US bond yields, and new COVID-19 lockdowns in parts of Europe, weighing on sentiment. Investors also seemed to have priced-in a rapid global recovery from the pandemic on the back of unprecedented stimulus measures (the US Congress passed a US1.9trn COVID-19 relief package in mid-March) and with a massive vaccine rollout in especially the US and the UK (among major developed markets [DMs]). On Wednesday (31 March), US President Joe Biden also unveiled a US$2trn American Jobs Plan, which will focus on increasing spending on major infrastructure categories (roads, highways, bridges etc.) as well as confronting climate change and attempt to curb wealth inequality. Biden said that the spending, over an 8-year period, would generate “millions of new jobs” and, to help pay for it, he proposed substantial increases on corporate taxes.

Following its March meeting, the US Federal Reserve’s (Fed) Federal Open Market Committee (FOMC) left the fed funds rate unchanged at 0.00% to 0.25% – its level for the past year. However, the Fed greatly improved its economic forecasts and indicated that it does not expect to hike interest rates through 2023. Fed Chair Jerome Powell also said that the Fed will “tolerate” inflation above its 2% target for a period of time before increasing rates. The major US indices ended March in the green, with the S&P 500 setting an intraday record on 31 March. MoM, the Dow Jones gained 6.6% and the S&P 500 rose by 4.2% (these two indices are up 7.8% and 5.8% YTD/1Q21, respectively). The tech-heavy Nasdaq advanced by 0.4% MoM (+2.8% YTD/1Q21) – its fifth consecutive positive month.

On the US economic data front, ADP’s private sector payrolls data showed a jump of 517,000 in March (the largest gain in c. six months) and the Chicago purchasing managers index (PMI) for March recorded its highest level (66.3) in around 30 months (a level above 50 indicates expansion, while below 50 signals contraction). The index gauges business conditions in the Chicago region, which is seen as a bellwether for US economic growth. In late March, the US Bureau of Economic Analysis (BEA) released its third 4Q20 GDP estimate, which was revised upwards to 4.3%, from a second estimate of 4.1% YoY. Unfortunately, February US pending home sales slid 10.6% MoM and by 0.5% YoY, with all regions recording a decline, while personal spending and retail sales also fell more than expected. The US dollar held at near five-month highs as Treasury yields resumed their upward march.

It was a bullish month for major European markets, with the region’s largest economy, Germany’s DAX up 8.9% MoM (+9.4% YTD/1Q21), while France’s CAC rose 6.4% MoM (+9.3% YTD/1Q21). In terms of economic data, both Germany and eurozone manufacturing PMIs hit record highs on the back of a demand rebound. Although the eurozone’s services sector continued to contract, Germany’s services sector expanded in March. Business and consumer confidence data rose as hopes of an end to the pandemic and a pickup in economic activity surfaced, although we note that with the implementation of fresh lockdowns across Europe, economists only expect the economy to bounce back in 2H21.

In the UK, the FTSE 100 gained 3.6% MoM (+3.9% YTD/Q21), while on the economic data front, UK inflation slowed to 0.4% in February vs January’s 0.7% print. This as the country’s third lockdown saw a wave of discounting from clothing retailers and secondhand car dealers. The Financial Times (FT) reports that, in general, the latest UK economic data have been significantly better than expected. The FT writes that “most of the important economic data for the period of the lockdown that began on 4 January, including output, employment, business sentiment and public finances, have been better than forecast and much stronger than in the first lockdown, showing the ability of businesses and consumers to adapt.”

Asia was a mixed bag, with Chinese markets under pressure as the Hang Seng lost 2.1% MoM (+4.2% YTD/1Q21), while Hong Kong’s Shanghai Composite Index closed 1.9% lower (-0.9% YTD/1Q21). The Hang Seng has been under pressure recently over the Chinese government’s move to ratchet up regulation and anti-trust scrutiny on the largest Chinese corporates. China’s official March manufacturing PMI came in at a faster-than-expected pace of 51.9 vs February’s 50.6 print, while the Caixin/Markit manufacturing PMI for March came in lower – at 50.6, vs February’s reading of 50.9. In Japan, the Nikkei closed the month 0.7% higher (+6.3% YTD/1Q21).

On the commodity front, oil prices (-3.9% MoM/ +22.7% YTD/1Q21) came under pressure as data showed an increase in Iranian oil production, which pushed March OPEC oil output higher. The Suez Canal opening, after days of being closed due to a grounded containership, also weighed on oil prices at month-end. OPEC+ meets this week and the possibility of supply curbs may be on the table amid new COVID-19 lockdowns. Gold remained under pressure – down 1.5% MoM and 10% YTD/1Q21. Iron ore lost 6.2% MoM, while tight supply and strong demand in palladium (+13% MoM) saw the metal rally towards the all-time highs it achieved pre-COVID.

South Africa’s (SA’s) FTSE JSE All Share Index rose for a fifth-straight month, although its March gain was by the slightest of margins (+0.5% MoM). Nevertheless, the local bourse had a strong quarter with a double-digit return as the index soared 11.9% YTD/1Q21. For March, gains were largely limited to industrial counters, with the Indi-25 gaining 1.5% MoM (+12.2% YTD/1Q21). Among the JSE’s biggest market cap shares, MTN jumped 19.5% MoM after saying that it was considering spinning out its fibre and financial services units to unlock value in its core business. It was followed by Anglo American Platinum, Sasol, impala Platinum, British American Tobacco, and Annheuser Busch Inbev (AB InBev), which soared by 17.3%, 12.3%, 11.2%, 7.4% and 6.4% MoM, respectively. The Fini-25 rose 0.6% MoM (+1.7% YTD/1Q21), dragged into positive territory by counters such as Capitec (+6.0% MoM), ABSA (+3.9% MoM), and FirstRand (+2.6% MoM). The Resi-10 lagged – down 1.2% MoM, but still 15.8% higher YTD/1Q21. Prosus, the JSE’s largest share by market cap, lost 6.9% MoM, while Naspers (the fourth-largest share on the exchange) eked out a gain of 0.4% MoM. Despite US dollar strength and volatility in emerging markets (EMs) after Turkey’s President Recep Tayyip Erdogan fired his central bank governor after only four months in office, there seemed to be very little spillover effects on the rand, which closed 2.3% higher MoM, and is now 0.6% firmer against the US dollar for 1Q21/YTD.

In local economic data, February annual consumer price inflation (CPI) slowed to 2.9% YoY vs January’s 3.2% print – the lowest CPI reading since June 2020, when the inflation rate was 2.2%, and the third time in the past year that annual inflation has slipped below the bottom end of the South African Reserve Bank’s (SARB’s) 3%-6% inflation target range. January retail sales were down 3.5% YoY vs December’s revised 1.2% YoY decline. This was worse than the 2.4% YoY contraction which Bloomberg consensus economists had expected. The biggest negative contributors were the food, beverages, and tobacco stores (-33.6% YoY in sales contributing a negative 2.6% YoY to the overall decline) and general dealers’ categories (-6% YoY in sales and contributing a negative 2.5% YoY to the overall 3.5% drop). Both categories would have been hard hit by the alcohol ban that was in effect for the entire January. Elsewhere, the trade surplus widened to R28.96bn in February vs a revised R12.42bn in January. Exports rose 16.5% MoM to R128.25bn, while imports advanced by 1.6% MoM to R99.29bn. At its March meeting, the SARB’s Monetary Policy Committee (MPC) kept the repo rate at 3.5%. The SARB now forecasts 2021 GDP to grow by 3.8% YoY (up from its 3.6% YoY forecast in January). Notably, GDP is expected to grow by 2.4% YoY in 2022 and by 2.5% YoY in 2023 – both forecasts unchanged from the January meeting.

On the COVID front, President Cyril Ramaphosa announced that 11mn doses of the Johnson & Johnson COVID-19 vaccine had been secured and that a further 20mn of these single-dose shots would be arriving in SA soon. He also said that government was finalising the acquisition of 20mn doses of the Pfizer vaccine, stressing that enough vaccines would be available to start phase two of the vaccine rollout in May. The latest data from the Department of Health show that as at 31 March 2021, the total number of confirmed COVID-19 cases stood at 1.55mn vs end-February’s 1.51mn.

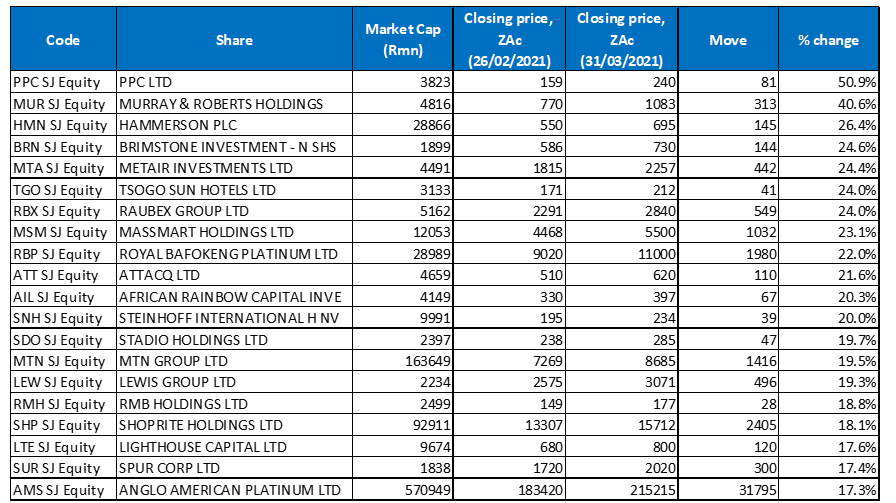

Figure 1: March 2021’s 20 best-performing shares, MoM

Source: Anchor, Bloomberg.

PPC (+50.9% MoM) was March’s best-performing share. The share price rocketed after the cement producer announced that it had made progress in de-risking its balance sheet and improving its investment prospects. Business Day reports that PPC has reached a binding agreement with lenders to its unit in the Democratic Republic of Congo to restructure R2.6bn in senior debt owed by the unit, which simultaneously eliminates their right to seek recourse from the broader Group in the event of non-payment. In addition, improved cement sales, cost reductions, better working capital management, and cash preservation over the 11 months to end-February 2021, meant that PPC’s lenders have agreed to postpone a R750mn capital raise (initially planned for 31 March), by six months. PPC has been struggling for some time now as its African expansion strategy saw it accumulate debt totalling c. R5.2bn at end-September 2020.

PPC was followed in second spot by construction and engineering Group, Murray & Roberts (+40.6% MoM). Last month, the firm said its order book had achieved a record high of R60.5bn in the six months to end December, after it won tenders for large projects in Australia’s energy sector. The company believes this could grow by c. 32% to around R80bn by end-June 2021. In an interview with Business Day, CEO Henry Laas said that this meant that Murray & Roberts was well positioned for a return to profitability in FY21.

March’s third-best performing share was UK mall owner, Hammerson Plc. Hammerson, which has been hit hard by the COVID-19 pandemic and ensuing lockdowns, recorded a share price gain of 26.4% MoM. In March, the company said that it would look towards further disposals to strengthen its balance sheet, and to manage the refinancing and sharpening of its the operations to maximise income. The retail sector, already in the grip of major structural change due to the growth of online sales, has been significantly impacted by pandemic restrictions, and there has been several retail failures. Results for the year ended 31 December 2020, showed that the Group’s portfolio value dropped by 23.9% YoY to GBP6.34bn (c. R132bn).

Hammerson Plc was followed by Brimstone Investments, Metair Investments, Tsogo Sun Hotels, and Raubex Group, which recorded MoM gains of 24.6%, 24.4%, and 24.0% (both Tsogo Sun and Raubex). Last month, Brimstone, the largest shareholder in food producer Sea Harvest, reported a FY20 loss of R43.8mn vs a profit of R75.3mn in FY19, mainly due to a downward revaluation of its listed investments. According to the company, the pandemic has forced it to become “leaner and meaner.” Brimstone said it is waiting until “more market certainty” before making any new investments as COVID has made it “harder to accurately value potential acquisitions.” Meanwhile, automotive parts manufacturer, Metair, which was also hard hit during 1H20 as the pandemic weighed on demand for its products, reported FY20 results. Group revenue fell 9% YoY to R10.3bn on the back of the decline in vehicle demand in 1H20, while headline earnings per share (EPS) recovered to ZAc148 from a ZAc56 loss per share in 1H20. However, this was still 66% lower than the EPS of ZAc336 achieved in FY19. In March, the company said that trading conditions had improved in 2H20, prompting it to reinstate its dividend, adding that 2021 had started positively and the business was performing reasonably, thus far.

Rounding out the top-10 performing shares in March was Massmart, platinum miner Royal Bafokeng Platinum, and Attacq, which recorded MoM gains of 23.1%, 22.0%, and 21.6%, respectively. Massmart’s FY20 results, released in March, showed that its overall sales declined 7.7% YoY to R86.7bn, while it reported a diluted loss per share of ZAc802.30 compared with a loss of ZAc594.9 in the same period of the prior year. However, Massmart’s share price surged 20.8% on the day, after it announced that it intended to sell its stand-alone Rhino and Cambridge grocery stores as part of a turnaround strategy it had embarked on in January 2020 to bring the business back to profitability.

Royal Bafokeng reported FY20 results, which showed a revenue increase to R13.38bn from R7.49bn posted in the previous year, while diluted EPS rose YoY to R12.44. Last year was characterised by a significant improvement in the platinum group metals (PGMs) market, a weaker rand, and a strong operational performance which resulted in record production numbers. The miner also declared its maiden dividend on the back of a 2,734.2% increase in FY20 headline earnings to R3.5bn. Finally, in its 1H21 results, real estate investment company Attacq reported a YoY revenue advance to R1.21bn, while its diluted loss per share stood at ZAc56.40, compared with ZAc5.30 recorded in 1H20.

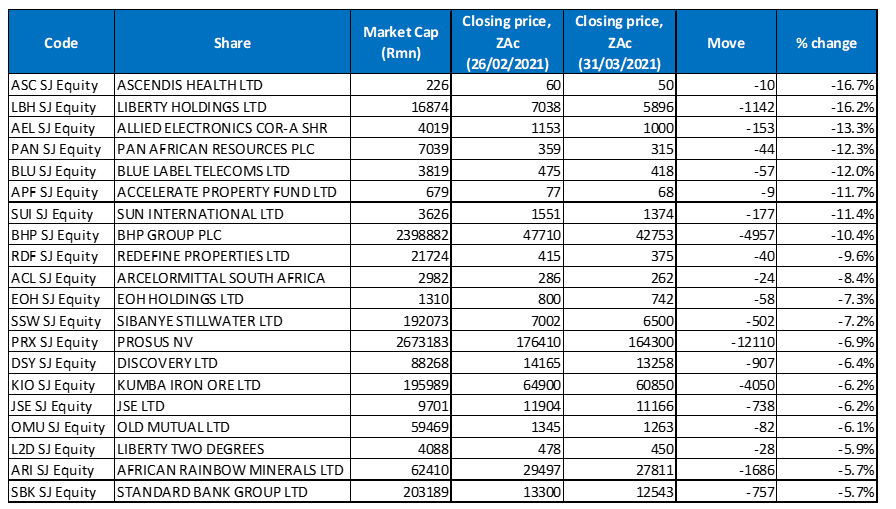

Figure 2: March 2021’s 20 worst-performing shares, MoM

Source: Anchor, Bloomberg.

Ascendis Health was March’s worst-performing stock, with a 16.7% MoM share price decline. In its 1H21 results, the pharmaceutical company revealed that it had suffered a massive R673.80mn loss from a R204.96mn profit in 1H20. This came as rising debt, higher finance costs, increased tax expenses, and impairments impacted its performance. The company incurred a R246mn impairment during the period with its tax expense increasing to R139mn and net debt rising to R6.6bn, pushing normalised headline earnings down 131% YoY to a loss of R43mn, with a normalised headline loss per share from continuing operations of ZAc9. Despite these losses, its revenue jumped 33% YoY to R3.98bn, while its diluted loss per share stood at ZAc140, compared with an EPS of ZAc46.00 recorded in 1H20. Last month, Ascendis also informed shareholders that it had up to the end of April to negotiate a deal with lenders that would see it recapitalise its business to survive. The company has been struggling to pay off a debt burden of R6.9bn (as at the end of June), leading to it looking for ways and means to solve its short-term liquidity challenges.

Insurer and asset manager, Liberty Holdings was March’s second-worst performing share, with a MoM decline of 16.2%, while Allied Electronics (Altron) came third, recording a 13.3% MoM share price drop. In March, Liberty reported a significant swing in its profitability (-R4.8bn) due to the impact of the second wave of the pandemic in late-2020. It opted not to pay a dividend as it swung from FY19 headline earnings of R3.25bn to a FY20 headline loss of R1.54bn. Most of this related to the establishment of a pandemic reserve of R3bn to deal with the immediate fallout of elevated insurance claims associated with COVID-19. The other major contributor to the swing from a profit to a loss was the R1.2bn economic impact of the pandemic, which manifested in constrained sales and higher costs associated with the hard lockdowns.

Meanwhile, February’s worst-performing share, Pan African Resources lost a further 12.3% in March, coming in at fourth position. In March, Pan African Resources said that it had chosen to prioritise repaying its debt over declaring an interim dividend during the six months to the end of December 2020. The Group’s debt was reduced by 47.3% YoY to c. R951mn in December as it pushed to strengthen its capital structure. CEO Cobus Loots said that, given the record rand dividend the company had paid last year, it wanted to strike a balance between debt reduction and a dividend. “At the R900,000/kg gold price, the Group should be debt-free by the end of the financial year,” according to Loots.

It was followed by Blue Label Telecoms, Accelerate Property Fund, and Sun International, with MoM declines of 12.0%, 11.7% and 11.4%, respectively. At the end of February, Blue Label reported 1H21 results, which showed that revenue fell 15% YoY to R9.6bn, while core headline earnings for the period amounted to R376mn (-4% YoY), equating to core headline earnings of ZAc42.70/share, of which R351mn related to continuing operations. The company is a 45% shareholder in Cell C, which has been impaired to a valuation of nil and it said that it is confident Cell C will continue as a going concern for a while, and that it will eventually be recapitalised. Sun International has been battered by the pandemic, with its FY20 income from continuing operations plunging by almost half to R6.1bn, following the complete closure of its operations during the three-month hard lockdown and ongoing restrictions to trade. It was forced to completely close its operations for just more than three months in 2020, but then faced ongoing trade restrictions (travel bans, liquor bans, curfews, capacity limits etc.), which weighed heavily on the Group. The drastic drop in income, saw the Sun International reporting a R1.1bn headline loss for the year.

BHP Group (-10.4% MoM), Redefine Properties (-9.6% MoM), and ArcelorMittal SA (AMSA; -8.4% MoM) rounded out the ten-worst performing counters for March. BHP was weighed down by a sell-off in iron ore (-6.2% MoM) for most of March, as China closed more steel mills and in reaction to anti-pollution output curbs in the country’s top steel-producing city of Tangshan. Reuters reported last week that investors were concerned that more steel production cuts in China could significantly dampen demand. A notice that reportedly circulated in China’s steel industry threatened output cuts of between 30% and 50% for pollution defaulters in Tangshan, with the restriction expected to be expanded to other steel-producing cities in China. After its 77.6% MoM rise in February, AMSA fell back in March. Last week it registered its objection to calls for the introduction of a refund to cushion steel importers reeling due to the high duties they face in SA, saying that imports without duties will lead to an oversupply in the country later this year. The steel sector has had a difficult time in recent years, with the broader metals and engineering industry shedding c. 49,000 jobs over the past decade and industry players blaming this on the protection offered to AMSA. Downstream users argue they are operating on the back foot as they have to buy steel at uncompetitive prices from AMSA to make their products, which generally do not enjoy any import protection, and struggle to compete with imported finished goods made from cheap Chinese steel.

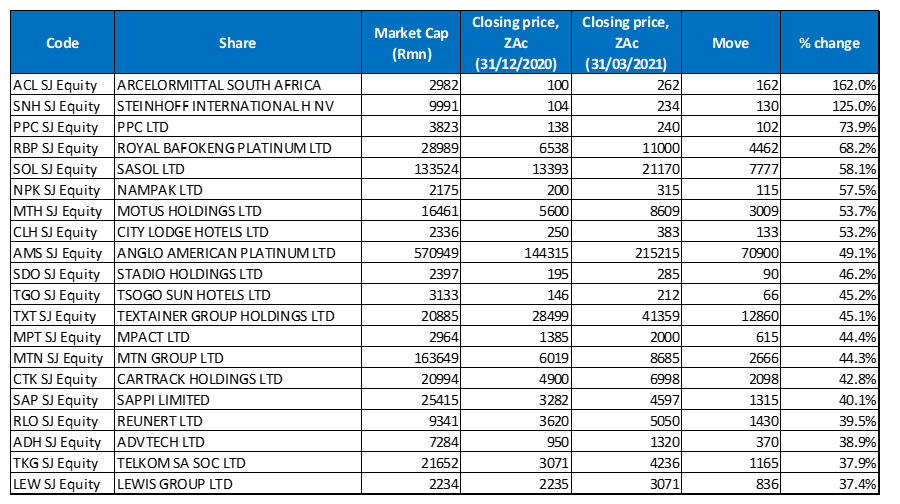

Figure 3: Top-20 March 2021, YTD/1Q21

Source: Anchor, Bloomberg

Eight of the top-10 YTD/1Q21 best-performing shares were unchanged from February, with the new entrants being PPC and investment holding company, Stadion Holdings moving into the top-10. PPC was the second-best performing share YTD, after its stellar 50.9% MoM gain in March, while Stadio (+46.2% YTD/1Q21) took tenth position. In March, Stadio posted double-digit growth in FY20 earnings, boosted by a 10% YoY rise in student numbers to 35,031, despite the pandemic. Its revenue surged 14% YoY to R933mn, while core headline EPS increased 31% YoY to ZAc14.2.

ArcelorMittal SA (+162.0% YTD/1Q21, discussed earlier) again took the top spot, followed by Steinhoff (+125.0% YTD/1Q21), in second position for another month. Steinhoff gained a further 20.0% MoM in March, with the company saying in March that it had received support from four large active claimant groups (ACGs) for the implementation of its proposal to resolve multi-jurisdictional legacy litigation against it. These claimants represented market purchases based in SA and abroad. Earlier in March, Steinhoff reached an agreement of up to EUR78.1mn with some of its former directors and officers, who worked for, or had been associated with, the company, to settle legacy claims against it. PPC (discussed earlier) was the third-best performing share YTD/1Q21, with a 73.9% gain.

PPC was followed by Royal Bafokeng (discussed earlier), Sasol, and Nampak, with YTD/1Q21 share price gains of 68.2%, 58.1% and 57.5% YTD. Nampak said last month that its businesses have bounced back since SA exited the hard lockdown in June 2020 and restrictions eased further in September. In a voluntary trading update for the five months to end-February 2021, Nampak reported that total revenue has climbed 1% YoY. Motus Holdings (+53.7% YTD), City Lodge Hotels (+35.6% YTD), Amplats (+35.3% YTD), and Stadio (discussed above) rounded out the top-10 YTD performers. Motus and City Lodge’s shares surged by 13.0% and 9.6% MoM in March, respectively. Last month, Motus announced it had acquired a 49% stake in Synapt Proprietary, which owns GetWorth, a tech and pre-owned vehicle business that uses its own patented technology to assist customers “to buy right and sell smart”. The acquisition is expected to fast-track Motus’ positioning in online vehicle buying and warehouse retailing, resulting in increased vehicle sales, according to the company.

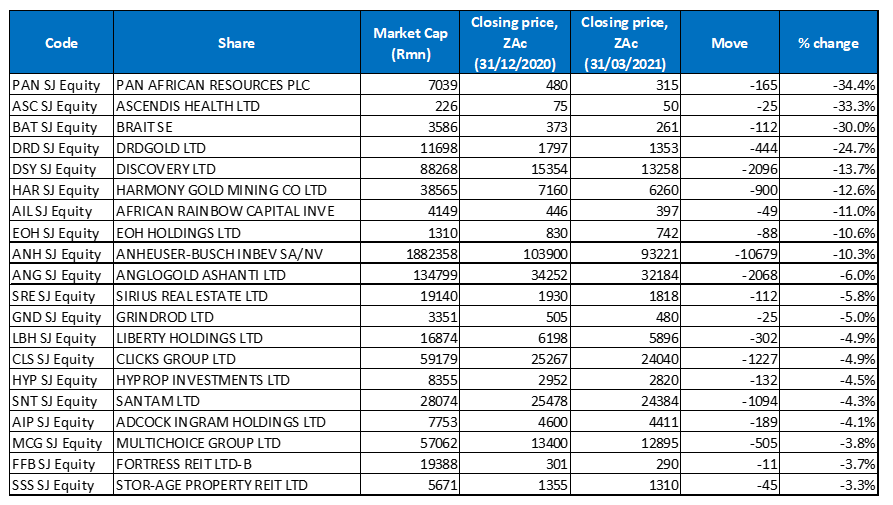

Figure 4: Bottom-20 February 2021, YTD/1Q21

Source: Anchor, Bloomberg

Looking at the YTD worst performers, eight of the shares among the ten-worst performing counters were also among the 10 worst performers for the year to end February. Last month’s worst performer YTD, investment Group Brait (-30.0% YTD/1Q21) strengthened and moved to third position for the year to end March, with Pan African Resources (-34.4% YTD) replacing it as the overall worst performing share YTD. Meanwhile, March’s worst performer MoM, Ascendis Health (-33.3% YTD/1Q21), discussed earlier, came in second.

Brait was followed by DRDGold (-24.7% YTD/1Q21), Discovery (-13.7% YTD/1Q21), Harmony (-12.6% YTD/1Q21), and African Rainbow Capital Investments (ARC; -11.0%YTD). Weakness in the gold price has weighed on gold producers this year, while ARC’s share price has fallen from a high of c. R8 at its late-2017 listing to the current level of R3.97/share which, according to Moneyweb, is less than half its NAV. Last month, ARC said that the pandemic and resultant lockdowns had a mixed impact on its portfolio of 50 businesses, with some impacted favourably, while others were adversely impacted. The value of its intrinsic portfolio rose 15% to R12.8bn – up from R11.1bn at the end of June 2020, with cash in the ARC Fund of R455mn to deploy for future investments.

Other companies featuring prominently among the ten worst-performing shares were EOH Holdings (-10.6% YTD), AB InBev (-10.3%), and AngloGold Ashanti (-8.3% YTD). EOH said in March that it expects its losses to narrow significantly in 1H21, but the share price nevertheless fell sharply on the day (-10% on 25 March) in reaction to the trading statement. EOH said it will report positive operating profit and earnings before interest, tax, depreciation and amortisaton (Ebitda) for the period, with continued improvement in gross profit and normalised Ebitda margins despite the current difficult economic environment. It also indicated that it expects the headline loss per share to improve by between 83% and 86% YoY, for a loss of between ZAc66 and ZAc54/share (vs -R3.95 a year ago).