Global stock markets have experienced material downside and massive volatility in recent weeks. Below, we look at the current situation in more detail. Our key points are:

- We now have a double black-swan scenario, where two unexpected impacts are being felt by markets – first the novel coronavirus (COVID-19) phenomenon; and second Russia effectively pulling out of OPEC+, which has seen the oil price fall over 30% in a few hours (to close at its lowest levels in 15 years). The market is digesting the impact of both events and buyers have stepped back, resulting in massive share price drops.

- Markets are down by between 15% and 25% from their highs – a massive drop. We consider 20% to be significant and 30%-40% to be a crash. Nobody can predict what happens next and investors should be prepared for continued volatility. As fund managers we are keeping our eye on the horizon and not panic-selling out of quality businesses where we do not think their long-term value has changed. Equity investors have to be prepared to stomach this volatility from time to time and selling out of panic is almost always the wrong thing to do over a reasonable time period.

- The key decision we have to make is whether current market drivers are transitory in nature or whether they will have long-term impacts. While there are certainly businesses whose values will change materially (e.g. cruise ship companies or airlines), for the most part, we think this scenario will pass with time and most businesses will not be permanently negatively impacted. Nevertheless, there is a supply chain impact across many businesses which will see earnings being impacted in the short term. This is different to the global financial crisis (GFC), where it became clear that it would take many years to repair big banks’ balance sheets. However, global GDP growth could slow materially in the short term.

- From a global stockmarket perspective, after the first leg down in markets we cautioned investors that it was too early to “buy the dip”. This was mainly due to the fact that markets started the year at fairly high valuations and were not yet in bargain territory. Markets are down another 10% since then and attractive buying opportunities are surfacing. Many businesses are worth the same as they were a few months ago, but you can buy them at 20%-plus cheaper.

- Locally, domestic shares had effectively already crashed, and this second wave of declines leaves many counters at valuations last seen during the 2008 crash. Some banks are approaching 10% dividend yields and quality property shares are trading at 15%-plus yields. This does not mean that share prices cannot get worse in the short term, but the potential downside obviously decreases the lower share prices get. We are avoiding new buys in shares with potential balance sheet issues and where it is apparent that risks have increased materially.

- Market declines feel very uncomfortable, but real money is made by investing at the bottom of the market in quality companies at good prices. We cannot predict when exactly this will be and investors have to accept that you can never buy precisely at the actual bottom, but we aim to be taking advantage of the current scenario. With patience!

- Conditions are fluid and we are meeting continually as new information comes to light, to assess whether there is potentially a worse impact than the scenario we are presenting above. Making any predictions is hazardous in the current environment, but we are retaining a fundamental unemotional response to assessing opportunities.

Market review

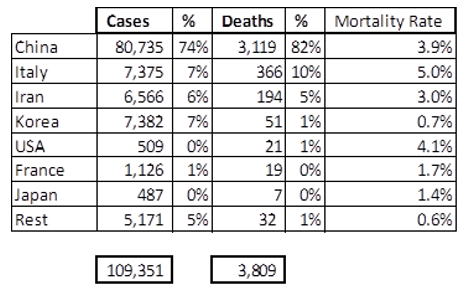

The spread of the coronavirus has now accelerated outside China. Three weeks ago, China had recorded 96% of confirmed cases and 98% of deaths related to the virus, but Italy now accounts for 10% of deaths and, although the US numbers still look low, that’s largely a function of their clumsy response to this outbreak and their current inability to effectively test for infections.

Figure 1: Novel coronavirus cases and deaths as at 9 March 2020

Source: Anchor, Bloomberg

Chinese authorities have severely restricted travel for its citizens in an attempt to control the spread of the virus, including quarantining around 10% of the population since mid-January, which has had a huge impact on oil demand. Initial estimates suggest that the lower Chinese demand for oil accounts for about 3% of global oil demand. Meanwhile, OPEC accounts for c. 30% of global oil supply, with another 12% of supply coming from Russia. On Friday (6 March) a meeting in Vienna between Russia and OPEC attempted to respond with supply cuts to support the oil price but the meeting ended acrimoniously with the Russians unwilling to support supply cuts and the Saudis responding with increased supply. The oil market has responded dramatically this morning (9 March), with crude oil down about 20% to around $36/bbl – as low as it’s been at any time over the past 18 years. At this level, it’s expected that many leveraged US shale oil producers will be under severe pressure and that could flush out some of the excess supply.

Figure 2: Brent crude oil price, 1999 to date ($/bbl)

Source: Anchor, Bloomberg

Ultimately, neither OPEC or Russia can afford for the oil price to stick at these levels for long and it’s likely that demand could normalise once we’re through the worst of the novel coronavirus’ impact. However, for the next few months this is likely to add to anxiety and market volatility.

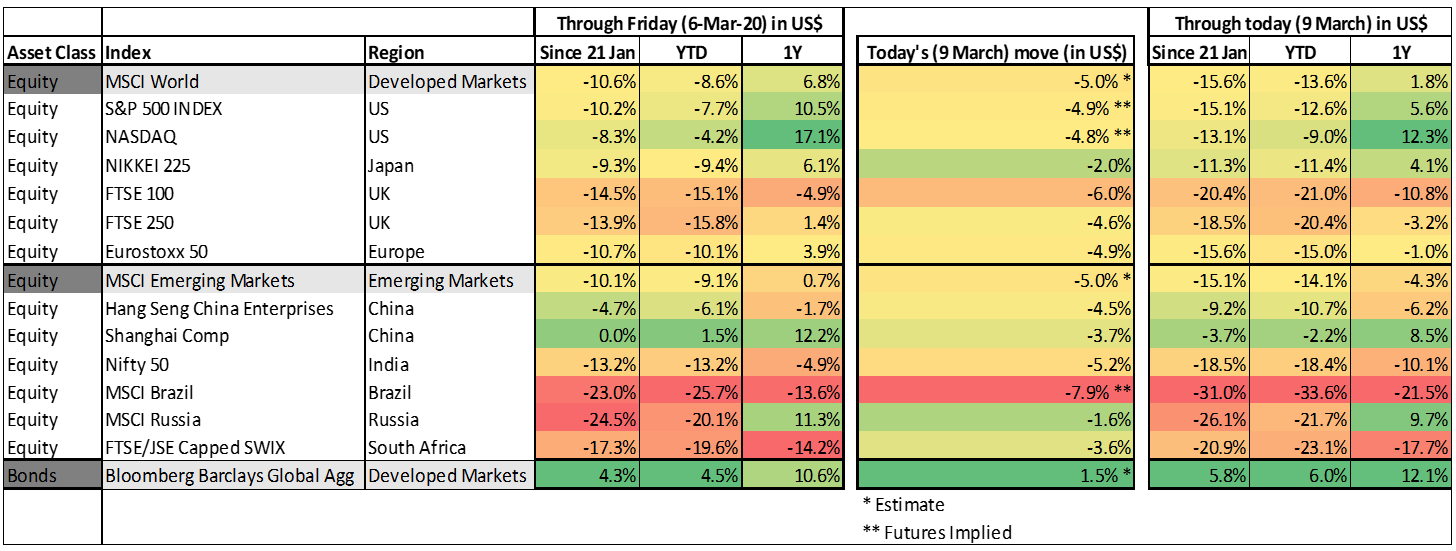

Global stocks markets have also started the week 5%–10% lower, with most stock markets down 10%–20% for the year (factoring in estimates for how the US market might respond when they open later today [9 March]). The US is one of the few markets still up over the past 12 months:

Figure 3: New coronavirus impact on major equity and bond benchmarks

Source: Anchor, Bloomberg

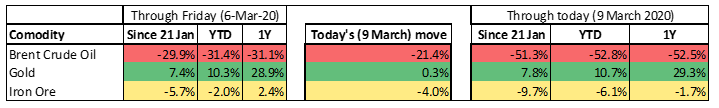

Oil, at the centre of the storm, is obviously the worst-performing commodity and gold has benefited slightly from its status as a haven in times of crisis:

Figure 4: New coronavirus impact on commodities

Source: Anchor, Bloomberg

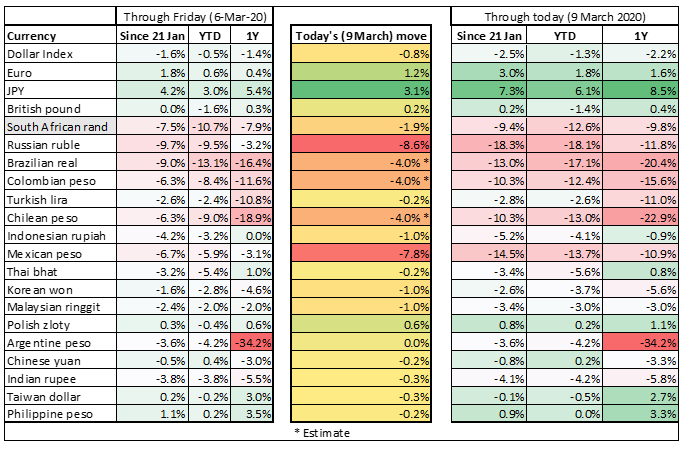

The Japanese yen, which tends to also act as a haven, is one of the few currencies which has strengthened against the US dollar. Emerging market (EM) currencies, particularly those with high current account deficits that rely on commodity exports, are down c. 10%–20% this year.

Figure 5: New coronavirus impact on currencies

Source: Anchor, Bloomberg

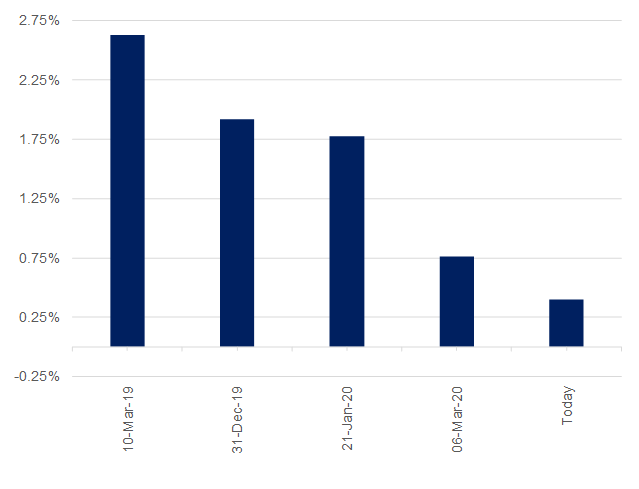

US bond yields have rallied dramatically and continue to reach new lows since the news of the outbreak first gathered pace in late January. This partially reflects the recent 0.5% emergency rate cut by the US Federal Reserve and expectations that we’ll see additional central bank support, but it is also an indication of the extent to which investors have rushed to haven assets.

Figure 6: New coronavirus: Impact on US 10-year rates

Source: Anchor, Bloomberg

We expect the market to continue to experience irrational moves for the next few weeks until it’s clear that novel coronavirus infections are no longer accelerating, particularly in developed markets. Until then, our base case is to avoid getting sucked into the panic or rushing-in to buy assets that look to be unreasonably cheap. It is extremely likely though that we’ll start to see opportunities to buy companies whose businesses are largely unaffected in the long run at absurd valuations if we remain patient.