Major global markets had a strong month, with US markets posting their best August performance in over three decades despite some turbulence during the month, likely fostered by the upcoming November presidential election. Renewed hope for COVID-19 vaccines and treatments pushed equities to fresh highs and the US held trade talks with China, which seemed to indicate that a phase-one trade deal is steadily progressing. Major economies also looked to be on a recovery track thus helping allay investor concerns. The US markets’ outperformance came about despite concerns around a second wave of COVID-19 infections in the coming US fall and winter and the ongoing stalemate in Congress about pandemic aid.

Among the three major US indices, the S&P 500 continued its now five-month gains ending 7.0% higher MoM (up 8.3% YTD), although the index took a breather on Monday (31 August) after a seven-day winning streak during which it reached new all-time highs. Since its 23 March-low, the S&P is up c. 60%. The Dow Jones Industrial Average (DJIA) jumped 7.6% MoM although it remains down slightly YTD (-0.4%). Still, both the S&P and the DJIA clinched their best August performance since 1986 and 1984, respectively, according to CNBC. The tech-heavy Nasdaq jumped 9.6% MoM, its fifth consecutive positive month and its best MoM performance since 2000 (when it gained 11.66%). The US dollar, however, remained under pressure, trading near two-year lows. Last week, US Federal Reserve (Fed) Chair Jerome Powell addressed a virtual sitting of the annual Fed symposium in Jackson Hole saying that the Fed would switch to inflation targeting as part of its monetary policy. This implies that the Fed will pursue lower rates for longer, even if US unemployment (historically associated with rising price pressures) started to fall.

On the US economic data front, the final August consumer sentiment survey rose to 74.1, up from July’s 72.5 print. However, the survey remains near pandemic lows – it bottomed out at 71.8 in April after reaching a c. two-year high of 101 in February. Unemployment data also remained elevated with another 1.0mn people filing for first-time unemployment in the week of 17 August – a small WoW decline. Since March, when the pandemic started to take its toll on US jobs, there has only been one week (at the start of August) with less than 1mn claims. Overall, 27mn US workers filed for some form of jobless assistance under various government programmes for the week ended 8 August. While this was a c. 1mn WoW decrease, it highlights the seriousness of the COVID-19 induced US jobs crisis. Congress’ weekly $600 supplemental jobless aid expired at the end of July, and US lawmakers have not reached agreement on another round since.

The UK market also recorded good gains, with the FTSE 100 Index rising 1.1% last month (-20.9% YTD). European equity markets closed in the green, with Germany’s Dax advancing by 5.1% MoM (-2.3% YTD), while France’s CAC rose 3.4% MoM (-17.2% YTD). On the data front, European Union (EU) GDP sank 11.7% QoQ – the lowest reading since records began in 1995. QoQ, EU employment declined by 2.6% and by 2.7% YoY.

In Asia, Japan’s Prime Minister Shinzo Abe resigned last week due to deteriorating health. However, market commentators seem to be of the view that there will not be much of a change in Japan’s economic policies because of Abe’s resignation. The Nikkei closed the month 6.6% higher but is still down 2.2% YTD. China’s Shanghai Composite Index rose 2.6% MoM (up 11.3% YTD), slowing after an impressive 10.9% gain in July, while Hong Kong’s Hang Seng gained 2.4% MoM (-10.7% YTD). Chinese economic activity continued to rebound in August with the country’s services sector gauge coming in at its strongest level since early in 2018. However, expansion in the manufacturing industry slowed slightly with the official August manufacturing purchasing managers index (PMI) moderating to 51 from 51.1 in July. Above 50 signals expansion, while below 50 indicates contraction.

On the commodities front, iron ore demand remained strong as China recorded another firm month of iron ore imports, thus helping to justify the steel-making ingredient’s resilience. MoM, the iron ore price is up c. 11%, with the price surging above $125/tonne in August for the first time since February 2014. The platinum price was up 3.6% MoM, while palladium rose c. 6.0% in August. Crude oil prices ended the month c. 4.6% higher, reaching $45.28/bbl by month-end although the oil price is still down c. 31% YTD. Gold’s five consecutive monthly gains ended in August with the price of the yellow metal declining by 0.4% MoM (YTD the gold price is still c. 30% higher). Nevertheless, expectations of a low interest rate regime in the US, following the Fed’s announcement last week, and the dollar coming under pressure should continue to boost investor appetite for gold.

The JSE’s August performance disappointed with the FTSE JSE All Share Index ending the month 0.4% lower (-2.8% YTD), as sentiment, especially around month-end, was negatively impacted by turmoil in the ruling ANC and concerns that party in-fighting could prompt a cabinet reshuffle. Some large-cap resource shares and major index constituents such as Naspers (-1.7% MoM) and British American Tobacco (-0.8% MoM), saw their share prices fall, although Prosus (+3.1% MoM) held up well. Among the large-cap resources counters AngloGold Ashanti (-10.8% MoM), Anglo American (-3.3% MoM), Anglo American Platinum (-3.1% MoM), and Gold Fields (-1.6% MoM) recorded MoM declines as the gold price took a breather. Both the Indi-25 and the Resi-10 eked out minor MoM gains of 0.3% and 0.1%, respectively. The Fini-15 ended August 4.0% in the red as major constituents including Sanlam, Capitec, FirstRand, and Standard Bank recorded share price declines of 9.6%, 5.6%, 2.9%, and 2.8% MoM, respectively.

The rand made some positive gains against the dollar on some risk-off sentiment and as the greenback weakened last week, recording an especially impressive c. 3% rally on Friday (28 August) against the US currency. However, it gave back these gains on Monday and MoM, the rand was only slightly up in August (+0.8%) and is down 21.0% YTD.

On the economic data front, SA’ July annual consumer price inflation (CPI) rose to 3.2% – back within the SA Reserve Bank’s target range of 3% to 6%. It was also an increase from June’s 2.2% YoY annual inflation rate and May’s 2.1% print as lockdown restrictions continued to ease. MoM, CPI rose 1.3% – the biggest MoM rise since February 2016, largely driven by fuel prices and municipal tariffs. SA recorded a trade surplus in July as imports continued to lag but exports rose on the back of improving global demand.

The ANC’s National Executive Committee (NEC) meeting over the weekend took centre stage in local politics. After ongoing revelations around corruption in the ruling party, President Cyril Ramaphosa wrote an open letter to ANC members saying the party was accused number-one in terms of allegations of corruption. This prompted the so-called pro-Zuma faction, including the ex-president in a scathing letter addressed to Ramaphosa, to come out of the woodwork asking the president to resign and accusing him of corruption over his CR17 campaign finances. Fortunately, Ramaphosa finally demonstrated some much-needed decisiveness from his administration when it comes to corruption and also seemed to outmaneuver his detractors by subjecting himself to the ANC Integrity Commission, noting that there was a “choreographed campaign” against him, amid attempts to “confront the scourge of corruption”. He also announced that the NEC had decided that all those in the party formally charged with corruption and other serious crimes must immediately step down from all official positions pending a finalisation of their court cases and subject themselves to the Integrity Commission. Overall, the president seems to have emerged from the NEC meeting emboldened and assured, even announcing the NEC decisions himself at its conclusion – something the party’s secretary general usually does.

As local COVID-19 infections seem to have peaked, the ban on alcohol and cigarette sales was finally lifted and the country moved to level-2 lockdown on 18 August. By 31 August less than 2,000 new cases were confirmed in a 24-hour cycle, with the Health Department saying that 1,985 new cases had been identified with a total of 627,041 confirmed cases in SA to date. The local recovery rate now stands at 86% vs a 66% recovery rate at the end of July. The US remains the country with the most COVID-19 infections worldwide at 6.2mn, followed by Brazil (3.9mn), India (3.7mn), the Russian Federation (1mn) and Peru (652,307) in fifth spot.

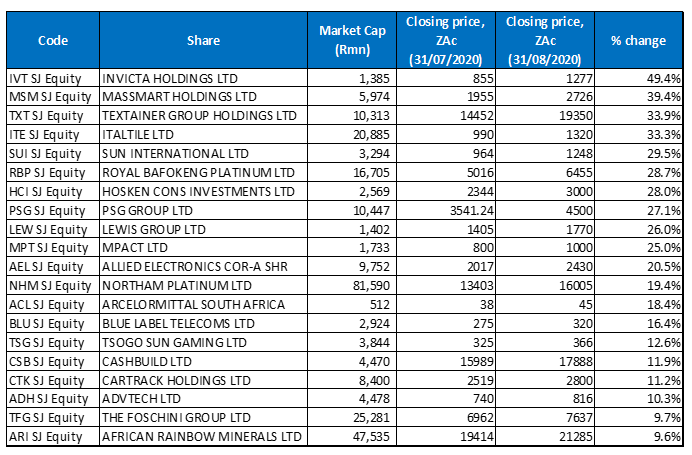

Figure 1: The 20 best-performing shares in August 2020, MoM

Source: Anchor, Bloomberg.

August’s top-performing shares looked very different from the resources-laden, top performers in July, with a smorgasbord of sectors and companies accounting for last month’s best-performing shares. The announcement that SA would move to level-2 lockdown meant the legal sale of alcohol and cigarettes was allowed (positive for companies such as Distell, British American Tobacco) and it also lifted the prohibition on inter-provincial and leisure travel (which had badly impacted the hospitality sector and companies such as Sun International, City Lodge Hotels, Tsogo Sun etc.). In addition, it allowed longer trading hours (and the serving of alcohol) at restaurants.

Investment holding company, Invicta (+49.4% MoM) was August’s best-performing share. In July the share price jumped 48.7% after the firm entered into an agreement with CNH Industrial SA to sell four of the businesses within its Capital Equipment Group (CEG) segment for c. R507mn to service its debt. The disposal will be effective in 2021 once regulatory approvals and outstanding suspensive conditions had been met. Last month, Invicta said it had entered into a subscription agreement with CEO Steve Joffe whereby Joffe will subscribe for, and the company will issue, 3mn ordinary shares at a subscription price of R8.76/ share, for a total cash investment of R26.3mn, resulting in Joffe holding 2.71% of Invicta’s shares in issue. The rationale, according to the board, is that the subscription by Joffe “ensures the appropriate alignment of the interests of the CEO with those of the Company and its shareholders. The funds will be used for general corporate purposes without any other impact on the financial statements.”

After getting pummeled in July (-14.8% MoM), Massmart’s share price fortunes saw a turnaround with the share price jumping 39.4% MoM – August’s second-best performing share. Massmart released 1H20 results last week, in which the retailer reported a revenue drop to R39.71bn (from R43.91bn in 1H19), while its diluted loss per share stood at ZAc534.20, compared with ZAc378.30 in the prior-year period. However, what has likely buoyed the share price is Massmart’s announcement that it is strengthening its relationship with parent company, Walmart in a bid to turn around the business and leverage off the world’s largest retailer’s expertise. Massmart is also bringing a Walmart veteran, Martin Halle (he worked for Walmart for 20 years in the US and Latin America) on board to head up its supply chain unit. Mitchell Slape, another Walmart veteran, took over as Massmart CEO in September 2019, and said last week that Walmart has shown “unflinching” support for Massmart.

Textainer Group (+33.9% MoM), which is owned by Trencor, was the third-best performing share after having reported better-than-expected results in August and with the share’s primary listing being in the US, it benefitted from robust US markets last month. Textainer was followed by Italtile, Sun International and Royal Bafokeng Platinum, which posted share price gains of 33.3%, 29.5% and 28.7% MoM, respectively.

Hotel and Casino operator, Sun International’s share price has been battered by the COVID-19 induced lockdown and, while the easing of restrictions has resulted in improved trading activity, the company has warned that it was not expecting a quick recovery. In its 1H20 results, Sun International reported that total income declined by 54.6% YoY to R2.54bn, while its diluted loss per share stood at ZAc894, compared with diluted EPS of ZAc132 recorded in 1H19. Meanwhile, Italtile’s share price jumped c. 14% on 25 August alone after the company said it would pay a dividend. This was despite Italtile reporting a 19% YoY drop in FY20 adjusted headline earnings per share (EPS) to ZAc82.3 and a systemwide total turnover decline of 7% YoY to R9.3bn. The company’s results were negatively impacted by a once-off broad-based black economic empowerment (BBBEE) transaction charge of R39mn and the COVID-19 outbreak.

Hosken Consolidated Investments (HCI; +28.0% MoM) was another counter which saw a share price turnaround in August (albeit from a low base) after it dropped 24.4% MoM in July. Last month, HCI reached a R400mn settlement with lottery operator Ithuba, thereby calling off their court battles. In July, after a five-year legal battle, HCI was awarded the right to examine Ithuba’s financial statements after the investment group had taken legal action against Ithuba, saying that it was owed management fees by the lottery operator.

PSG Group (+27.1% MoM, and price adjusted for the impact of the rights issue), furniture and appliance retailer Lewis Group (+26.0% MoM) and corrugated packaging firm, Mpact (+25.0% MoM) accounted for the remainder of August’s top-10 performers. Lewis reported a 30.8% YoY drop in annual earnings, as the COVID-19 pandemic hit its last month of trading and increased provisions for unpaid customer debts. However, despite the impact of the pandemic, Lewis declared a final dividend of ZAc65/share for the year to 31 March, taking its total dividend to ZAc185. Mpact reported 1H20 results in August which showed that its revenue declined by 1.4% YoY to R5.06bn, while basic EPS stood at ZAc9 vs the ZAc57.8 recorded in 1H19. Loadshedding and the lockdown weighed on the firm’s results, although Mpact did say that it is optimistic that demand for some of its products will pick up a little over coming months.

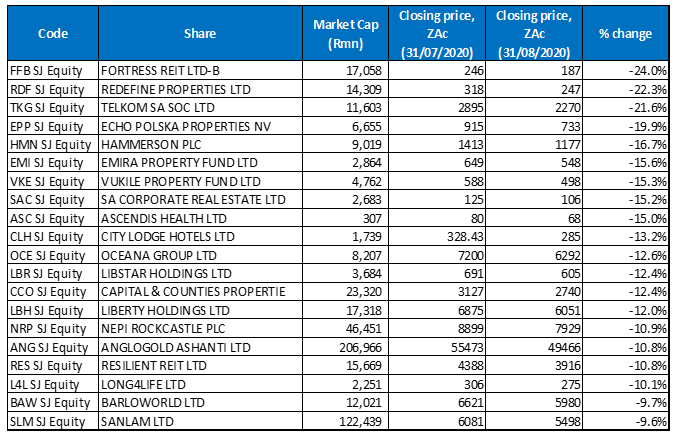

Figure 2: The 20 worst-performing shares in August 2020, MoM

Source: Anchor, Bloomberg

The listed property sector was already under pressure pre-COVID-19, due to weak fundamentals and the SA economy being in a technical recession. However, the COVID-19 pandemic has plunged listed property counters into their most challenging year yet, and August saw these listed property stocks accounting for most of the month’s worst-performing shares, with seven of the ten worst performers coming from the property sector.

Fortress REIT -B- was the month’s worst-performing share with a 24.0% MoM drop. In a trading update released last week, the real estate investment trust (REIT), said that based on the revised distribution methodology and including the NEPI Rockcastle Plc capitalisation issue, its FY20 distributable earnings are expected to decline by c. 30.0% from the distributable earnings forecast for FY20 disclosed in its interim results.

In second place, Redefine (-22.3% MoM) warned in a trading statement that due to the impact of COVID-19 on its operational performance, and assuming no dividends are received from its foreign-listed investments, it expects a decline in FY20 DPS of at least 45% YoY, or ZAc45.5/share. Telkom, August’s third-worst performing share, declined by 21.6% MoM. The company announced last month that it will start offering financial services with the launch of a life insurance business that will initially sell funeral coverage to customers.

Property firms Echo Polska Properties, Hammerson plc, Emira Property Fund and Vukile Property Fund followed Telkom, and posted losses of 19.9%, 16.7%, 15.6% and 15.3% MoM, respectively. At its FY19 results announcement, Hammerson had declared a dividend of GBp14.8/share and guided that the FY20 dividend would be GBp14.0/share – a 46% YoY drop. However, in March, it withdrew the FY19 final dividend payment to preserve cash and liquidity and the directors are now also not proposing a 1H20 dividend payment. Meanwhile, in its FY20 results released this week, Emira said that its revenue fell to R1.5bn from R1.69bn in FY19. In addition, the impact of COVID-19 and the relief Emira and its partners provided to tenants has resulted in a 61.4% YoY decrease in its 2H20 dividend. The company provided R119mn in rental relief in the form of discounts and deferrals to more than 1,150 tenants to ease the impact of the lockdown. Vukile last week pushed back the declaration of its final-year dividend by about a month amid discussions with the JSE on possible payment exemptions. It was expected that Vukile would declare a ZAc48.186 dividend for the year to end-March on 31 August, but discussions are still underway with the JSE regarding possible exemptions for minimum payments by REITs.

SA Corporate Real Estate (-15.2% MoM), Ascendis Health (-15.0% MoM) and City Lodge Hotels (-13.2% MoM) accounted for the remainder of August’s ten worst-performing shares. Last week, City Lodge delayed the release of its FY20 results for the second time, moving it to “on or about 3 September”. The company blamed the delay on “the impact of COVID-19 and the associated challenges around finalising the audits in the various territories in which the Company operates, …“ Meanwhile, shareholders have applied for more than 97% of shares issued as part of City Lodge’s new R1.2bn rights offer – an attempt by the company to shore up its finances amid the COVID-19 crisis. City Lodge CEO Andrew Widegger said that “The capital raised will bring much needed stability to our financial standing and allow management to focus fully on operational matters as we continue to navigate these highly uncertain times,”.

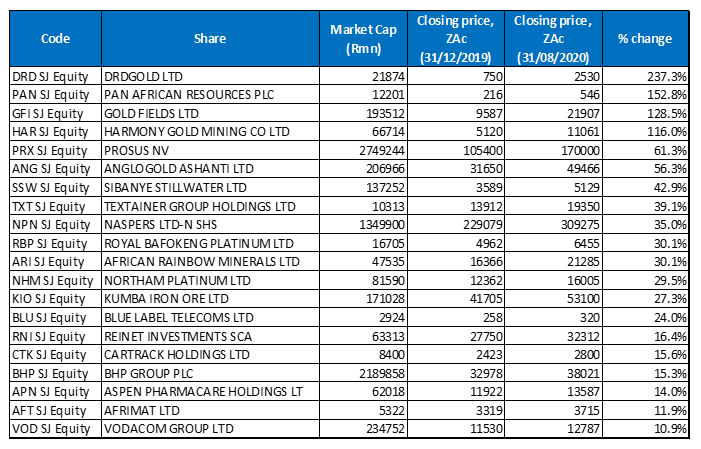

Figure 3: Top-20 YTD performers (to end August 2020)

Source: Anchor, Bloomberg

While the gold price surge may have hit a slight wobble in August (-0.4% MoM), the price of the yellow metal has been soaring for most of this year (+29.7% YTD) and it is therefore not surprising that the four best-performing shares YTD (DRD Gold [+237.3%], Pan African Resources [+152.8%], Gold Field [+128.5%] and Harmony Gold [116.0%]) were once again gold counters and also unchanged from July’s YTD best performers. Much like the year to end July, six of the ten best-performing stocks YTD were also gold counters – DRD Gold, Pan African Resources, Goldfields, Harmony Gold, AngloGold Ashanti, and Sibanye Stillwater.

Gold’s rally this year has seen the gold price reaching new highs and, with gold counters ultimately leveraged to the price of the yellow metal, these shares are tracking higher. While DRD (-0.7% MoM), Gold Fields (-1.6% MoM), Pan African Resources (-4.7% MoM) and AngloGold Ashanti (-10.8% MoM) recorded share price declines in August, these were not enough to detract from their impressive respective YTD gains.

In addition, 15 of July’s YTD best-performing shares remained among the 20 best performers for the year to end August. Five shares – Textainer (+39.1% YTD), Royal Bafokeng Platinum (+30.1% YTD), Blue Label telecoms (+24.0% YTD), Cartrack Holdings (+15.6% YTD) and Afrimat (+11.9% YTD) were last month’s new entrants into the YTD top-20, bumping Steinhoff, Oceana Group, Quilter, Stenprop and Peregrine out of the YTD top-performers list.

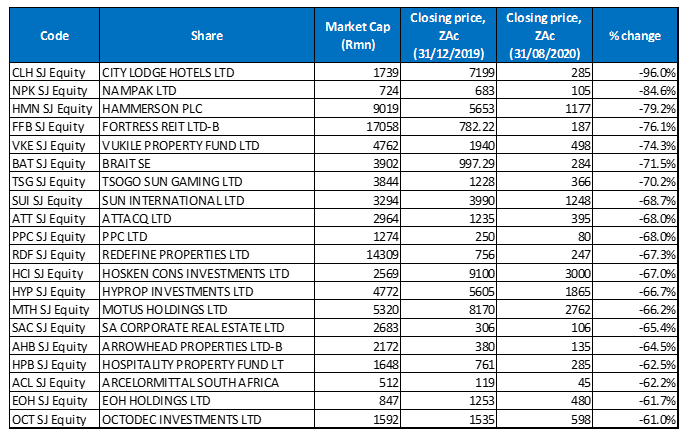

Figure 4: Bottom-20 YTD performers (to end August 2020)

Source: Anchor, Bloomberg

Looking at the year to end-August’s worst performers, only two shares (both from the property sector) entered the arena. Redefine (-67.3% YTD), and Octodec (-61.0% YTD) replaced Massmart and Lewis Group among the 20 worst-performing shares YTD after the latter two recorded good MoM share price performances (discussed earlier), which pushed them out of the YTD worst-performers grouping. However, Redefine’s 22% loss in August saw it return to the YTD worst-performing shares, while Octodec gave back its 5.7% July gain after recording a 7.3% MoM loss for August. In addition, much the same as with the MoM worst performers, 10 of the 20 counters were property and property-related shares.

Invicta’s sterling share price performance in July and August, pushed it out of the 20 worst-performing shares list, while Octodec and Foschini’s July gains of 5.7%, and 23.8% MoM, respectively, resulted in these counters also moving out from among the twenty worst-performing shares YTD.

In terms of the top-three, worst-performing shares, City Lodge (-96.0% YTD) bumped Nampak (-84.6% YTD) out of first position in the year to end August, after recording a further 13.2% share price drop last month. Nampak moved to second spot, followed by UK and European shopping centre owner, Hammerson (-79.2% YTD), which replaced Sun International as the YTD third worst-performing share.

Hammerson was followed by Fortress REIT -B- (-76.1% YTD), Vukile Property Fund (-74.3% YTD), Brait SE (-71.5% YTD), and Tsogo Sun Gaming (-70.2% YTD).

Sun International (-68.7%), Attacq and PPC (both down 68.0%) rounded out the month’s ten worst-performing shares YTD.