“Gradually, and then suddenly”. This rather famous line from Ernest Hemingway’s novel, The Sun Also Rises, manages to express one of the most profound insights into the human experience of the phenomenon of change. Hemingway captures exactly how a simple weed may destroy an entire garden, how a tiny termite can bring down a house – or how a seemingly isolated virus in a remote Eastern region could change the world in just 6 months.

And change the world it did. Some aspects of life will go back to normal, but others will never be the same again – and we believe the same can be said of global capital markets going into 2021.

As your appointed investment managers, we would like to share our insights into some of the key themes that will shape our strategy as we head into the new year. We will briefly dissect the significance of each theme and explain how we are incorporating it into our investment process.

INVESTING IN A ZIRP (ZERO INTEREST RATE POLICY) WORLD

WHY IS THIS SIGNIFICANT?

We are currently experiencing one of the more extreme instances of ZIRP in modern history as central banks around the globe have cut benchmark rates to zero (or close to it). Their actions are both understandable and necessary.

In times of recession, central banks will lower interest rates to force liquidity into the economy to offset the contraction in activity levels – this time around resulting from an unprecedented supply-side shock. The very intentional effect of this is to lower the return earned on risk-free assets, which forces market participants to take on more risk to earn their required return. The result is that companies in need will have access to capital (both debt and equity), which would otherwise have dried up.

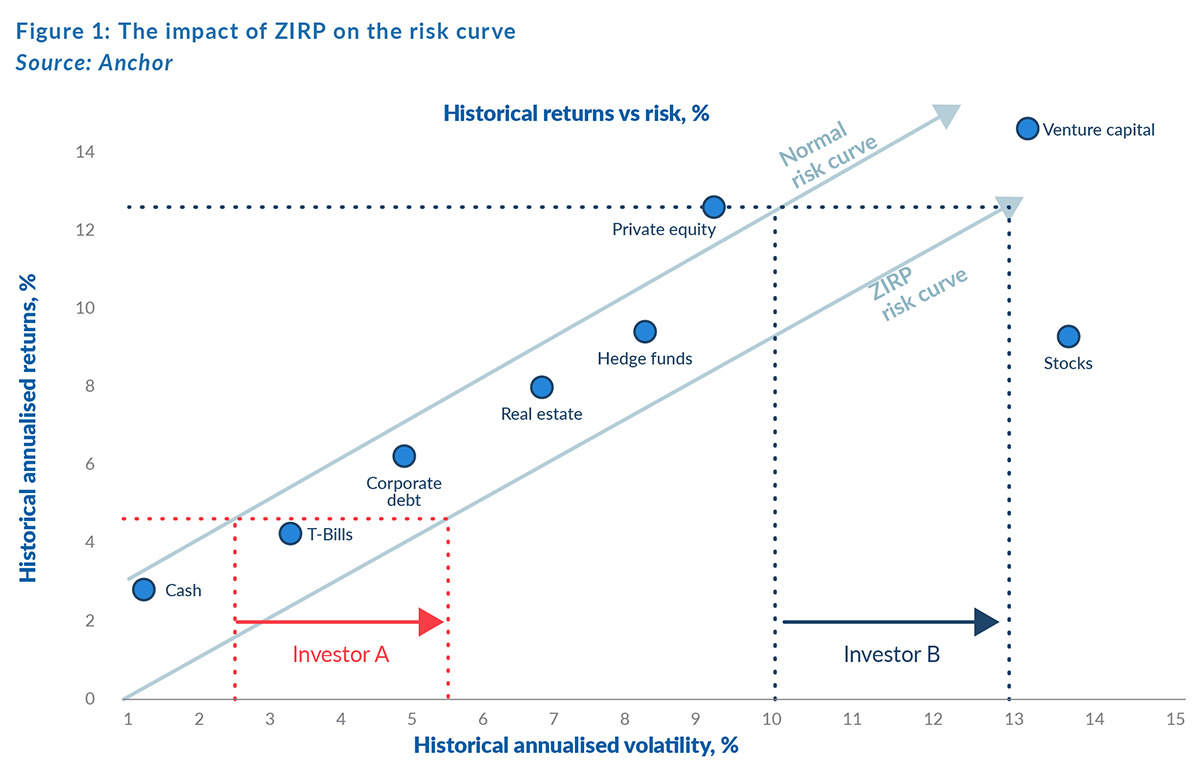

This phenomenon is illustrated in Figure 1 below showing two investors’ risk preferences along the “normal” and the ZIRP risk curve. Investor A, who ordinarily invests in a combination of cash and T-bills will now need to include riskier corporate bonds to earn their required return. Investor B, a private equity specialist, will now need to seek out riskier venture capital investments to deliver the requisite alpha to his clients.

However, ZIRP is a blunt instrument. As you may deduce from Figure 1 above, a lot of money will find its way to places where it is needed – but also to where it is not needed. While ZIRP may drive an abnormally high demand for debt issued by a troubled hospitality business (and hence saving its existence), this same policy will drive an almost incomprehensible tolerance for risk at the higher end of the curve.

How could Tesla, which currently produces just 500k vehicles p.a., be worth more than the next top-6 vehicle manufacturers, which together produce over 45mn vehicles annually? Why was Bitcoin up over 300% for the year? How can Uber, with no clear path to profitability, trade at a market cap of over US$100bn?

The cause is likely excess capital with a near-infinite risk tolerance, and the culprit is almost certainly ZIRP. Calculated risk-taking has been replaced with FOMO (fear of missing out), fundamentals have been replaced by narratives and bull cases have now become base cases.

HOW WILL THIS IMPACT THE WAY IN WHICH WE INVEST?

Clearly, the risk here is the unwind of ZIRP. In our view, it is not a matter of if, but rather a matter of when. While Fed Chair Jerome Powell’s most recent comments suggests a dovish view from the US Fed (“we have the ability to be patient”), we also know from experience that this can (necessarily) change rapidly.

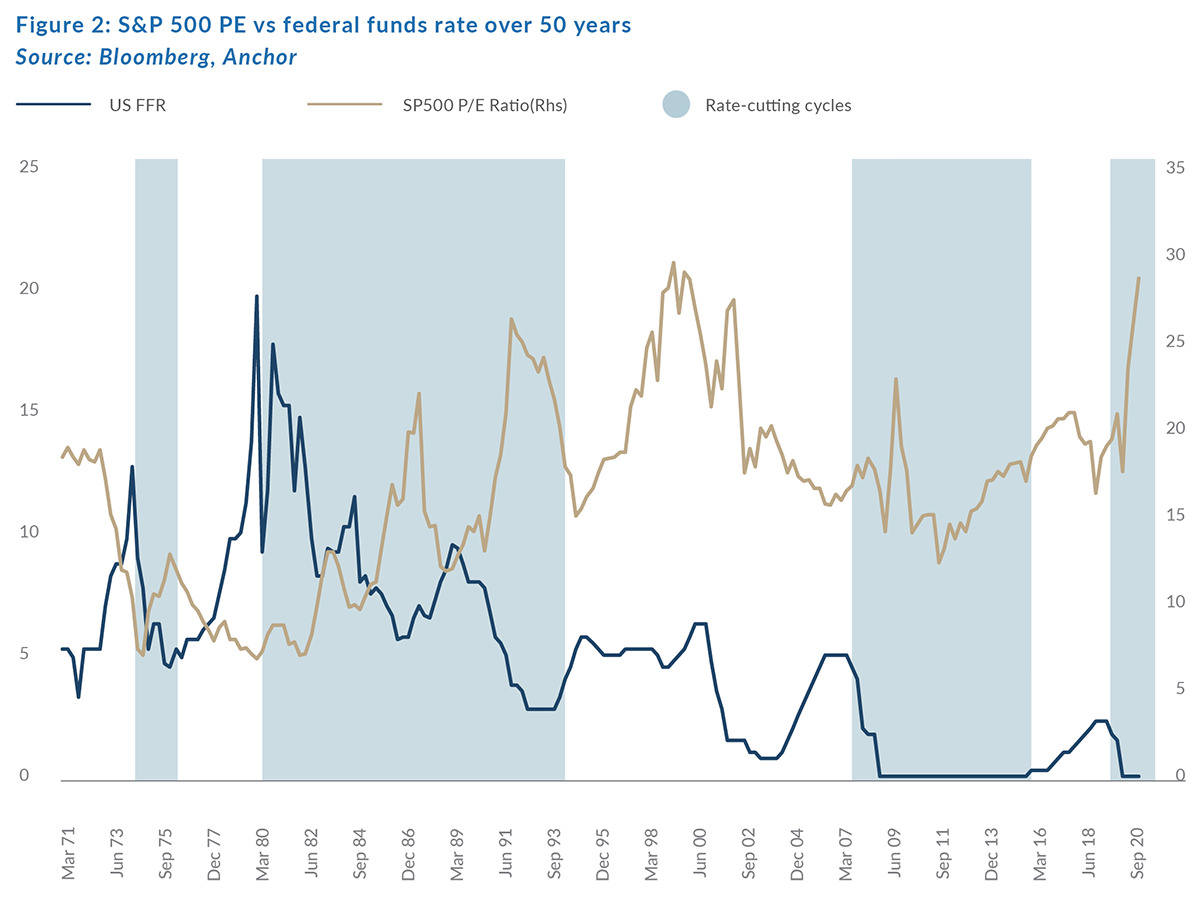

Given the rather extreme point from which we are starting (see historical graph of the US federal funds rate in Figure 2 below), it stands to reason that the negative impact of higher reference rates on valuations would be equally as significant as the recent impact of historically low rates, albeit in the opposite direction.

It is not difficult to envisage a scenario where a combination of the subsidence of COVID-19, significant US fiscal stimulus and pent-up consumer demand drive a sudden pick-up in inflation in 2021. The market will likely react to the earliest acknowledgement of any evidence of such a trend by the US Fed, which could be as subtle as the mention of “asset price inflation” or “inflation bottoming out”.

Naturally, we believe the most exuberant valuations will be hit the hardest when this happens. Fundamentals will come into focus again and, at this juncture, it will be important to own companies which are not priced for absolute perfection and total market domination.

Hence, we find ourselves favouring the large-cap counters which have, to some extent, fallen out of favour as the market chases newer, more exciting, growth stories. We are owners of Facebook, Alphabet, Amazon, and Alibaba – and we find ourselves being wary of Tesla, Uber, and Zoom.

So, the story seems fairly dependent on the state of the US consumer, and the prospects of the more cyclical end of the economy – which leads us to our second key theme …

THE FINANCIAL HEALTH OF THE US CONSUMER

WHY IS THIS SIGNIFICANT?

Given that consumption expenditure constitutes around 70% of US GDP, it follows that the financial health of the US consumer is a major determinant of the trajectory of that economy. This is also why the most recent two rounds of US stimulus have directly targeted the pockets of US citizens, both with transfer payments and massively inflated unemployment insurance.

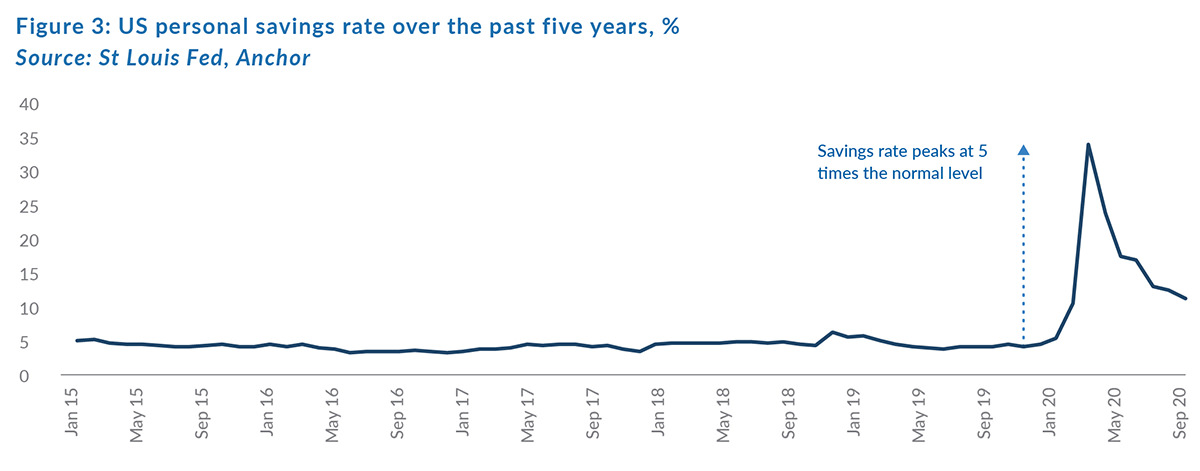

Although there are many statistics to consider, the one that we find the most striking is the US personal savings rate – a measure of the percentage of disposable income that remains after taxes and monthly expenses. A combination of 100% wage replacement through extended unemployment benefits stimulus cheques and poor economic sentiment sent the savings rate skyrocketing up to five times the normal level (35%) in April – and by October it would still sit at roughly twice the normal level (see Figure 3 below).

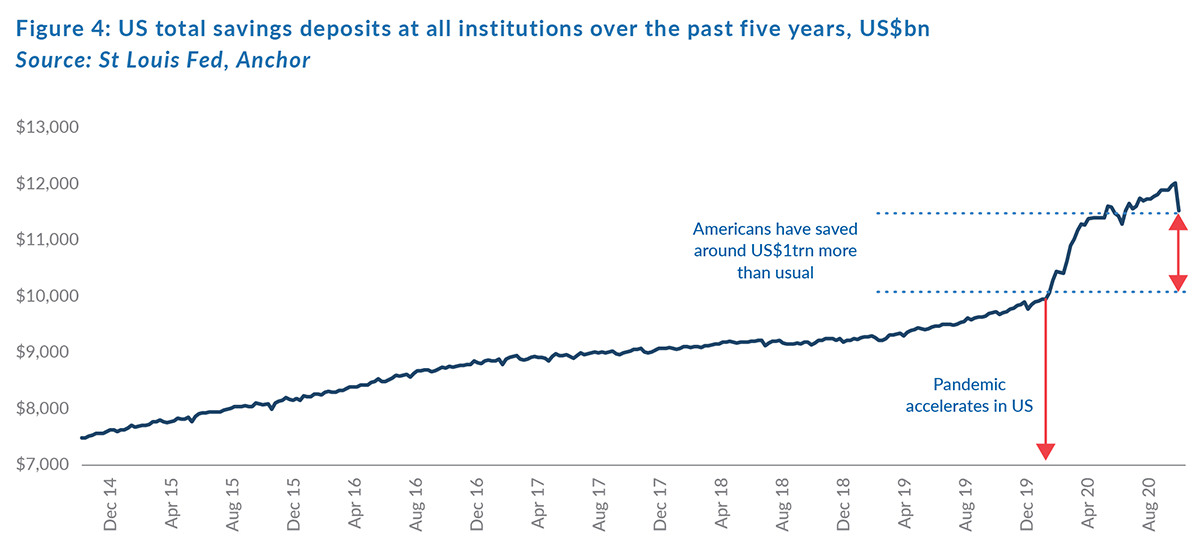

This has meant that Americans have put away around US$1trn more than usual over the past year, having saved around US$1.7trn by the end of August 2020 as compared to an annual average of around US$500bn (see Figure 4 below). This is not an insignificant number and amounts to roughly 5% of the country’s annual GDP.

This “pent-up demand”, from an incremental perspective, could prove to be a tremendous tailwind to consumer spending once the pandemic subsides and consumer confidence returns.

HOW WILL THIS IMPACT THE WAY IN WHICH WE INVEST?

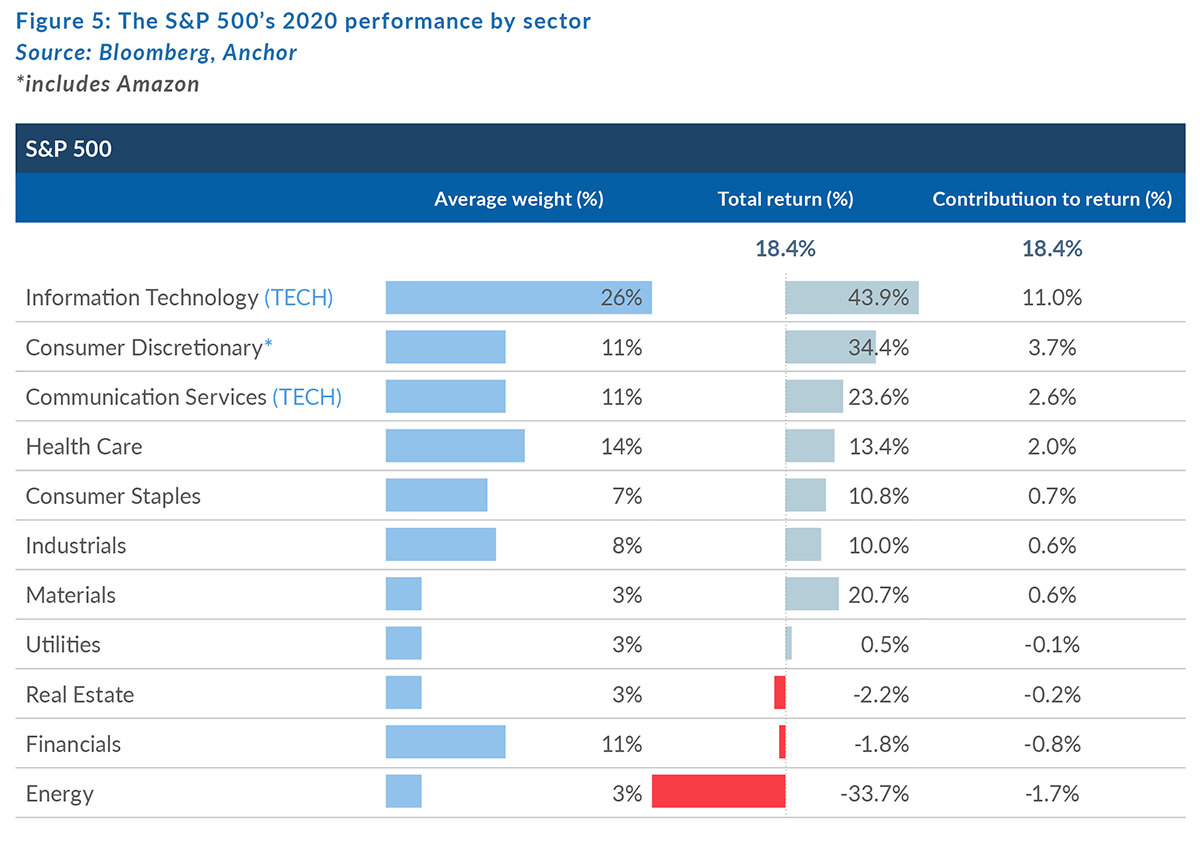

While technology stocks have been the standout beneficiaries of the “pandemic trade” (see Figure 5 below showing the S&P 500’s performance per sector for 2020), the performance of the more cyclical end of the economy has been far more subdued. Banks, industrials, physical retailers, hospitality companies and their associated service providers have all had a relatively weak year – and many of these stocks are still trading at levels meaningfully below their pre-pandemic values.

Despite the obvious near-term negative impact of the pandemic, these cyclical counters stand to benefit tremendously from consumers who a.) now sit on excess savings; and b.) who will likely demonstrate an abnormally high propensity to spend these savings as the world returns to normal.

We like Sysco, one of the largest food service companies in the US, which is still down around 15% over the past year. In our view, the value of a solid balance sheet, strong cash flow generation and a structurally entrenched market position all outweigh the temporary hit to revenues from reduced restaurant activity.

Ryman Hospitality Properties is another example, which is still c. 30% below its January 2020 levels. The owner of several premium convention and country music venues has the resources to weather what has become the perfect storm, and it should come out on the other side intact.

We also own several US banks, which collectively now trade at heavily discounted price-to-book ratios given low absolute interest rates and market pessimism around credit book impairments. While prevailing economic conditions remain challenging, this point in the cycle is likely (more than) priced in.

This is not to say that we cannot identify value within the tech sector, however – and over the longer term we still believe that tech will continue to outperform the broader market for fundamental reasons. At present, there is a particularly interesting scenario in that space which we believe is yielding an opportunity – and that brings us to our third key theme for 2021.

THE RESURGENCE OF ANTI-TRUST ACTION IN TECH

WHY IS THIS SIGNIFICANT?

The tech sector has created more value for investors over the past decade than any other sector, explaining around 43% of the returns of the S&P 500 since 2010. Then last year, when the US House Judiciary Antitrust Subcommittee summoned the CEOs of Amazon, Alphabet, Apple, and Facebook to an initial hearing – the market became concerned with what seemed to be a big, new hurdle for tech.

Just months later in China, Alibaba would feel the brunt of similar antitrust action. The growth story now seemed to be under threat, sending the share down c. 25% (until time of writing) from its October high.

Although one may be tempted to blame politicking in an election year in the case of the US, or perhaps Jack Ma’s outspokenness against China’s legacy banking system in Alibaba’s scenario – the truth is that both the US and China are just now coming out of a prolonged period of “inaction” from market regulators. Tech has benefitted from a sort of golden 15-year period, where they have been able to run rampant and either acquire competitors, or to leverage their dominance to crush them.

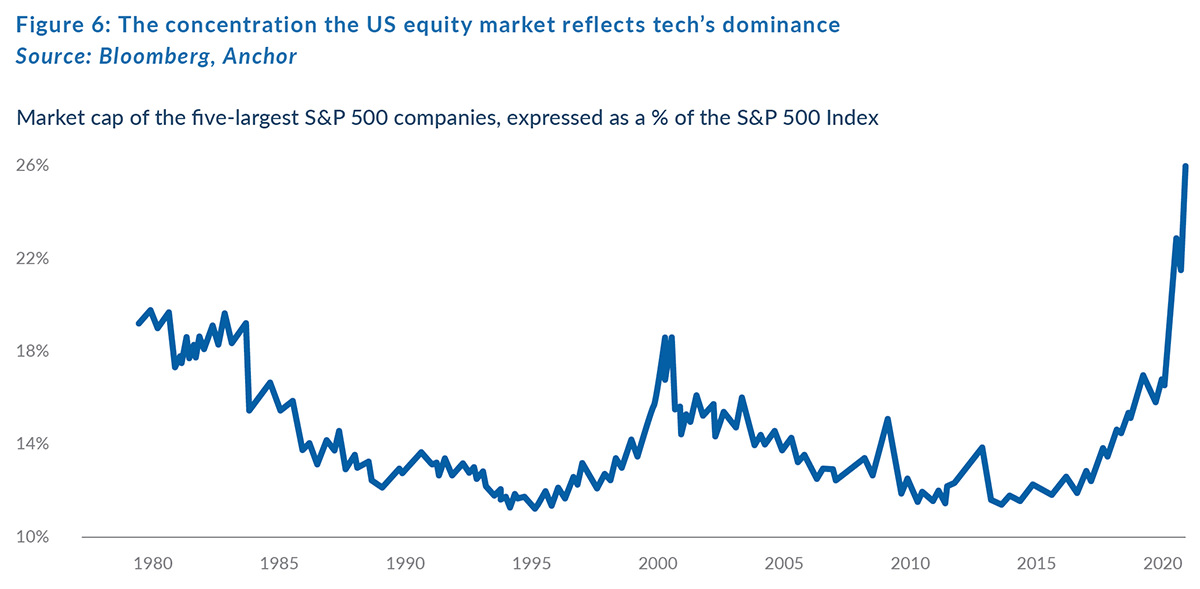

The result is a historically high concentration of “market power”, spread among a few firms which are now virtually impossible to compete with – as is illustrated by the collective market capitalisation of the S&P 500’s five-largest companies, expressed as a percentage of the total index (see Figure 6 below).

Four of the five companies are the very companies summoned to the August hearings – Apple, Amazon, Alphabet, and Facebook – with the fifth company, Microsoft, having been through its own round of antitrust issues two decades ago.

HOW WILL THIS IMPACT THE WAY IN WHICH WE INVEST?

Here is the thing, though. While antitrust measures sound bad, and certainly do not suit management teams that want to dominate the world – they are in fact a net positive for shareholders. Conglomerate structures, which make the stifling of competition a lot easier, also tend to dilute a lot of shareholder value.

Often acquisitions or subsidiaries are run as the sacrificial enablers of others. Amazon’s retail profits funded Amazon Web Services. WhatsApp’s user base of over 1bn is simply used as a data mine for Instagram/Facebook. Alibaba offers several services to its merchants below cost in exchange for exclusivity.

Breaking these giants up will necessarily result in enhanced profitability, and hence will lead to the unlocking of trapped shareholder value. It then follows that the best investment opportunities likely lie with the same companies that seem to have fallen foul of regulators.

Antitrust action in 2021 could result in the eventual IPO of Ant Financial (in which Alibaba has a 33% stake), the possible break-up of Facebook or the potential spin- off of Amazon or Alphabet’s cloud businesses. These are all instances where the sum of the parts will almost certainly be greater than the whole.

Ironically, these are also some of the most attractively valued companies in the context of the broader tech sector as the market misinterprets antitrust measures – a likely catalyst for value creation – as some kind of punishment. We are inclined to take the opposite view, and we believe that the market will come around eventually.

PUTTING IT ALL TOGETHER

As other contributors to this strategy document will attest, to contemplate the performance of global equity markets through 2020 in aggregate would have caused you to miss gigantic tectonic shifts that have taken place beneath the surface of the indices.

Heading into 2021, it is imperative to look through the market’s recovery into the underlying and disparate instances of excessive pessimism and unfounded optimism – and to position your portfolio accordingly.

Hopefully, we have given you some insight into what we believe are the more obvious themes and catalysts that will explain market volatility, and how we plan to leverage the subsequent upside while mitigating the inevitable downside.

We will endeavour to recognise trends early, and to react decisively – remembering that change has a habit of manifesting at first “gradually, then all of a sudden”.