Anchor Head of Private Clients, Brendan Gace discussed the key decisions facing investors looking to invest offshore. He gave a practical guide with some illustrative examples on whether to pay CGT now or later and discussed the various structures that can be helpful in enhancing long-term returns and limiting investors’ tax liability.

How do you move forward with an offshore investment when you are unsure as to which route to follow? In addition, there is certain information that we see impacting people’s judgement. Many investors have, for example, had negative experiences in the past when investing offshore.

The first area which we see clouding people’s judgement is the tax-deferred principle – this principle claims that when a taxpayer can delay paying their taxes to some future date then any tax saved by virtue of the delay is better for you and you should in fact delay paying tax for as long as you are legitimately able to do so.

While those may seem to be sound principles, at some point you will need to change your strategy and start deciding regarding when taxes due will be paid. Taxes can sometimes be deferred indefinitely or may be taxed at a lower rate in the future. In addition, having all your assets invested only in SA has become limiting so a key decision to make when you want to take a basket of assets out of the country or invest these elsewhere is do you trigger capital gains tax (CGT) on these local assets to reinvest offshore? What options do you weigh up?

Below we highlight those factors you should consider when making such a decision, these include:

- Your future returns in SA vs your future returns offshore and considering currency depreciation? You have to believe currency depreciation will continue. The rand is one of the world’s most volatile currencies and prone to extreme moves. During all of our lifetimes the rand has depreciated, and it is highly likely that this long-term trend will continue. BUT, we also note that first world or developed market returns will not be as exciting as emerging market (EM) returns. Importantly, consider or take the local currency into account before making an offshore investment decision and ask yourself whether you will indeed be better off?

- Paying your tax over to the SA Revenue Service (SARS): In the SA economic/investment environment this question tends to cloud people’s judgement. There is a universal distaste for paying tax across to government unnecessarily (if you don’t need to at that juncture).

- Diversification: You have SA investments that are diversified in a typical balanced fund, which is 70%-80% regulation-28 compliant, which gives you a degree of diversification in hard rand vs asset swap investments. But when we talk of diversification, we mean that here you are looking to having a much greater diversification by also investing offshore.

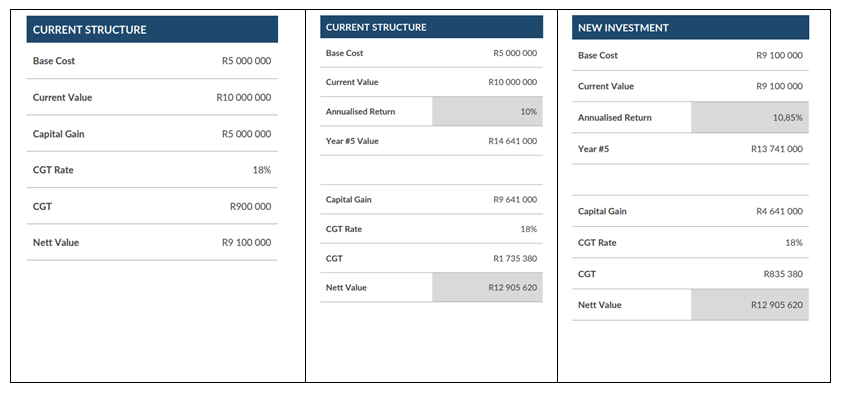

Paying capital gains – Do you pay SARS now? (see Figure 1)

Example 1: A person has a base cost/investment of R5mn, with a current value of R10mn, which means a capital gain of 100% (R5mn). This means that, for CGT, you will be paying R900k in tax. Are you prepared to do that?

If you left your money in SA and received a certain return, or if you decided to take your balance of money offshore (R9.1mn) and you are starting off with a R9.1mn investment centered offshore and R10mn local. What extra return over a five-year period do you need to receive over that 5-year period to get you back on par to where you were if you had ignored the deferred tax principle (by paying the tax)? The difference in total return would be an annualised return of 10% on your local investment vs 10.85% – so 0.85% would be the material difference. If you bring it down to a number like that (0.85%), the universe of opportunities provides a great chance of getting back that 0.85% you lost out on by paying tax upfront. Additionally, you will do well beyond that because you now have a much broader universe of shares from which to choose.

Figure 1: Capital gains – do you pay SARS now?

Source: Anchor

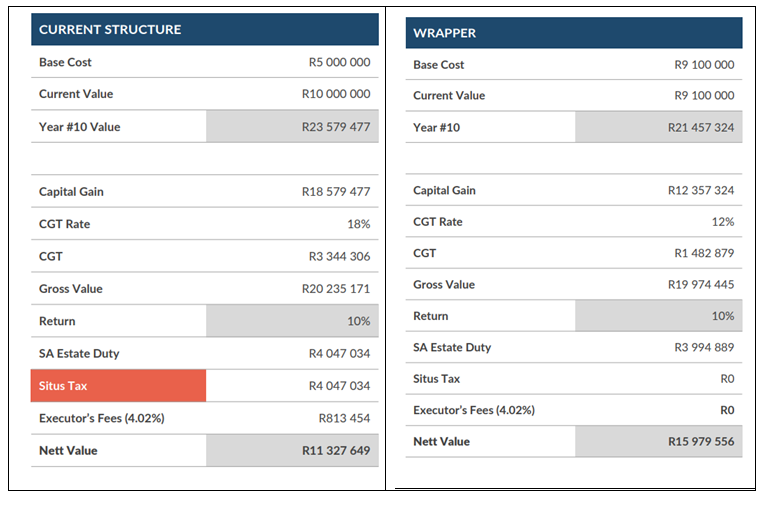

Situs tax (see Figure 2)

Example 2: Avoiding situs tax – This is a single structure and, we believe, with each solution careful thought should be given around the price-, product-, and services elements. Is it suitable for you? Do you get the right information, and do you receive decent service from the structure’s offshore providers? You also want to have the comfort of proper regulation where you are investing. It is therefore important to ask yourself – are my assets being protected by being regulated properly in the jurisdiction and/or structure where my assets are invested?

Using the same example as before – a R5mn current value being R10mn and 10 years from now (using a 10% growth rate) an investor will end up with a value of R23mn. The CGT if you pass on would be c. c. R3.3mn and your estate duty will be another R4mn (20% of the value). In addition, take off situs tax (using the US or UK example of 40% situs tax) and deduct executor fees and then your net value will be c. R11.3mn, which is passed on to your beneficiaries.

However, if you move across to a wrapper, which is a change of ownership, there is a life insurance company behind it, then the calculation is as follows: If your current value is R10mn and 10 years from now (using 10% growth) you have c. R21mn then the CGT when you die will be slightly lower because your base cost was higher and inside the wrapper you have a 12% CGT rate and, as an example, you will also have lower estate duty, no situs tax and take off executor fees (none on that endowment structure) then your net value will be R15.9mn. That gives you a return enhancement over the 10-year period, after paying the tax, of R4.65mn or 41%. We note though that there are wrapper costs along the way – c. 0.35% but as an investor you also need to shop around, some can be more expensive than others. Do you stay where you are on, going forward, or do you pay the wrapper cost, make the change, and pay CGT (R900k) along the way?

It is advantageous to clean up your affairs – You do not want to pay estate duty, CGT, and situs tax if you get caught on the wrong side of an investment profile.

If you take it over a 20- to 30-year period it becomes significantly bigger. So, the structures can all be very helpful – there are many options available.

Here it is important to note that you must keep everything legitimate. If not, it will result in you getting caught up in a net as both the SARB and SARS (as well as the US IRS tax authority) know everything about your finances and their penalties are extremely high if you go down a route which is not legitimate.

Figure 2: Wrapper – avoiding situs tax

Source: Anchor

Key considerations are ongoing costs vs taxes payable.

Another material issue when deciding on setting up an offshore company, looping structure etc. is that if the investor needs to access these assets it is a wrong decision to take money out again as this can become extremely cumbersome.

STRUCTURES CAN BE HELPFUL under the RIGHT CIRCUMSTANCES

Conclusion

- Be open minded around your need to restructure and possibly pay some of the tax now. The tax deferred principle can be put to be bed as being somewhat of a myth under certain circumstances. Move forward – it’s the right thing for your overall investment strategy – do not look back on decisions made in the past.

- Do your homework and understand the potential implications of your decision – costs, benefits etc. Ill-informed fear holds people back from taking advantage of the great opportunities that are out there.