Two months of solid gains saw global stockmarkets record a stellar end to 2020, with many markets having recovered the losses sustained during the March crash and January 2021 also started on a positive note. Unfortunately, after the first week of January showed major markets all in positive territory YTD as the US extended its bull run, the second week of the month started the downward trend and, with a lot of good news priced in, the month ended on downbeat note. While optimism around the various COVID-19 vaccine rollout programmes initially buoyed share prices, there have been ongoing concerns about the pace of global vaccine rollouts, supply, as well as its effectiveness against COVID-19 variants that have popped up. Continuing lockdowns in the UK and parts of Europe added to these concerns.

US President Joe Biden was inaugurated as Donald Trump left the White House under a dark cloud. Courts had continuously rejected the Trump campaign’s unsubstantiated claims of widespread voter fraud. Vice President Mike Pence led Congress in certifying Biden’s victory after violent insurrectionists, heeding Trump’s call to “fight like hell” against Biden’s election, overran the Capitol building in an unprecedented assault on US democracy, which killed 5 people. Biden’s eventual inauguration was largely welcomed by markets and he immediately set out plans for a more rapid vaccine rollout, and a proposed $1.9trn economic aid/rescue package.

On Wall Street, even the US’ powerhouse indices struggled, with the Dow Jones losing 2.0% MoM and the broader S&P 500 down 1.1% MoM, while the Nasdaq gained 1.4% MoM as US tech majors recorded modest gains. As investors digested results (the US earnings season started in earnest on 19 January), selling gathered pace despite some good results, including from US tech giants. However, sentiment was impacted by a surge in speculative trading from retail investors using social media platforms to organise a mass movement to buy stocks such as GameStop and AMC, which had been massively shorted by hedge funds. Despite the large falls in US markets last week, investor attention was focused on the battle between these large hedge funds and day traders, who helped drive up heavily-shorted, video-game store GameStop’s share price by c. 139% on Wednesday (27 January) alone, in an attempt to squeeze investors who have been shorting the stock. The unprecedented surges (GameStop is up c. 1,000% YTD) in those counters resulted in heavy losses for large investment firms, triggering a flight to safety in markets on Wednesday.

On the US economic data front, 4Q20 GDP declined 2.5% YoY, while overall growth for 2020 fell 3.5% – the largest contraction since 1946, but still better than forecast during the early days of the pandemic last year. In stark contrast, disposable personal income (which excludes taxes paid but adds government benefits received), experienced its fastest annual growth since 1984, buoyed by supplements to unemployment insurance, stimulus checks, and support for small businesses. At its January meeting, the US Federal Reserve (Fed) left rates and its bond-buying programme unchanged but noted that “the pace of the recovery in economic activity and employment has moderated in recent months”.

Elsewhere, investors were watching coronavirus infection spikes in parts of Europe and Asia, and the renewed travel curbs and lockdowns. In the UK, the FTSE 100, having lagged throughout 2020 (-14.3% YoY), played catch-up in early January as the Brexit trade deal removed uncertainty surrounding trade relations between it and the EU. However, after 8 January, the FTSE 100 trended downward, finally ending the month 0.8% lower.

Major European markets also closed in the red, with the region’s largest economy, Germany’s DAX down 2.1% MoM, while France’s CAC dropped 2.7% MoM. On the data front, the French economy contracted by less than expected in 4Q20 amid its second COVID-19 lockdown, with GDP coming in at a negative 1.4% vs Reuters consensus forecasts of a 4% contraction. Following a decade of growth, Germany’s full-year 2020 GDP shrank by 5%, as lockdowns hit businesses and consumer activity.

In China, the Hang Seng rose 3.9% MoM, while Hong Kong’s Shanghai Composite Index closed January 0.3% higher. China’s Spring Festival travel season, or Chunyun, ahead of the Lunar New Year holiday, started on 28 January (and runs to 8 March), amid fears that it could become a superspreader event. In a normal year, China sees around 3bn trips during the Chunyun period, although in 2020, as the pandemic gained momentum and government introduced travel bans, data from the Ministry of Transport showed the number of trips fell by more than half. In terms of economic data, China’s 4Q20 GDP came in at 6.5%, higher than the 6.1% which consensus forecasts had expected, and pushing the country’s 2020 overall GDP to a 2.3% gain (still its lowest level in over 40 years). China’s official manufacturing purchasing managers’ index (PMI) dipped to 51.3 for January (vs December’s 51.9), remaining in expansion territory (above 50 indicates expansion, below 50 signals contraction). Japan’s Nikkei closed only slightly higher – up 0.8% MoM. Unfortunately, the country’s January factory activity contracted amid a rise in COVID-19 infections and a new state of emergency, covering Tokyo and other areas, which impacted operating conditions.

On the commodity front, crude oil started the year on a strong note as Saudi Arabia pledged further output cuts and increased the price of its oil to Asia. Although oil’s initial rally eventually ran out of steam, the oil price still gained c. 8% MoM. While gold ended last year 25.1% higher, its best annual performance in around a decade, it started 2021 on a sour note, closing January 2.7% in the red as a resilient dollar weighed on the price of bullion. After a stellar run in December (+29% MoM), iron ore was down c. 1.9% MoM as margins and expected crude steel production cuts weighed on sentiment. The price of platinum gained c. 1% MoM.

South Africa’s (SA’s) FTSE JSE All Share Index rose for a third straight month, closing January 5.2% higher (the index soared 10.5% in November and was up a further 4.1% in December). At one stage, on 25 January, the index surged past the 65,000 mark for the first time, before retreating to end the day at 64,559.84. The JSE’s impressive performance was largely thanks to Prosus (+9.2% MoM, and the largest share on the JSE by market cap) and Naspers (+15.2% MoM), which took their cue from Hong Kong-listed Tencent (up c. 21% MoM), in which the Naspers stable is the single largest shareholder. Expectations of further stimulus efforts in the US also helped support gains on the local bourse. Other large market cap companies on the JSE including Sasol (+23.2% MoM), Glencore (+10.25 MoM), BHP Group (+7.2% MoM), Richemont (+6.7% MoM), and Anglo American Platinum (+5.2% MoM) also contributed to the rally. Among the major indices, the Fini-15 lagged (-3.1% MoM), while the Indi-25 gained 8.4% and the Resi-10 rose 4.9% MoM. The rand, however, was weaker in January as the US dollar firmed, with the local unit down 3.2% MoM vs the greenback.

In local economic data, average annual consumer price inflation (CPI) for 2020 stood at 3.3% – the lowest annual average rate since 2004 (1.4%) and the second-lowest since 1969 (3.0%). December annual inflation advanced to 3.1% YoY (vs 3.2% in November), while MoM, price growth was 0.2% vs 0% in November. At its January meeting, the SA Reserve Bank’s (SARB) Monetary Policy Committee (MPC) left the repo rate at a record-low 3.5%. Meanwhile, November retail sales fell 4% YoY, following a revised 2.3% YoY decline in October and a 2.4% YoY drop in September. SA’s trade surplus narrowed to R32.0bn in December vs a revised R35.26bn surplus in November. The SA Revenue Service (SARS) said that exports fell 8.2% MoM to R125.95bn, while imports declined 7.8% MoM to R93.95bn

On the COVID front, the latest data from the Department of Health show that the peak of the second wave of the pandemic has passed. Still, as of 31 January 2021, the total number of confirmed COVID-19 cases to date stood at 1.45mn (vs end December’s 1.11mn). Last month, President Cyril Ramaphosa also said that the amended lockdown level 3 (initially implemented with effect from midnight on 28 December) would continue until mid-February, with the sale of alcohol still banned. SA’s first batch of 1mn COVID-19 vaccines from the Serum Institute of India were scheduled to arrive in the country on Monday (1 February).

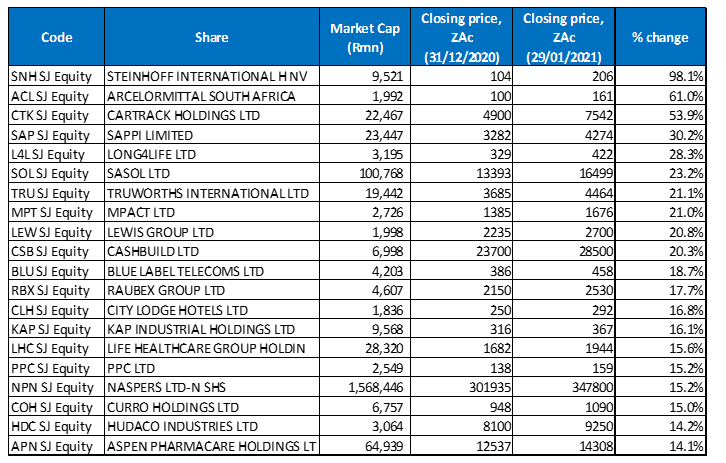

Figure 1: January 2021’s 20 best-performing shares, MoM/YTD

Source: Anchor, Bloomberg.

Steinhoff was January’s best-performing share, albeit from a very low base, rocketing 98.1% MoM. Most of the gains happened in the last week of the month (with Steinhoff’s share price jumping c. 60% last week alone) and Business Insider is reporting that trading volumes in the share were the highest last week since July 2020. Meanwhile, Business Day writes that the retailer has undertaken legal processes to obtain the requisite authority to reach settlements with its shareholders. Earlier in January, Steinhoff had announced that it was reviving plans to list its European discount retail subsidiary the Pepco Group (which owns the PEPCO and Dealz brands in Europe, and Poundland in the UK). In a 1Q21 trading update, Pepco said it “continued to “trade resiliently” while increasing its total number of stores in spite of the pandemic…”.

Despite the January dip in iron ore prices after last year’s stellar run, ArcelorMittal SA was in second spot with a 61.0% MoM gain. The company had a very difficult 2020 as lockdowns eroded steel demand and by June last year it had announced wide-ranging restructuring initiatives and job losses, even closing its Saldanha steel plant. However, in October, the share price started to rise, as the firm said it would restart a second blast furnace at Vanderbijlpark in December as local steel demand recovered at an unexpected pace on the back of construction projects and improved sales at its retailers. On 8 January, Arcelor said the furnace was in full operation and would add around 600,000 tonnes to SA’s flat steel production p.a. According to the company, “With the restart of the second blast furnace in Vanderbijlpark, the increased steel capacity from the beginning of January 2021 will quickly resolve any remaining backlog issues”. Arcelor also released a trading update in January indicating that its headline loss for the year to end December 2020, would decline by at least R1bn. In FY19, the company recorded a R3.3bn loss.

In third position, local telematics car and fleet tracking company, Cartrack (+53.9% MoM), said in January that it will move its primary listing to the Nasdaq, with a secondary inward JSE presence for shareholders who opt to stay invested in the business under a scheme of arrangement. According to Business day, the move will enable the company to tap global capital markets and accelerate its global growth ambitions.

Paper and packaging company, Sappi, and Long4Life followed with MoM gains of 30.2% and 28.3%, respectively. Last month, Brian Joffe’s lifestyle investment company, Long4life said that it has been repurchasing shares rather than using surplus liquidity to pay dividends. The firm plans to ask shareholders to authorise more share buybacks ahead of its annual general meeting in July so it can put its surplus cash to use. Long4Life will ask shareholders to approve further repurchases at a special general meeting on 16 February so it can start the next repurchase programme as soon as its new financial year gets underway.

Sasol (+23.2% MoM), released a 1H21 trading update last week, saying that it expects EPS to be between R22.76 and R24.07 compared with the prior half-year’s EPS of R6.56. The company also expects its HEPS to be between R18.59 and R19.78 compared with the prior half-year HEPS of R5.94. Sasol is aiming to raise up to $6bn through asset disposals, opex, capex and working capital savings, and potentially a rights issue. It has previously said it will update investors on a potential rights issue when it reports its results in February. Given the progress made on asset disposals (c. $3.1 bn) and cost cutting, there could be a small rights issue (less than $1bn) or no rights issue at all, in our view.

Retailer, Truworths International Ltd (+21.1% MoM) said in its business update, that both of its main markets, SA, and the UK, continued to be materially affected by the impact of the COVID-19 pandemic. Group retail sales for the 26-week period ended 27 December 2020 decreased by 8.5% to R9.70bn compared with the R10.60bn recorded in the same period of the prior year. Still, in our view, the update was very good and beat consensus estimates handsomely. Group sales decreased by 8.5% but improved from the 10% decline Truworths reported in November, while Truworths Africa’s sales declined by 6.8% improving from the 9% drop reported in November, and Office UK sales recorded a 24.6% decline in British pound terms (an improvement from the 26% decline reported in November). Truworths also guided that its HEPS would decline by between 4% and 9% YoY for the full year.

MPact, the biggest paper and plastic packaging and recycling business in Southern Africa, Lewis Group, and Cashbuild rounded out January’s ten best-performing shares, gaining 21.0%, 20.8% and 20.3% MoM, respectively. In a 3Q20 trading update, released last month, Lewis indicated that the Group had delivered strong sales growth of 16.6% YoY, supported by another buoyant Black Friday performance. Cash sales for the quarter grew 35.9%, while credit sales rose by 2.0%. Total revenue, comprising of merchandise sales and other revenue, increased by 11.5% for the quarter. Meanwhile, Cashbuild’s share price surged over 12% on 25 January following a strong trading update in which the company said its earnings would increase by a minimum of 100% for the six months to end December. The building materials retailer attributed the jump in earnings to a 21% YoY rise in revenue during 2Q20 and continued cost-control measures.

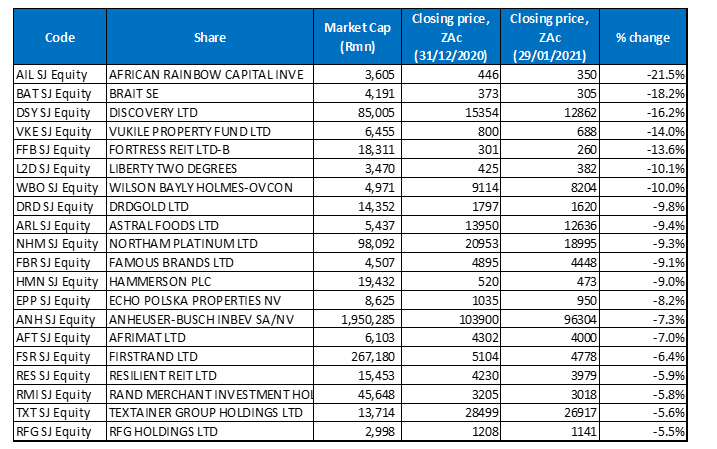

Figure 2: January 2021’s 20 worst-performing shares, MoM/YTD

Source: Anchor, Bloomberg.

January’s worst-performing shares were a mix of resources companies, financial firms and, for the most part (continuing last year’s trend) real estate businesses hard hit by the pandemic. African Rainbow Capital Investments (ARC) was January’s worst-performing share, with a 21.5% MoM decline. It was followed by investment Group, Brait SE and Discovery, which posted MoM share price falls of 18.2% and 16.2% MoM, respectively. Brait has exposure to the Virgin Active fitness chain, which has been especially hard hit in the UK by the fallout of the pandemic. Last month, in a further sign of its global aspirations, Discovery announced a partnership with French mutual insurance group Covea to launch motor vehicle insurance in the UK.

Discovery was followed by three property counters, Vukile Property Fund (-14.0% MoM), Fortress REIT -B- (-13.6% MoM), and Liberty Two Degrees (-10.1% MoM). We note that the property sector had a relatively strong rally in November and December and the increased COVID-19 infection rates towards the end of December and in January, as well as the reintroduction of various lockdown restrictions, likely weighed on their share prices as all of these counters have substantial retail property exposure (in the case of Vukile it has c. 100% retail exposure).

Wilson Bayly Holmes-Ovcon’s (WBHO; -10.0% MoM) shares were weighed down by news that the planned sale of its Australian building subsidiary, Probuild, fell through at the last minute after the Australian government refused the deal due to national security concerns. WBHO said that it “… has been advised by the potential acquirer of Probuild that it has withdrawn its proposed investment application in Probuild lodged with the Australian Foreign Investment Review Board following advice that its application would be rejected by the Federal Government on the grounds of national security,”. Over the past few months, WBHO told shareholders that it had received an unsolicited offer from “a major international construction and civil services company” to acquire its 88% stake in Probuild.

DRDGold, one of the world’s largest gold tailings retreatment specialists, took a breather from its fantastic share price run last year and was down 9.8% in January. In 2020, DRDGold was the JSE’s best-performing share, soaring by 139.6% for the year. Finally, rounding out the ten worst-performing shares were Astral Foods (-9.4% MoM) and Northam Platinum (-9.3% MoM).