Apart from Chinese markets, most major global bourses ended November higher, largely due to the hope that the US-China trade negotiations will bring about an end to the trade war between the two superpowers. However, optimism surrounding a possible trade deal did come under pressure towards month-end after US President Donald Trump signed two bills into law supporting the Hong Kong protesters. China’s Foreign Ministry reacted angrily saying that the US has “sinister intentions” and that China will take “strong counter-measures” against the US. Investors rightly fear that this could put pressure on trade negotiations between the two countries ahead of a 15 December deadline for fresh US tariffs on Chinese goods. However, The Wall Street Journal (WSJ) writes that Chinese authorities are looking to separate geopolitics from trade and do not necessarily see the passage of the Hong Kong bill as irreparably harming prospects for a phase-one trade deal. Meanwhile, in a speech on 23 November, Federal Reserve (Fed) Chair Jerome Powell gave an upbeat assessment of the US economy, noting that the Fed’s three rate cuts have helped spur more home purchases, which have contributed to the economy’s ongoing expansion (currently in its 11th year – the longest on record).

Looking at the performance of the three major US indices last month, all three posted their best gains since June. The tech-heavy Nasdaq rose 4.5% MoM (+30.6% YTD), while the Dow Jones Industrial Average rallied 3.7% MoM (+20.3% YTD) and the S&P 500 posted a 3.4% MoM increase (+25.3% YTD).

In terms of US economic data, the Conference Board’s November consumer confidence index dipped to 125.5– its fourth consecutive monthly decline. However, IHS Markit’s flash purchasing managers index (PMI) showed that US November manufacturing output accelerated to its fastest pace in seven months, while services activity also picked up more than expected, indicating the continued resilience of the US economy despite the ongoing trade war and other headwinds. A revised estimate of GDP growth showed an increase of 2.1% in 3Q19, driven by consumer spending.

For a third month running, major European equity markets closed in the black. Germany’s DAX gained 2.9% MoM (+25.4% YTD), while France’s CAC advanced 3.1% MoM (+24.8% YTD). On the economic front, the latest OECD data show that exports and imports fell across all major European economies on the back of the US-China trade war, Brexit uncertainty and the industrial downturn in the EU’s largest economy, Germany. OECD data also indicate that EU exports contracted by 1.8% QoQ in 3Q19, while imports fell 0.4% QoQ. In early November, the European Commission warned of “a protracted period of subdued growth and low inflation in the context of high uncertainty,” as the factors mentioned above combine to impact nearly every sector of the economy. The EU now forecasts real GDP growth of 1.1% (down from a previous estimate of 1.2%) and inflation of 1.2% this year. To provide some context, the US economy, which is also slowing, is forecast to grow at twice that rate (+2.2%).

The UK FTSE 100 gained 1.4% MoM (+9.2% YTD), reaching its highest level in c. four months on 27 November, on hopes of a trade war breakthrough, before following global markets lower again on Friday (29 November). The UK managed to miss a recession as the latest GDP data (released in November), showed the economy grew 0.3% in 3Q19, following a negative reading in 2Q19, and annual growth slowed to just 1% YoY (the slowest annual growth rate in c. 10 years as Brexit uncertainty continued to weigh on businesses). Prime Minister Boris Johnson struck a new deal with the EU after being forced by the UK Parliament into asking for another Brexit extension. The UK will now hold a general election on 12 December, after MPs backed Johnson’s call for an election (the country’s third in just four years) following months of Brexit deadlock.

In Asia, China’s Hang Seng retreated by 2.1% (+1.9% YTD), while the Shanghai Composite dropped 1.9% MoM (+15.2% YTD). China’s factory activity returned to growth in November, with the National Bureau of Statistics data showing that November PMI bounced back to 50.2 – its highest level since March and above the 50-point level separating expansion from contraction. In Japan, the Nikkei rose 1.6% MoM (+16.4% YTD), after previously closing at 2019 highs on 12 November.

On the commodity front, despite plunging c. 4% on Friday (29 November), the price of Brent crude oil closed November c. 2.7% higher (+16.0% YTD) on the back of slowing US output growth and optimism around a US-China trade deal. After the gold price’s impressive performance in October, the price of the yellow metal once again ended November (its worst month since September) in the red (-0.6% MoM; +14.2% YTD). This as positive US data dulled the attractiveness of safe-haven assets. Benchmark iron ore prices dropped c. 5.4% MoM, while the platinum price was down c. 3.0% MoM. The price of palladium (which together with platinum, rhodium and three other metals forms part of the platinum group metals [PGM] basket) continued its upward trend, rising 3.2% MoM. The rand strengthened 3.1% MoM against the dollar but is down 2.3% YTD vs the greenback.

After staging a turnaround in October, the JSE retreated in November with the FTSE JSE All Share Index losing 1.9% MoM (+5.0% YTD). However, both the Resi-10 and the Fini-15 posted good gains of 6.1% (+12.3% YTD) and 1.0% (-4.9% YTD) MoM, respectively, although the Indi-25 was down 2.6% MoM (+6.5% YTD). Market-cap heavyweights such as Richemont (-6.1% MoM), Anheuser-Busch InBev (AB InBev; -5.0%), Prosus NV (-4.8% MoM) and Naspers (-2.4% MoM) all came under pressure during the month, dragging the overall market lower.

Finance Minister Tito Mboweni’s depressing Medium Term Budget Policy Statement (MTBPS), which painted a bleak picture of SA’s finances, continued to weigh on the rand and sentiment going into November. Ratings agency Standard & Poor’s (S&P), which downgraded SA to sub-investment grade or junk status in November 2017, last month changed the country’s sovereign credit rating to negative watch, highlighting in its outlook statement that state-owned power utility, Eskom, will likely be an lasting drain on fiscal resources. Moody’s (the only ratings agency to have maintained an investment-grade rating on SA), downgraded its SA outlook to ‘negative’ bringing the country closer to junk status. In some positive news, President Cyril Ramaphosa’s second SA Investment Conference (SAIC) took place in early November and, at this year’s conference, R363bn in total investment commitments were made.

Local economic data showed that November consumer price inflation (CPI) dropped to its lowest level in eight years, coming in at 3.7% YoY (vs 4.1% in September). Stats SA highlighted that the main contributors to the annual inflation rate increase were food and non-alcoholic beverages (+3.6% YoY), housing and utilities (+4.8% YoY), and miscellaneous goods and services (+5.7% YoY). The latest September retail sales data showed only a 0.2% YoY rise vs August’s revised 1.0% YoY gain, while the October trade surplus narrowed to R3.09bn from a revised R4.53bn in September. Exports rose 11.9% MoM and imports jumped 13.7% MoM. The SA Reserve Bank’s Monetary Policy Committee (MPC) decided not to cut interest rates at its last meeting for the year on 21 November, which supported the local currency.

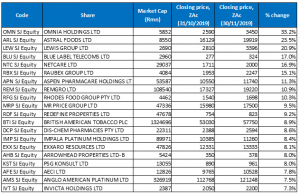

Top-20 November 2019 MoM performers

Source: Bloomberg, Anchor

Diversified chemicals company, Omnia Holdings was November’s best-performing share, rising 33.2% MoM. We note though that this was from a low base as the share price had lost c. 27% of its value in the year to 1 November. Nevertheless, the firm seems to have stabilised the business and, in its 1H20 results, it reported a slight revenue increase to R8.72bn from R8.65bn posted in 1H19, while diluted EPS stood at ZAc38 vs a loss per share of ZAc120 in the same period of last year. Omnia has been impacted by a downturn in its key sectors and a hefty debt burden but the company said last week that it was finalising a new debt package, including core facilities of R2bn, of which R250mn is payable in two years, R750mn in three years, and R1bn after four years. Omnia also implemented a R2bn rights issue in September, which was oversubscribed, with the proceeds used to reduce its debt.

Despite reporting a 55% YoY drop in FY19 profit, poultry and animal feed producer Astral Foods was last month’s second-best performer – up 23.5% MoM. Astral said its full-year profit plunged after higher feed costs hit its poultry division, a decline it first warned the market about in October. Headline EPS stood at R16.59 – a 55% YoY drop from R36.91 reported in FY18, but turnover increased 4% YoY to R13.5bn and CFO Daan Ferreira said that the company “… continues to deliver strong cash flows, with reported surplus cash on hand of R555mn… The final dividend for the year was ZAc425/ share, bringing the total FY19 dividend to ZAc900/share.”

Household furniture and appliances retailer, Lewis Group, which has also been under pressure this year, was in third spot with its share price gaining 20.9% MoM. In 1H19, Lewis’ revenue increased to R3.08bn from R2.90bn posted in 1H18, while diluted EPS rose 18.0% YoY to ZAc211.30. The company purchased United Furniture Outlets (UFO) about two years ago and the move has brought cash for a business which has historically been reliant on giving credit to customers. According to Business Day, the move enabled Lewis to reduce its sales on credit to 58% of turnover – down from 70% in the past.

Lewis was followed by Blue Label Telecoms (which has been negatively impacted in the past by its 45% Cell C stake), Netcare and Raubex Group, with gains of 17.0%, 16.9% and 15.1% MoM, respectively. Netcare reported FY19 results earlier in November which showed that revenue rose 4.2% YoY to R21.6bn, while adjusted headline EPS gained 3% YoY to ZAc171.2. The adjusted number excludes the prior year’s interest income on its contractual economic interest in UK group BMI Healthcare’s debt. We note that, while growth remains difficult, paid patient days (PPDs) advanced 3.7% YoY on the back of growth in the mental health space. Acute hospital PPDs declined 1.4% YoY. Meanwhile, Raubex’s repositioning into a fully-fledged construction group has seemingly paid off with the firm reporting a 64.1% YoY improvement in headline EPS to ZAc58.6 for the six months to end August. Although Group revenue decreased 1.9% YoY to R4.4bn, operating profit jumped 37% YoY to R216.mn. Raubex’s secured order book has increased 8% YoY to R9.08bn, with contracts outside SA (the rest of Africa and Western Australia) accounting for 12.5% of the total.

Aspen Pharmacare’s (+11.3% MoM) share price was buoyed by news that it had agreed to sell its Japanese business to Sandoz for EUR400mn (R6.54bn) as part of an asset disposal to reduce its debt. Aspen also entered into a five-year manufacturing and supply agreement with Sandoz, with the option of an additional two-year extension for “the supply of active pharmaceutical ingredients, semi-finished and finished products related to the portfolio of divested brands effective at the completion of the transaction.”

Investment group, Remgro and Rhodes Food Group recorded MoM gains of 10.9% and 10.3%, respectively. The Remgro share price jumped in anticipation of a boost to the company’s value, following news of a planned restructuring of Rand Merchant Investment Holding (RMH). RMH CEO Herman Bosman suggested last month that the Group give shareholders its 34.1% stake in FirstRand, the parent of First National Bank valued at R130bn, as part of restructuring of the Group’s portfolio of assets and liabilities. Remgro is RMH’s biggest shareholder. Rhodes, meanwhile, reported FY19 results, which showed a revenue increase to R5.41bn from R4.99bn posted in FY18, while diluted EPS jumped 39.8% YoY to ZAc82.50.

Rounding out the top-10, Mr Price posted a 9.5% MoM share price gain, despite recording an overall decline in profit due to the underperformance of its apparel division. Headline EPS declined c. 8% YoY to ZAc455, while revenue rose slightly (+2.6% YoY) to R10.8bn. Five of its divisions managed to grow sales, gross margins and operating profits and the results also showed robust growth in its mobile and online divisions.

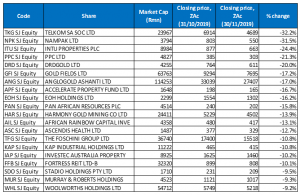

Bottom-20 shares: November 2019 MoM performance

Source: Bloomberg, Anchor

Telkom was November’s worst-performing share, falling 32.2% MoM. The share price initially came under pressure following a profit warning in early November, but it continued on this trajectory post-results. News that Cell C (the company for which Telkom had made a takeover offer which was repudiated) had signed a roaming pact with rival MTN increased its share price woes. In terms of results, Telkom’s half-year profit slumped 36% YoY, driven down by a surge in finance costs and unfavourable foreign exchange shifts. In addition, compared to a restated figure for 1H18, Telkom’s HEPS dropped 44% YoY, although revenue increased 4.7% YoY to R21.5bn despite “the challenging operating environment.”

Telkom was followed (once again) by Nampak (-31.5% MoM), which reported worse-than-expected results and saw its share price plummet to a more than 20-year low in November. The packaging Group recorded a FY19 net loss of R390mn (down 132% YoY) vs last year’s profit of R1.2bn, while headline EPS declined by more than two-thirds (-69% YoY) from ZAc173.3 to ZAc54.1. Revenue fell 8% YoY from R15.9bn to R14.6bn. Zimbabwe and Angola have weighed on Nampak’s earnings in the past and were again the main reasons for the declines. Nampak recorded a R1.9bn net pre-tax foreign exchange loss in Zimbabwe, while in Angola, a change in tax legislation saw Nampak fall in a “higher-than-anticipated” effective tax rate with the firm not getting a full deduction for losses it incurred due to foreign exchange movements.

Intu Properties (-24.4% MoM) was in third spot. The UK-based mall owner’s share price plunged after a trading statement said it has a plan to “fix the balance sheet,” which included a capital raising. The company has battled fallout from Brexit uncertainty and a struggling UK retail sector. Intu, which owns 17 of the largest shopping centres in the UK and a few Spanish malls, also sold a shopping centre in Northern Ireland to shore up its balance sheet.

PPC was November’s fourth worst-performing share, dropping 21.3% MoM. Last month, the cement manufacturer revealed in its 1H19 results that its revenue declined 12.0% YoY to R4.95bn, while its headline EPS stood at ZAc6.00, compared with ZAc21.00 recorded in 1H18. The company blamed the slump on a weak building market in SA, the rand remaining under pressure, the devaluation of the Zimbabwean dollar and hyperinflation in Zimbabwe.

PPC was followed by several gold miners (DRD Gold [-20.0% MoM], Gold Fields [-17.2% MoM], and AngloGold Ashanti [-17.0% MoM]), which had recorded good share price gains in October but saw those gains evaporate following gold’s lacklustre performance in November.

Real estate investment trust (REIT), Accelerate Property Fund lost 16.7% MoM, after it announced that it had reached a deal to sell its Edcon warehouse for R94mn, as it looks to dispose of non-core assets and reduce its debt.

Rounding out the ten worst-performing shares for November were EOH Holdings, Pan African Resources and African Rainbow Capital, which recorded MoM share price declines of 16.2%, 15.8% and 13.9%. In November, EOH CEO, Stephen van Coller told Cape Talk that EOH has blacklisted 50 of its enterprise development partners implicated in “fake work and overbilling” fraud totalling almost R1bn. The business’ NAV has dropped by 70% in the past year, partly due to the fraud. The lower gold price put pressure on Harmony, which released a positive 1Q20 operational update showing that its total gold production rose 1.5% YoY to 11,231kg compared with 11,061kg in the previous quarter. Total gold revenue was also 20.0% higher YoY at c. R8.00bn.

Top-20: YTD best-performing shares

Source: Bloomberg, Anchor

For the most part, the best performing shares YTD (to November) were unchanged from October. Among those that fell out of the top-20 were Pan African Resources Plc, Bid Corp and Investec Australia Property. They were replaced by Raubex Group, Pioneer Foods and Capitec Bank Holdings after their strong respective performances last month.

After four months at number one YTD, platinum miner Impala (+207.0% YTD) was ousted from that position by Sibanye Gold (+188.2% YTD) in October, following the gold price’s impressive run during the month (discussed earlier). However, November saw Impala once again grab the top position, pushing Sibanye back to second place, followed by Northam Platinum (+147.3% YTD) in third spot. The impressive performances of platinum counters are on the back of a c. 16% YTD rally in the platinum price, while platinum’s sister metals, palladium and rhodium have surged by c. 45% and 144%, respectively, in 2019.

Following a c. 20.0% MoM slide in November, DRDGold (+95.2% YTD) moved from third to fourth spot. DRDGold was followed by Cartrack Holdings (+88.0% YTD), which moved up from 8th position to 6th spot after a further 3.4% rise in its share price for November. After Cartrack came Harmony (+78.7% YTD), Royal Bafokeng Platinum (+76.0% YTD) and Gold Fields (+56.0% YTD). While all three of these shares recorded MoM declines in November, their strong performances in October saw them maintain their positions among the best YTD performers.

Rounding out the top-10, and dropping to tenth spot from ninth position in October, AngloGold Ashanti (+50.8% YTD), was last month forced to suspend its gold mining operations in Guinea after a community protested on its Siguiri mining site. According to media reports, AngloGold had also last week narrowed the list of bidders for its remaining local assets to two of SA’s biggest gold miners -Sibanye and Harmony.

Bottom-20: YTD worst-performing shares

Source: Bloomberg, Anchor

November’s YTD worst-performing shares were relatively unchanged from October’s line-up. City Lodge and Netcare fell out of the list of 20 worst-performing shares YTD, while PPC (-48.6% YTD) and Stadio Holdings (-40.1% YTD) recorded steep enough November share price declines to replace these counters.

Among the bottom-twenty shares, Intu Properties (-68.6% YTD) was the worst performing share YTD, replacing Massmart (-58.7% YTD), which dropped to third position as SA’s lacklustre economy, high unemployment and difficult macro-economic environment continues to impact the retailer. Nampak’s poor performance in November (discussed earlier) saw it move up the worst-performers ladder – from 11th position to the no 2 spot – down 60.3% YTD.

After Massmart came EOH (discussed earlier), Sappi and Accelerate Property Fund (also discussed earlier) – down 57.8%, 51.2% and 50.0% in the year to end November. They were followed by Arcelor Mittal (-49.6% YTD), which said last month that it would close its steel operations at Saldanha Works because it could no longer compete in export markets. The company has for some time complained about cheap imports negatively impacting its business and has also been hit by the current subdued investment and infrastructure spending in the country, as well as the weak local economy.

Rounding out the remainder of the ten worst-performing shares YTD, were Kap Industrial Holdings (-48.8%), PPC Ltd (-48.6%, discussed earlier) and Brait SE (-47.6% YTD). In November, Business Day reported that the Competition Commission has referred wood-based panel companies Kap Industrial (as well as Steinhoff and Sonae Arauco SA) to the Competition Tribunal for prosecution relating to alleged cartel conduct. The commission wants the tribunal to impose an administrative penalty of 10% of their annual turnover on these companies.

Brait’s share price slumped further in November after it announced plans to raise up to R5.6bn in equity to reduce its debt. In the shareholder update, Brait said it intends to undertake an equity capital raise of between R5.25bn and R5.6bn, which will comprise a fully underwritten rights offer of R5.25bn, and a specific issue of shares of up to R350mn at the rights offer price. According to Brait, its core portfolio of investments was undervalued due to the “current high levels of debt on Brait’s balance sheet and concerns over Brait’s ability to meet its debt obligations”.