US home improvement retailer, Home Depot released 2Q19 results on Tuesday (20 August 2019). The results were roughly in-line with expectations, with a marginal miss in terms of revenue ($30.84bn [+1.2% YoY] vs the Refinitiv consensus forecast of $30.99bn). However, this was offset by a gain on earnings per share (EPS) – adjusted EPS came in at $3.17 (+3.9% YoY) vs the Refinitiv consensus analyst expectation of $3.08. Meanwhile, same-store sales rose by 3% YoY vs Refinitiv consensus expectation of 3.5% YoY growth. The average ticket size increased 1.7% YoY to $67.31, whilst sales per square foot advanced by 1.1% YoY and big-ticket items (items retailing at over $1,000) increased 3.7% YoY. Gross and operating margins declined c. 20bps YoY. Online sales grew by 20% YoY, with c. 50% of online orders being picked up in-store, according to the company.

As happened in 1Q19, lumber impacted the business negatively with lumber prices continuing to drop as US home construction and housing starts declined. Lumber accounts for c. 8% of Home Depot’s total revenue and unless we see a change in 2H19, it could have a further $600mn impact on the firm’s results, representing an additional 0.5% decline in revenue.

Looking ahead, management continued to guide cautiously, pulling back full-year numbers to below prior guidance levels, with the full-year revenue mid-point now being guided at $110.7bn and EPS at $10.03, representing growth of 2.3% and 3.1% YoY, respectively. Comparative growth is expected to be closer to 4% YoY vs the 5% YoY previously guided. Margins are likely to decrease slightly as the company looks to mitigate some of the trade-war tariff impact.

We still believe Home Depot to be a strong inclusion in our client portfolios. Although the company is experiencing some headwinds from tariffs and a general slowdown within the US housing construction sector, it continues to see same-store sales growth of 4% p.a. CEO Craig Menear stated that the current health of the US consumer and a generally stable housing environment will continue to support the business. As previously mentioned, lumber deflation and the tariff outlook is responsible for the lower full-year growth forecast and any turnaround in either (or even both) would be positive for Home Depot. The company is also cash flow positive with a free cash flow yield of 5.1% and its debt is within acceptable levels. The share price is up 28% YTD (to Tuesday’s close) and has more than doubled since we included it in our portfolios. The share is also trading at our target price.

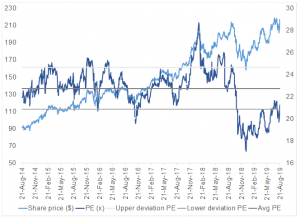

In our view, Home Depot is attractively valued on a trailing price earnings (PE) ratio of 21.2x and a 12-month forward PE of 20.4x – both well below the long-term average of 22.7x. The share has a dividend yield of 2.5%.

Figure 1: Home Depot share price performance and PE, August 2014 to date:

Source: Bloomberg, Anchor

Although the results were mixed vs consensus expectations and guidance was lowered, Home Depot’s share price nevertheless rose 4.4% on Tuesday to close at $217.09.