We have had many discussions with clients recently about adding gold and Bitcoin to their investment portfolios.

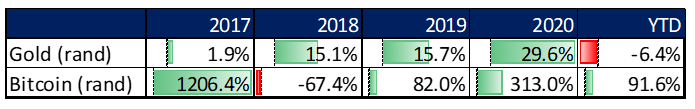

Figure 1: Gold and Bitcoin investments have rewarded investors handsomely over the past few years

Source: Anchor, Bloomberg

With the gold price having fallen by 16% since its August 2020 highs, many clients wonder if this perhaps presents a good opportunity to buy gold. Eye-watering price appreciation for Bitcoin, which seem to be gathering an ever-growing army of supporters, has also piqued most investors’ interest.

Executive summary

- We typically evaluate our investment decisions based on:

- the income an investment will deliver over the long term; and

- the current environment (and broad expectations for how that might change) and how it will impact supply and demand fundamentals for those investments.

- Analysis of future cash flows involves evaluating the potential for growth in future income against the certainty of receiving that income (with the latter usually commanding a premium, thus removing some of the potential for excess returns).

- Evaluating the supply/demand environment for various investments includes assessing the availability of liquidity, investor sentiment, and the economic environment as well as anticipating how the expected trajectory of these might change.

- Typically, estimates of the current value of future cash flows act as an anchor for evaluating the impact of supply/demand dynamics on the current price equilibrium.

- Gold and Bitcoin are both non-income producing assets and, as such, can only be evaluated based on the expectations for supply/demand, without the benefit of a cash flow-based valuation for context of what is being factored into the current price.

- Both gold and Bitcoin have a finite supply, of which > 80% has already been mined – suggesting to us that the bulk of short- to medium-term supply for these assets will come from those stocks held by existing owners. Understanding how demand for gold and Bitcoin evolves, and the price at which existing owners may be willing to sell, is therefore key to evaluating the investment merits of these assets.

- The demand environment for gold seems to be softening as yields rise, central bank intervention slows, and fear subsides alongside improving economic prospects.

- The base of potential Bitcoin investors is growing, which should act as a tailwind for demand. The extent to which regulation and alternative digital- or blockchain-based currencies dilute that demand is hard to quantify. It is also difficult to estimate the price equilibrium at which existing Bitcoin investors will be tempted to sell.

- For South African (SA) investors the prospect of owning gold and Bitcoin (which are US dollar-priced assets) come with the additional benefit of protecting them against rand depreciation. However, there are multiple US dollar-priced, income-producing investment options that can fulfil that currency hedging role in investors’ portfolios effectively.

Before diving into the individual merits of gold and Bitcoin, it makes sense to take a step back and have a look at the framework which we use to make investment decisions. We think it is helpful to have this context before narrowing in on the specific investment cases for gold and Bitcoin.

We broadly analyse investments from two perspectives:

- The present value to us of any future income that the investment might generate.

- The impact on the price, resulting from changes in supply of, and demand for, those investments.

The above is probably a vast oversimplification of investing but encapsulates the bulk of what determines investment returns over various investment horizons (the former predominantly over longer horizons, the latter typically over shorter horizons). We discuss the two perspectives in more detail below.

- Present value of future income

Future income from investments comes in many forms, including:

- interest and capital repayments on loans/bonds;

- rental income from properties or other fixed assets; and

- earnings from businesses.

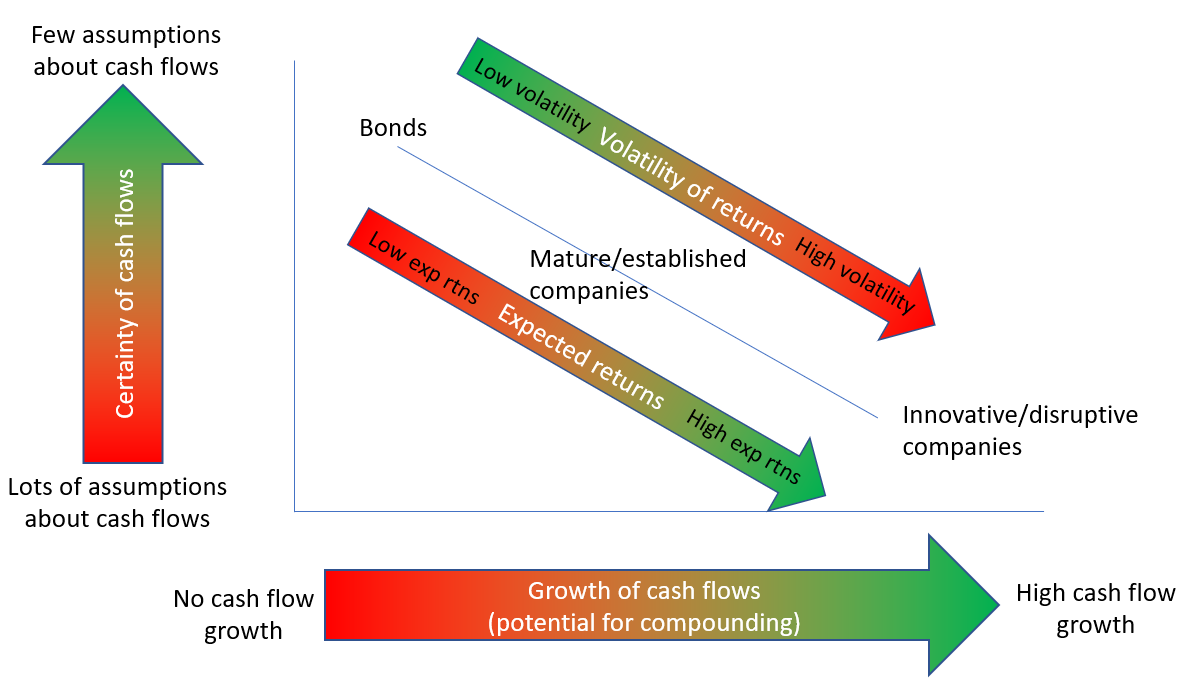

Analysis of future income potential tends to be focussed on a multi-year time horizon and involves trying to quantify:

- The level of certainty of receiving that future income.

- The growth which we can expect in income over time.

Investments with a high degree of predictability of future cash flows (e.g., bonds or loans to credit-worthy borrowers), typically offer limited potential for significant above-inflation returns relative to those investments, which offer the prospect of meaningful future income growth. However, investments with the prospect of significant future income growth (e.g., innovative companies starting out in potentially disruptive industries) typically require many assumptions to forecast future cash flows and, as such, these offer the potential for superior long-term returns but with a much greater risk of not achieving those expectations. Skilled analysts will try to identify investments where the market is underestimating the future potential for income due to various reasons including:

- The failure to sufficiently quantify the total addressable market (TAM) and/or failure to quantify the company’s future market share of the TAM.

- Underestimating the impact of technology, scale, and efficiency on gross profit margins.

- Misjudging the ability of management to control operating costs or expand into new markets or products.

- Underestimating pricing power.

Figure 2: The framework for evaluating the future income potential of financial assets

Source: Anchor

- The impact of changes in supply of and demand for an investment

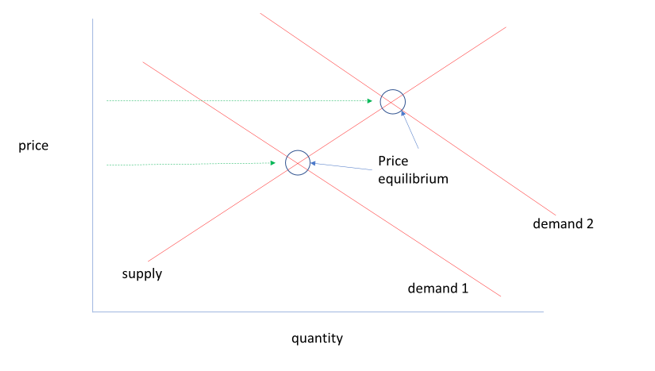

This economic concept suggests that the “invisible hand” of the market will nudge prices in the direction of an equilibrium between supply and demand. Supply and demand changes tend to be cyclical and transitory and price equilibrium tends to be achieved over a short time horizon (seconds to months).

Figure 3: Anticipating unexpected changes in supply and demand dynamics for an investment is key to understanding short-term price changes

Source: Anchor

Skilled traders of financial assets, much like skilled traders of goods and services, tend to have a knack for buying securities in anticipation of temporary, unexpected excess demand, selling them at a higher equilibrium price or even selling ahead of temporary, unexpected excess supply to buy them back at a lower equilibrium price. Events that can impact supply and demand in financial assets include:

- Availability of liquidity: This tends to be driven by the action of central banks. Currently, global central banks are stimulating demand by providing an abundant supply of cheap funding. Recently, the US government has also taken a more direct approach to demand stimulation by handing out cheques directly to its citizens.

- Sentiment e.g., an increase in uncertainty, often leads to fear, which usually results in excess supply of investments with a high degree of uncertainty and excess demand for those investments with more certainty around their future income prospects.

- Economic factors, including near-term prospects for economic growth and employment (which tend to be correlated with corporate earnings and/or the ability to pay interest, rent, etc., which investors are expecting to receive as income).

- The level of regulatory intervention.

- Idiosyncratic events – typically random one-off events e.g., natural disasters, pandemics, and the death, or arrest, of key individuals associated with an investment etc.

These factors (perhaps apart from idiosyncratic events) tend to be interlinked and are often influenced by the actions of governments and central banks.

These two perspectives work best alongside each other, with income-based valuation estimates providing an anchor against which to assess the extent to which anticipated supply/demand factors and trends are already factored into the market value of these investment.

While that was a very long-winded introduction to assessing the investment merits of gold and Bitcoin, we think it is also a crucially important one, since both of these investments are characterised by a lack of income-producing ability. This leaves us with only one lens through which to view these investments and that is the impact that supply and demand dynamics will have on their respective prices. Crucially, without the ability to estimate their present value based on future income, it is difficult for us to assess what expectations regarding trends in supply and demand are already built into the current price.

So, with only one possible leg of our valuation framework with which to assess gold and Bitcoin, let us delve into the individual merits of each.

Gold

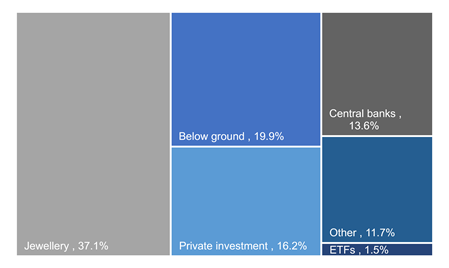

We are going to attempt to frame the impact on supply and demand of the major factors influencing gold. However, before we do that, we need to understand that supply and demand for gold in the short- to medium term are predominantly a function of above ground supplies of gold changing hands. 80% of the world’s gold is already above ground, so most of the changes in supply are likely to come from above-ground sources (i.e., current owners of gold in the form of investments or jewellery, who are willing to sell those holdings should they assess the current price to be attractive).

Figure 4: Gold supply – 80% of world gold reserves are above ground

Source: World Gold Council, Anchor

- Availability of liquidity: Typically, environments with abundant liquidity are characterised by low interest rates, and interest rates also tend to be a meaningful driver of the gold price, particularly real (inflation-adjusted) interest rates. Since gold produces no income, holding gold comes with an opportunity cost – the foregone interest that would have been earned on the cash used to purchase gold. The recent increase in US interest rates is likely to have weakened the demand for gold, we do not expect much of the recent rise in interest rates to reverse and, as such, we do not foresee a return of excess demand.

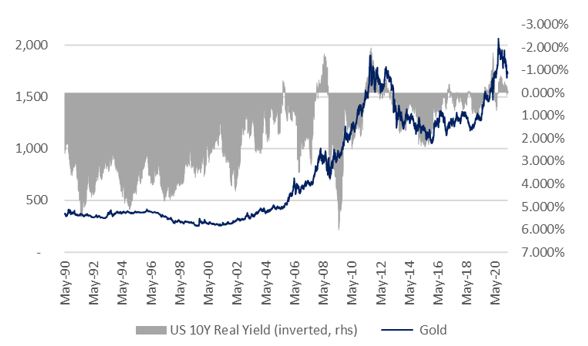

Figure 5: Rising real rates tend to act as a headwind for the gold price

Source: Anchor, Bloomberg

- Sentiment: Fear is major factor driving the price of gold, with those investors most bullish on the prospects for the gold price typically being those who are expecting excessive central bank intervention (excessive “printing of money” in the form of quantitative easing [QE]) or excessive government borrowing (or both) to result in the demise of the current fiat monetary system or hyper-inflation (or both). The trend for “money printing” and excessive government borrowing is likely to slow going forward as economic activity normalises post the COVID-19 pandemic, helping to allay fears of catastrophic consequences for the global monetary system. Less fear should act as a headwind to demand for gold.

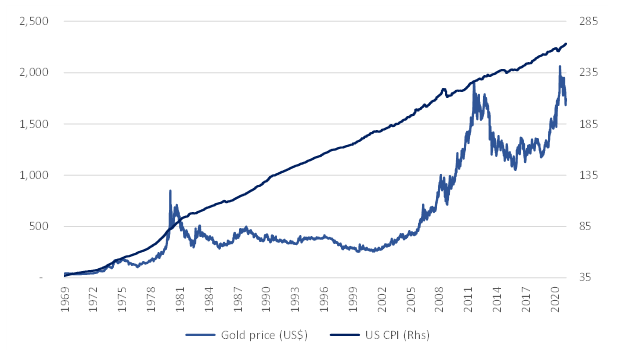

The final discussion point, regarding investments in gold, is the hypothesis that gold tends to insulate investors from inflation and act as a hedge against falling equity markets. Over the past 50 years or so, this inflation argument has not been particularly compelling. If you invested in gold in the early 1980s, when you had a real reason to fear inflation (US inflation was in the teens at that time), the value of your investment would have almost halved over the next 10 years as central bankers worked to tame inflation. This is perhaps a good example of the gold price in the early 1980s having been driven by excess demand from investors anticipating extended periods of high inflation which, ultimately, did not materialise.

Figure 6: The price of gold diverges from trends in inflation for meaningful periods

Source: Anchor, Bloomberg

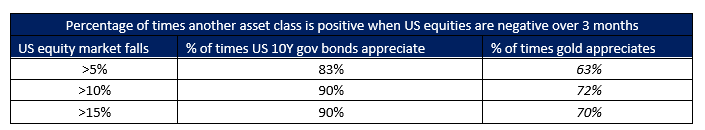

Gold does tend to act as a reasonable hedge against falling equity markets, but we note that it is not as reliable as government bonds at acting as a portfolio hedge.

Figure 7: Over the past 50 years, government bonds have tended to be more reliable than gold at hedging against equity market corrections.

Source: Anchor, Bloomberg

Bitcoin

Bitcoin and gold share many similarities, including the following:

- Both are indestructible and cannot decay.

- Bitcoin is touted as a viable alternative to the current fiat monetary system for those that believe the current monetary system is flawed and vulnerable and/or susceptible to hyper-inflation.

- Bitcoin is a non-income producing asset and as such, like gold, there is an opportunity cost associated with owning it (roughly equivalent to the level of real interest rates).

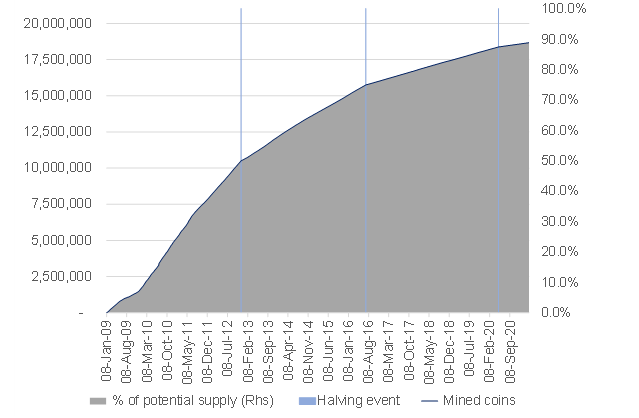

- There is a finite supply of bitcoins (21mn) and the majority of those (88% or 18.5mn) have already been mined. Much like gold, the biggest source of supply for Bitcoin is the supply already owned by existing holders.

Figure 8: Most bitcoins have already been mined

Source: Anchor, Bloomberg, Mosaic

So, rising rates and a moderation in central bank activity may also act as a headwind to the price of Bitcoin.

We see the following as the major differences between Bitcoin and gold (at least as it relates to factors that might impact its price via supply and demand):

- With gold having been around for considerably longer, it tends to be better understood and is significantly more widely held (including by many investors and most central banks). As Bitcoin becomes better understood and more broadly adopted, it could have a long runway of increasing demand.

- Gold has some industrial application (predominantly its use as a conductor) and more than one-third of all gold is used in jewellery. Bitcoin has yet to find meaningful alternative, practical uses outside of it being a parallel currency, thus perhaps limiting its sources of demand.

- Bitcoin’s ability to circumvent exchange controls and tax networks leaves it susceptible to increased regulatory scrutiny, which could weaken demand.

- While other precious metals like silver and platinum have been touted as viable alternatives to gold, they have struggled to meaningfully compete with the yellow metal when it comes to jewellery and investment demand. The proliferation of other blockchain-based and digital currencies may dilute the demand for Bitcoin over time.

- As far as we are aware, you cannot purchase a Tesla with gold!

On balance, the likelihood of broader Bitcoin adoption and its impact on demand seems compelling. However, with this alternative currency still in its infancy relative to other investments and asset classes, it is difficult to forecast whether the risks to demand are going to outweigh that. Without the option of an income-based valuation as a sense check, it is almost impossible to gain comfort that its current price does not already incorporate significant assumptions about future demand.