Japan’s Nikkei was the best-performing developed market stock index in September, rising by 5.5% as Shinzo Abe comfortably won another three-year term as leader of the ruling Liberal Democratic Party (which will see him remain as Japan’s prime minister). The Japanese markets were buoyed by the prospect of a few more years of fiscal and monetary stimulus via a continuation of his “Abenomics” policies. In emerging markets (EMs), most of August’s big losers stabilised and rallied in September, with the Shanghai Composite and the Brazilian Bovespa stock market indices both up 3.5% for the month. However, the best returns came from the Russian stock market (the MSCI Russia Index rose 9.3% in September) largely thanks to the 50% weighting of energy companies which were beneficiaries of a surging oil price. Oil prices rallied on news of further drawdowns in US inventories at the same time that US sanctions are starting to remove Iranian supply from the markets. The Saudis indicated that they were comfortable with oil above the $80/bbl-level and are unlikely to increase their output.

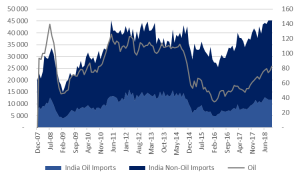

Oil accounts for more than 20% of India’s imports and the rising prices, together with a weakening currency, are starting to place increasing pressure on that country’s economy. With the current account deficit already amongst the worst in EMs, the additional pressure on the trade balance is forcing the Reserve Bank of India to respond with rate hikes, the first casualty being one of India’s largest shadow banks which has failed to make a few interest payments. India’s domestically focussed stock market has been resilient in the face of the recent EM crisis but these latest troubles saw its stock market fall by 6.4% in September.

Surging oil prices a drag on India’s trade balance

Source: Bloomberg, Anchor Capital

The S&P 500 Index was also marginally up in September thanks largely to pharmaceutical stocks which have started to recover from the negative sentiment that has plagued the sector as politicians took aim at perceived excessive drug pricing.

Trade tariffs were back in the news in September as the US implemented tariffs on another $200bn of Chinese imports, initially at 10% but increasing to 25% from 2019. The Chinese responded with tariffs on $60bn of US imports at a rate of 5%-10%, which was lower than expected, presumably to keep hopes of a negotiated deal on the table. The tariffs coincided with US 10-year bond yields breaching 3% for the fourth time this year on the back of rates that had been pushing higher since early September when US employment data showed wages growing faster than anticipated. The US Federal Reserve (Fed) predictably hiked rates during the month. Higher rates were a drag on real estate stocks, which were comfortably the worst-performing S&P 500 sector in September.

Written by:

Peter Little,

Fund Management