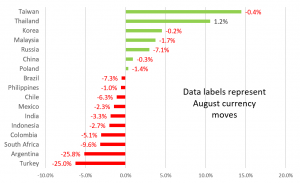

Emerging markets (EMs) were a key focus in August as Turkey led a rout that plunged EMs into chaos. What started off as a slide due to questionable governance in July (when Turkish President Recep Tayyip Erdogan appointed his son-in-law to oversee the economy), escalated into the US imposing sanctions over a spat about the continued detention of a US pastor in Turkey and then into a full-blown crisis as a speech by Erdogan on 10 August failed to introduce any measures aimed at managing the country’s deteriorating economic situation. The Turkish lira plunged 25% during the month, doubling its losses for the year and dragging other EM currencies with it. Argentina exacerbated EM woes late in the month as concerns about its ability to meet its 2019 debt obligations forced it to approach the IMF for early access to the funding it had been promised. While the 2013 EM currency crisis was all about which countries were most reliant on foreign funding (remember the “Fragile 5” countries with the biggest current account deficits), this crisis was more about liquidity as the Russian ruble (current account surplus) sold off alongside the South African rand (large current account deficit).

Emerging markets – current account balance as % of GDP and August currency moves

Source: Bloomberg, Anchor

EM stocks had a mixed month with Russia, India and South Africa’s equity indices up in local currency terms for the month, while Brazil and China’s stock market indices ended the month down. The Shanghai Composite stock market index had another torrid month as the negative momentum has dragged it down over 15% since May when talk of trade wars started to escalate.

Turkish troubles also spilled over into European stock markets, predominantly via European banks, which have material lending into Turkey, dragging the overall European market down. To make matters worse, Italian Deputy Prime Minister Luigi Di Maio, who represents Italy’s anti-establishment, threatened tough tactics for negotiations with the EU on budgetary restrictions and migration. On the other side of the Atlantic, the US stock market showed resilience as 2Q18 earnings for S&P 500 companies concluded with earnings growth of over 25% YoY. In a repeat of the story playing out this time last year, it was the large US tech stocks which led the US market higher. FAANG stocks (Facebook, Apple, Amazon, Netfilx and Google) along with Microsoft account for less than 15% of the S&P 500 Index but have delivered almost half of the performance YTD (4.6% of the 9.9% YTD rise) with an aggregate return of over 30% YTD between them.

Heightened risk aversion kept a lid on interest rates as US 10-year bond yields fell slightly during the month and credit spreads for both high-yield and investment-grade credit were largely flat. Most of the pain was felt in EM bonds – spreads on US dollar denominated EM bonds were about 0.1% wider and lira-denominated Turkish 10-year government bond yields were 3% higher. The Brazilian 10-year bond also ended the month more than 1% higher and the JP Morgan index of local currency EM bonds was down 7%.

Written by:

Peter Little

Fund Management