Markets globally had a rough October with the S&P 500 Index experiencing its worst month in over 7 years (since September 2011, when we were in the midst of a European debt crisis). The month started with an escalation of the tension between Italy and the European Union (EU) over Italy’s proposed debt-fuelled budget, driving the spread between Italian and German bond yields to levels last seen during the European debt crisis in 2011/2012. China’s A50 Index of large-cap onshore stocks had its worst start to the month since January 2016 as foreigners dumped $1.4bn of onshore shares via the Hong Kong exchange link. International events started to weigh on the US stock market, with the S&P 500 dropping over 5% in the two days leading up to the start of the third-quarter earnings announcements.

During the month, over 60% of S&P 500 companies reported 3Q18 earnings, which grew by over 23% in aggregate (more than 6% ahead of expectations). However, despite this, results did nothing to shake fears that this would be as good as it gets for US corporates. Large-cap US tech companies, which have been dragging markets higher for most of the year, pulled markets down this month as Amazon and Google, reporting earnings on the same day, delivered revenue growth that disappointed and kicked off the second leg down for equity markets late in the month.

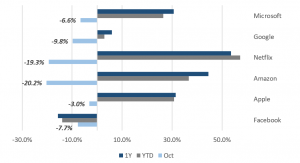

Large-cap US tech shares led the market lower in October

Source: Bloomberg, Anchor

A two-day rally into month-end was just about enough to haul US markets back into positive territory for the year. However, after the damage done in October it was very difficult to find another market still up YTD. The one exception being the Brazilian stock market which, despite an 11% weakening of the Brazilian real YTD, remains marginally higher in US dollar terms for the year. Jair Bolsonaro won the Brazilian presidential elections during the month and markets cheered the prospect of the far-right candidate’s proposed reforms. The picture in the rest of emerging markets was less rosy and the MSCI Emerging Market Index more than doubled its YTD losses in October, leaving it down 16% for the year.

Amongst the turmoil, the US dollar kept its haven-status with the Dollar Index another 2% higher during the month. Oil dipped in October with the focus shifting from supply concerns to demand worries. This despite the US releasing 3Q18 economic growth data which comfortably beat expectations (up 3.5% vs expectations of 3.3% growth). GDP was driven by 4% growth in personal consumption (vs expectations of 3.3%) and no sign of growing inflation pressure as the US Federal Reserve (Fed’s) preferred gauge of inflation came out in-line with expectations at 2%.

Written by:

Peter Little

Fund Management

Synchrony Financial

Synchrony Financial (SYF) is a US retail credit card company and partner to several retailers who want to stimulate sales by providing credit to customers. SYF was spun out of General Electric (GE) in the second half of 2014, when the parent company downscaled GE Capital, and has been in business for 80 years. SYF is also the dominant retail credit card provider in the US. It is said to have around 40% of the private-label retail credit card market. Some of its major clients include JC Penney, Lowe’s (a partner for 38 years) and Amazon.

The retail card sector is currently out of favour and retail card companies have typically traded at a higher rating of say 9.8x forward earnings over the past five years, while the current rating is <9x. Investors are concerned about a potential slowdown and a negative turn in the job and credit metrics. However, for now, higher interest rates benefit the card companies – until the write-offs eventually begin to increase. The SYF management team have to carefully balance risk and return in this arguably more cyclical end of the credit market and we are backing them to do that. The business generated a ROE of 18.7% for the first nine months of 2018. The book value is $19.47 (i.e. P/B on latest book value is 1.58x). We believe that this has scope to improve further as the firm shows its ability to manage credit well through the cycle. We note that Berkshire Hathaway is a large shareholder in SYF.

Written by:

David Gibb

Fund Management

Amazon releases 3Q18 results

Amazon’s 3Q18 revenue was slightly below street estimates, while EPS was materially above ($5.75 vs $3.11 expected). Revenue rose 29% YoY (30% in constant currencies) to $56.6bn – ahead of company guidance of $55.75bn. The operating profit grew 974% YoY to $3.7bn (the street had forecast $2bn). In terms of segments, North America recorded a 35% YoY revenue rise, with the operating profit margin at 5.9%, while operating profit rocketed by 1,700% YoY. In the International business, revenue rose 13% YoY, while the operating profit margin came in at -2.5% (vs -5.1% in 3Q17) and the operating loss reduced from -$919mn to -$385mn – an improvement of $534mn YoY. Amazon Web Services (AWS) recorded a revenue rise of 46% YoY, with an operating profit margin of 31.1% and operating profit growth of 75% YoY.

We believe the Amazon story is changing, but the market narrative is not yet reflecting that change. Amazon is moving from a revenue growth story to a profit growth story. In our view there are three main drivers of the change: Faster growth in high-margin segments, like AWS (Cloud), Subscription services, and Advertising; faster growth in the Marketplace business (selling on behalf of third parties) vs Amazon’s own products; and, after years of investments in people and infrastructure, Amazon is starting to reap material efficiency gains. Operating leverage is also driving profitability higher.

Amazon will continue to invest aggressively in future projects, but we’ve reached an inflection point, where Amazon’s ability to generate profit will exceed its ability to reinvest in the business. We believe that Amazon is arguably the most dominant growth company in the world and we view the current pullback following the results as a buying opportunity.

Written by:

Nick Dennis

Fund Management

JP Morgan

Following, the release of its 3Q18 results, we decided to increase our existing investment in this large US bank. The results were very good, with average loan growth up 6% and net interest margins benefiting from higher interest rates. Credit conditions remain very solid in the US, with no signs of any stress from the increase in rates (rates are still low by historic terms). Jamie Dimon, CEO of JP Morgan, believes that the economy could be strong for quite a while still for the following reasons – confidence is high, wages are growing, and there is a shortage of housing.

The operating conditions for the large US banks are good, although one may have expected stronger loan growth to corporates across the country. For JP Morgan, the rise in interest rates is really helping with operating leverage although we didn’t see much of this in 3Q18 – but will see a sizeable impact for FY18. At a share price of $108.13, and a tangible book value of $55.68, with a return on tangible common equity of 17%, we see upside here to $155 or more (i.e. at least 44% upside from the current share price of $108). This remains an excellent business with good long-term prospects. The credit conditions will deteriorate at some stage, but this still seems some way off.

Written by:

David Gibb

Fund Management

Alibaba

We added Alibaba to the High Street Equity Portfolio, post a c. 30% crash in the share price and the share trading at a 52-week low. Alibaba is one of China’s two big internet plays and one of the biggest companies in the world ($370bn). It generated close to $20bn of free cash in the last year and we believe it can still grow meaningfully for a good few years to come. Notably, it spent $12bn on new investments last year – that’s almost 15% of SA’s GDP (but would only pay half of Eskom’s debt). Companies like this are re-inventing the future of the world and making a fortune in cash along the way. It spans the range of internet business and has some similarities with Amazon (in China), but its biggest businesses are Chinese marketplaces (or big malls, for the oldies!), Alipay (mobile wallet) and its cloud business. It is now cheap at a forward 22x PE (less than Clicks!).

Written by:

Peter Armitage

Chief Executive Officer

Nasdaq Sale

Having purchased Nasdaq in January 2014, we held the share for c. 5 years and over this period it outperformed the S&P 500 by about 51%. Almost 20% of this outperformance came from a re-rating in the stock, which we bought when it was trading at a 15% discount to the S&P 500 (which we then sold at a marginal premium). During the period in which we held Nasdaq it did a number of transactions which increased its exposure to the US-listed equity derivatives market and reduced its exposure to its Scandinavian exchanges. The business has tried to transform itself away from a reliance on transactional revenues (i.e. costs for trading on its exchanges), but that segment still represents around 40% of operating income after our holding period – not meaningfully different from 5 years ago. Nasdaq’s information services business, which includes the selling of market data and the licensing of index data, currently accounts for about a quarter of its revenues, but due to the attractive margin this represents around 40% of operating profit. That segment has been growing at a decent clip, particularly with the growth of exchange-traded products. However, the recent decision by the Securities and Exchange Commission (SEC) to review and possibly regulate market data costs puts a cloud over this part of the business and, with the valuation fairly full, it seems an appropriate time to sell the stock.

Written by:

Peter Little

Fund Management

Hastings Plc: 3Q18 Results

Hastings Plc delivered what, at face value, appeared to be a sound 3Q18 operational performance. Important metrics such as gross written premium and claims ratios progressed in a positive direction with net revenue up 9% YoY and total live customer policies rising by 4% YoY. The outlook for the loss ratio is unchanged at 75% for 2018 and 77% for 2019. Too low a loss ratio infers that management have been too conservative on risk and may be missing out on profitable growth that a lower risk tolerance provides. A key negative in the result, which at this stage remains a difficult-to-forecast outcome, is the high levels of claims inflation which the insurers have not been able to pass on to consumers due to the intensive competitive environment.

Over the short term, barriers to entry are low in the property and casualty (P&C) insurance industry, with entrants drawn to the high returns on capital employed on offer. This apparent overcrowding of the sector has taken pricing power away from the insurers in a manner with which we feel uncomfortable.

Hastings, as a relative newcomer, may be more exposed to volatile market sentiment while navigating the various cycles. As such, we feel it a prudent measure to manage the risk in our portfolios by cutting the position and monitoring the progress from the perspective of a spectator, as opposed to a participant, with our preferred exposure being the position in the more proven Admiral Plc.

While we believe that, over the long term, fundamental shifts are taking place (with specific reference to motor insurance, where autonomous vehicles pose a deep threat), we remain constructive on the nature of the P&C business model.

Written by:

Liam Hechter

Fund Management

Microsoft

Microsoft is the largest software company in the world and a key partner to corporates that are having to transform their operations to compete in an increasingly digital world. This trend towards digital is good for IT spend, especially for IT companies like Microsoft. Note that Microsoft is the second-largest player, after Amazon Web Services (AWS), in cloud computing.

Microsoft is currently experiencing a growth phase (with revenues rising well above 10%) for two major reasons: corporates are upgrading their IT infrastructure; and the long-term shift from on-premise to cloud computing continues apace. Corporate IT spend is typically rather cyclical but the shift to cloud computing is likely to continue for many years to come. It is estimated that, say, 20% of corporate computing has shifted to the cloud and AWS and Microsoft are by far the leading players in this market. Overall, cloud computing now represents some 29% of Microsoft’s revenues and is growing at a strong rate. The new growth phase bodes well for Microsoft’s profit margins, and EPS growth for the next few years. After some missteps under the previous CEO, Steve Ballmer, Microsoft is once again leading the IT world in many areas. Credit must go to the new CEO, Satya Nadella, who is returning the company to its former glory.

We decided to take advantage of the stock market sell-off in October 2018 by investing in Microsoft.

Written by:

David Gibb

Fund Management