The historic meeting between North Korean leader, Kim Jong-un and US President Donald Trump took place in Singapore on 12 June and was arguably the high point of the month before the possibility of trade wars stepped back into focus to spoil the party. Central banks were also in on the action during June with the US Federal Reserve (Fed) delivering a much anticipated 0.25% rate hike, while the European Central Bank (ECB) announced plans to wind down its quantitative easing (QE) programme by year end, but maintain rates at current levels until at least 3Q19.

Emerging markets (EMs) were in the eye of the storm during June, with the Brazilian stock market down over 5% and the Shanghai Composite Index ending the month 8% lower. The US implemented tariffs on $50bn worth of Chinese imports during June (this was a follow through on a proposal first raised in April) and then, when China responded with its own measures largely targeting US agricultural imports, Trump ordered US officials to draft a list of an additional $200bn of Chinese imports that could also be targeted for tariffs. To make matter worse for China, economic data released during the month was disappointing, with industrial production and fixed-asset investment both coming in below expectations (the latter coming in at the slowest pace since 1999). In Brazil, the currency continued its slump, despite central bank intervention, with the Brazilian real down 15% in 2Q18. Trucking strikes, which had brought the country to a standstill in May, finally ended in early June as the government bowed to pressure to introduce fuel subsidies in a return to less market-friendly practises at state oil company, Petrobras. This resulted in the resignation of CEO, Pedro Parente and spooked investors. Russia and India’s stock markets were largely unscathed for the month, but the losses in Brazil and China were enough to leave the MSCI Emerging Market Index down over 4% for June.

Brazilian market woes

Source: Bloomberg, Anchor Capital

Oil prices were again higher in June as large drawdowns in US oil inventories surprised markets. Outside of oil, commodities had a poor month. Agricultural commodities suffered from the tariffs China imposed on US agricultural imports, while industrial commodities sold off on weak Chinese economic data.

US equities managed to eke out a positive return for the month, with the S&P 500 dragged higher by the interest rate sensitive real estate and consumer staples sectors, which benefited as risk aversion kept a lid on bond yields. The US dollar was also positive against most major currencies as the country’s monetary policy continues to diverge from other major developed markets.

Written by:

Peter Little, Fund Management

Starbucks – updated 3Q18 guidance

Starbucks updated elements of its 3Q18 (June 2018) and long-term guidance on 19 June, which saw the company’s share price plummet by 9.1% the following day. The most important points of the announcement were:

- 3Q18 same store sales (SSS) is now forecast to be ~1% higher YoY. The Street had been looking for a 2.9% YoY rise.

- In April, management guided for SSS growth of 3%-5% YoY for FY18 (September 2018) – a strong pick-up from 1H18. This is clearly not going to happen.

- Perhaps most concerning from the announcement is the indication of flat SSS prospectively in China – a meaningful deceleration from the previous trend, while SSS progression in the US is also slowing. Comparative SSS slowing at this rate is never a good sign.

- The Americas contributed 70% of revenue and c. 90% of operating income in FY17. China is relatively small but it is also Starbucks’ great hope for the future.

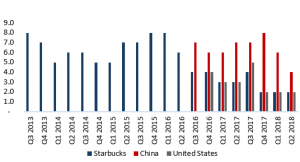

Starbucks SSS, YoY % change:

Source: Bloomberg, Anchor Capital

- Management are compensating by returning $25bn of capital to shareholders by FY20 (September 2020), which is $10bn more than the $15bn announced in November 2017 and represents c. one-third of the current market cap.

- We believe that the stock is transitioning from a growth to a capital-allocation story.

- On a PE basis, Starbucks is currently about as cheap as it has been for a long time but, in our view, this reflects declining growth expectations for the company and we have sold our positions in the share.

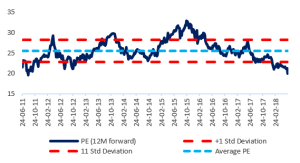

Starbucks PE (12 months forward):

Source: Bloomberg, Anchor Capital

Written by:

Nick Dennis, Fund Management