In July, markets returned their focus to corporate earnings, which were a welcome distraction from geopolitics. 60% of S&P 500 companies reported 2Q18 earnings during July and earnings for those companies were up about 25% in aggregate – roughly 5% ahead of expectations. While most corporates are still seeing earnings boosted by lower tax rates and a US dollar which is slightly weaker than for the same period last year, tech companies were the ones that showed the best earnings growth relative to 1Q18. Strong earnings were enough to see the S&P 500 Index deliver its best return since January but, amongst the individual companies, strong earnings growth wasn’t necessarily a guarantee of good share price performance. Facebook delivered quarterly earnings growth of 31% YoY (almost 5% better than expectations) but shocked the market by guiding to operating margins that would gradually shrink towards 30% from the current level (44%). The share duly had almost $120bn wiped from its market value as the counter plummeted 18% – comfortably the biggest loss of market value by any company in a single day.

Facebook – one-day loss in market value

Source: FactSet, Anchor Capital

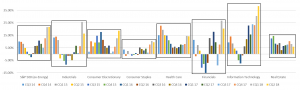

S&P 500 earnings growth (YoY%) by sector

Source: Bloomberg, Anchor Capital

Emerging markets had a decent July, with the MSCI Emerging Market Index breaking a sequence of five consecutive negative months. India and Brazil led the way, with Chinese markets still lacklustre, held back by the threat of trade wars with the US. Meanwhile, Turkish markets suffered as President Recep Tayyip Erdogan appointed his brother-in-law to run the Treasury. Politics also hampered UK markets as Brexit continued to cause divisions in Parliament. During July, Foreign Secretary Boris Johnson and Brexit Minister David Davis both resigned their posts and Prime Minister Theresa May narrowly avoided a defeat in Parliament as a result of a rebellion in her own party around her handling of the UK’s Brexit strategy.

Global interest rates were mostly stable during the month, though an increase in US bond issuance into month-end caused US long-bond rates to drift slightly higher. Rates also experienced a bout of volatility leading into the Japanese central bank meeting over concerns that the Bank of Japan (BoJ) may consider reducing its bond buying programme. While the BoJ did announce the addition of some flexibility to its approach to stimulus, the bank calmed markets with a firm message about its intent to pursue loose monetary policy for the foreseeable future.

Oil had its worst month in over two years as the Saudis announced plans to increase production next month and US President Donald Trump suggested that the US was considering releasing some of its strategic oil reserves. Industrial metals also had a tough month as markets weighed the potential impact of trade wars on Chinese demand.

Written by:

Peter Little, Fund Management

Facebook: Downgrade to guidance creates short term headwind

Facebook reported 2Q18 results on 25 July after the market closed. On the following day, Facebook shares fell by 19%. In terms of the results, revenue and earnings per share (EPS) grew 42% and 32% YoY, respectively. These figures were slightly below the market’s expectations. However, on the quarterly conference call, CFO David Wehner surprised the market when he announced: “…we expect our revenue growth rates to decline by high-single digit percentages from prior quarters sequentially in both Q3 and Q4.” He attributed the deceleration to three factors: 1) currency headwinds, 2) promoting Stories instead of a Newsfeed in Facebook, and 3) providing users with more privacy options. Wehner also announced that expenses would grow faster than revenues, causing operating margins to fall to the mid-30% range over the next few years (vs 44% in 2Q18).

Based on the above guidance, we have cut our 2019 EPS estimates to a level that is c. 17% below Wall Street consensus forecasts. This is roughly in line with Facebook’s share price fall on the day after the results. Facebook’s lowered guidance creates a headwind for performance over the short term. However, over the intermediate term (beyond one year) we suspect that Management has lowered the expectations bar, making it easier to beat their own guidance. Longer term (three years and more) we think Facebook’s other properties, particularly Instagram and WhatsApp, have enormous monetisation potential.

Written by:

Nick Dennis, Fund Management