According to the latest Janus Henderson Global Dividend Index report, global dividend payments jumped 12.9% YoY in 2Q18 to $497.4bn, hitting a new record on the back of rising corporate profitability. The report says dividend payments rose in nearly every region of the world in headline terms, noting that records were broken in 12 countries including France, Japan, and the US, which were some of the largest contributors to worldwide income.

The index analyses dividends paid by the 1,200 largest firms by market cap. It ended 2Q18 at a new record of 182.0, a level which the report says means global dividends have risen by more than four-fifths since 2009.

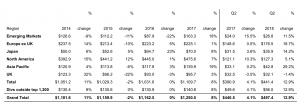

Annual dividends by region, $bn:

Source: Janus Henderson Investors

The data analysed by Janus Henderson show that continental Europe dominated in the period under review as two-thirds of the region’s dividends are paid during the quarter. In this region underlying growth was the strongest since 2Q15 with European companies paying a record $176.5bn in dividends – up 18.7% YoY as higher corporate profits in 2017 flowed into dividends. Underlying growth, accounting for strength of European currencies vs 2Q17, was 7.5% YoY.

In the US, dividend payments rose by 4.5% YoY to a record $117.1bn in 2Q18 with underlying growth at 7.8% YoY after lower special dividends and index changes were considered – the fastest expansion in two years. The report notes that US dividends have grown more steadily than anywhere else, declining in only four quarters over the last decade. Only 1 company out of 50 in the US cut its payout, Janus Henderson writes, with the largest firm to do so being General Electric (GE) as it commenced its restructuring programme.

The quarter under review also marked a seasonal dividend high point in Japan with rapid 14.2% YoY headline growth (12.3% YoY underlying) to $35.9bn– a record for Japanese payouts.

In the rest of the world, Canada’s dividends outpaced the US, while Asia’s underlying 2Q18 dividend growth was 13.5% YoY in Hong Kong and 46.9% YoY in Singapore.

On the back of 2Q18’s strong global dividend growth, Janus Henderson increased its 2018 forecast for underlying dividend increases from 6.0% to 7.4% YoY. However, the report warns that the strong dollar is offsetting the improvement in dividend increases as 2H18 dividends will be translated at less favourable exchange rates, meaning Janus Henderson’s forecast of$1.36trn (+8.6% YoY) in total is unchanged.