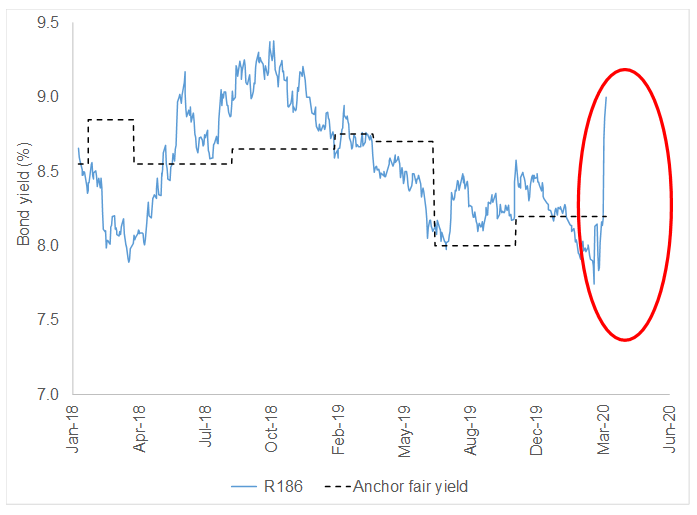

Figure 1: Anchor SA bond yield monitoring

Source: Thomson Reuters, Anchor.

These are unprecedented times and fears run high. Risk assets have responded, and it appears that investors are dumping all assets. We have seen US investors withdraw just over $7bn from emerging market (EM) bond funds in the past week. At times like these, liquidity becomes key and, as one of the world’s deepest and most developed fixed income markets for the EM universe, South Africa (SA) has seen a disproportionate foreign selling of bonds.

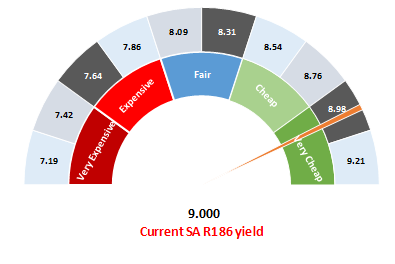

Over the past two weeks, R42bn worth of local bonds have been sold by foreigners. This selling is to raise liquidity, either for fund redemptions or for margin calls. Either way, these are forced sellers and in these cases the price becomes a secondary consideration. Market makers are reluctant to show bids, because the bonds just keep coming. In response, they have been pushing bonds weaker. In just two weeks the yield on the R186 benchmark bond moved from 7.75% to 9.00%, while the price has moved from 114.30% down to 107.48%. The six-year bond has also lost about 6% of its value over the past two weeks. Longer-dated bonds have lost a little more – up to 12% in some cases.

The Anchor Flexible Income Portfolio is designed to be defensive, but we are up against an unrelenting tide. The portfolio holds about 2.5% in listed property, which is also detracting from its performance at the moment as listed property is down c. 10% month-to-date.

In times like these, fundamentals break down and forced selling drives prices. We are seeing incredible buying opportunities develop, although it is uncomfortable at present. Right now, we are waiting to buy – bonds are the cheapest that they have been in recent memory.

In this context, we expect the Anchor Flexible Income Portfolio to record a loss for March. We are currently sitting on a month-to-date loss of only c. 1.3%, which is testimony to our conservative portfolio construction doing its work. This still leaves investors with a small gain on a YTD basis. In the context of the current market movements we are seeing in equities, listed property and bonds, our portfolio is still doing its job of being defensive, albeit that we are in the tide and have been dragged down slightly. The lower unit price means that the yield on the portfolio has, however, been pushing upwards and is now around 9%.

The advantage of bonds is that they tend to recover quickly and that yields provide an underpin for value as soon as the selling stops. For now, we highlight that patience is the best strategy in the current volatile global and local market environment.

Figure 2: SA R186 (2026 maturity) vs Anchor fair value

Source: Thomson Reuters, Anchor.