The South African Reserve Bank (SARB) has cut interest rates by 2.75% YTD and is signalling that it might consider further cuts of up to 0.50% as early as its next meeting that ends on 23 July 2020. This has provided some support to an economy that is in trouble, however, it has also had a devastating impact on those people who are reliant on income from their savings. In fact, if interest rates are indeed cut again in July, people who were earning R58,000/month on their 32-day call accounts in January will see that drop to R31,250/month in July. Faced with such a steep fall in income, investors and retirees have been reaching out to Anchor, asking what can be done to protect their income.

In this article, we look at the options available for investors to increase their yield based on the environment as at 30 June 2020.

Obviously, the current environment will change should interest rates indeed be cut again and we urge investors to speak to one of our financial advisors before deciding on an investment option.

Below, we highlight the various fixed-income options available to SA investors and provide a comment on each. These options have been sequenced in ascending order of risk.

A 32-day notice account

These are deposits at one of the major banks in SA. The value of the deposit is stable, and, over time, your money earns interest at about 4% p.a. An investor can access their cash by giving the bank 32 days’ notice of a withdrawal.

Money market funds

Instead of investing money with a bank for 32 days, an investor can invest in a money market fund. A money market fund has several different investors with withdrawals likely to be at different times, allowing it to lend money to SA’s major banks and high-quality corporates for periods of up to one year. The average life of the portfolio is always less than six months and money market funds are tightly regulated in SA. These funds are designed so that the value of the investment remains constant over time, with interest income accruing upwards. For taking the extra term risk and blending in a few higher-quality corporate issuers in the portfolio, an investor should earn a yield of about 4.8% (net of fees) in the current environment.

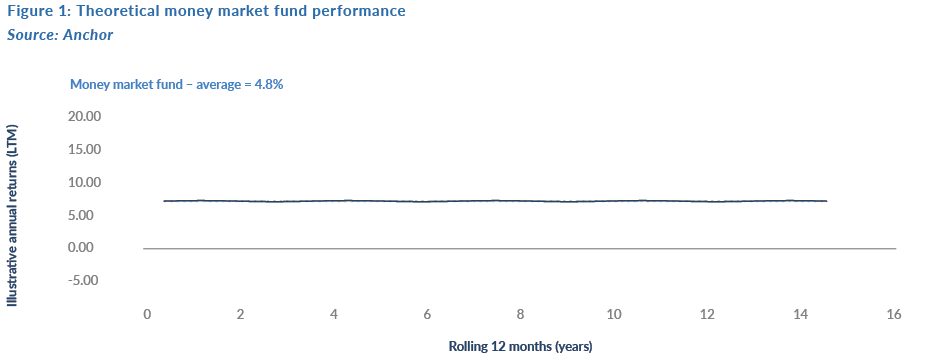

Figure 1 below shows a hypothetical money market fund. The expected yield is about 4.8% (in the dotted line), while the actual yield closely follows this. The fund is ideal for those investors that are not prepared to take any risk with their capital values.

In theory, these portfolios should not report in any calendar month, where they experience a loss.

Stable income funds

Stable income funds are also known as JIBAR plus or cash plus or core income portfolios. The portfolio works on a similar principle to a money market fund, except that it will lend money to the major banks and corporates for longer periods (usually up to three months), enables it to earn slightly more interest income. The loans that these funds make are in the form of bonds.

A bond is essentially a loan that is tradable on the bond exchange. In reality, bonds work in a similar way to equities and investors are able to buy or sell the bond over an exchange. Because the loans (bonds) now trade, there is a market price for them which means the value of a portfolio that holds loans can increase and decrease over time.

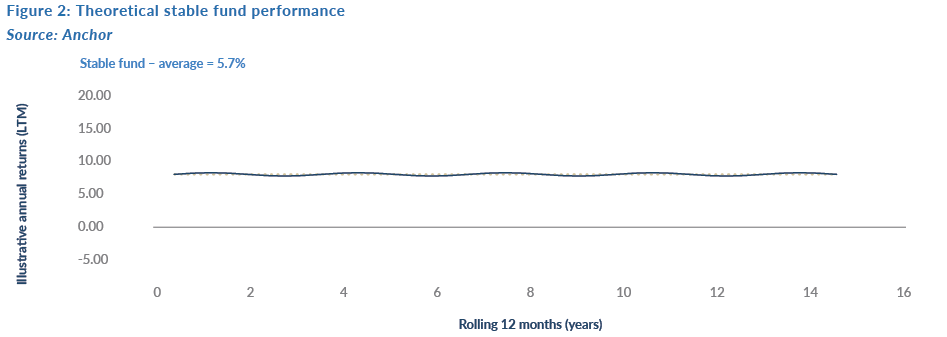

One of the most important factors that determine the size of possible price swings in the value of a bond is its time to maturity. These portfolios hold bonds that are all quite short-dated, usually with a remaining life of three years or less. As a result, the size of the price swings in these bonds is generally quite small. This means the portfolio will likely see its value remaining relatively stable although it is not dead constant. For taking this extra term risk, and the little bit of volatility in prices, the investor can earn a yield of about 5.7% currently.

However, we highlight that care should be taken in understanding the aggressiveness of the portfolio with regards to credit risk. We are of the view that these portfolios should not take significant risks, although we are aware of a few funds that are on the more aggressive side. The portfolio design of these funds is such that they should only report a monthly loss once every five years or so. These portfolios work well for those corporates that are looking for a low-risk investment for any excess cash that might be on the company’s balance sheet.

In Figure 2, we show the expected return is 5.70% (the dotted line). There is a small and almost insignificant wave pattern to the returns over time (the solid blue line). There will be some months that are better than others, however, you would expect that over a period of three- to six months the returns will average out to be level with the dotted line.

Flexible income funds

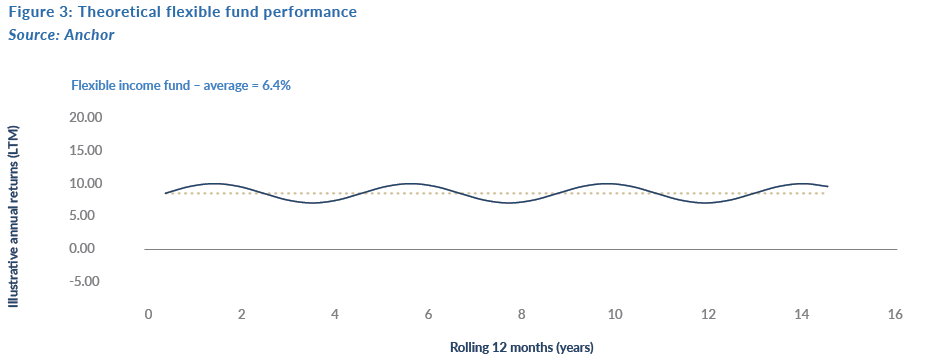

By taking a stable fund and blending in some longer-dated bonds, maybe 5- to 7-year bonds, the portfolio can further increase its yield. As the remaining life of these bonds get longer, the amplitude of the wave pattern around the expected returns increases.

This portfolio will also blend in some listed property (very little at this stage), as well as US dollar exposure and exposure to global bonds. Bringing in different asset classes creates a diversification effect in the portfolio, enabling an investor to earn a slightly higher yield for a given risk appetite. This means that we can target a return for the investor of 6.4% p.a., over time.

Figure 3 shows that stepping up from a stable fund to a flexible income fund again increases the amplitude of the peaks and troughs of the waves. The dotted line is still the expected return over time; however, monthly returns can be quite different. Over a period of 12- to 24- months, you would expect that the monthly returns will average each other out to an anticipated return of 6.4%.

We have found that the flexible income fund reports a monthly loss about once every two years. As a result, this has been the portfolio of choice for those private investors who find that the yield pick-up is quite attractive and who can tolerate a negative outcome once every two years. We note that bonds are mean reverting, which denotes that the biennial loss is usually recovered in the few months that follow the loss.

Bond funds

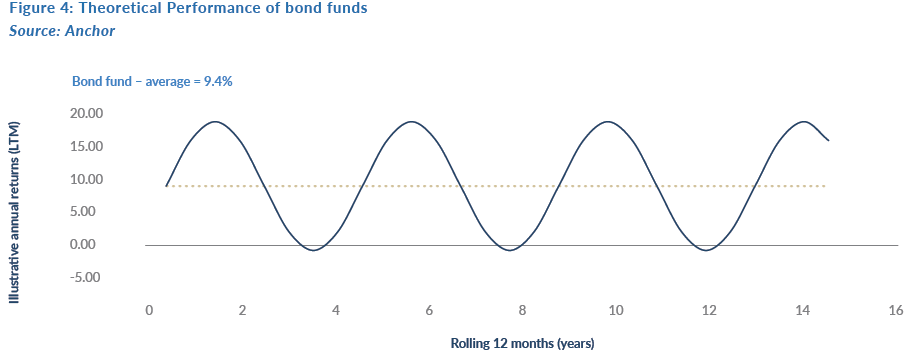

Bonds in the flexible income fund are usually limited to about 5 to 7 years from maturity. We can choose to lend money to the government for even longer periods of up to 30 years. This will significantly increase the portfolio’s yield, but it also increases the amplitude of the waves quite a bit.

These funds are generally focused on bonds only, so there are no other asset classes included in the portfolios.

In Figure 4 the dotted line has an expected return of 9.4% for the investor. The returns in the solid blue line, however, are quite volatile and the portfolio could report a loss once every three months. On average, if you hold the portfolio for 3 to 5 years, you can expect the monthly oscillations to cancel each other out and the average return to be around 9.4%. This has been a handy investment option for investors who have a higher risk appetite but might not want domestic equities and can also afford to tie up capital for longer periods of time.

Conclusion

The recent SARB interest rate cuts have made earning interest income more difficult and many investors have been pushed into taking slightly more risk with their fixed income investments to maintain their earnings. We are in a position to assist you, however, the art in fixed income investing is about ensuring that each investor is taking an appropriate amount of risk with their fixed income investments depending on their own unique circumstances. We would suggest that you speak to one of our advisors to assist you in getting the most out of your income investments.