FedEx released disappointing 1Q20 results on Tuesday (17 September), with revenue of $17.05bn coming in marginally below (-0.1%) the Refinitiv consensus forecast of $17.06bn and slightly down from 1Q19’s $17.06bn. Adjusted EPS was 3.3% below expectations at $3.05/share vs the Refinitiv forecast of $3.15/share and 1Q19’s $3.80. Earnings dropped by $90mn to $745mn – a 10.7% YoY decline. The operating margin for the quarter declined to 5.7% from 6.3% in 1Q19. The miss on the top and bottom line, coupled with a drastic pull back in its FY20 guidance, saw the share price drop 12.4% on Wednesday (18 September).

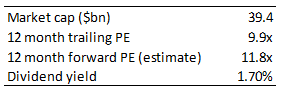

Figure 1: FedEx metrics:

Source: Anchor, Bloomberg

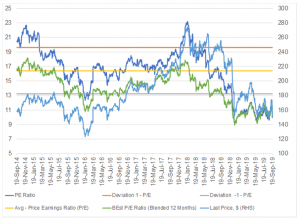

Figure 2: FedEx share price performance and P/E (LHS):

Source: Anchor, Bloomberg

In its earnings release, FedEx’s chairman and CEO Frederick W. Smith said the company’s performance “… continues to be negatively impacted by a weakening global macro environment driven by increasing trade tensions and policy uncertainty, …” He added that “Despite these challenges, we are positioning FedEx to leverage future growth opportunities as we continue the integration of TNT Express, enhance FedEx Ground residential delivery capabilities and modernize the FedEx Express air fleet and hub operations.”

Operating results declined primarily due to what the company said was weakening global economic conditions, increased costs to expand service offerings and a continued mix shift to lower-yielding services. The impact of one fewer operating day and the loss of business from a large customer (presumably Amazon) also negatively impacted these results. The aforementioned factors were partially offset by lower variable incentive compensation expenses, revenue growth at FedEx Ground and increased yields at FedEx Freight.

There was a marked increase in debt levels to $32bn in the quarter vs $17.5bn at the end of FY19 and margins also slipped. In addition, there was a degradation of free cash flow – while 1Q is normally a negative quarter 1Q20 is the lowest quarter in the past 10 years.

Divisional reporting:

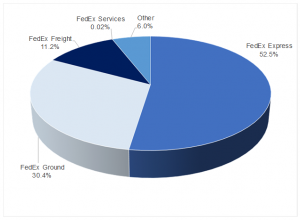

Figure 3: FedEx revenue contribution by segment, 1Q20:

Source: Anchor, Company data

- FedEx Express (the largest at 52.5% of revenue) remained under pressure. Revenue was down (-3% YoY) to $8.9bn from $9.2bn in 1Q19.

- FedEx Ground (30.4% of revenue) saw improving results, although increasing expenditure impacted the numbers.

- FedEx Freight (c. 11.2% of revenue) recorded a revenue decline of 2.8% YoY to $1.9bn.

Volumes were up on YoY basis but down QoQ. Ground volumes increased by 7% on the back of growing e-commerce sales.

Guidance:

Whilst these results didn’t paint a healthy picture, it was the FY20 management guidance which sent the share price into a freefall (-12% on the day). FedEx said it was lowering its full-year earnings guidance to between $11 and $13/ share. This was down markedly from the prior mid-range guidance of $14.75 indicated in June 2019. Management highlighted volumes moving out of the US postal system and the decision not to renew the Amazon contract as near-term impacts. A weak global environment and trade tensions also negatively impacted the company.

Management said it was still looking to TNT for growth. However, the integration of TNT appears slow and, according to management, a meaningful contribution is at least one year away. Again, this is dependent on the macro environment and any escalations in trade tensions could negatively impact the company. Management are planning additional cost cutting and older planes to be retired after the 2020 season. FedEx also aims to reduce intercontinental flights post peak season.