Despite share prices slumping and major global indices recording losses in the last week of February amid bond market volatility, pressure from rising interest rates, inflation concerns and worries that markets are overheating, MoM most major US and global indices still ended February in the green. The yield on the benchmark US 10-year rose as high as 1.6% on 25 February before falling back to c. 1.41% on Friday (26 February). Still, major US indices were boosted by a strong start to the US earnings season (according to FactSet over 75% of S&P 500 companies reported better-than-expected 4Q20 revenue and earnings), positive news on vaccine rollouts (the US Centers for Disease Control and Prevention advisory panel approved the use of Johnson & Johnson’s one-shot vaccine on 28 February), and another US stimulus package on the horizon. The $1.9trn COVID relief bill was passed by the US House of Representatives over the weekend and the US Senate will now consider the legislation.

So, in spite of last week’s wobble, the major US indices closed February firmer (and all three of the below-mentioned indices set new all-time highs during the course of last month). The Dow Jones gained 3.2% and the S&P 500 rose by 2.6% MoM (these two indices are up 1.1% and 1.5% YTD, respectively). The tech-heavy Nasdaq lost 6% last week but still managed a gain of 0.9% MoM (+2.4% YTD) – its fourth consecutive positive month.

On the US economic data front, the University of Michigan’s consumer sentiment index hit a six-month low in February. However, the CBOE Volatility Index (VIX), which measures market volatility over the next 30 days, dropped from its January spike to the lowest levels since the pandemic hit the US in 2020. At one stage it closed below 20 (although we note that volatility remains above the long-term average at c. 27). US 4Q20 GDP data were revised slightly upwards to 4.1% vs the first estimate of 4% growth but annual GDP, which shrank 3.5% YoY, the US’ largest decline since 1946 according to CNBC, was unchanged. Weekly jobless claims dropped sharply to 730,000 for the week ended 20 February, representing a significant decrease from the prior week’s 841,000. Still, though the overall number fell, Americans filing through pandemic-related programmes continued to increase, with just over 1mn more claims on the Pandemic Emergency programme, which compensates those whose regular benefits have run out. CNBC writes that c. 19mn Americans have received some form of compensation as of 6 February.

In the UK, the FTSE 100 gained 1.2% MoM (+0.4% YTD), despite the index dropping 2.5% on 26 February alone – its biggest one day decline since the end of October 2020. The UK government announced a roadmap to lifting lockdown restrictions (and all legal limits on social contact) by 21 June, if certain conditions were met. Major European markets also closed in the green despite last week’s losses, with the region’s largest economy, Germany’s DAX up 2.6% MoM (+0.5% YTD), while France’s CAC rose 5.6% MoM (+2.7% YTD).

In China, the Hang Seng gained 2.5% MoM (+6.4% YTD), while Hong Kong’s Shanghai Composite Index closed February 0.7% higher (+1.0% YTD). China’s official February manufacturing PMI came in at 50.6, a slower pace than January’s reading of 51.3 but nevertheless above the 50-point level separating contraction from expansion. In Japan, the Nikkei ended the month 4.7% higher (+5.5% YTD)

On the commodity front, a robust demand recovery saw crude oil prices soar (+18.3% MoM; 27.7% YTD). In the short term, the oil price was buoyed by the freezing weather gripping parts of the US, pushing prices to levels last seen in January 2020, with a crippled US energy supply supporting the supply-demand imbalance that has been a major market driver. US shale producers are unlikely to return to pre-COVID output anytime soon while Saudi Arabia and Russia are heading to an OPEC+ meeting this week with market commentators’ opinions differing as to whether more supply will be added to the market in April. While gold ended 2020 higher (+25.1% YoY – its best annual performance in c. a decade), to date 2021 has not been kind to the yellow metal – down 6.1% MoM and 8.7% YTD. After an impressive run in December (+29% MoM), iron ore was down 1.9% MoM in January but gained ground again in February (up c. 4% MoM) as demand from China’s steel sector remained strong and doubts have been raised regarding shipments from Brazil after a fire at a Vale iron ore terminal last month. Meanwhile, copper (+18.3% MoM), platinum (+10.5% MoM), and silver (+1.5% MoM), took centre stage in February, soaring to multi-year highs with these industrial metals expected to continue to benefit from tight supplies, strong demand, and the global recovery.

South Africa’s (SA’s) FTSE JSE All Share Index rose for a fourth-straight month, closing February 5.9% higher (YTD, the index has soared 11.3%), and surging past the 66,000 mark to end the month at 66,138.05. The JSE’s continued impressive gains were largely thanks to blowout performances from commodity counters, with the Resi-10 soaring 11.7% MoM (+17.2% YTD). Large-cap resources companies such as Anglo-American Platinum (+20.8% MoM), Glencore (+19.2% MoM), Sibanye Stillwater, Impala Platinum (both up 18.8% MoM), Anglo American Plc (+16.1% MoM) and BHP Group (+14.4% MoM) rose by double-digits on the back of higher metals prices and good results. The Indi-25 was up 2.0% MoM (+10.6% YTD), with Prosus, the JSE’s largest share by market cap, and Naspers (the fourth largest) gaining 0.6% and 1.1% MoM, respectively. After lagging in January, the Fini-15 rose 4.4% last month (YTD, the index is up 1.2%) as financial counter gained ground with shares such as Nedbank, ABSA Group, Sanlam, and FirstRand, up 6.7%, 6.2%, 5.4%, and 5.3% MoM, respectively. The rand was basically unchanged MoM, posting a slight 0.3% MoM advance (-2.9% YTD) vs a firmer US dollar.

In local economic data, January annual consumer price inflation (CPI) increased to 3.2% vs December’s 3.1% – still at the lower end of the SA Reserve Bank’s (SARB’s) 3%-6% inflation target. MoM, CPI rose 0.3%, vs a 0.2% gain between November and December. The increase in local fuel prices, food and non-alcoholic beverages were the biggest contributors to the increase. December retail sales were down 1.3% YoY, following November’s revised 4.3% YoY contraction. Nevertheless, retail sales continued to recover from lows during the COVID pandemic, although the pace of recovery is gradual, as consumers remain cautious in the current uncertain environment. SA’s trade surplus narrowed to R11.83bn in January vs a revised R33.06bn in December. The SA Revenue Service (SARS) said exports fell 13.6% MoM to R109.76bn, while imports advanced 4.2% MoM to R97.93bn

On 24 February, Finance Minister Tito Mboweni tabled the 2021/2022 Budget in Parliament – arguably the most important and difficult budget since the dawn of democracy. SA’s fiscal position remains precarious and the country’s debt service burden is unsustainable, so striking the right balance between providing relief and improving the country’s fiscal prognosis was imperative. Overall, we believe the budget struck a confident note, and financial markets will likely view it in a positive light. Still, government remains in a tight race to repair its finances and, whilst there has been credible progress, execution risk continues to remain high. A sharp increase in tax payments from mines (predominantly driven by the commodity booming) and a faster-than-expected recovery in value-added tax (VAT), led to the state earning c. R99.6bn more in tax revenue than it had expected. In our view, scrapping a proposed R40bn in tax hikes over 4 years (as per October’s Medium Term Budget Policy Statement), government setting aside R19.3bn to fund COVID-19 vaccines without introducing new taxes for their procurement, and a shifting of personal income tax brackets, should provide welcome relief for local consumers and was a brave move on government’s part.

On the COVID front, President Cyril Ramaphosa announced on 28 February that SA will move to lockdown level 1. However, he warned that the danger of a third wave was ever-present as was the threat of new variants. The latest data from the Department of Health show that as at 28 February 2021, the total number of confirmed COVID-19 cases to date stood at 1.51mn.

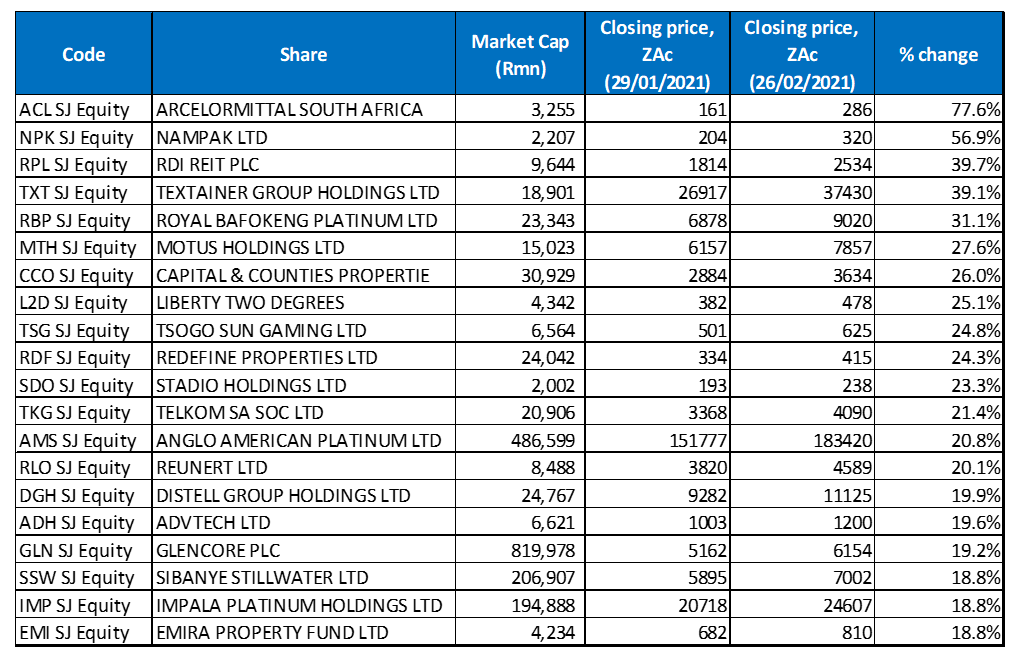

Figure 1: February 2021’s 20 best-performing shares, MoM

Source: Anchor, Bloomberg.

ArcelorMittal SA (AMSA) was February’s top-performing share – up 77.6% MoM. The steelmaker reported FY20 results in February, which showed that it had swung into a profit in 2H20, despite 2020 being an “exceptionally difficult year with unprecedented challenges”, according to the company. AMSA posted a 2H20 profit of R1.02bn, resulting in a full-year earnings before interest, taxes, depreciation and amortisation (EBITDA) profit of R37mn vs a R632m loss in 2019. Revenue decreased to R24.64bn from R41.35bn posted in FY19, but its diluted loss per share stood at ZAc175 vs ZAc419 in the prior year. Still, AMSA reduced fixed cash costs by 33% YoY to R5.06bn, as it implemented a new operating model and completed a large-scale labour reorganisation. It also reported positive cash flows of R117mn in 2020 vs negative cash flows of R1.35bn a year earlier. AMSA said 2H20 saw an unexpected bounce in near-term steel demand internationally, which it took advantage of by restarting its second blast furnace in Vanderbijlpark to support supply. The company also decided against mothballing its Vereeniging electric arc furnace towards year-end as it had initially planned. A worldwide steel shortage has buoyed steel prices to levels last seen in 2008 on the back of a sharper-than-expected recovery, helping AMSA narrow its losses.

Nampak (+56.9% MoM) followed in second spot, with the share price surging over 28% on 5 February alone, after it reported a positive trading update for its 1Q21 (4Q20). The packaging Group said in the update that trading profit jumped 18% YoY as cost-saving initiatives paid off and the third SA alcohol ban proved to be less disruptive for the company than it had initially expected. Nampak said operating conditions were improving in SA and in Nigeria. Group revenue rose slightly (c. 1% YoY), with the company saying that “… Cost saving initiatives undertaken during the prior financial year yielded benefits, complemented by export sales, which were reflected in the group trading profit improving by 18% compared to the first quarter last year.” It added that its metals segment saw “healthy beverage can demand” locally and export contracts secured by Bevcan SA “… were serviced as planned after the easing of COVID-19 restrictions during 4Q20.”

With most property counters having been under severe pressure due to the COVID-19 pandemic, the vaccine rollout and an easing of lockdown restrictions have seen some positive momentum boosting the performance of the FTSE JSE SA Listed Property Index (J253), which was up 8.6% MoM in February. While several property counters featured prominently among February’s top-performing shares, UK-based RDI REIT Plc (+39.7% MoM), was February’s third best-performing counter. RDI’s share price jumped on Friday (26 February), after its board agreed to a cash offer from Starwood Fund (which owns c. 26% of RDI’s shares) for the remainder of RDI’s shares at a c. 33% premium to the Group’s 25 February closing price.

RDI was followed by Textainer, a supplier of large shipping containers, platinum miner, Royal Bafokeng and retail motor group, Motus Holdings, which recorded share price gains of 39.1%, 31.1% and 27.6% MoM, respectively. In its FY20 trading update, Royal Bafokeng stated that its earnings were positively impacted by a significant uplift in the platinum group metals (PGM) basket price, improved market conditions, and a weaker rand. This growth in the business and improved market conditions supported significant revenue and operating profit growth – it expected revenue to increase by 70%-plus YoY and EBITDA to jump by over 200% YoY. The company also expects EPS to be between R13.66 and R13.71 (up by between 5.0% and 5.1% YoY), and its HEPS to be between R13.47 and R13.57 (an increase of between 2.57% and 2.59% YoY). Meanwhile, in its 1H21 results, Motus announced that its revenue rose 6.0% YoY to R44.34bn, while diluted EPS stood at ZAc496.00 vs ZAc466 posted in the same period of 2020. A strong used-car market and robust aftermarket parts sales helped Motus bounce back from the pandemic-induced declines it recorded in its 2H20 results.

Two other property counters, Capital and Counties (Capco) and Liberty Two Degrees (L2D) were up 26.0% and 25.1% MoM. In February, UK Prime Minister Boris Johnson announced a new four-step plan to ease England’s lockdown restrictions, which could see all legal limits on social contact lifted by 21 June, if strict conditions are met. This announcement likely benefited Capco with its significant UK exposure. Meanwhile, L2D released FY20 results in February and said it would pay out 100% of distributable earnings. L2D’s DIPS growth was also c. 20% better than initially expected/guided.

Tsogo Sun Gaming and Redefine rounded out February’s best-performing shares with gains of 24.8% and 24.3% MoM, respectively. Redefine announced in February that it would be retaining 100% of its dividend and, while this might sound counterintuitive, it does strengthen the company’s liquidity profile, which the market may have approved of as being positive.

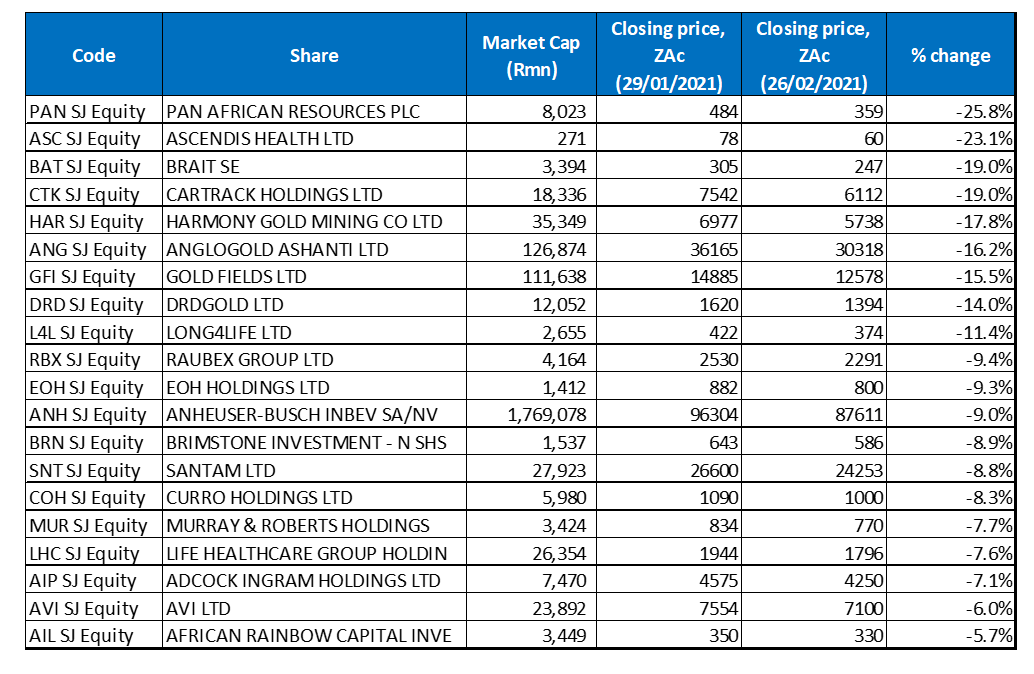

Figure 2: February 2021’s 20 worst-performing shares, MoM

Source: Anchor, Bloomberg.

February’s worst-performing shares were, for the most part, made up of gold counters weighed down by a c. 6% drop in the price of the yellow metal, with these counters also likely taking a breather after stellar runs in 2020. Pan African Resources was the worst-performing share – down 25.8% MoM, despite reporting strong FY20 results and reiterating its aim to be debt-free during 2021. The miner said at the release of its latest results that it has chosen to prioritise repaying debt instead of declaring an interim dividend for 2H20. The company’s debt was reduced by 47.3% YoY to $65.2mn (c. R950mn) in December as it pushed to strengthen its capital structure.

It was followed by Ascendis Health (-23.1% MoM) in second spot, with Brait (-19.0% MoM) the third-worst performing share. Ascendis has been struggling with a huge debt burden and the threat of being forced to sell its most profitable assets. In early February, it posted a trading update saying that its interim operating profits were up more than one-third amid robust demand for vitamins and supplements during the pandemic. The company expects revenue to rise by 35% YoY to R4bn when accounting for the impact of business disposals. Still, while the performance may be impressive its heavy debt burden remains a drag on the share price.

Shareholders in Cartrack (-19.0% MoM) have approved a plan to move its primary listing from the JSE to the Nasdaq in the US. Shareholders participating in the scheme will be paid R42/share in a deal worth just over R48bn. Cartrack expects the move to take place around mid-April.

Cartrack was followed by Harmony Gold, AngloGold Ashanti, Gold Fields and DRD Gold with MoM declines of 17.8%, 16.2%, 15.5% and 14.0%. Last week, Harmony said that it will reinstate its dividend for the first time in 3 years. This follows a 31% improvement in the rand gold price which has helped it cut its net debt. For the six months to end December, gold output rose 8% YoY, coming in at 745,347 ounces produced at an all-in sustaining cost of $1,370/oz – a c. 8% increase over the prior period. AngloGold Ashanti released FY20 results in February, stating that its revenue increased to $4.43bn from $3.53bn posted in FY19, while diluted EPS rose from the same period of the prior year to ZAc225. Gold Fields also reported a strong 4Q20, as a higher gold price and production increases buoyed the gold miner in FY20. HEPS for FY20 were expected to rise by between 305% and 325% YoY to as much as USc85 (R12.50), the company said. FY20 normalised profits more than doubled to $879mn from $343mn in FY19, and it declared a dividend of ZAc480/share. DRDGold, one of the world’s largest gold tailings retreatment specialists, took a breather from its fantastic share price run last year and was down 14.0% in February. In 2020, DRDGold was the JSE’s best-performing share, soaring 139.6% YoY.

Rounding out the top-10 performers were Long4Life Ltd and Raubex, which recorded MoM share price losses of 11.4% and 9.4%, respectively. Raubex’s order book has essentially doubled over the past six months to c. R18bn, with Business Day quoting its CEO Rudolf Fourie as saying the projects are largely SANRAL-related.

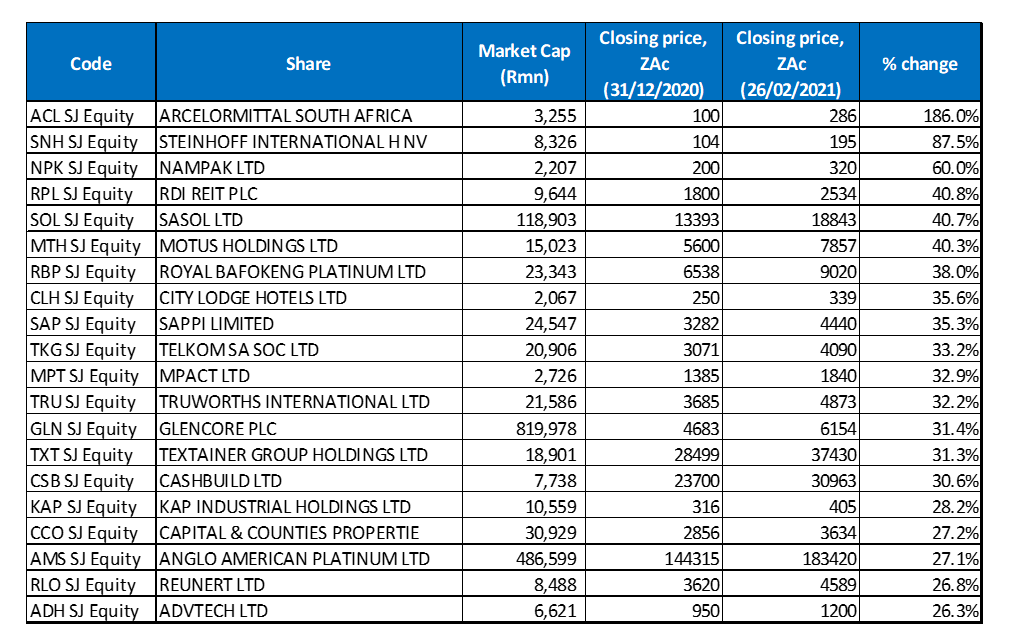

Top-20 February 2021, YTD

Source: Anchor, Bloomberg

Five of the top-10 MoM best-performing shares also featured among the YTD 10 best performers, with ArcelorMittal SA (+186.0% YTD, discussed earlier) taking the top spot in both rankings. Nampak moved down a spot YTD to the third-best performing share (it was the second-best performer MoM), with a 60.0% YTD gain. January’s best-performing share, Steinhoff, fell to second position with an 87.5% YTD rise. The company’s share price leapt In February after the troubled retailer said it had reached an agreement with Conservatorium Holdings LLC and certain entities linked to its former chairperson Christo Wiese to resolve the multi-jurisdictional legacy litigation and claims against the Group. The claims against Steinhoff stem from its December 2017 share price collapse of over 90% because of accounting irregularities, which led to a number of litigations in countries such as The Netherlands, Germany, and SA.

Steinhoff was followed by RDI REIT (discussed earlier), Sasol, and Motus (also discussed earlier,) with share price gains of 40.8%, 40.7% and 40.3% YTD. Last week, Sasol reported good 1H21 results, which showed that the Group’s total debt at the end of its interim period stood at R126.3bn, vs the R189.7bn as at 30 June 2020 (its full-year).For us, the major announcement coming out of its results was no doubt Sasol’s decision regarding its balance sheet – the company has decided not to pursue a R30bn rights issue stating that it has raised enough capital via asset disposals (up to $3.8bn of announced transactions) and through cuts in its operating costs, capex, and working capital (c. $1bn). A recovery in oil and chemical prices has also alleviated pressure on Sasol’s earnings and the balance sheet.

Royal Bafokeng (+38.0% YTD and discussed earlier), City Lodge Hotels (+35.6% YTD), Sappi (+35.3% YTD), and Telkom (+33.2% YTD) rounded out the top-10 YTD performers. Telkom shares surged the most in more than 12 months on 8 February (+12.4%), after investors cheered growth in its mobile service revenue (+40.7% YoY to R12.5bn), which cushioned the impact of its fixed voice and interconnection revenue, during the nine months ended December 2020.

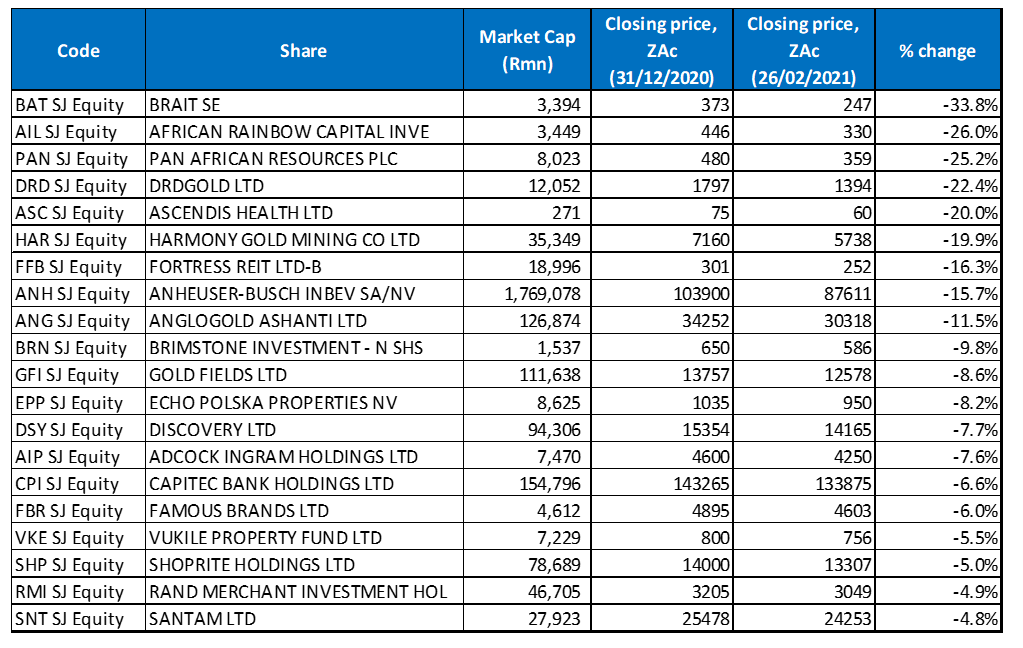

Bottom-20 February 2021, YTD

Source: Anchor, Bloomberg

Looking at the YTD worst performers, six of the shares among the ten worst-performing counters were also among the 10 MoM worst performers, including investment Group Brait (-33.8%, and the worst-performing share YTD), Pan African Resources (in third spot and down 25.2% YTD), DRDGold (-22.4% YTD), Ascendis Health (-20.0% YTD), Harmony (-19.9% YTD), and AngloGold Ashanti (-11.5% YTD). Following African Rainbow Capital Investments’ (ARC’s) January performance (where it was the month’s worst-performing share, with a 21.5% MoM decline), the counter moved to second position with its YTD loss now standing at 26.0%.

Other companies featuring prominently among the ten worst-performing shares were Fortress REIT (-16.3% YTD), Anheuser Busch InBev (AB InBev; -15.7%), and Brimstone Investments (-9.8% YTD). AB InBev said in February that it ended 4Q20 of its FY20 financial year in a strong financial position and with “momentum in key markets,”. Revenue rose 4.5% in 4Q20 compared to a 3.7% YoY decline for the full-year. In SA, its business was significantly impacted by three government bans on the sale of alcohol during 2020, which resulted in double-digit volume, revenue and EBITDA declines and significant EBITDA contraction.