Continued mixed signals around the US-China trade war appeared to drive global market volatility in September in what has been a dizzying month for markets. No sooner were investors encouraged by the announcement that trade talks with China were set to resume on 7 October, before shares turned sharply lower after US President Donald Trump, in a speech before the United Nations, accused China of “the theft of intellectual property and … trade secrets on a grand scale”, while promising that he would “not accept a bad deal.” Reports also emerged that the White House was discussing whether to limit flows from Chinese investors into the US and delisting Chinese companies from US exchanges. Despite this, and a decade-long bull market, the US remained on far firmer footing than most of its peers, and not even House Speaker Nancy Pelosi’s official endorsement of an impeachment inquiry in Trump could stop major US indices from ending the month higher.

The tech-heavy Nasdaq (+0.5% MoM; +20.6% YTD), which has come under pressure recently, was cheered by Apple – its share price closed at its highest level this year on Monday (30 September) as the tech giant again pushed above the $1trn market cap. The S&P 500 recorded a 1.7%. MoM gain (+18.7% YTD), while the Dow Jones Industrial Average posted a 1.9% MoM gain (+15.4% YTD).

US economic data showed that August manufacturing (released in September) recorded the sector’s first decline in c. 3 years, with the Institute of Supply Management’s manufacturing index coming in at 49.1 (below 50 signifies contraction, above 50 expansion). The August consumer sentiment index also logged its biggest monthly drop since December 2012 at 89.8 points – below consensus expectations of 92.1 points. The University of Michigan, which releases the index, found one-in-three US consumers were worried about tariffs and with consumer spending accounting for c. 70% of the US economy this is a worrying trend. Growing consumer caution was also reflected in personal spending, which rose only 0.1% in August – its slowest pace since February, while business investment fell for a second straight month. On the positive side, August’s robust new home sales beat market expectations. At its September meeting, the US Federal Reserve (Fed) delivered a much-anticipated 0.25% interest rate cut.

Despite weak economic data and the US-China trade war continuing to dampen sentiment across the region, major European equity markets closed September in the black after two months of declines. Germany’s DAX gained 4.1% MoM (+17.7% YTD), while France’s CAC advanced 3.6% MoM (+20.0% YTD). Economic data, however, looked far less rosy with the flash eurozone manufacturing purchasing managers index (PMI) falling to its worst level in c. 7 years and coming in at 45.6 for September, down from 47 in August. Germany, Europe’s largest economy, saw its manufacturing PMI drop to 41.4 – the worst reading in over a decade. Weakness was also seen in the services sector, where flash eurozone services PMI fell to an eight-month low, while new goods and services orders dropped at their fastest pace in in more than six years.

The UK’s FTSE 100 gained 2.8% MoM (+10.1% YTD), boosted by hopes for lower UK interest rates and despite continued Brexit fears as the current 31 October deadline looms. After multiple parliamentary defeats, Prime Minister Boris Johnson and his fellow “Brexiteers” suffered a further setback in September when the Supreme Court upheld an earlier ruling by a Scottish court that Johnson’s move to shut down Parliament was illegal. The pound also came under pressure last month, dropping c. 1.5% against the greenback, after a Bank of England (BoE) policymaker said the BoE might want to consider lowering rates even if a Brexit deal is reached.

Asian markets ended September slightly higher with Japan’s Nikkei recording its best performance in c. 12 months as the index jumped 5.1% MoM (+8.7% YTD). Bloomberg quotes Morgan Stanley as saying that Japan has seen a “… greater resilience … in earnings vs history as corporates have focused on productive capex, better corporate governance in the form of non-core cross share sales, share buybacks and the like.”

Chinese markets remained on the back foot, with the Hang Seng gaining 1.4% (+1.0% YTD), while the Shanghai Composite rose 0.7% (+16.5% YTD) for September. Chinese manufacturing activity (the Caixin/Markit factory PMI) came in at a better-than-expected 51.4 – its fastest pace in 19 months according to CNN. The official government PMI also exceeded expectations at 49.8, although it remained below the 50-point level separating expansion from contraction.

On the commodity front, Brent crude posted its biggest percentage rise on record in the days following the 14 September drone attack on Saudi oil infrastructure. However, supply fears waned towards month-end on news that Saudi is producing 9.9mn-plus barrels a day of crude as it recovers from the attacks. This saw the oil price close September only 0.6% higher (+13.0% YTD). Gold (-3.1% MoM; +14.8% YTD) posted its lowest MoM close in c. 2 months as a strong US dollar headwind drew demand away from the yellow metal. The dollar remained strong and on Monday (30 September) rallied to a 52-week high, weighing on emerging markets (EMs) and gold. Benchmark iron ore prices rose c. 2.2% MoM, while platinum dropped c. 5.0% MoM. The rand strengthened slightly (+0.3% MoM) against the dollar, but is down 5.5% YTD.

The SA market declined in September (for a third month running) albeit only slightly, with the FTSE JSE All Share Index down 0.8% MoM (+4.8% YTD). Financials, which had in previous months been the hardest hit sector, rebounded and the Fini-15 jumped 1.9% MoM (-5.9% YTD) as Capitec (+17.6% MoM) reported strong results in a difficult macro environment, and FirstRand (+3.7% MoM) recorded robust FY19 HEPS. After a strong run in previous months, resources was the worst-performing sector and the Resi-10 declined 2.0% MoM (+5.9% YTD), with large index constituents such as BHP Group, Kumba Iron Ore, Sasol and AngloGold Ashanti falling 0.6%, 4.7%, 14.1% and 17.9% MoM, respectively. The Indi-25 remained under pressure posting a 1.4% MoM decline (+9.4% YTD) as index heavyweights such as Naspers (-2.7%) and Richemont (-5.6%) recorded MoM losses.

On the political front, President Cyril Ramaphosa had his hands full as xenophobia reared its ugly head again, with intermittent looting following several days of violence, aimed mainly, although not exclusively, at foreigners. SA’s pervasive gender-based violence (GBV) was also top of the agenda as thousands marched to denounce the scourge and demand government action. News around these topics overshadowed the World Economic Forum being held in Cape Town. Finance Minister Tito Mboweni released a surprise proposed economic policy document entitled Economic Transformation, Inclusive Growth, and Competitiveness: Towards an Economic Strategy for South Africa, which included several politically controversial recommendations such as selling off Eskom assets to stabilise government finances and reforming government departments. Ramaphosa last month also published the first of his weekly newsletters on the state of the local economy as well as other issues in SA.

Local economic data showed that the country avoided a second recession in two years, with GDP growing by a stronger-than-expected 3.1% YoY in 2Q19 (Reuters consensus economist forecasts had expected 2.4% growth). In 1Q19, the economy shrank by 3.2%. SA’s headline consumer price inflation rose by a higher-than-expected 4.3% YoY in August (vs 4.0% in July), with increases in the prices of food and non-alcoholic beverages (+3.9% YoY) the main drivers. Core inflation, which excludes the volatile food, non-alcoholic beverages, petrol and energy categories, advanced slightly at 4.3% YoY (vs 4.2% in July). The latest retail sales numbers showed a 2.0% YoY rise for July vs June’s 2.4% YoY gain. SA also reported an August trade surplus of R6.8bn vs a July trade deficit of R2.9bn. Meanwhile, the SA Reserve Bank’s (SARB) Monetary Policy Committee voted unanimously to keep the repo rate unchanged at 6.5% at its September meeting.

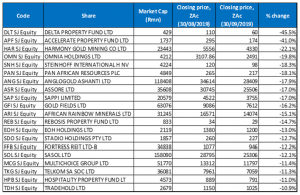

Top-20 September 2019 MoM performers

Source: Bloomberg, Anchor

September’s best-performing shares were a mix of industrial, financial and even property counters. Gold mining shares, conspicuously absent following an impressive performances over the past few months, were weighed down as the price of bullion, which recorded its fourth consecutive monthly gain in August, but dropped by 3.1% last month. Among the top-10 shares, Wilson Bayly Holmes-Ovcon (WBHO), was by far the best-performer. WBHO, now the largest remaining JSE-listed construction firm, saw its share price soar 42.6% MoM (admittedly from a very low base) as it said that four state-owned enterprises (SOEs) – the Airports Company of SA (ACSA), Transnet, Eskom and the SA National Roads Agency (SANRAL), had returned to issuing tenders “for the first time in years”. WBHO indicated that it had been awarded some of these and, as a result, the performance of its Roads segment improved in 2H19. The firm also stated that it saw a strong improvement in its Australian operations following a once-off, write-off in 2018.

In second spot, investment holding firm, Trencor’s (+30.5% MoM) share price has been on an upward trajectory as the proposed unbundling of its controlling stake in US-listed marine cargo container firm, Textainer inches closer. If all goes according to plan, the 27.2mn Textainer shares which Trencor owns will be distributed to shareholders before year-end.

Property Group, Hammerson plc, which has its primary listing in the UK, was last month’s third best-performing share with a MoM gain of 26.2%. In September the company said it is selling Abbotsinch Retail Park, to Ashby Capital for GBP67mn (c. R1.3bn), noting that its ‘absolute priority” is debt reduction. According to CEO David Atkins with this deal the company has “… exceeded our target of more than GBP500m in disposals in 2019.” Atkins added that disposals would enable it to prove the value of its business, strengthen its balance sheet, and “provide flexibility to benefit from opportunities that would arise in the coming years, particularly with regards to the City Quarters pipeline …”

Sun International soared 18.0% MoM, following a rise in 1H19 income from its SA operations and marginal increases in revenue and earnings. In its results, the company said its income increased to R5.60bn vs R5.47bn in 1H18, while diluted EPS fell 0.8% YoY to ZAc132. Capitec Bank and Capital & Counties (CapCo) rose 17.6% and 15.6% MoM, respectively. Capitec reported a substantial increase in 1H20 HEPS in a lacklustre macro-economic environment, while the bank’s profit jumped 20% YoY to R2.9bn. CapCo said last month that preparations for the demerger of Covent Garden as a central London focused REIT were nearly finalised. It confirmed there had been a “broad range of interest” in Earls Court, but there was no certainty at this stage of a sale being completed.

Local food producer, Libstar Holdings jumped 15.3% MoM, while MAS Real Estate rose 14.1% and Momentum Metropolitan Holdings closed September 13.4% higher. Last month, Libstar posted strong interim results, buoyed by its core businesses (perishables, ambient groceries, snacks and confectionary etc.) despite the difficult local retail and consumer market. The firm recorded a 4.6% YoY rise in 1H19 revenue and a 12.4% YoY increase in HEPS. On the back of steep cost cutting and new business growth, Momentum Metropolitan saw a sharp rise in FY19 profitability, while diluted HEPS rocketed 61% YoY to ZAc202.5, bolstered by November’s R2bn share buyback programme and solid underwriting results across the business.

Finally, private schooling and tertiary education firm, ADvTECH closed September 12.7% higher. At the end of August, ADvTECH reported a 15% YoY rise in 1H19 revenue to R2.5bn, while its HEPS jumped 28% YoY to ZAc43.4.

Bottom-20 shares: September 2019 MoM performance

Source: Bloomberg, Anchor

For the most part, September’s worst-performing shares came from the mining and real estate sectors, with a few industrial counters thrown in the mix. For the second month running Delta was the worst performer, declining by a further 45.5% MoM in September (it was down 39.9% MoM in August).

Delta was followed by Accelerate Property Fund (-41.0% MoM) in second spot. The Accelerate share price hit an all-time low on Monday (30 September), after it warned in a trading statement that rental reversions and additional costs at its newly upgraded Fourways Mall would have a material impact on its payments to shareholders. Accelerate said DPS could drop by as much as 15% in FY20.

With the weaker gold price and a rampant dollar, Harmony Gold (-22.1% MoM) was last month’s third worst-performing share. This was in stark contrast to its performance in August when the share price rocketed 50.4% MoM as the stronger gold price and impressive FY19 results (released on 20 August) buoyed the counter.

Chemicals Group, Omnia Holdings, embattled Steinhoff International and Pan African Resources ended 19.8%, 18.3% and 18.1% down MoM. Omnia’s share price slid despite the company announcing it had raised R2bn (which would be used to repay its debt) via a rights offer. Omnia completed the rights offer of 100mn new ordinary shares at a subscription price of R20/rights-offer share. The Financial Sector Conduct Authority (FSCA) last month levied its largest fine to date against Steinhoff – a record R1.5bn for misrepresenting its finances to the market. However, Steinhoff will only need to pay R53mn of the fine, with the FCSA noting the retailer’s current financial position and co-operation with authorities, according to Business Day. Although Pan African Resources beat FY19 production guidance, returned to positive earnings, and resumed its dividend payment the lower bullion price weighed on the gold producer.

The lower gold price also dragged AngloGold Ashanti (-17.9% MoM), Assore Ltd (-17.0% MoM) and Gold Fields (-16.2%) lower, while paper manufacturer, Sappi dropped 17% MoM. Following the listing of Prosus (Naspers’ new internet subsidiary), Sappi has been knocked out of the JSE Top-40 Index and the share price drop is likely due to large institutional investors selling out of the stock, although Sappi’s latest results (3Q19) were also disappointing (HEPS fell 78% YoY to and sales were down 5% YoY). Assore was down despite reporting record FY19 earnings – EPS rose 15% YoY, while revenue rose 4% YoY. Finally, diversified miner, African Rainbow Minerals ended September 15.1% lower.

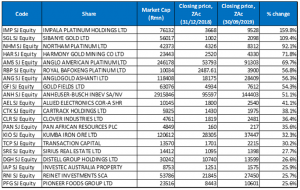

Top-20: YTD best-performing shares

Source: Bloomberg, Anchor

While September was a poor month for resource counters, their gains over the previous few months saw these shares continuing to account for most of the twenty best-performing shares YTD (to end September) and for eight of the top-10 performers. For a fourth-month running, platinum miner Impala was the top-performing share YTD, having soared by an impressive 158.9%.

Sibanye moved from third spot in August to a second-place position (where it was in the year to end July), with a 109.4% gain YTD. It was followed in third spot by Northam Platinum (+92.1% YTD), which rose up in the ranks from its sixth position in the year to August.

Following a poor performance in September, Harmony fell two spots to the fourth best-performing share with a YTD gain of 71.8%. It was followed by Anglo American Platinum (Amplats), Royal Bafokeng Platinum, AngloGold Ashanti, and Gold Fields, which gained 69.7%, 56.8%, 56.3% and 54.3% YTD.

Rounding out the ten best-performing shares YTD, were Anheuser-Busch InBev and Allied Electronics (Altron) with gains of 51.1% and 41.1%, respectively. Last month Altron said Thobela Telecoms had been granted leave to appeal a July High Court judgment that set aside the City of Tshwane’s Municipal Broadband Network Project after alleged irregularities in awarding the contract were discovered. Altron’s subsidiary, Altron Nexus, is involved as the primary network designer and architect, supplier of broadband equipment and related services, as well as being a minority shareholder in Thobela.

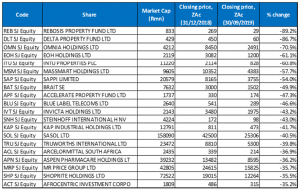

Bottom-20: YTD worst-performing shares

Source: Bloomberg, Anchor

Once again September’s YTD worst-performing shares were relatively unchanged from the August line-up. Netcare, Sun International, Nampak and PPC fell out of the list of 20 worst-performing shares YTD, while Accelerate, Steinhoff, (both discussed earlier), Mr Price (-7.8% MoM), and Afrocentric Investment Corp (-8.7% MoM) recorded steep enough share price drops in September to place these counters among the YTD 20 worst-performing shares. Last month, Mr Price said that it faces potential financial exposure of between R10mn and R20mn in a probe relating to the “non-compliance” between two senior managers and one of its suppliers (the investigation is reportedly ongoing). Investment holding firm, Afrocentric reported muted FY19 headline earnings growth which increased only 1.6% YoY to R265.2mn. The company attributed the flat headline earnings to increased gearing and the higher amortisation costs of intangible assets.

Among the bottom-twenty shares, Rebosis -B- was once again the worst performer, with its price now having plummeted 89.2% YTD. It was followed by another property counter Delta, which is down 86.7% YTD and in the same spot as in the year to end August. Chemicals and fertiliser manufacturer, Omnia was in third spot – down 70.5% YTD, followed by EOH Holdings (-61.1% YTD) and Intu Properties (-60.8% YTD), which saw its share price strengthen by 11.6% MoM in September.

SA’s lacklustre economy, high unemployment and difficult macro-economic environment has hit most retailers, with Massmart now down 57.7% YTD. Massmart also reported 1H19 results in August which had revealed the Group’s first loss in c. 20 years.

Finally, rounding out the ten worst performers YTD, Brait, Accelerate (discussed earlier) and Blue Label Telecoms, are down 49.9%, 47.3%, and 46.6% YTD, respectively. Brait last week said that it was in talks with its major shareholder, Titan, as it plans to materially cut debt through raising equity and recapitalisation, among other ways. Blue Label Telecoms, meanwhile, reported delayed results in Septtember which showed the firm recorded a FY19 headline loss per share of ZAc312.49. The telecoms Group attributed this to its mobile network subsidiary (it owns a 20% stake), Cell C’s trading losses, impairment of its property, plant and equipment and the impact of a de-recognition of its deferred tax asset and the impairment of Blue Label’s total investment therein.