In A Tale of Two Cities, Charles Dickens wrote “It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, …” – an apt description for these contradictory times and for US and most global markets over this past quarter. While US equity market returns have been impressive (and volatile), we highlight that these moves come after 1Q20, which saw the emergence of the COVID-19 pandemic in the US and its devastating impact on the US and global economies, as governments introduced lockdowns to curb the spread of the virus. As 1H20 comes to an end, the number of COVID-19 cases, especially in the US, continued to rise, triggering a considerable amount of uncertainty in markets as it leads to new restrictions and a rollback of previously announced reopenings. World Health Organisation (WHO) Director-General Tedros Adhanom Ghebreyesus warned this week that “the worst is yet to come” as several countries saw a flare up of the pandemic. Currently, the US accounts for over 20% of all COVID-19 reported deaths, more than any other country. It is followed by Brazil, the UK, Italy, and France.

Nevertheless, most major global markets ended June in the green, with the Dow Jones Industrial Average (DJIA +17.8% in 2Q20 and -9.6% YTD) and the S&P 500 (+20.0% in 2Q20 and -4.0% YTD) up 1.7% and 1.8% MoM, respectively, and recording their best quarterly performances since 1938, according to Dow Jones Market Data. The tech-heavy NASDAQ rose 6.0% MoM and jumped 30.6% in 2Q – its best quarter since 2001. YTD, the NASDAQ is up 12.1%. Here it is worth noting that, while these performances may sound impressive, the DJIA recorded its worst first six months of any calendar year since the 2008 global financial crisis and the S&P 500 its worst first half-year in a decade. Towards month-end, US investor sentiment was buoyed by upbeat economic data and hopes for a stimulus-backed economic rebound. US housing market activity showed a quick recovery in May, while June consumer confidence data, released on Tuesday (30 June), exceeded consensus economist forecasts, recording its biggest jump since 2011.

Elsewhere, the UK’s FTSE 100 gained 1.5% last month (-18.2% YTD) but recorded its best quarter since 2010, rising 8.8%. However, UK 1Q20 gross domestic product (GDP) growth suffered its sharpest decline in over 40 years, falling by 2.2%.

While Europe was pulled in different directions over the course of June by the continually alarming COVID-19 headlines, European equity markets closed higher on Tuesday, wrapping up their best quarterly performance in five years, according to CNBC. Germany’s Dax jumped 6.2% MoM (+23.9% for 2Q20, but down 7.1% YTD), while France’s CAC rose 5.1% MoM (+12.3% in 2Q20, but down 17.4% YTD). On the data front, June economic confidence in the European Union (EU) and the eurozone improved sharply, with the Economic Sentiment Indicator (ESI) climbing 8.2 points to 75.7 (from 67.5 in May) in the EU27 (all member countries of the bloc) and by 8.1 points to 74.8 in the eurozone.

In Asia, Japan’s Nikkei advanced 1.9% MoM and closed 17.8% higher for 2Q20. However, YTD the Nikkei is still down 5.8% YTD. China’s Shanghai Composite Index jumped 4.6% in June (up 8.5% in 2Q20 but down 2.1% YTD), while Hong Kong’s Hang Seng soared by 6.4% MoM (up 3.5% in 2Q20 but down 13.3% YTD). The latest economic data seems to suggest that an economic recovery is underway in China, with that country’s official June manufacturing purchasing managers index (PMI) coming in above expectations at 50.9 (vs May’s 50.6), according to China’s National Bureau of Statistics (NBS). Reuters consensus economists had expected a 50.4 print. Meanwhile, the June Caixin/Markit manufacturing PMI came in at 51.2 – also above consensus expectations of a 50.5 reading (above 50 signals expansion, below 50 indicates contraction). We note that China’s new national security law for Hong Kong came into effect on Wednesday. The legislation gives Beijing greater control over the city and, under the new law, many of Hong Kong’s protests that took place last year would be punishable by law.

On the commodity front, the iron ore price rose c. 12.0% in June. However, the resumption of operations at the world’s largest iron ore producer, Brazil’s Vale, could see supply-side issues, which resulted in iron ore surging to fresh highs, withering away. Meanwhile, platinum and palladium prices were basically unchanged, while rhodium recorded a c. 12% decline. The price of crude oil jumped c. 16% as it reached $41.15/bbl by month-end, but despite a massive move in May and its June gains, YTD oil is down c. 38%. The gold price recorded another great run in June (up 2.9% MoM), with the yellow metal topping $1,800/oz earlier this week – its highest finish since 2011. The gold price has been buoyed by uncertainties around the COVID-19 pandemic which continues to cloud the global economy, feeding gold’s appeal as a safe-haven investment.

In SA, the JSE posted impressive gains in June despite some hiccups along the way, with miners, especially gold miners, Prosus (+12.9% MoM) and Naspers (+13.4% MoM) doing most of the heavy lifting. The FTSE JSE All Share Index jumped 7.7% MoM, propelled higher by strong share price gains from various large-cap constituents including the aforementioned Prosus and Naspers as well as AngloGold Ashanti (+19.1% MoM), Anglo American Platinum (Amplats; +13.0%), Glencore (+11.5% MoM), and Anglo American (+9.8% MoM). The index is also up 22.2% in 2Q20, but down 4.8% YTD. The Resi-10 jumped by 8.6% MoM (+40.6% in 2Q20 and up 4.1% YTD) as gold counters and diversified miners rallied. Buoyed by Naspers and Prosus, the Indi-25 closed 8.2% higher (+16.7% in 2Q20 and up 8.9% YTD), while banking and financial counters lagged, although the Fini-15 did end June 3.1% higher (the index gained 7.0% in 2Q20 but is down 36.0% YTD). The rand strengthened by 1.1% in June to close at R17.35/$1 – YTD, the local currency is down c. 24% vs the greenback.

Stats SA released GDP data on Tuesday which showed a 2% decline in 1Q20 GDP growth, deepening the recession SA entered at the start of 2020. This was also the third quarterly growth decline in succession, following drops of 0.6% in 3Q19, and 1.4% in 4Q19. However, it did beat consensus expectations of a 4% decline for 1Q20. YoY, 1Q20 GDP was down 0.1% – also better than the expected 0.9% drop. We highlight that the data reflect GDP prior to the nationwide hard lockdown which was implemented on 27 March. Consumer price inflation (CPI) data, delayed by the pandemic, showed April annual inflation, reflecting the impact of the first month of the COVID-19 lockdown, dropped to 3.0% vs 4.1% in March – the lowest reading since June 2005 when inflation stood at 2.8%. Consumer inflation is now at the bottom of the SA Reserve Bank (SARB) target range of 3%–6%. May’s trade balance showed a surplus of R15.94bn (c. $918.2mn) vs April’s revised deficit of R35.95bn. Exports rocketed 96.1% MoM to R101.85bn, while imports declined 2.2% to R85.91bn.

With the hard lockdown that started in late March being gradually eased to allow more businesses and sectors of the economy to open, SA’s total number of confirmed COVID-19 cases rose to 151,209 at end-June (vs 32,683 confirmed cases as at 31 May) and with the epicentre of the virus moving from Cape Town to the economic hub of Gauteng. The total number of local COVID-19 deaths now stand at 2,657, with 73,543 recoveries to date.

Finance Minister Tito Mboweni presented his 2020 Supplementary Budget on 24 June, which was relatively low on detail (likely pushed to October’s Medium Term Budget Policy Statement where demonstrable traction with infrastructure investment plans and the necessary savings could make it a catalyst for domestic business and consumer sentiment to improve). However, the economic picture the minister painted was bleak – GDP is now expected to decline by 7.2% YoY in 2020, while growth in 2021 is forecast at a paltry 2.1% YoY. The government deficit is also projected to be a record-breaking 15.7%. The nation’s fiscus is indeed in a dire straits with economists agreeing that the pandemic, along with government’s response to the crisis, has dealt a devastating blow to SA’s already weakened finances.

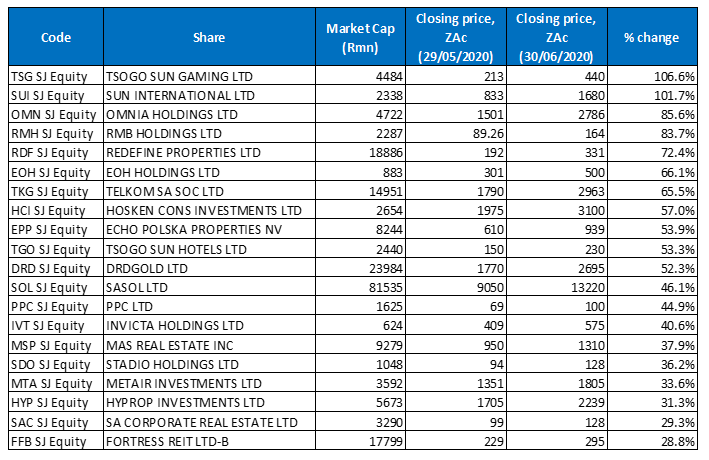

Figure 1: The 20 best-performing shares in June 2020, MoM

Source: Anchor, Bloomberg.

Tsogo Sun Gaming has been on the back foot for some time now with its share price, battered by COVID-19 induced lockdowns, dropping by 82.7% for the year to end May. However, its fortunes turned around and the share price soared in June, emerging as last month’s top-performing counter with an impressive 106.6% gain. After the company warned that its FY20 earnings would decline by more than 20% YoY, hurt by c. R2bn in impairments, the share price had plummeted to a record low of c. R1.31/share in late-May. But in June, Tsogo Sun Gaming initially jumped over 50% on 2 June alone, before posting further gains later in the month as news emerged that government would allow the reopening of industries such as entertainment, personal care, and commercially licensed accommodation.

Tsogo’s peer, Sun International surged 101.7% MoM – June’s second best-performing share. The share price rocketed 16.1% on 17 June, amid reports of a positive announcement from government regarding the opening of casinos. Later in the month, Sun International said that, after consulting with a number of its largest shareholders about a turnaround plan, it will shut two properties (Sun Carousel and Naledi) and reduce staffing at others as the local hotel and casino industry grapples with the pandemic. While the share closed the month higher, the share price was volatile for most of June likely due to the R1.5bn bid for a majority stake in the Group from Chilean company, Nueva Inversiones Pacifico. The offer of R22/share (for a 50.1% stake), valued Sun International at c. R3bn, but its two largest shareholders rejected the bid saying it significantly undervalued the business.

In third spot, chemicals manufacturing company, Omnia Holdings recorded an 85.6% MoM jump after saying that its restructuring was bearing fruit and it returned to profit in the year to end-March. In its FY20 trading statement, Omnia said it expects EPS to be between ZAc65 and ZAc130, compared with loss per share of ZAc609 in FY19. HEPS is expected to be between ZAc177 and ZAc196, vs a headline loss per share of ZAc112 in the prior year.

RMB Holdings, Redefine and EOH Holdings recorded MoM gains of 83.7%, 72.4% and 66.1%. The listed property sector recorded a strong rebound in June, with most property counters delivering positive share price returns. Among these, Redefine, SA’s second-largest listed real estate company by assets, was the strongest, with an impressive 72.4% jump in its share price. In a continuing drive to strengthen its balance sheet, Redefine announced in June that it will sell its 90% interests in two Australian student accommodation businesses to subsidiaries of German insurance group ,Allianz, for a total price of c. R5.4bn. In addition, the firm last week announced the conclusion of a deal that will see the global private investment firm Starwood Capital acquire its 111.9mn shares in UK-based RDI real estate investment trust (REIT) for GBp95/share – a 20.9% premium to the share price. This disposal will generate GBP106.3mn (c. R2.3bn) for Redefine. EOH Holdings’ share price also rose after the company said that it had paid R540mn of the R1.60bn debt burden it agreed to repay by the end of February 2021 and stated that these payments are in addition to the R500mn agreed with lenders and ahead of the 31 August deadline.

Telecommunications services provider, Telkom (+65.5% MoM) reported FY20 results last month, which showed that its revenue rose by 3% YoY to R43.03bn, from R41.77bn posted in FY19, while HEPS fell 66% YoY to ZAc208.1. Telkom’s normalised HEPS, which excludes one-off items (mainly retrenchment costs) was down 37.2% YoY to ZAc504.6. Telkom declared a final dividend of ZAc50/share (paying ZAc121/share for the full year), but the company has suspended its dividend policy for the next three years as it considers its capital expenditure needs in light of the imminent spectrum auction by government..

Hosken Consolidated Investments (HCI) and Poland’s largest retail landlord, Echo Polska Properties (EPP), posted MoM gains of 57.0% and 53.9%, respectively. EPP said last month that it is over the worst of the COVID-19 pandemic and should be able to pay a dividend again in 2021. Containment measures against the pandemic have been more effective in Poland than in many western economies. In addition, most of EPP’s lenders have agreed to temporarily waive capital amortisation for the year and the firm has negotiated with banks to suspend covenant testing until the end of this year. EPP has also introduced plans to optimise costs and mitigate the impact of COVID-19 induced lockdowns, including reductions in its capital expenditure. In addition, the company implemented a 20% salary cut for all employees, including board members and executive directors, with effect from May 2020.

Tsogo Sun Hotels (+53.3% MoM), which already has a strong portfolio of over 90 hotels, announced plans last month to take over the management of Mount Grace, the Edward and the Protea Hotel Hazyview, after Marriott International said it would close these iconic properties due to the financial impact of the pandemic. Tsogo Sun Hotels, via its subsidiary Hospitality Property Fund, already owns a controlling stake in the three hotels with which Marriott is terminating its relationship.

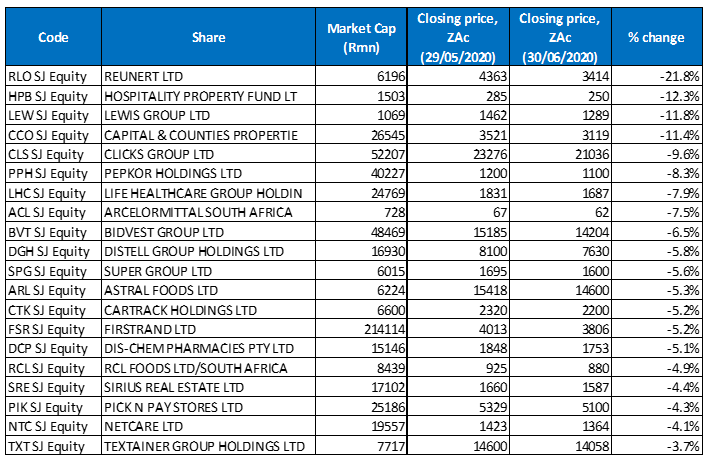

Figure 2: The 20 worst-performing shares in June 2020, MoM

Source: Anchor, Bloomberg.

Industrial goods and services Group, Reunert (-21.8% MoM) was by far the worst performing share in June after reporting 1H20 results which revealed that its revenue fell 22.0% YoY to R4.14bn, while it also recorded a diluted loss per share of ZAc169 compared with EPS of ZAc223 in 1H19. The firm’s electrical engineering segment was hit by a seven-week labour disruption at the power cable business which resulted in limited production in 1Q20. In addition, Reunert’s results were impacted by impairments arising from the predicted impact of COVID-19 and the resulting highly uncertain future economic conditions.

Reunert was followed by the Hospitality Property Fund (-12.3% MoM) in second spot and Lewis Group (+11.8% MoM) in third position. Marriott International said in June that it would permanently exit three of its SA hotels because of COVID-19 created uncertainty, especially in the local tourism and hospitality sector. Marriot will hand the three hotels back to the property owner, Hospitality Property Fund, which also owns Tsogo Sun and Radisson Blu Hotels, and Tsogo Sun Hotels will take over their management.

Capital & Counties Properties (CapCo), Clicks Group and Steinhoff subsidiary, Pepkor Holdings, were down 11.4%, 9.6% and 8.3% MoM, respectively. Last month, Pepkor announced the placement of an additional 5% of its ordinary shares at a low of R11/share. The R1.9bn raised will, according to the company, be used for debt and to secure the business against future uncertainty, providing investors “with an opportunity to invest in the future growth of the business.”

Life Healthcare (-7.9% MoM) said in June that its southern African operation has been the victim of a targeted cyber-attack on its IT systems. The hospital group said that the extent to which sensitive data had been compromised was yet to be determined and it is investigating the incident.

Last week, ArcelorMittal SA (-7.5% MoM) said that jobs were on the line as it struggles due to the impact of the COVID-19 pandemic on the economy. The company is contemplating “a large-scale restructuring” of its businesses “and the number of jobs impacted will depend on alternatives identified and agreed to mitigate the impact. The final outcome and number of positions affected is subject to a formal consultation process,” … Arcelor Mittal said that its initial cost-saving measures are not enough because of the unprecedented impact of the pandemic and the associated lockdowns. In a statement the firm noted that “it will take some time for crude steel production levels to return to historical levels or planned levels of 2020. Therefore, a significant part of the company’s available production capacity may remain unutilised for an extended period,”.

Early last month, Bidvest Group (-6.5% MoM) warned of possible job losses because of coronavirus-related disruptions across its operations. The Group said that the fallout from the pandemic was likely to result in a review of its business, as its full-year earnings (FY20) were expected to decline by more than 20% YoY. Bidvest recorded R232.2mn in impairments during the period, with its shareholding in Comair contributing R209.7mn to these losses.

Rounding out June’s ten-worst performing shares, Distell Group declined by 5.8% MoM. Africa’s leading producer of wines, spirits and ciders, said in a June trading update that, despite a spike in local demand as restrictions on the sale of alcohol were eased, volumes remained down. According to the company, from 1 July 2019 to end June 2020, its SA revenue declined by 18.3% YoY and volumes are down by 25.6% YoY. It added that, while easing of export regulations related to agricultural products during level-4 lockdown meant that its open orders to the value of about R440m could be processed, it had only managed to fulfill 54% of the value of these orders since local ports were operating at a reduced capacity and some customers cancelled their orders. Distell also affirmed its trading statement, released in May, which stated that FY20 headline EPS were expected to be between 60% and 80% lower YoY.

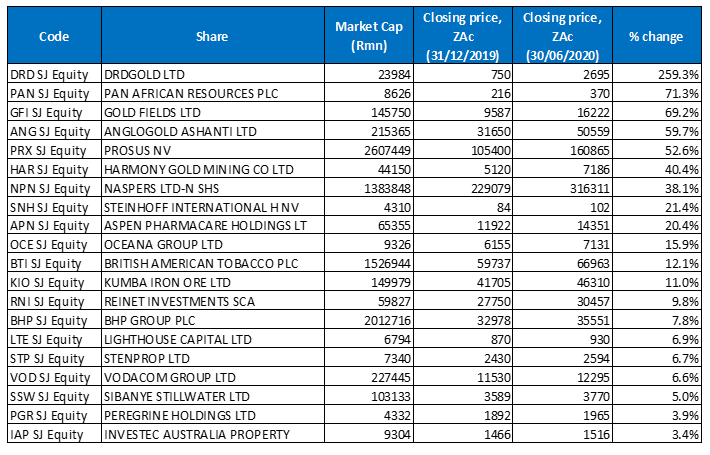

Figure 3: Top-20 YTD performers (to end June 2020)

Source: Anchor, Bloomberg

Fourteen of May’s YTD best-performing shares remained among the 20 best performers for the year to end June. Oceana Group, Lighthouse Capital, Stenprop, Sibanye Stillwater, Peregrine Holdings and Investec Australia Property were June’s new entrants in the top-20, bumping Textainer, Sirius Real Estate, African Rainbow Minerals, Mondi Plc., JSE Ltd., and RFG Holdings from the year’s top-performers list.

DRD Gold remained the best-performing share YTD (for the fourth month running), with an impressive 259.3% share price gain to end June. With gold experiencing a rally this year (+17.4% YTD) and trading recently at its highest levels in c. 8 years, the DRD share price jumped by 52.3% in June alone, as nervous investors continue to seek out so-called safe-haven assets amid the pandemic. Local gold miners are also benefiting from a weaker local currency (-24% YTD) as they earn their income in US dollar, while paying expenses in rand. As was the case in May, DRD Gold was followed by Pan African Resources (+71.3% YTD) in second place and Gold Fields (+69.20% YTD) in third spot.

Following AngloGold Ashanti (+59.7% YTD) in fourth position, Prosus (+52.6% YTD), which has been spurred along by growth in online gaming during the various lockdown periods and its investment in Chinese gaming juggernaut Tencent, took fifth spot, after gaining a further 12.9% in June.

Prosus was followed by another gold counter, Harmony Gold (+40.4% YTD), with Naspers (+38.1% YTD), Steinhoff (+21.4% YTD), Aspen (+20.4% YTD) and Oceana Group (+15.9% YTD), rounding out the top-10 YTD performers.

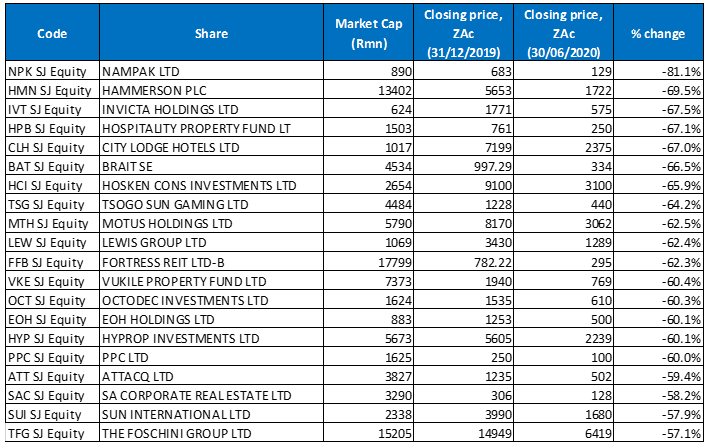

Figure 4: Bottom-20 YTD performers (to end June 2020)

Source: Anchor, Bloomberg

Looking at the year to end-June’s worst performing shares, five new counters entered the arena with Hospitality Property Fund (-67.1% YTD), Lewis Group (-62.4% YTD), Octodec (-60.3% YTD), Attacq (-59.4% YTD) and The Foschini Group (-57.1% YTD), replacing Intu Properties (its shares have been suspended on the Johannesburg and London stock exchanges as it goes under administration), Redefine, Sasol, Arrowhead and EPP.

While Nampak recorded a 12.2% MoM share price gain in June, this was not enough to pull it out of the YTD worst-performing shares category. Indeed, the counter maintained its position as the worst performer YTD for a second consecutive month, with the share price now down 81.1% YTD. Nampak was followed by UK and Europe shopping centre owner, Hammersons Plc (-69.5% YTD) in second position and Invicta Holdings (-67.5% YTD) in third spot. Last month, Hammerson announced the resignation of its board chair David Tyler. This comes a few weeks after its CEO, David Atkins said he would step down. In May, the Group’s sale of nine retail parks to Orion European Real Estate for c. R9bn fell through.

Invicta was followed by Hospitality Property Fund (-67.1% YTD), City Lodge Hotels (-67.0% YTD), Brait SE (-66.5% YTD), and HCI (-65.9% YTD). In a June operational update, City Lodge said it now has enough liquidity to get it through the pandemic after lenders extended its facilities and waived borrowing covenants for the June and December measurement periods. Meanwhile, Brait gained 28.0% MoM in June after the investment group announced the sale of its 63.1% stake in Iceland Foods for c. R2.45bn. The proceeds will be used to repay debt. Unfortunately, its share price gain in June was not enough to move it out from among the ten worst-performing shares YTD.

Tsogo Sun Gaming (-64.2% YTD), Motus Holdings (-62.5% YTD) and Lewis Group (-62.4% YTD) rounded out the ten YTD worst performers.