2020 has indeed been a remarkable 12 months for global financial markets. After the first wave of the COVID-19 pandemic early last year initially triggered a collapse in global equity markets, we watched as the rollout of unparalleled stimulus measures by major central banks and (more recently) vaccine breakthroughs sent markets soaring to record highs. After a record November, with extraordinary gains across the board, spurred on by the prospect of a swift rollout of COVID-19 vaccines and further central bank stimulus measures, December continued this trajectory albeit at a slower pace and most major global markets ended the month higher. The renewed vaccine optimism seemed to offset concerns surrounding the further escalation in coronavirus cases globally, and key indices recorded a succession of all-time highs. Given the pandemic’s severity, especially in the US (where more than 360,000 Americans have died) and in parts of Europe, as well as the job losses accompanying these tragic deaths and the uncertainty that still lies ahead, it is astounding how strong markets have been.

Following its mid-December meeting, the US Federal Reserve (Fed) said it would continue buying at least $120bn of bonds every month until the US economy reaches full employment and inflation stays at 2%. As expected, the Fed also voted to hold short-term borrowing rates near zero. Meanwhile, President Donald Trump last week approved Congress’ bipartisan $900bn stimulus package after initially objecting to the bill which includes a $1.4bn funding bill to keep the federal government running through September 2021, thus preventing a shutdown. The pandemic relief package included a more modest $600 payment that fell short of Trump’s demand of $2,000 checks to most Americans. Unfortunately, the delay in signing the bill into law has created a lapse in unemployment benefits for c. 14mn Americans. On the economic data front, the US Labor Department reported that last week’s first-time jobless claims had come in at 787,000. While this was a 19,000 decline from the previous week’s revised total, it remains elevated and is a stark reminder of the ravages of the pandemic on US households. US consumer confidence dropped to a four-month low in December amid more states tightening business and travel restrictions, while November US pending home sales (released last month) also fell unexpectedly.

On US equity markets, the S&P 500 closed the year 16.3% higher (+3.7% MoM), while the Dow Jones ended 2020 up c. 7.2% (+3.3% MoM), with both indices ending the year at record levels. Since US markets bottomed on 23 March, the S&P 500 has risen by an incredible 68%. However, the tech-heavy Nasdaq left these indices in the dust, gaining a mind-blowing 43.6% for the year (+5.7% MoM) as tech stocks rallied in the new normal. The historic gains in these indices came on the back of an extraordinary infusion of liquidity into the US monetary system by the Federal Reserve (Fed) – the biggest government stimulus in history, while optimism around COVID-19 vaccines being widely distributed also buoyed sentiment. Still, there seems to be a continued and large disconnect between Wall Street and Main Street as investors seem, for the most part, to have ignored the impact of the pandemic on the average American, including marked unemployment (c. 20mn people remain unemployed in the US, a jobs crisis worse than during the Great Depression according to The Washington Post), overwhelmed hospitals, and battered small businesses.

The UK stock market has been particularly volatile this past year but closed at its highest level on 29 December since COVID-19 sparked a market rout in March. This as investors seemed to welcome the Brexit agreement between the UK and Brussels after four years of uncertainty, while optimism surrounding the rate of vaccinations across the UK also supported gains. However, the FTSE 100 still ended the year 14.3% in the red (its worst annual performance since 2008), although it did close 3.1% higher MoM. The UK is set to begin the rollout of a coronavirus vaccine developed by AstraZeneca and the University of Oxford this week, although Prime Minister Boris Johnson has indicated that more restrictions could be on the cards.

The pandemic continued to be the focus for European markets, although sentiment was seemingly buoyed by a rally in US stocks the last week of December after Trump signed the coronavirus relief package into law, and by the formal approval of a Brexit trade deal. France’s benchmark CAC closed the year 7.1% down (+0.6% MoM), but Germany’s Dax was up 3.5% for the year and 3.2% higher in December.

In Asia, China’s Shanghai Composite Index rose 13.9% YoY (+2.4% MoM), while Hong Kong’s Hang Seng ended 3.4% in the red YoY (+3.4% MoM) after a turbulent year, although the region was far more successful in containing the virus than their US and European counterparts. China’s economic recovery continued in December, albeit at a slower pace. The country’s official manufacturing PMI fell to 51.9 in December vs 52.1 in November, according to the National Bureau of Statistics. However, it remained above the 50-point mark that separates growth from contraction. According to CNBC, China’s economy is expected to expand by c. 2% for the full year and while this might be the weakest in over three decades, it is much stronger than other major economies which are struggling to contain new COVID-19 infections. Japan’s benchmark Nikkei closed the year 16.0% higher and rose by 3.8% in December.

On the commodities front, iron ore prices leapt to more than ten-year highs on 21 December, before falling back in the last week of the month as China urged the steel industry to produce less crude steel in 2021 amid the government’s carbon neutrality plan. For 2020, the iron ore price has soared c. 88%, while it jumped c. 29% in December alone. The price of platinum gained c. 10% YoY and was up c. 2.5% MoM, while gold ended the year 25.1% higher (+6.8% MoM in December) – its best annual performance in around a decade as a surge in new COVID-19 cases and prospects of tougher restrictions lured investors to safe-haven assets. Oil prices bottomed in April as fuel demand all but collapsed amid global lockdowns to combat the pandemic. This in turn depressed economic activity and hit fuel demand. However, Brent crude has more than doubled since its April lows (closing the year 21.5% higher YoY) as the opening of economies and vaccinations bolstered demand, although news of a more infectious COVID variant last month did result in a murky demand outlook for the oil price in December (+8.8% MoM).

Following a spectacular performance in November, South Africa’s (SA’s) FTSE JSE All Share Index rose by a further 4.1% in December, also ending the year 4.1% higher. Looking at the best performers in December by market capitalisation, the large-cap gold, and platinum companies outperformed, with Anglo American Platinum soaring 28.1%, Impala Platinum jumping 24.1%, Northam Platinum rocketing 18.9%, while Kumba Iron Ore (Kumba), Sibanye, and BHP Group recorded MoM gains of 18.2%, 16.5%, and 9.6%, respectively. Unprecedented stimulus measures globally and a low interest rate environment to cushion economies from the impact of the pandemic have benefited gold (seen as an inflation hedge) and December’s jump in the gold price and other precious metals lifted the Resi-10 by 9.2% MoM. For the year, the index is up 16.9%. Elsewhere, the Fini-15 rose 8.1% MoM but was down 23.1% YoY, while the Indi-25 lost 1.3% MoM but ended 2020 c. 12.4% higher.

The rand has gradually strengthened over the past few months and after November’s 5% gain against the US dollar, the local unit firmed a further 5% in December. For 2020, however, the local unit is still c. 5% down against the greenback. We note that, although the US dollar recorded its largest annual loss since 2017 last year, after March’s panic subsided, it has settled into a downtrend and the current global environment continues to support a gradual weakening of the dollar against cyclical currencies as the vaccine becomes available and investors position for a cyclical recovery.

On the economic data front, SA’s November annual consumer price inflation (CPI) slowed to 3.2% YoY (vs October’s 3.3% YoY rise), driven by cost increases of food and non-alcoholic beverages, housing, and utilities, as well as miscellaneous goods and services. MoM, inflation was flat in November from 0.3% in October. Core inflation, which excludes prices of food, non-alcoholic beverages, fuel, and energy, declined to 3.3% YoY vs October’s 3.4%. MoM, core inflation was also flat. October retail sales fell by 1.8% YoY, following a 2.4% YoY contraction in September. MoM, October retail sales declined by 0.2% vs the restated September rise of 1.0%. SA’s trade surplus continued to show resilience, jumping to R36.72bn in November vs October’s restated surplus of R34.94bn as the country enjoys a bumper year of exports. YTD (1 January-30 November 2020), the trade surplus of R238.33bn is also an improvement on the R9.18bn surplus for the same period of 2019. Since the opening of the economy following level-1 lockdown, SA has achieved record-breaking monthly trade surpluses which were initially mostly due to lack of imports as the local economy shut down and some mining operations could continue exporting goods. It was expected the surplus would quickly reverse as the economy emerged from the lockdowns but, surprisingly, exports kept pace and exceeded the recovery of the imports.

Unfortunately, on the COVID front, SA was hit by a second wave of the pandemic, resulting in President Cyril Ramaphosa announcing that the country would go into an amended lockdown level 3 with effect from midnight on 28 December 2020. The sale of alcohol was also be banned, and these measures will continue until 15 January 2021. As at 4 January 2021, the Health Department said the total number of confirmed SA COVID-19 cases to date stood at 1.11mn vs 790,004 recorded at the end of November 2020.

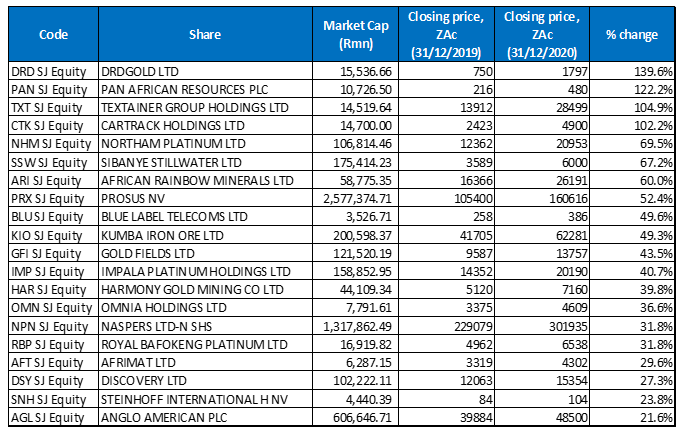

Figure 1: The 20 best-performing shares of 2020

Source: Anchor, Bloomberg

While 2020 was a year in which commodity supply chains and demand recorded huge disruptions due to the pandemic, it was also a breakout year for precious metals prices. Uncertainty and risk-off sentiment created by COVID-19 increased the attractiveness of precious metals and commodity counters as investment destinations. The price of the platinum group metals (PGM) basket soared as the pandemic triggered stockpiling by investors. Along with supply deficits, the abovementioned factors pushed commodity prices higher – silver soared c. 47%, palladium jumped by over 20% and the platinum price gained c. 10% YoY. Meanwhile, the iron ore price, which had held up reasonably well even during the first wave of the pandemic (at above the $80/tonne level), recorded sustained gains throughout 2020 as tight supply and strong demand from China pushed prices of the steel-making ingredient to multi-year highs. For 2020, the iron ore price rocketed by c. 88%, ending the year at $158.50/tonne.

Gold was another stellar performer (despite a few hiccups along the way), ending last year more than 25% higher as the yellow metal benefited from the uncertainties clouding the global economy due to COVID-19 as well as moves by major central banks to expand balance sheets to support economies, companies, and individuals. Mountains of government debt, negative real returns on bonds and the likelihood of ongoing market turbulence, should continue to support the gold price. With these impressive movements in mining and metals prices it should come as no surprise that 12 out of 2020’s top-performing shares came from the sector and six out of the top-10 were also commodity counters.

2020’s gold price rally also buoyed gold stocks such as DRD Gold (+139.6% YoY), which was the best-performing share of 2020, Pan African Resources (+122.2% YoY and the year’s second-best performer), and Sibanye Stillwater (+67.2% YoY). In October, DRDGold reported a 45% rise in its gold production for the quarter ended 30 September and the company said that sales jumped by more than half in its 1Q21. For the year to 30 June, DRDGold increased its gold production by 9% YoY, despite the COVID-19 induced lockdown, while its operating profit rocketed 320% YoY thanks to the increase in gold produced and a c. 33% rise in the average rand gold price received.

Last month, Pan African Resources, which is also listed in London, said it will invest R140mn towards the construction of a 9.975MW solar power plant at its Evander Mines to reduce its reliance on Eskom. Construction is expected to commence in 1Q21 with first power expected in 3Q21. In November, the gold miner entered into a conditional agreement to buy two tailings retreatment projects from Mintails. The company said it will pay R50mn for Mogale Gold and Mintails SA Sowetos Cluster (MSC) if the due diligence results are positive. The tailings are expected to yield an estimated gold content of 2.36mn ounces.

Pan African Resources was followed by Textainer Group (+104.9% YoY) in third place. The company leases shipping containers and is listed both on the JSE and in New York. In August 2020, Textainer reported better-than-expected results buoying its share price and with the company’s primary listing being in the US, the counter has also benefitted from robust US market gains. In September, Textainer said it had $829mn (c. R13.9bn) in asset-backed bonds and it has used the proceeds to pay off other debts and to take advantage of the low interest rate environment.

Textainer is followed by Cartrack Holdings, Northam Platinum, Sibanye Stillwater, and African Rainbow Minerals (ARM), with YoY gains of 102.2%, 69.5%, 67.2%, and 60.0%, respectively. Cartrack, the local telematics car and fleet tracking company, which operates in 23 countries across Africa, Asia, and Europe, more than quadrupled its interim dividend in October after reporting that the pandemic had failed to dull interest in its software. It opted for an interim dividend of ZAc87/share for the six months to end-August – up c. 335% YoY, while its revenue grew by 16% YoY to R1.08bn. Cartrack also said that it had added 13% more subscribers despite the pandemic, bringing its total number of subscribers to 1.2mn at that stage. Meanwhile, the platinum price rally helped Northam’s share price while Mining Weekly reported earlier this year that Northam had strengthened its liquidity position in response to COVID-19 by attracting additional new long-term funding during the lockdown period as part of the completion of a R2.65bn restructuring of its domestic medium-term note programme. ARM, which has platinum, copper, iron ore, and nickel interests has seen gains in the prices of these minerals supporting its share price.

Rounding out 2020’s top-performing shares are Prosus (+52.4% YoY), Blue Label Telecoms (+49.6% YoY), and Kumba (+49.3% YoY). Naspers subsidiary and the biggest share on the JSE by market cap, Prosus, had a phenomenal year as it continued to benefit from its holding in Chinese internet giant Tencent, and its food-delivery businesses were buoyed by the various lockdowns around the globe. Unfortunately, the share price did come under pressure in December (down 4.8% MoM) following reports that Beijing could ‘tighten the screws” on China’s tech giants through planned legislation. Last month, Kumba lowered its FY20 sales and production guidance, underscoring the impact of COVID-19 disruptions. The company said that it had cut its production target to 37mn tonnes from previous guidance of between 37mn and 39mn tones. CEO Themba Mkhwanazi said Kumba expected 39mn tonnes in sales, down from a previous sales guidance of between 38mn and 40mn tonnes.

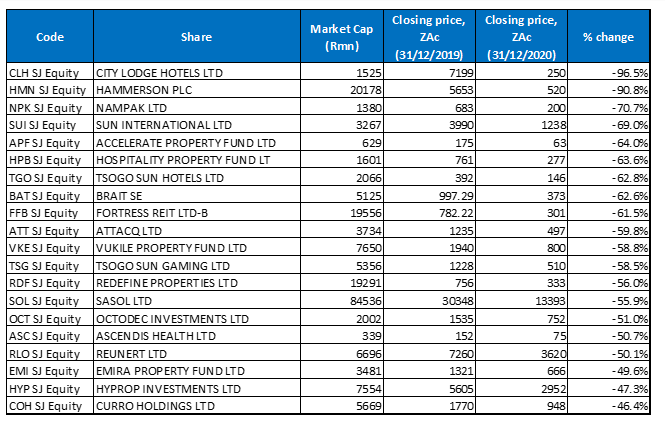

Figure 2: The 20 worst-performing shares of 2020

Source: Anchor, Bloomberg

Much like 2019, the majority of 2020’s worst-performing shares came from the property sector and included retail and industrial counters. The dire local economic outlook had already impacted property share prices hard when COVID-19 struck, but lockdowns forced retailers into a situation where they were unable to pay rentals or had to arrange for payment holidays, adding further pressure to an already-struggling sector which has since emerged as the asset class hardest hit by the pandemic. Probably a very close second, was the local hospitality industry, with hotels, casinos, and other places of entertainment forced to close their doors for most of the various government-imposed lockdowns, thus cutting the industry off from its customers.

In light of the above, it should come as little surprise that City Lodge was 2020’s worst-performing counter, with its share price plummeting by 96.5% for the year. This, as last year’s government-mandated hard lockdown, in the wake of the pandemic, brought the local hospitality industry to its knees, with COVID-19 prevention regulations temporarily closing almost all of the Group’s c. 62 hotels. This saw City Lodge record a R486.6mn loss in the year to end June and the company tapping shareholders for a R1.2bn cash injection to cover working capital requirements in August. However, City Lodge did say in September that it expected to break even on earnings before interest, tax, depreciation and amortisation (EBITDA) in the last quarter of its FY21 (the year-ended 30 June 2021). More recently, Business Day reported that the company said occupancies at its SA operations, based on all the hotel room inventory, have steadily improved each month, from 4% in the last quarter of its FY20, to 7% at end-July 2020 and 28% at end-November. The Group also expects headline EPS and EPS for the six months to 31 December to be more than 20% lower YoY.

Last year’s second-worst performing share was Hammerson Plc (-90.8% YoY). In September, the London and JSE-listed property development and investment company, wrapped up a highly dilutive rights issue and capital reorganisation aimed at shoring up its balance sheet. Hammerson said shareholders representing 94.9% of its share capital took up their rights in the rights issue. The COVID-19 outbreak in March and consequent trading restrictions on shopping centres has seen accelerated losses for retail property owners around the world, and Hammerson has been one of many UK-focused shopping centre owners hit hard by the pandemic and negative investor sentiment.

Packaging Group, Nampak (-70.7% YoY) was 2020’s third-worst performing share. This was despite the share price posting impressive gains of 81.2% and 29.9% MoM in November and December, respectively, and bouncing back from its low of around ZAc60/share (it ended December at ZAc200/share). Last month, the company reported a FY20 loss of R4.3bn, with its CEO, Erik Smuts ascribing the loss to impairments related to goodwill at Nampak’s Bevcan Nigeria operations and assets at Bevcan Angola, Plastics SA, and DivFood. Nampak also posted a basic loss per share of ZAc595 from continuing operations and ZAc538 from total operations vs basic EPS and a loss per share of ZAc42.2 and ZAc132.1, respectively, in FY19. The company has been hard hit by reduced economic activity in its key markets due to the pandemic, and especially the ban on the production and sale of alcohol locally which resulted in Nampak not selling beverage cans and ends to brewers as well as drums for bulk alcohol exports. In addition, a significant debt burden (some of which is dollar-denominated), restructuring costs, and currency devaluations in its Angolan and Nigerian operations have weighed heavily on the Group.

Nampak was followed by Sun International (-69.0% YoY), another casualty in the hospitality industry heavily impacted by COVID-19 lockdown restrictions. However, Sun International said in November that it was “on the mend” after its operations were severely curtailed by the government-imposed trading restrictions following the COVID-19 outbreak, with its SA operations at the centre of its recovery. The company said that in October it had achieved 73% of October 2019’s total income compared with July, when the Group only achieved 33% of total income compared to July 2019. Nevertheless, Sun International did say that the effect of the pandemic continued to impact trading due to reduced capacity and despite its local operations showing some recovery.

In a trading statement released in September, Accelerate Property Fund (-64.0% YoY), which owns a diversified portfolio of assets in Austria and Slovakia as well as SA’s largest shopping centre, Fourways Mall, said that it will retain cash and not pay distributions for the 30 September 2020 and 31 March 2021 reporting periods. Accelerate also highlighted that distributable income for the period ending 30 September 2020 and 31 March 2021 was expected to be more than 15% lower vs the corresponding preceding periods, due to the COVID-19 assistance it has granted to tenants.

The start of the hard lockdown in March 2020 resulted in the total closure of Tsogo Sun Hotels’ (-62.8% YoY) portfolio and in November the company, SA’s biggest hotel operator, warned of further job losses as the pandemic continued to impact corporate travel and international tourism, with a recovery in the Western Cape expected to be particularly slow. At the release of its interim results, the hotel operator, which is buying out Hospitality Property Fund (-63.6% YoY), said that its results clearly reflect the devastating impact the pandemic and the accompanying lockdown regulations have had on the hospitality industry in general and on it in particular. In its results for the six months to end September, income fell 84% YoY to R335mn, and EBITDA and rental costs swung to a R206mn loss from a positive R559mn in 1H19. It also reported a basic loss per share of ZAc16.2, down from earnings of zAc9.8 previously, while its adjusted headline loss came in at zAc39.1/share vs earnings of ZAc13.3 last year. The Group said that uncertainty and the weak economy will continue to weigh on the sector.

Rounding out last year’s ten worst-performing shares were Brait SE (-62.6% YoY), Fortress REIT -B- (-61.5% YoY), and Attacq (-59.8% YoY).

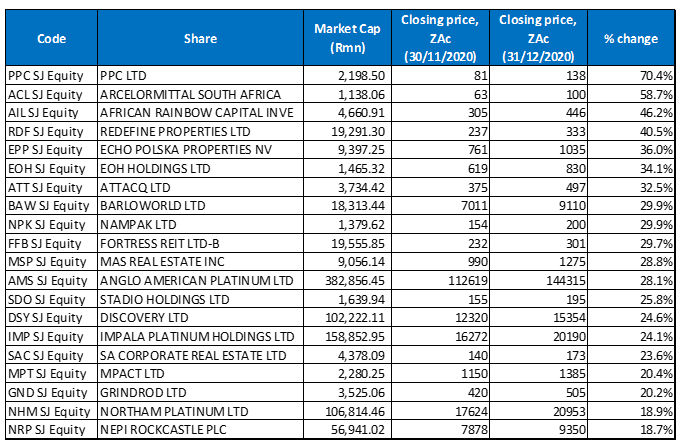

Figure 3: The 20 best-performing shares in December 2020, MoM

Source: Anchor, Bloomberg

December’s best-performing shares were a mix of property, resources, and industrial companies, with several counters in last month’s top-10 recording share price turnarounds after months of declines. Ironically, several of 2020’s worst-performing shares were also counted among December’s best performers including shares such as Redefine Properties (+40.5% MoM), Attacq (+32.5% MoM), Nampak (+29.9% MoM), and Fortress REIT -B- (+29.7% MoM)

Perennial underperformer, PPC (+70.4% MoM) continued its share price turnaround which had started in November, emerging as last month’s best-performing share. The cement producer’s share price jumped c. 16% alone on 8 December – the day it announced its latest results. The firm, which has been weighed down by an unsustainable R5.2bn debt load, said that it had managed to grow its half-year operating profit as its SA sales rebounded strongly from COVID-19 lockdown restrictions. After taking a significant hit from the pandemic in April and May 2020, the Group has consistently reported double-digit sales growth since June, with a decline in imports due to global trade disruptions adding additional support. Business Day reports that strong retail sales and signs of increased demand from infrastructure projects have also given PPC some optimism, although the firm said that it remained cautious as the full economic and health effects of the pandemic are still unfolding.

PPC was followed by ArcelorMittal and African Rainbow Capital Investments in second and third spot, with MoM gains of 58.7% and 46.2%, respectively. ArcelorMittal had a difficult year, as lockdowns eroded steel demand and by June 2020 it announced wide-ranging restructuring initiatives and job losses, even closing its Saldanha steel plant. By October, however, the share price had started to rise as the firm said it would restart a second blast furnace in Vanderbijlpark this month as local steel demand recovered at an unexpected pace on the back of construction projects and improved sales at its retailers.

Property companies Redefine and Echo Polska Properties recorded MoM gains of 40.5% and 36.0% and they were followed by EOH Holdings, which saw a 34.1% MoM rise in its share price.

Attacq, Barloworld, Nampak (which also featured prominently among the year’s worst-performing shares), and Fortress REIT -B- rounded out December’s ten best performers with MoM gains of 32.5%, 29.9%, 29.9% and 29.7%, respectively.

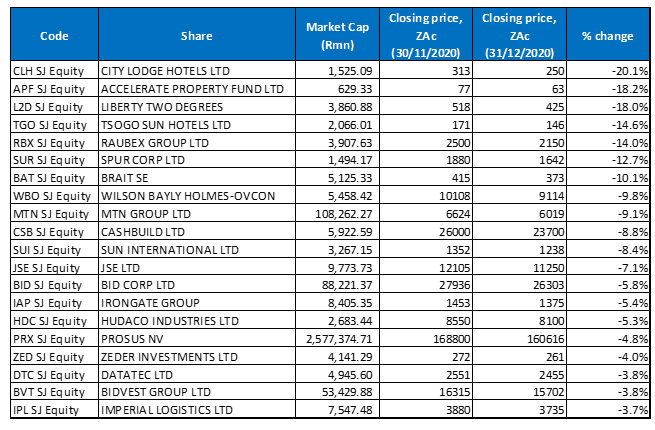

Figure 4: The 20 worst-performing shares in December 2020, MoM

Source: Anchor, Bloomberg

Several counters featured among 2020’s worst-performing shares also popped up among December’s worst performers including City Lodge (-20.1% MoM), Accelerate (-18.2% MoM), Tsogo Sun Hotels (-14.6% MoM), Brait SE (-10.0% MoM), and Sun International (-8.4% MoM).

As was the case among last year’s worst-performing shares, City Lodge was also December’s worst performer, followed by Accelerate in second position and Liberty Two Degrees in third spot, with a decline of 18.0% MoM.

Tsogo Sun Hotels (-14.6% MoM and discussed earlier), Raubex (-14.0% MoM), Spur Corp (-12.7%) and Brait SE (-10.1% MoM) followed, with Wilson Bayly Holmes-Ovcon (WBHO; -9.8% MoM), MTN (-9.1% MoM), and Cashbuild (-8.8% MoM) accounting for the remainder of December’s worst-performing shares. In late November, construction firm, WBHO reported a R508mn loss for the year to end-June vs a profit of c. R549mn in 2019, while its headline EPS fell 200% YoY to a loss of ZAc937/share. WBHO blamed this on the impact of the pandemic, which added to already substantial losses in its Australian business. Meanwhile, MTN’s share price fell after Nigeria’s telecoms regulator ordered network operators to suspend the sale and activation of new SIM cards in the company’s biggest market. In addition, Business Day reports that Nigeria’s Communications Commission has embarked on an audit of the country’s subscriber registration database.