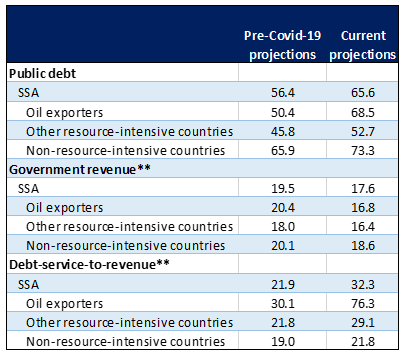

Amid a range of socio-economic and fiscal consequences, the COVID-19 pandemic is driving a resumption of rapid debt increases in sub-Saharan African (SSA)* countries. After the completion of the IMF’s Heavily Indebted Poor Countries (HIPC) and Multilateral Debt Relief (MDRI) initiatives (amongst other agency support initiatives), public debt declined significantly in SSA countries until the end of the 2000s. Subsequently, as SSA countries took advantage of the greater fiscal space generated by these initiatives (including to build human and physical capital), public debt rose from an average of around 35% of GDP in the early 2010s to about 55% of GDP in the mid-2010s. Thereafter, it largely stabilised and was expected to start declining in 2020 as several countries across the continent began to embark on fiscal consolidation. However, when the COVID-19 pandemic hit, these countries were forced to relax their fiscal stance in order to appropriately respond to the health crises at hand. As a result, the IMF projects that SSA’s public debt will increase to 65% of GDP by the end of 2020, with the largest increases naturally forecast for oil-exporting countries.

As a further cause for concern, SSA countries’ capacity to support their debt burdens is becomingly increasingly strained. Because of weaker economic activity and government support measures to the private sector in the context of COVID-19, the IMF further forecasts that 2020 SSA countries’ government revenue will fall below pre-COVID-19 projections or by around 2.3 ppts of GDP. The combined effects of this revenue shortfall, and the higher debt-service costs, have consequently driven up forecasts for the debt-service-to-revenue ratio from about 22% under pre-COVID-19 projections to c. 27% under current IMF projections. This increase is particularly significant for oil exporters. Based on the latest, low-income country debt sustainability analysis prepared by IMF and World Bank staff, 11 SSA countries are currently at a high risk of debt distress, and six SSA countries are already in debt distress, while vulnerabilities have increased for those countries with market access as investors’ appetite and issuances have not yet recovered for SSA countries.

Figure 1: IMF forecasts (as at October 2020), as % of GDP

Source: IMF, Anchor. **Excluding grants

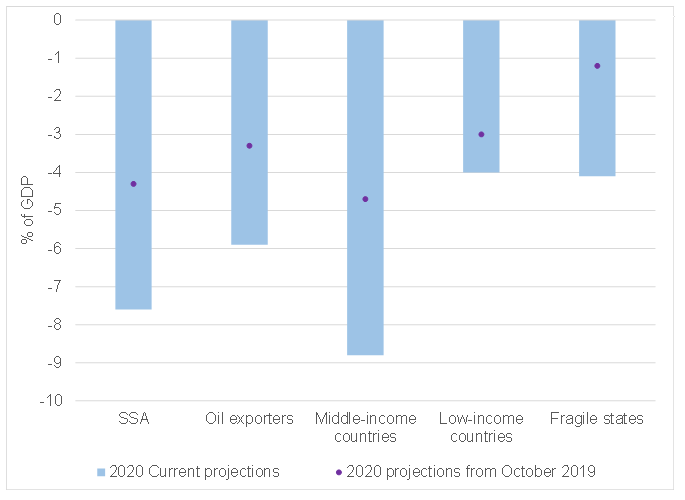

Figure 2: SSA countries’ fiscal balance, 2020 IMF projections

Source: IMF, Anchor

Overall, SSA will face a substantial funding shortfall over the medium term in the wake of the COVID-19 pandemic. Without the type of assistance that has been provided to SSA thus far by the international community (such as that received from the IMF), many of these countries will be forced to undertake far deeper adjustments, which will jeopardise growth and adversely impact social stability. Using bottom-up estimates from IMF country teams, SSA’s potential external financing needs are estimated to be about $890bn (c. 55% of 2020 regional GDP) for the period 2020–2023. Just over half (about $480bn) of this amount reflects external debt amortisation obligations, while another one-third (about $280bn) constitutes the region’s current account deficits. The remainder captures the impact on spending of COVID-19- related trade-offs with which many countries have had to contend.

All in all, assessing a country’s debt sustainability can be difficult, especially in the current environment where future growth is more uncertain than usual. Most countries’ debt-carrying capacity has clearly been diminished — because of the weaker outlook for growth, lower reserve coverage, slowing remittance inflows, and a worsening global environment. Moreover, exchange rate volatility could negatively affect debt-servicing costs, given the often-large fraction of public debt denominated in foreign currency. As a result, several SSA countries may have been pushed beyond the sustainability threshold. If a country’s debt-servicing requirements exceed its capacity to pay, it is in the best interests of both creditors and SSA borrowers to agree on terms of relief from creditors, where needed (as seen with Angola and now Zambia). Much like the rest of the world, the true impact of the COVID-19 pandemic on SSA’s public debt/fiscal outlook will only be made clear in time.

** The SSA countries include Angola, Benin, Botswana, Burkina Faso, Burundi, Cameroon, Central African Republic, Chad, Congo, Cote d’Ivoire, Eritrea, Ethiopia, Gabon, Gambia, Ghana, Guinea, Guinea-Bissau, Kenya, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mauritius, Mozambique, Namibia, Niger, Nigeria, Rwanda, Senegal, Sierra Leone, Somalia, South Africa, United Republic of Tanzania, Togo, Uganda, Zaire, Zambia, Zimbabwe.