April was a bumper month for most major world markets and the US especially, despite a sell-off on the last day of the month. Markets were buoyed by strong US economic data and robust 1Q21 company earnings. While there was not much new coming out of the US Federal Reserve’s (Fed’s) April meeting (the Fed reiterated its guidance from the March meeting), it did commit to supporting the economy and maintaining interest rates at near zero this year, boosting investors’ appetite for stocks. The major US indices closed April in the green, with the S&P 500 notching up its third straight month of gains (up 5.2% MoM and 11.3% YTD), after closing at a new record level on Thursday (29 April) following impressive earnings from Apple and Facebook. The Dow Jones gained 2.7% (+10.7% YTD), while the tech-heavy Nasdaq rose 5.4% MoM (+8.3% YTD) – its sixth consecutive positive month. Thus far (to 30 April), CNBC reports that 87% of S&P 500 companies have posted earnings which beat estimates and, according to Refinitiv, these earnings appear to be growing by over 46% YoY.

Thursday marked US President Joe Biden’s 100th day in office and the previous evening he addressed a joint session of Congress for the first time, pushing an agenda which includes a US$2trn infrastructure plan and a newly unveiled $1.8trn plan for families, children, and students. On the US economic data front, 1Q21 GDP growth accelerated at an annualised rate of 6.4% as fiscal stimulus measures fuelled consumer spending. The Labor Department also reported that initial jobless claims during the week of 26 April totalled 553,000 – a fresh pandemic-era low but still higher than a 528,000 Dow Jones estimate. With the US government sending out $600 and $1,400 cheques in January and March, respectively, 1Q21 consumer spending, which accounts for two-thirds of US economic activity, surged with personal consumption expenditure (PCE) soaring 10.7% on an annualised basis. US business investment was also strong – growing by an annualised 9.9%.

In Europe, the region’s largest economy, Germany’s DAX rose 0.8% MoM (+10.3% YTD), while the eurozone’s second-biggest economy, France saw its CAC Index end April an impressive 3.3% higher (+12.9% YTD). In terms of economic data, the eurozone fell back into a recession (-0.6% QoQ) in 1Q21, due to a slow vaccination drive and tougher COVID-19 restrictions (intended to stem a third wave), which weighed on the region’s various economies. Among these, France recorded stronger-than-expected 1Q21 GDP growth of 0.4%, while Germany’s GDP fell more than expected (-1.7%) on a seasonally adjusted basis.

The UK FTSE 100 Index gained 3.8% MoM (+7.9% YTD), while on the economic data front, the UK economy advanced in February as GDP grew 0.4% (vs January’s 2.2% contraction), despite widespread pandemic-induced restrictions that weighed on economic activity. Nevertheless, this was still below expectations of a 0.6% growth print. The improved February growth number was due to a partial recovery in the trading relationship between the UK and the EU, following January’s 42% post-Brexit drop, when new regulations governing the relationship between the UK and EU came into effect.

Asia was a mixed bag, with Chinese markets under pressure as Hong Kong’s Hang Seng gained 1.2% MoM (+5.5% YTD), while the Shanghai Composite Index advanced by only 0.1% (-0.8% YTD). Hong Kong-listed Chinese tech shares came under pressure last week after Beijing ordered 13 internet platforms to strengthen their compliance with Chinese regulations. In terms of economic data, China’s 1Q21 GDP surged 18.3% YoY (albeit from a COVID-19 induced low base) but slowed to 0.6% QoQ – below Bloomberg consensus expectations and compared with 2.6% growth between 3Q20 and 4Q20. China’s official April manufacturing purchasing managers’ index (PMI) expanded at a softer-than-expected pace vs March, missing expectations, and falling to 51.1 as “supply bottlenecks and rising costs weighed on production and overseas demand lost momentum”, according to CNBC. Still, China’s April Caixin/Markit manufacturing PMI (which measures sentiment among smaller, mostly private firms) rose to 51.9 from March’s 50.6 reading, as new orders increased amid a upturn in export sales. The 50-point mark separates expansion from contraction. Japan’s Nikkei closed the month 1.3% down (+5.0% YTD), while the final au Jibun Bank’s Japan manufacturing PMI rose to 53.6 in April – the fastest pace since early 2018, highlighting the strong external demand tailwind that manufacturers have been getting.

On the commodity front, oil prices (+5.8% MoM/+29.8% YTD) climbed to six-week highs on Thursday (29 April) ahead of the US and UK summer holiday season, when people usually drive more and increased fuel is consumed. However, the oil price then took a breather, dropping from these elevated levels on Friday (30 April) as concerns over wider lockdowns in India and Brazil, to curb rampant COVID-19 infections, weighed on the oil price.

Although it came under pressure several times in April, for the first time this year, the gold price recorded a MoM increase (+3.6%) but the yellow metal is still down 6.8% YTD. This year’s rally in the price of iron ore (+8.0% MoM) has been compounded by tight supply from Brazil and Australia (especially over 1Q21 when Brazil’s largest mine, Vale, recorded a production drop of 20% QoQ). Iron ore hit a 10-year high in April on the back of rising steel demand, especially from China, and amid a global building boom funded by worldwide infrastructure spending. According to a report from IndexBox, 2021 worldwide steel consumption is forecast to increase by 4.1% YoY. Meanwhile, a supply deficit and strong demand in palladium (+12% MoM), which is used in catalytic converters to curb emissions of petrol-powered vehicles, sent the metal towards an all-time high in April, closing the month at US$2,937/oz – well on its way towards the US$3,000/oz level. Palladium has been in a production deficit for a few years as tighter pollution standards in China and Europe spur demand.

On the JSE, South Africa’s (SA’s) FTSE JSE All Share Index rose for a sixth-straight month, gaining 0.7% in April, with resources counters doing most of the heavy lifting (the Resi-10 rose by 2.9% MoM and 19.2% YTD). Still, YTD the local bourse has given investors a double-digit return with the All Share Index soaring 12.7%. April’s gains were, for the most part, limited to resources and financial (Fini-15 +0.6% MoM and 2.3% YTD) shares, while the Indi-25 declined by 1.5% MoM (+10.5% YTD). Prosus, the JSE’s largest share by market cap, lost 3.7% MoM, while Naspers (the fourth-largest share on the exchange) fell 6.3% MoM. These shares sold off after Prosus announced plans to sell 2% of its Tencent stake, which will reduce its share from 30.9% to 28.9%. This, together with a stronger rand and consistent negative newsflow around antitrust tech regulation in China may be causing investors to cut their risk exposure to the Naspers/Prosus complex, even though Tencent’s share price held up relatively well in April. Among the larger-cap resources shares, Sasol soared 15.3%, Kumba Iron Ore jumped 8.2%, Anglo American rose 6.5%, and Sibanye Stillwater gained 4.2% MoM. The Fini-15 was dragged into positive territory by counters such as Capitec (+4.7% MoM), and Nedbank (+5.6% MoM). The rand has been an outperformer vs other emerging market (EM) currencies, strengthening by c. 1.9% MoM and 1.4% YTD against the US dollar, while rand-denominated government bonds have also delivered impressive returns despite a rise in US Treasury yields which spooked other EMs.

In local economic data, March consumer price inflation (CPI) came in at 3.2% YoY (up from 2.9% YoY in February) and falling just below consensus expectations of a 3.3% print. It also remained well within the SA Reserve Bank’s (SARB’s) target range of 3%-6%. The main contributors to the 3.2% annual inflation rate were food and non-alcoholic beverages, housing and utilities, transport, and miscellaneous goods and services. This was all in conjunction with the local economy reopening again after stricter lockdown restrictions were eased on 1 February (among these the lifting of the alcohol ban, a shortening of curfew hours, and allowing public spaces such as parks and beaches to be reopened), with the effects of this typically taking a month or two to filter through. February retail sales came in better than expected, rising 2.3% YoY vs January’s 3.5% YoY decline. MoM, retail sales rose 6.9% benefitting from a delayed start of the school year, due to the pandemic, which resulted in January spending on stationery and school uniforms being pushed out to February. Other drivers of the better-than-expected print included purchases of furniture, appliances, equipment, and leather goods. Elsewhere, March’s trade surplus widened to R52.77bn vs February’s revised R31.22bn surplus. Exports rose 28.9% MoM to R168.29bn, while imports advanced by 16.3% MoM to R115.52bn.

On the COVID-19 front, a outbreak in India has devastated that country, with c. 7mn cases reported in April alone, according to Johns Hopkins University. This accounts for a significant share of the 19mn-plus cases India recorded during the entire pandemic. Much like President Jair Bolsonaro’s government in Brazil (where there have been 400,000 deaths), Indian Prime Minister Narendra Modi’s government is facing increasing criticism for the disaster, as the latest outbreak seems to have been fuelled by the government allowing large crowds to gather for election rallies and religious festivals across the country. Meanwhile, in SA the latest data from the Department of Health show that as at 30 April 2021, the total number of confirmed COVID-19 cases stood at 1.58mn vs end-March’s 1.55mn.

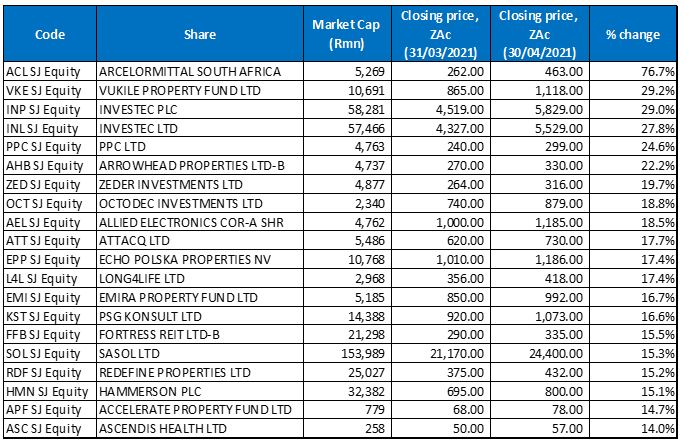

Figure 1: April 2021’s 20 best-performing shares, MoM

Source: Anchor, Bloomberg

ArcelorMittal South Africa (Amsa), an underperformer of late, saw its fortunes turn around and emerged as April’s best-performing share, with the counter rocketing 76.7% MoM, buoyed by optimism in its key steel markets and following the release of its latest annual report in late-April, which included an overview of the progress it had made with its new business model. This seemed to impress investors, with Amsa CEO Kobus Verster saying in the annual report that OneOrganisation, the company’s new business model aimed at simplifying the business had been key in rightsizing Amsa to “better optimise its assets, combat the negative, and decisively leverage the positive.” Verster also committed to addressing SA’s steel shortages – Amsa has been under fire for the critical steel shortages in the country. He said that Amsa had experienced considerable delays with starting its N5 blast furnace in Newcastle, which were frustrating, particularly because of the company’s “intense focus on addressing customers’ steel shortages that had been building up since before COVID-19.” “In the new year we have budgeted and planned to fix the problems caused by the unusual post-pandemic start-up of N5 and to improve its reliability”, he added.

Listed property, which has been especially hard hit by the pandemic, fared far better in April, and there were strong performances across the board from the sector, with Amsa followed by Vukile Property Fund (+29.2% MoM) in second spot, albeit from a low base. There seems to have been a significant overreaction on Vukile at the onset of the pandemic last year, with many investors perhaps grouping it as one of the counters with potential balance sheet issues and there was also skepticism around the MEREV put option etc. So, this performance is likely a recovery from that, although it could also have something to do with the Fairvest/Arrowhead potential corporate action which would allow Vukile to exit its position in Arrowhead (Vukile has been trying to do this for some time). Vukile was followed by Investec Plc (+29.0% MoM) in third position, and Investec Ltd (+27.8% MoM) coming in fourth.

PPC, March’s best-performing share (it was up 50.9% MoM), recorded another 24.6% MoM gain in April. However, news of a JSE investigation into possible insider trading after PPC’s shares surged in the week leading up to a 31 March announcement that it had reached a crucial debt restructuring deal with lenders to its beleaguered Democratic Republic of Congo (DRC) unit, weighed on the price. The agreement also eliminated the right of lenders to the DRC unit, PPC Barnet, to seek recourse from the Group’s balance sheet in the event of non-payment.

PPC was followed by Arrowhead Properties -B-, which recorded a MoM gain of 22.2%. Last month, real estate investment trust (REIT) Arrowhead said that it would consider Fairvest Property Fund’s advances if the transaction benefits shareholders. This followed Fairvest’s announcement on 29 April that it wants to buy a stake in Arrowhead. Fairvest is a specialist landlord that owns retail centres in rural areas, townships, and small towns. Business Day reports that the company indicated that some Arrowhead shareholders approached it and said corporate action between the two companies would be to their benefit.

Meanwhile, the market welcomed Zeder Investments (+19.7% MoM), which is part of the PSG Group, rewarding shareholders with yet another special dividend on 14 April, triggering the company’s biggest share price jump in eight months. Business Day writes that Zeder, which invests primarily in agribusinesses, said that it was “evaluating offers from several parties vying for some of the companies in its portfolio” as part of what it calls a strategy shift, which it initiated four months ago. In March 2020, the company successfully sold its stake in consumer good business, Pioneer Foods for R6.41bn and in June 2020 it disposed of its stake in Quantum Foods for R308mn, enabling Zeder to settle its debt obligations and return cash to shareholders.

Rounding out the top-10 performers for April were Octodec Investments, Allied Electronics (Altron), and Attacq with MoM share price gains of 18.8%, 18.5%, and 17.7%. Octodec reported results during the month, and while these results were not particularly good, the reaction could be a recovery story as its discount to NAV is amongst the highest at c. 63%. In a trading statement released last week, Altron said it expected basic EPS to jump by over 100% YoY in FY21, owing to the Bytes Technology Group demerger in December 2020, and to come in between ZAc3,256 and ZAc3,270 vs restated basic EPS of ZAc175 reported in FY20.

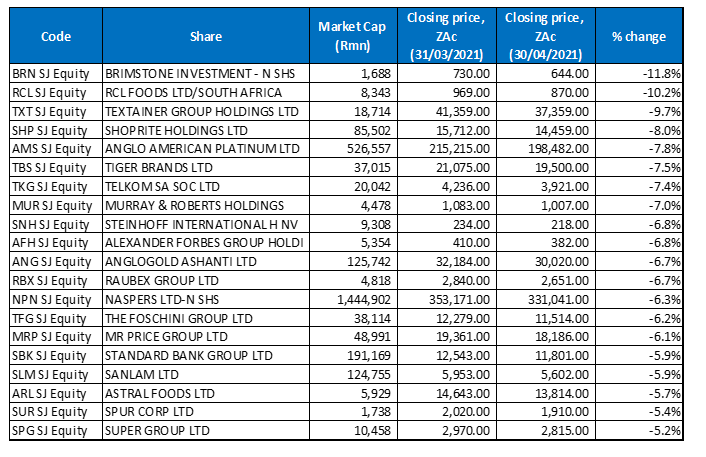

Figure 2: April 2021’s 20 worst-performing shares, MoM

Source: Anchor, Bloomberg

Brimstone, food producer Sea Harvest’s biggest shareholder, was last month’s worst-performing share falling by 11.8% MoM and giving back nearly half of the prior month’s gain (it was up 24.6% MoM in March). According to the company, the pandemic has forced it to become “leaner and meaner” and Brimstone said it is waiting until “more market certainty” before making any new investments as COVID has made it “harder to accurately value potential acquisitions.” Brimstone was followed in second spot by RCL Foods, which was down 9.7% MoM, with Textainer Group (-9.7% MoM), which focuses on purchasing, leasing, and resale of marine cargo containers, coming in third.

Shoprite (-8.0% MoM), Anglo American Platinum (Amplats; -7.8% MoM), and Tiger Brands (-7.5% MoM) all recorded single-digit MoM declines. In April, Amplats posted a 7% YoY increase in total platinum group metals (PGM) output to 1.02mn ounces, as platinum production rose by 6% YoY to 468,100 ounces, and palladium production increased 9% YoY to 330,500 ounces.

Rounding out April’s 10 worst-performing shares were Telkom (-7.4% MoM), Construction and engineering Group, Murray & Roberts (M&R; -7.0% MoM), Steinhoff International, and Alexander Forbes Group (both down 6.8% MoM).

M&R, which had soared 40.6% MoM in March, said in April that its subsidiary, RUC Cementation Mining Contractors, had secured a R2.3bn shaft lining and equipment contract at the world’s largest gold producer, Newmont Corporation, in Australia. RUC is a diversified underground mining contractor operating throughout Australia and Asia Pacific. M&R CEO Henry Laas told Business Day that the contract would boost the Group’s mining businesses in Australia. However, Laas said the local business, which builds wastewater treatment facilities has struggled in recent years, noting that “The tenders just aren’t there. We hope that projects for independent power producers will come online soon. But right now, tendering in SA is inefficient and frustrating,”.

Embattled Steinhoff International said in April that it is going ahead with the listing of Pepco Group on the Warsaw Stock Exchange after receiving approval from creditors. According to Steinhoff, the Pepco IPO will allow it to repay expensive debt as the 2017 accounting irregularities scandal continues to weigh on the Group.

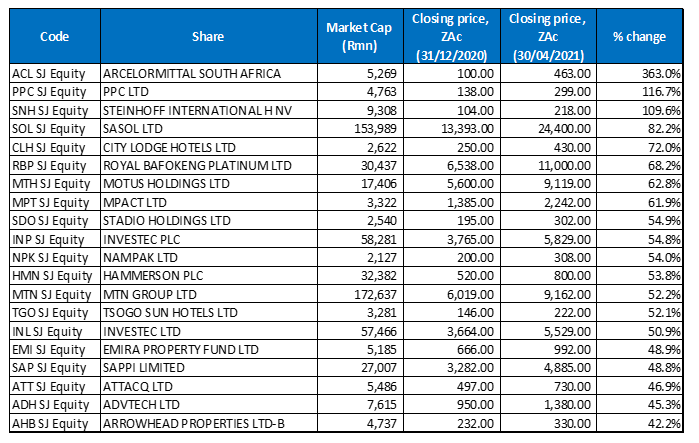

Figure 3: Top-20 April 2021, YTD

Source: Anchor, Bloomberg

Eight of April’s top-10 YTD best-performing shares were unchanged from March, with the new entrants being Mpact (+61.9%) and Investec Plc. ArcelorMittal SA (+363.0% YTD, discussed earlier) again took the top spot, with PPC (+116.7% YTD) remaining in second position after gaining another 24.6% MoM in April. The third place once again went to Steinhoff International (+109.6% YTD), despite its 6.8% share price wobble in April.

Sasol’s 15.3% MoM gain last month, saw it move up to fourth position in the rankings and YTD, Sasol’s share price has now risen by 82.2%. Last week, Sasol said it expects at least a 20% YoY rise in FY21 headline EPS as the oil price recovers. This is in stark contrast to last year, when the company had recorded a headline loss per share of R11.79 for the year ended June 2020.

Meanwhile, City Lodge’s 12.3% MoM gain in April, helped it move up from eighth position in the year to end March to the fifth best-performer YTD, while Royal Bafokeng Platinum (+68.2% YTD) moved down to sixth spot (from fourth) despite its share price being unchanged MoM.

Motus Holdings (+62.8% YTD) recorded a 5.9% MoM gain in April. The company also confirmed last month that it had acquired Renault France’s 40% shareholding in Renault SA for R250mn. Motus already owns the remaining 60% in Renault SA. Motus Retail and Rental CEO Corné Venter said that while consumers “have an appetite for new vehicles, especially in the entry-level, crossover, and SUV segments, and although we are seeing growth, we have not been able to convert all the interest into sales, due to global new-vehicle stock shortages,”.

Mpact (+61.9% YTD), and private higher-education investment company, Stadio (+54.9% YTD) rounded out the top-10 YTD performers. In March, Stadio posted double-digit growth in FY20 earnings, boosted by a 10% YoY rise in student numbers to 35,031, despite the pandemic. Its revenue surged 14% YoY to R933mn, while core headline EPS increased by 31% YoY to ZAc14.2.

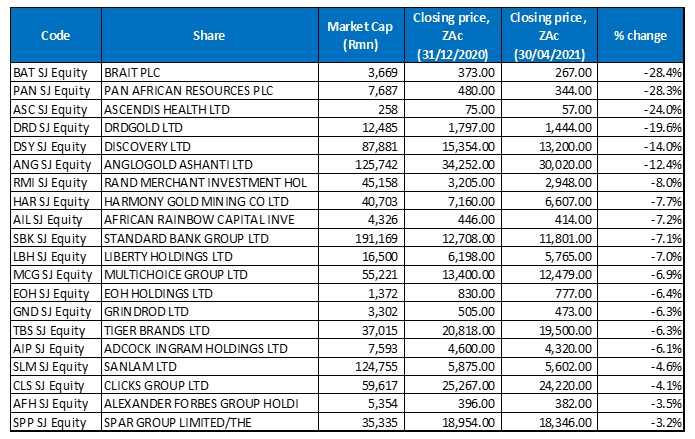

Figure 4: Bottom-20 April 2021, YTD

Source: Anchor, Bloomberg

Looking at the YTD worst performers, eight of the shares among the ten-worst performing counters for the year to end March were once again among the 10 worst performers for the year to end April. Investment Group Brait (-28.4%) moved back to being the worst-performing share YTD, after strengthening to third spot for the year to end March. It was followed in second place by Pan African Resources (-28.3% YTD), despite the latter recording a 9.8% MoM gain in April. Meanwhile, March’s second worst-performing share, Ascendis Health, came in third with a YTD decline of 24.0%. Ascendis, which renewed its 10 March 2021 cautionary announcement in April, advising shareholders that negotiations in respect of the Group’s recapitalisation are ongoing, last month recorded a 14% MoM share price gain.

Ascendis was followed by DRDGold (-19.6% YTD), Discovery (-14.0% YTD), AngloGold Ashanti (-12.4% YTD), Harmony (-7.7% YTD), and African Rainbow Capital Investments (ARC; -7.2%YTD). April’s stronger gold price (+3.6% MoM), saw some gold producers such as DRD Gold (+6.7% MoM), and Harmony (+5.5% MoM) posting MoM share price gains but these were not enough to move the counters out of the YTD worst-performers list. In March, ARC (+4.3% MoM) said that the pandemic and resultant lockdowns had a mixed impact on its portfolio of 50 businesses, with some impacted favourably, while others were adversely impacted. Rounding out the ten YTD worst-performing shares were Standard Bank Group (-7.1% YTD), and Liberty Holdings (-7.0% YTD).