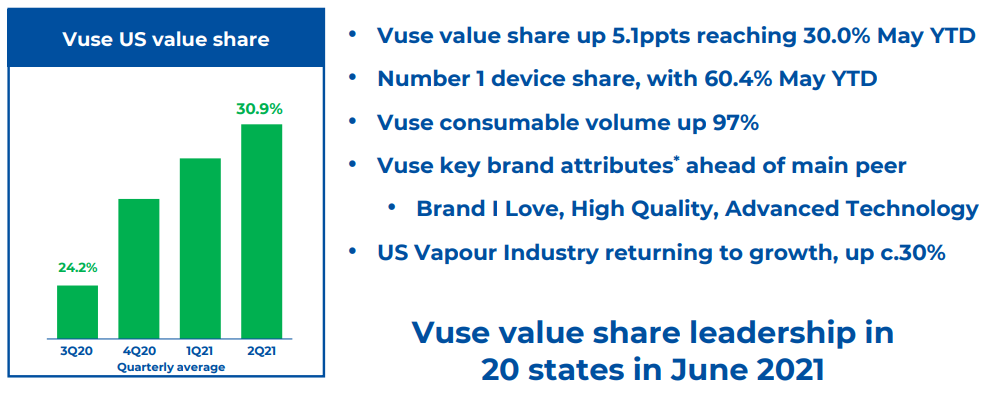

British American Tobacco (BAT) reported 1H21 results (to 30 June 2021) on 28 July. Revenue growth was slightly ahead of expectations with particularly strong growth (50% YoY in constant foreign exchange [FX] terms) from its Next Generation Products (NGPs), which now account for c. 12% of total sales. Growth in the US, where its vaping product (Vuse) is the key driver of NGP growth, was particularly strong.

Figure 1: Vuse – approaching a leadership position in the US

Source: BAT presentation

Value share of total vapour – monthly average of quarter share to May 2021, 2Q21 share reflects average of April and May 21. * Source: Image Attributes BIT Tracker among AV 21+ Aware of Brand

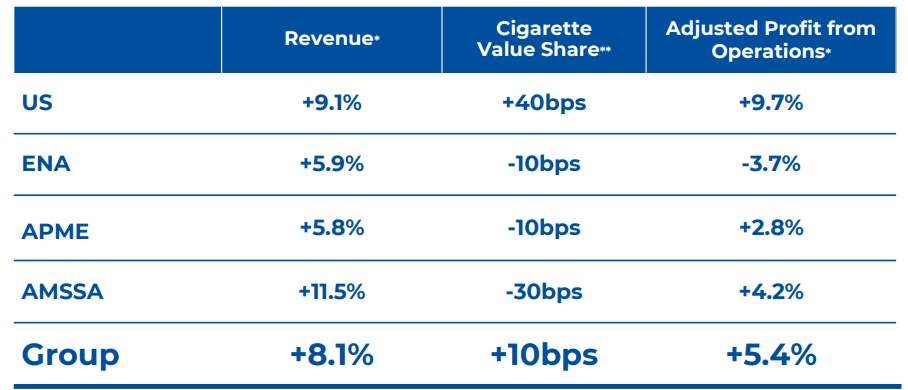

The US accounts for c. 50% of EBIT and seems to be the region with the strongest growth momentum (see Figure 2).

Figure 2: Over 5% revenue growth in every region

Source: BAT presentation

* On a constant rates basis. ** Value share of cigarettes vs FY20

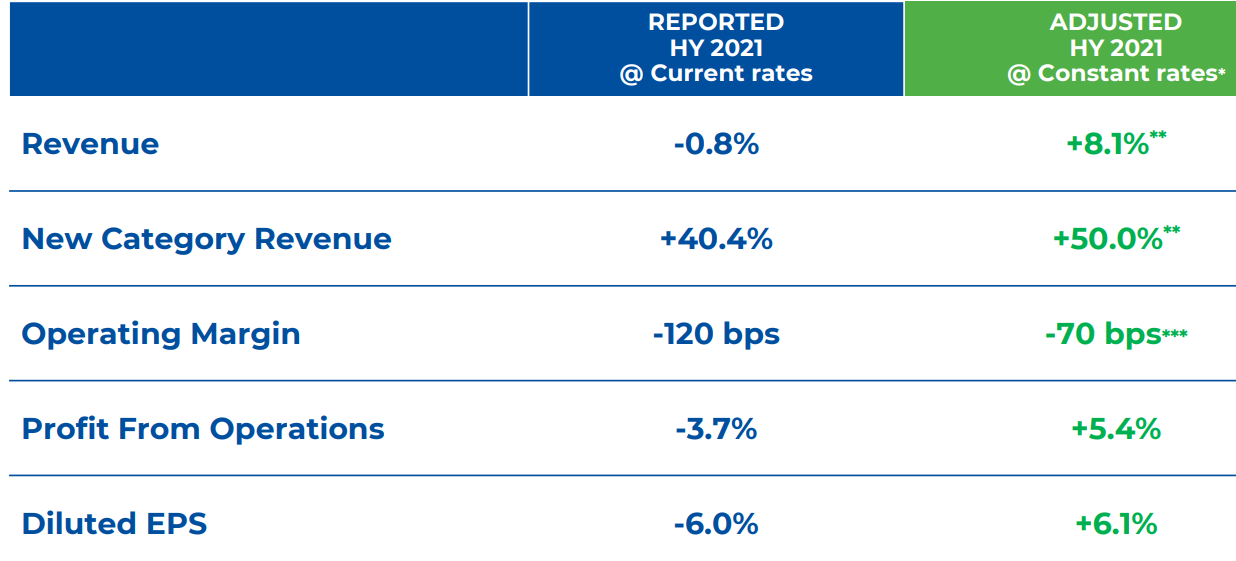

The company’s reporting currency (British pound [GBP]) was particularly strong YoY, which makes the reported numbers look slightly weaker, but in constant currency terms this was a solid set of results.

Figure 3: 1H21 currency translations mark strong growth

Source: BAT presentation

* On an adjusted, constant rate basis. ** On a reported, constant rate basis. *** Current rate growth.

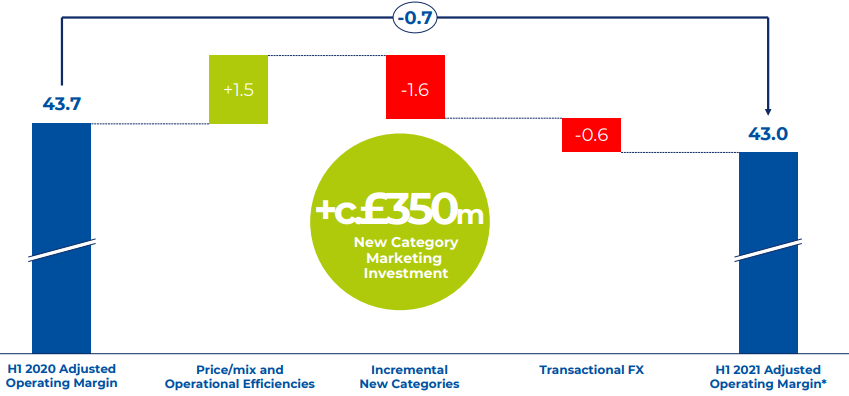

Perhaps the most disappointing part of these results was the announcement regarding an acceleration of investment into NGP, which is weighing on margins.

Figure 4: Group operating margin – incremental NGP investment holding margins back

Source: BAT presentation

* On an adjusted current rate basis.

Although BAT believes that it remains on track to reduce losses in NGPs.

Figure 5: 2021 – a pivotal year

Source: BAT presentation

* Revenue growth at constant rates, volume share growth in THP and Modern Oral and Value Share in Vapour. Share growth YTD May 21 versus FY20. ** Non-Combustible consumer definition. *** Adjusted net debt to adjusted EBITDA at current rates.

BAT’s target net debt/EBITA range is 2x–3x and it will get to the top-end of that range from the end of this year, which gives the company a lot more capital allocation freedom going forward.

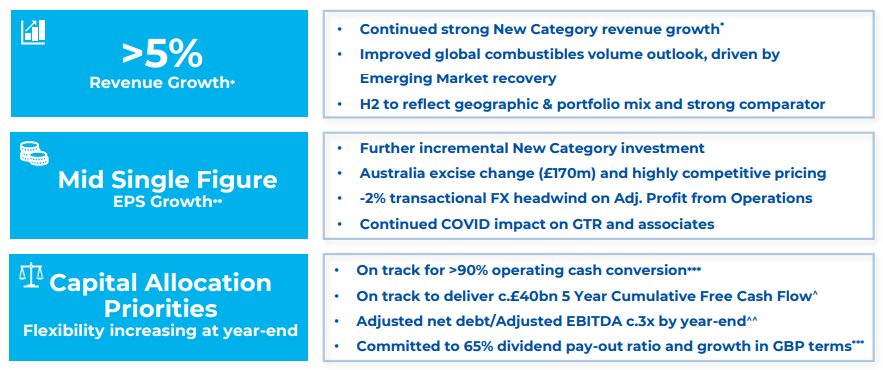

Figure 6: FY21 guidance – strong operational momentum and cash flow generation

Source: BAT presentation

* On a constant rate basis. ** Adjusted Diluted EPS on a constant rate basis. *** Targeted annually. ^ Pre dividend payments. ^^ Adjusted net debt to adjusted EBITDA at current rates.

Based on comments made during the conference call, it seems that management’s priority for capital allocation over the next couple of years is very much focussed on investment into the NGP business. Share buybacks will happen to the extent that cash is not needed for NGP product investment.

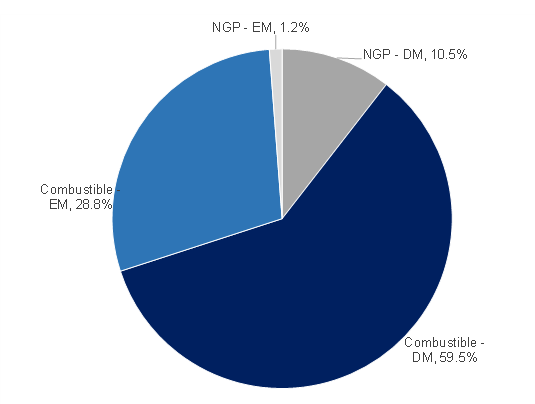

Like most producers, BAT is focussed on a digital strategy to achieve direct relationships with consumers in order to increase its margin (by cutting out the retailers) and gather data on customer behaviour (including getting real-time insight into the impact of pricing changes and product launches). The Group is making good progress here, particularly in its NGP products. NGP is still very much a developed market (DM) initiative, with 15% of revenue coming from DMs and only 4% coming from emerging markets (EMs).

Figure 7: 1H21 NGP revenue is still predominantly derived in DMs

Source: Anchor, BAT

BAT operates in an environment that leaves it very susceptible to regulatory risk. For example, the Group margin was impacted c. 0.7% by an increase in Australian excise duties, which it was not able to pass on to its customers in the competitive pricing environment and, while NGPs currently attract lower excise duties than combustibles, this will change, with Japan already seeing increases in excise duties for heated tobacco products. BAT also continues to face a very real regulatory threat to its US menthol combustibles business (c. 25%–30% of total earnings).

As the company heads towards profitability in NGPs, its operating profit margin should improve (from the current level of c. 41% towards 45%), which will provide a c. 10% tailwind to earnings growth. Its stated goal is to reach profitability in NGPs by 2025, but we get the distinct impression from management that much of the reduction in losses will happen closer to 2025, with the immediate priority being to maintain strong top-line growth in NGPs via investment in customer acquisition and brand building.

BAT continues to be a hugely cash generative business because of its combustibles segment and is maintaining its 65% earnings payout ratio, which leaves the stock on a dividend yield of c. 8% p.a., with the majority of those earnings in hard currency (c. 70% of revenue and even more of earnings come from DMs). The dividend should grow in-line with earnings (by c. 3%-6% p.a.) leaving investors with a likely total return from holding the share in the low teens. For investors in the JSE-listed, rand-denominate share, a gradual depreciation in the local currency relative to DM currencies (which constitute the bulk of the company’s earnings) could add 2%-3% p.a. to share price performance.

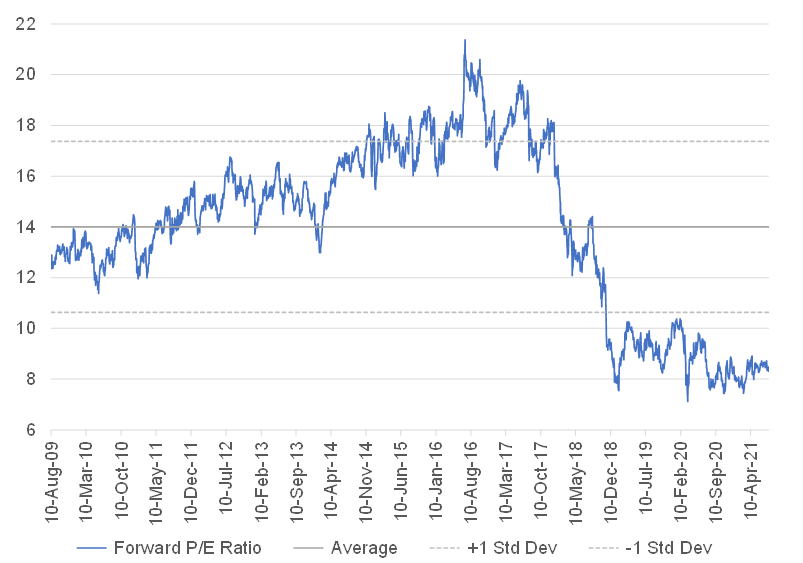

The share currently trades on a very depressed earnings multiple.

Figure 8: BAT forward P/E

Source: Anchor, Bloomberg

We think it is unlikely that the share will experience a meaningful re-rating until the company implements a material share buyback programme and, for the next couple of years, the capital allocation priorities remain investment into NGPs. As meaningful margin expansion and major share buybacks kick in (probably not before 2023), this should deliver c. 5% p.a. in additional share price performance.

As always, the risk of regulatory intervention leaves the company open to major earnings shocks (probably largely reflected in the current rating). The share price has not really reacted to the earnings release, suggesting to us that what was said was very much in-line with expectations.