British American Tobacco (BAT) has its primary listing in London and a secondary listing on the JSE. It has grown to be an important component of SA investors’ portfolios and has a weighting of between 2% and 3% in the major SA equity indices (depending on the index). Because of its defensive nature, a high dividend yield and optically reasonable valuation metrics, it generally commands an overweight position in many SA fund managers’ portfolios.

It is, however, a manufacturer and distributor of cigarettes and related products, a much-maligned and unloved industry, which is seemingly under permanent regulatory scrutiny and pressure. This report is therefore designed to keep investors up to date with the changing dynamics in the industry and the company, to explain the drivers in simple terms (there is currently a lot of product development and even more acronym-driven jargon around smoking), and to arrive at an investment conclusion.

Recent history

In terms of its recent history (<5 years) BAT has been shaped by two major events. One, very much within its control, was the acquisition of the remaining stake in Reynolds American Inc. (RJR Tobacco) it did not already own in July 2017. The second, and outside the sphere of its direct influence, were regulatory events which took place in North America, where it has been sued by nine Canadian provinces, and in the US where the regulator has flagged intentions to implement legislation aimed at lowering nicotine levels, as well as a ban on menthol in the manufacture of cigarettes.

The acquisition of Reynolds and BAT’s debt burden

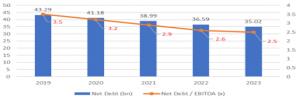

In 2017, BAT acquired the 58% of Reynolds American Inc. that it did not already own. The deal cost $50bn, was financed by equity and debt in a roughly 50/50 ratio and made BAT the largest standalone tobacco company in the world. At the time there was much investment logic, not least of which was the enhancement in margins and earnings – the US market generated 46% operating margins whereas BAT’s portfolio at the time generated 36%. However, absolute and net levels of debt increased dramatically (net debt rocketed from approximately GBP16bn to GBP45bn). Net debt/ EBITDA went from 1.5x to 4.3x. The company has committed to reducing this gearing ratio by 0.4x p.a. and to achieve a net debt/ EBITDA ratio of 2.5x by FY23. These metrics will be very closely watched by investors going forward.

Regulatory headwinds

In 2017, US Food and Drug Administration (FDA) Commissioner Scott Gottlieb stated that nicotine in cigarettes could, and should be, reduced to non-addictive levels. This non-regulated “guidance” took on a more sinister form for tobacco companies in late 2018, when a ban on menthol in combustible cigarettes was proposed (we note that menthol is a flavouring, which masks the harsher properties of tobacco smoke, allowing people to inhale more deeply and absorb more nicotine).

This caused a major sell-off in the stock, which was exacerbated at the time by bond yields of over 3% on the 10-year US Treasury and fears that the US Federal Reserve (Fed) would continue on a rate-hiking path. We highlight that in March, the Fed struck a more dovish tone going from expecting two rate hikes in 2019 to not expecting any hikes at all this year.

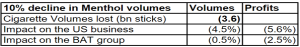

Nevertheless, there is no doubt that a ban on menthol in the US market would be bad news for BAT, particularly so soon after the acquisition of Reynolds America. Figure 1 below shows some research on quantifying this impact.

Figure 1: Possible Impact of a US menthol ban on BAT volumes and profit

Source: Company data, Morgan Stanley Research estimates

Menthol accounts for 55% of the US cigarette market and BAT has a 48% menthol market share in that country, meaning that 25% of group profits were in the firing line. However, evidence based on actual experience in Canada, where menthol was banned in nine provinces in 2015/ 2016, indicates the following:

1. 12% of smokers in a sample drawn from Ontario actually quit smoking for one month. but only 12% of those quit for a sustained period. So, a negative 1.44% (12% x 12%) impact on volumes. The rest (some 98.5%) would migrate to other products, including illicit cigarettes.

2. It needs to be pointed out that this menthol ban would be a long and protracted process and tobacco companies would litigate based on a lack of scientific evidence presented by the FDA in its decision-making process. According to the tobacco companies, there is not yet conclusive evidence that menthol cigarettes are more harmful than non-menthol. In addition, there may be unintended consequences as smokers switch to illicit menthol cigarettes.

3. On balance, we would expect the ban to happen no earlier than 4 to 5 years from the draft proposal (which is expected sometime this year) – so 2023/2024 at the earliest. If a 50% decline in menthol is assumed from 2023, then BAT’s earnings would fall by between 5% and 10%. We highlight that this is a worst-case scenario and would be mitigated assuming BAT captures some share of the replacement product. However, in our view, until the ban takes effect, there would be a negligible impact.

In addition to these factors, BAT’s ability to make meaningful inroads into the non-combustible cigarette market, generally referred to as Next Generation Product (NGP), is seen as a key driver for the company in an evolving nicotine industry.

NGPs

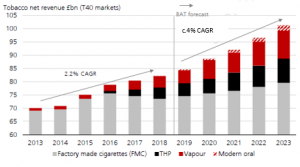

The traditional cigarette-smoking market is in structural decline, with volumes falling by 2%-3% p.a. for the past 5 years. As a result, tobacco companies are spending time, effort and money on NGPs because, by contrast, this is a market that is expected to grow, as per Figure 2 below.

Figure 2: NGP seen as growth avenue by tobacco companies (BAT expects it to double industry net revenue growth)

Source: UBS

NGP, also known as reduced-risk product, is broadly divided into two main categories: 1. Heat-not-burn (HNB) or tobacco-heated products (left hand side : Figure 3); and 2. E-cigarettes or vaping products (right hand side: Figure 3).

Figure 3: NGP’s two main categories:

Source: BAT

HNB/ tobacco-heated products. These are generally electronic devices that heat tobacco and produce an inhalable aerosol instead of burning tobacco like traditional cigarettes. The smoking experience is similar to smoking combustible (smoke when heated) cigarettes because (a) there is tobacco in the cigarette stick; and (b) the nicotine is inhaled nearly as quickly.

Electronic cigarettes/ vapour. E-cigarettes do not contain any tobacco. Rather the chamber/ device heats e-liquids, which consist of flavourings, water, propylene glycol and USP vegetable glycerin. E-liquids, unlike HNB products, may be ordered with different levels of nicotine including zero nicotine.

Forecasts are that BAT’s reduced-risk/ NGP portfolio will grow top-line sales by more than 20% from 2019–2025, and account for c. 25% of BAT’s revenues by FY25 vs 7% currently. It is, therefore, an important growth driver in BAT’s investment thesis.

Valuation

Using the building blocks of BAT’s current capital structure, the regulatory pressure the company is under, and the investment required in NGPs, what is a fair valuation for BAT?

Figure 4 below shows BAT’s key valuation metrics at the current share price of c. R528/ GBP28.39. They screen as undervalued in all cases.

Figure 4: BAT key valuation metrics

Source: Bloomberg, Anchor

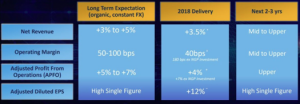

In addition, at an investor day recently the company’s internal guidance for growth was very impressive (see Figure 5 below).

Figure 5: BAT internal growth guidance

Source: BAT investor presentation

If the dividend pay-out ratio (65% of net earnings) can be maintained and the forecast levels of sales and profitability growth come to pass, then the share does seem to offer value. However, the levels of debt mean that mis-steps cannot be made, the NGP race will require investment/capex spend, and regulatory headwinds are unlikely to abate. The last aggressive litigation period in the late-1990s/ early-2000s saw the sector trade at mid-single digit forward P/Es. During the global financial crisis (GFC), forward FCF yields reached 10%-11%. It is possible then that investors will require higher FCF yields and lower multiples to compensate for the dynamics currently at play in the sector, and tangible evidence of the net debt/ EBITDA ratio reducing as per guidance below (see Figure 6)

Figure 6: BAT net debt and net debt/ EBITDA UBS forecasts

Source: UBS

Overall, we would hold BAT in yield-focused portfolios, with a sharp eye on the ability of sustainable earnings and cash flow generation to support the dividend, at least over the next two FY reporting periods, and up to a point where the market is comfortable with the firm’s debt levels.