US online travel agency, Booking Holdings delivered better-than-expected 4Q18 results on Thursday (28 February), earning $22.49/share (+33.4% YoY; share count fell 6%), compared to a Refinitiv consensus estimate of $19.42. The firm, which is the parent company of several online travel brands including Booking.com (the most important), Priceline, and Agoda, saw fourth-quarter revenue of $3.213bn (+16% YoY), only slightly surpass consensus estimates of $3.211bn.

We note that the actual results are ‘messy’ due to forex (as Booking is US-listed, while most of its other operations are in Europe) as well as accounting policy changes. Gross profit/revenue was up 21% YoY in constant currency terms (reported: +16% YoY). 5% was added to revenue from the change in accounting policy. Gross bookings and room nights both rose 13% YoY. EBITDA increased 17% YoY (more in constant currency), but only rose 4% on a like-for-like basis, due to the change in accounting policy and aggressive spend on Booking’s payments platform. This will make it easier for non-hotel owners to transact in whatever way they prefer.

However, looking ahead, current quarter (1Q19) guidance disappointed the market (causing the share price to fall 10% the day following the results release). This, after management pointed towards a sharp demand slowdown in Europe (its biggest market with more than two-thirds of sales coming from the region), as a near-term headwind. Management blamed uncertainties related to Brexit in the UK and political issues in France for a lower 1Q19 room bookings forecast. On the earnings call, CEO Glenn Fogel also said that the trade war between the US and China were making conditions worse for European economies such as Germany, whose slowing automotive industry was weighing on Europe’s overall growth.

Management advised towards more aggressive spend on brand advertising (intended to push people to go directly to Booking.com instead of via Google – it spent $1bn-plus on Google ads in 3Q18), customer acquisition and incentive programmes. In addition, management is guiding towards low double-digit growth in EPS (on a non-GAAP basis) for 2019 (on a constant currency basis). We highlight that forex is likely to remain a headwind for the year.

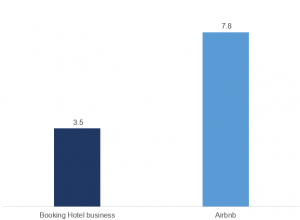

We note though that, for the first time, management provided select metrics on Booking’s non-hotel/ alternative accommodation business. This sub-segment has crossed the $1bn revenue per quarter mark, accounting for roughly 20% of total revenue. This is where things get interesting. Airbnb’s quarterly revenue is tracking at a similar run-rate as it reportedly boasts a $31bn valuation in the private market as of 2017. Airbnb is potentially preparing for an IPO in 2019. If we apply Airbnb’s multiple to Booking’s alternative accommodation business, then Booking’s remaining core hotel business is very cheap:

Figure 1: Implied EV/ revenue business

Source: Bloomberg, Anchor

If Airbnb does an IPO later this year, Booking management will have a very strong incentive to separately disclose its alternative accommodation segment’s results. This could be a catalyst for the share.

In the meantime, European slowdown aside, Booking should remain a steady double-digit earnings growth story for a few years to come. With c. $6bn of cash on the balance sheet vs a $77bn market cap, as well as $5bn-$6bn in free cash flow generated p.a., at least 7%-10% of that growth is already in the bag (via share buybacks).

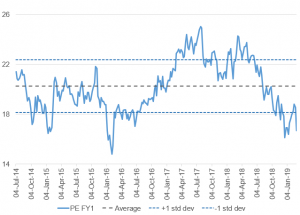

Booking is trading cheap vs the past 5 years (see Figure 2 below).

Figure 2: Bookings Holdings 12-month rolling forward PE

Source: Bloomberg, Anchor.

Based on the above, we are happy to hold the position in Booking.