Airline industry background:

Based on an expected long-term, average global GDP growth rate of 2.8%, the airline industry’s 20-year growth forecast is for a 3.5%-4.7% increase in passenger traffic and a 4.2% rise in cargo traffic. This demand will be mostly driven by increased globalisation and a wealthier middle class as well as the replacement of older planes no longer fit for service and switching to planes that are far more fuel efficient.

Boeing expects demand for commercial planes to be around 42,700 planes over the next 20 years. Boeing and Airbus have c. a two-third market share and both have at least a 5-year pipeline of orders.

Although there is close rivalry between these two businesses, they are only able to increase supply at about the same rate as long-term demand, which stands at c. 4%. This is because their business models are not highly scalable due to the nature of the product which the two companies are producing. The threat of new entrants is quite low however, although China has expressed a desire to compete in this space. Success in the aerospace industry is strongly linked to reputation and we believe that any Chinese producers will have to first prove themselves by developing a long-term track record before customers place meaningful orders. Thus, it is likely that current market share will remain quite consistent for the foreseeable future.

Boeing operates four segments: Commercial Airplanes (BCA); Defense, Space & Security (BDS); Global Services (BGS) and Boeing Capital (BCC). Boeing’s BDS segment is the second-largest defence contractor in the US and this segment has a backlog of $57bn (of which 30% is outside the US). Meanwhile, the BGS division is being driven by higher parts growth and pilot training (see Figure 1).

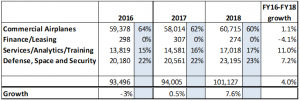

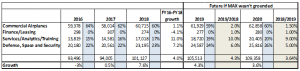

In Figure 1 below we highlight the company’s various segments and each segment’s revenues.

Figure 1: Boeing revenue drivers by segment:

Source: Company financial statements

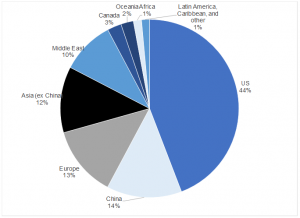

Figure 2: Boeing revenue by geography, FY18:

Source: Bloomberg, Anchor

Boeing’s US revenue has been fairly consistent, growing by 3.5% from FY13 to FY18. However, while the trade war threat seems to have had very little impact for now on revenue growth from China (which has shown consistent growth every year and has risen by 5.5% over a 5-year period), European growth declined YoY in FY17, before rising again in FY18. For the 5-year period, European growth is up 4.1%. Nevertheless, in other regions, growth has been uneven with Latin America, the Caribbean and other being the worst performer over a 5-year period – down 11.8%, while Asia (ex. China) has also recorded negative growth of 0.1% over 5 years. Although Africa appears to be have grown massively over the past 5 years, this is mainly due to extremely lumpy orders over this period and a very low base in 2013, in particular.

Margin analysis:

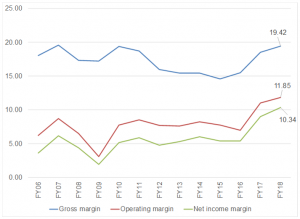

Figure 3: Boeing margin analysis, %:

Source: Bloomberg

Margin growth has been a big factor in Boeing’s profitability over the past 6 years. This is largely due to the mix of planes and, of course, increased efficiencies in the production line.

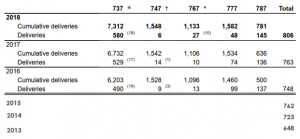

Figure 4: Commercial aeroplane deliveries as of 31 December:

Source: Company financial statements

Boeing’s total FY18 deliveries came in at 806 units – up 5.6% YoY. Boeing’s CAGR in terms of deliveries is in line with long-term demand expectations. The company’s 737 accounted for 65% to 72% of all its commercial liners in 2018, while the 737 MAX came in at c. 256 planes in 2018 and is expected to account for 90% of 737 deliveries in 2019.

737-MAX:

The MAX has been the subject of much controversy over the past few months following two crashes involving the Boeing 737 Max jets. The cause of the crashes centered around a software error that sent the planes into a deadly nosedive. The MAX has been grounded by the authorities until all safety concerns have been investigated.

Based on management commentary, analysts expect 737 MAX revenue to return to form in 4Q19 and consensus analyst forecasts then expect a massive bounce in 2020 revenue. This is based on full sales coming online and all previously produced planes, that are currently mothballed, being delivered over the next 18 months. However, if no more sales of the 737 MAX take place this year, then revenue is expected to fall to c. $80bn for FY19. We estimate that the 737 MAX would account for c. $30bn of FY19 revenue if these planes were not grounded.

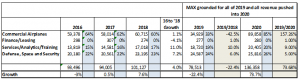

Figure 5: 737 Max production drivers and forecasts if the Max wasn’t grounded:

Source: Company financial statements

Figure 6: 737 Max production drivers and forecasts based on current consensus estimates:

Source: Company financial statements

Currently, while the MAX is grounded, Boeing is reportedly burning through $2.5bn cash every quarter. The company’s cash stood at $7.6bn in December 2018 and by March 2019 it was at $6.8bn. Meanwhile, debt rose from $10.6bn in December 2018 to the current $11.3bn (as at end March 2019).

Airbus is currently trading at about a forward 16x PE to 2020 year-end, while Boeing is at about a 15x PE (if the MAX grounding is lifted by year-end and business returns to normal).

With margins at long-term highs and revenue at very paltry low single-digits, EPS has grown largely due to share buybacks. Prior to the MAX grounding, this was adequately serviced by strong operating cash flows but currently the firm is burning through cash. We note though that, at present, share buybacks have been put on hold.

Conclusion

Boeing has had much to worry about lately, from the company’s 737 MAX crashes to US President Donald Trump’s trade war with China. Because of the MAX grounding, its 2Q19 earnings came in at a loss of $5.82/share compared to a profit of $3.33/share the previous year. Revenue declined by 35% YoY to $15.8bn, which was mainly due to potential $4.9bn concessions and considerations to airlines which are suffering as a result of the grounding and absence of deliveries to customers. In July, management indicated that the 737 Max should return to service by 4Q19. Analysts are using this as the base of their forecasts, but many press reports have indicated that we won’t see the 737 Max flying any passengers until 2020. No timeline has also been given by the US Federal Aviation Administration and other regulators globally for when the plane will return to the skies.

Besides the negative impact of the MAX crashes, ongoing trade tensions between the US and China are also likely to start weighing on Boeing’s share price (China is the world’s largest market for new jets according to Reuters). YTD (to Monday, 19 August), the Boeing share price is up 3.5% but since the Lion Air crash (30 October 2018), the price is down 4.6% and from the date of the Ethiopian Airlines crash (10 March 2019), the share price has dropped by 21.0%.

We believe that Boeing is a great company and the business is run extremely well, plus it operates as a duopoly in a sector that is structurally supportive of long-term growth. However, with so many uncertainties, until the grounding of the MAX is lifted and more clarity surrounding the consequences of this setback come to light, we would not invest in the company.

Boeing’s issues are explained in a video from Vox entitled The real reason Boeing’s new plane crashed twice.