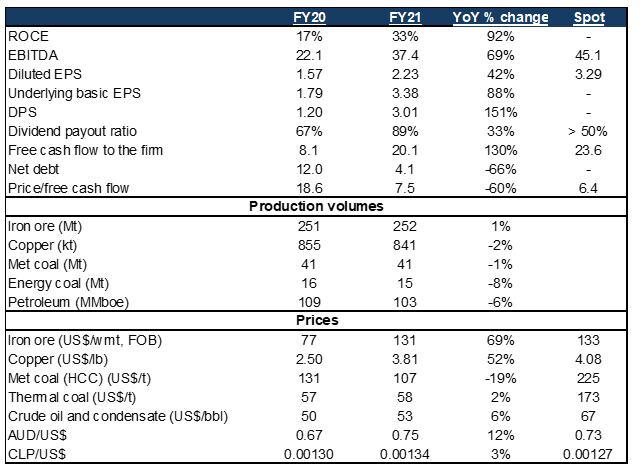

BHP Group reported stellar results for the year ended 30 June 2021 (FY21) on Tuesday (17 August), with profit jumping 80% YoY, while underlying earnings before interest, tax, depreciation, and amortisation (EBITDA) soared 69% YoY. Profit from operations rose to US$25.9bn (from US$14.4bn in FY20), and net operating cash flow was up 73% YoY, with net debt dropping by 66% YoY to US$4bn. The company announced a record dividend of US$2/share and has now returned US$15bn-plus to shareholders over the past 12 months.

Figure 1: BHP Group FY21 results overview, in US$bn except per share

Source: Anchor, Bloomberg

Strong earnings and free cash flow (FCF) growth driven by iron ore and copper

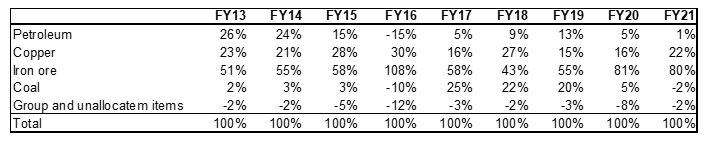

BHP is mostly an iron ore and copper business at this point, although coal should do better given current strong coal prices. Iron ore (80%) and copper (22%) accounted for more than 100% of the Group’s underlying operating profit.

Figure 2: BHP Group FY21 underlying EBIT by commodity

Source: Anchor, Bloomberg

The big dividend is below our expectations but seems to be well received by the market

Coming into these results, BHP had a net debt target range of US$12-US$17bn. As at 31 December 2020, BHP was already near the lower-end of that range with US$13bn of net debt. This implied that it would distribute all of the FCF it would generate in 2H21 via dividends and/or share buybacks (since it was already at the lower-end of its net debt range). BHP generated US$14bn in 2H21 (US$2.82 or R42/share). It has declared a final dividend of US$2.00/share or 71% of 2H21 FCF. Although that is a big number, we were expecting BHP to return all, or nearly all, of the FCF it generated. Nevertheless, it does seem to have been well received by the market. BHP said it will review its net debt target range and update investors at its 1H22 results in February 2022.

BHP and Woodside to merge their respective oil and gas businesses

It will be an all-stock merger, after which the combined entity will be:

- 52% owned by Woodside shareholders and 48% owned by BHP shareholders; and

- listed in Australia.

We note that petroleum is not a big contributor to operating profit for BHP, accounting for 1% of underlying EBIT this year (see Figure 2 above).

Potash project confirmed

BHP said it will spend US$5.7bn on a potash project called Jensen in Canada. Potash is primarily used in agriculture (fertilisers). First production is expected in 2027 and it will take another two years to ramp-up production. The internal rate of return (IRR) on the project does not look amazing at 12%-14%.

BHP to unify its dual-corporate structure and shift its primary listing from the UK to Australia

The dual-listed structure consists of BHP Ltd, which is listed in Australia and BHP Plc, which is listed in London. Currently, BHP trades at a discount on the London Stock Exchange (LSE) vs its Australia listing. The company will continue to have its secondary listing on the LSE.

Cost inflation creeping back up

Guidance for FY22 at the midpoint is for:

- copper unit costs to jump by 30% YoY;

- iron ore unit costs to rise by 21% YoY; and

- coal unit costs to increase by 4% YoY.

We estimate that at current spot prices, FY22 free cash flow (FCF) will be c. 17% higher than what BHP reported for FY21. The investment case is very dependent on the iron ore price and, to a lesser degree, the copper price. We are currently holders of BHP but the position is under review given the strong pressure that iron ore prices are under at the moment.