Introduction

In today’s fast-changing investment world, shaped by volatility, inflationary pressures, and shifting global dynamics, traditional portfolios built solely on stocks and bonds are being put to the test. Both institutional and individual investors are now seeking alternative ways to diversify risk, enhance returns, and tap into opportunities beyond public markets. This shift has brought alternative investments into sharper focus.

This article is a practical guide to the growing relevance of alternative assets, from private equity, private debt, and private real estate to hedge funds and structured products. We delve into why these investments are gaining traction, how they can strengthen a portfolio, and what risks investors should consider when allocating alternative investments. Supported by data and insights from leading financial institutions, we aim to provide readers with a clear and practical introduction to the world beyond stocks and bonds, empowering them to make informed investment decisions.

What are alternative investments?

Alternative investments are generally defined as investments that fall outside the traditional categories of stocks, bonds, and cash. This broad category includes a wide range of assets, each with its own strategy, risk profile, and return potential. One common feature is that many alternative investments are generally illiquid, meaning they can be difficult to sell quickly or be converted to cash because they may involve long-term commitments and more complex structures.

Common types of alternative investments are:

Private equity (including venture capital, growth equity, and buyouts) facilitates investing in privately held companies, providing the capital for existing owners to scale their companies and pursue growth opportunities. Private equity investments typically offer high potential returns but usually require capital to be invested for lengthy periods (often 5–10 years).

Private debt (or direct lending) is an investment strategy where non-bank lenders (such as institutional investors, debt funds, insurance companies and private investors) provide loans to support the financing requirements of businesses. Private debt can provide investors with higher yields, portfolio diversification, and lower portfolio volatility than traditional fixed income instruments.

Private real estate involves investing directly in physical properties or funds that own physical real estate. Investor returns are generated through rental income and appreciation in the value of the property (the latter is often a function of refurbishment and development).

Hedge funds typically make investments into traditional asset classes (stocks and bonds) whilst using sophisticated investment techniques (e.g., short-selling and leverage) and derivatives (e.g., options and futures) to create opportunities that will deliver positive returns regardless of the market environment. Various hedge funds and investment managers operate across a wide variety of investment strategies with a broad range of risk/return profiles.

Structured products are contractual obligations issued by banks and brokerages with defined maturity dates (usually 1 to 5 years). They reference investments (such as bonds, stocks or indices) but add bespoke features to create a more defined range of investment outcomes. These customisable features can include a capital guarantee, setting return ranges, gaining leveraged exposure, and receiving periodic, pre-defined coupons.

The rise of alternative investments

Over the past two decades, alternative investments have moved from the sidelines to the spotlight. Once reserved for institutions and ultra-high-net-worth individuals (UHNWIs), they have become more accessible and popular, especially after the 2008 global financial crisis (GFC), when investors began seeking assets that did not move in lockstep with the stock market.

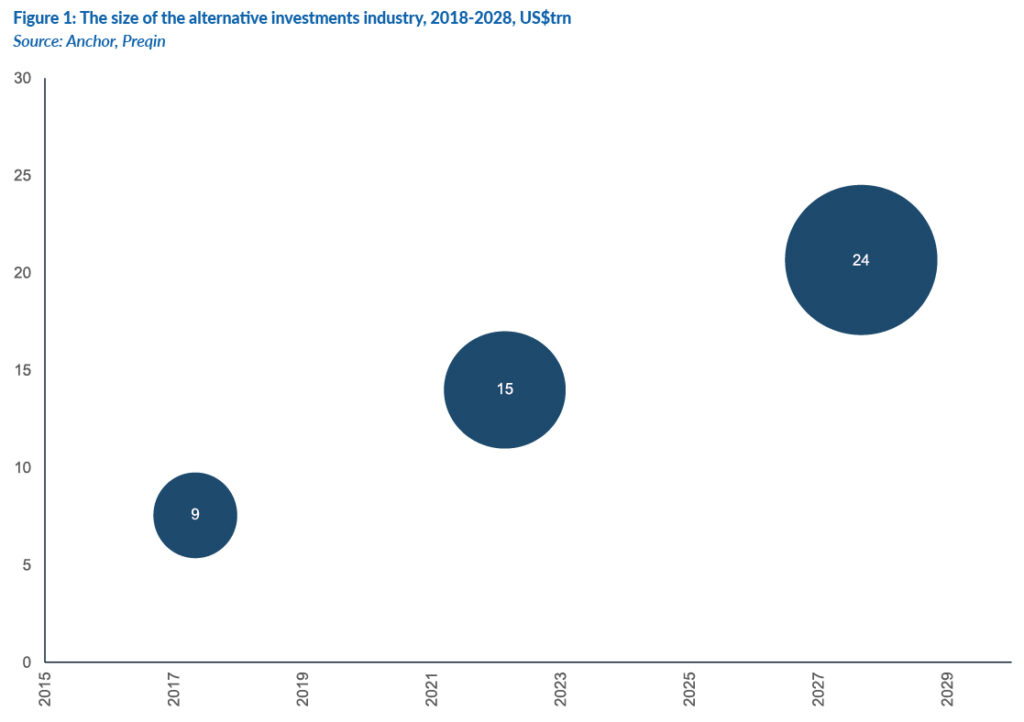

In 2003, global alternative assets under management (AUM) stood at around US$2.5trn. By 2022, that number had grown to US$15trn, and it is expected to reach at least US$24trn by 2028. Some experts even predict that private markets could grow to US$150trn globally over the next 50 years.

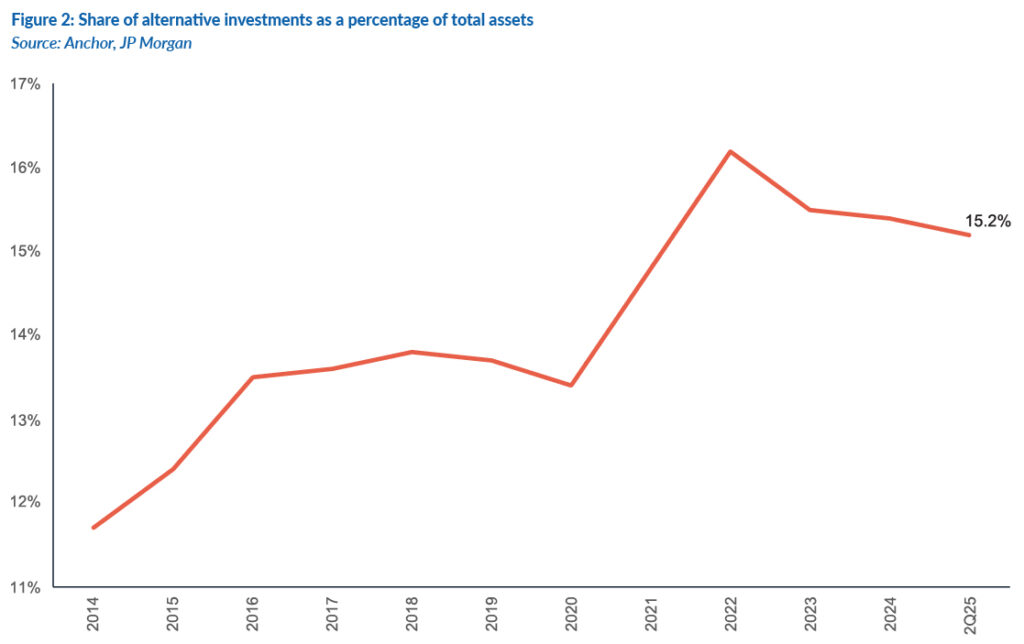

Although alternatives currently account for only c. 15% of clients’ total investable assets, more investors are incorporating them to diversify risk and enhance returns.

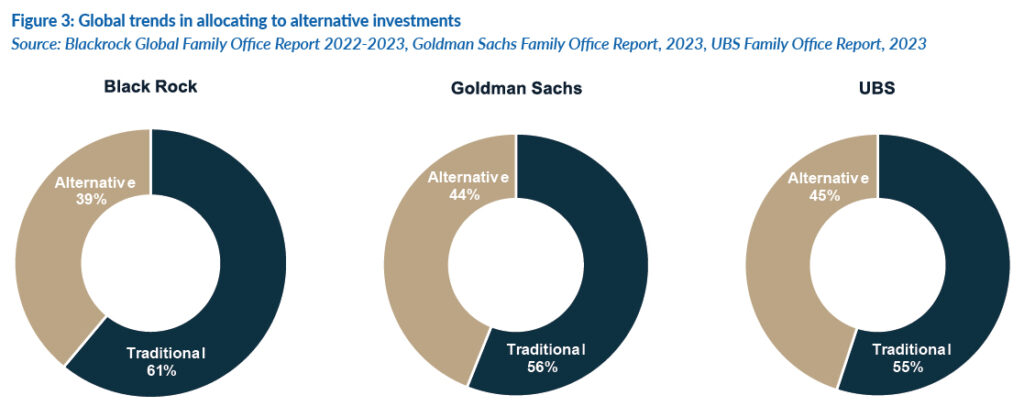

Alternative assets are becoming increasingly important in building a well-diversified portfolio. Research from institutions like BlackRock, Goldman Sachs, and UBS shows that family offices (i.e., those private wealth management advisory firms that cater to the needs of UHNWIs and families) allocate an average of 39%–45% of their portfolios to alternatives.

Family offices are drawn to alternatives for their lower correlation with traditional assets and relatively lower return volatility.

How alternatives can strengthen your portfolio.

1. Strength in variety: Diversifying beyond the norm. Alternative investments offer exposure to assets that do not always move in sync with stocks and bonds. This can help smooth out returns during periods of market volatility and reduce the overall portfolio risk.

2. The potential for higher returns. Private equity and venture capital, for example, aim to outperform public markets. While they often come with higher risk and longer time horizons, they offer access to early-stage growth, turnaround, or niche strategies not available on stock exchanges.

3. A natural hedge against inflation. Assets like real estate, infrastructure, and commodities often rise in value during inflationary periods. These investments can help protect purchasing power and preserve wealth over time.

4. Tapping into innovation and global growth. Alternatives provide access to sectors and regions underrepresented in traditional portfolios, such as tech startups, renewable energy, or infrastructure in emerging markets (EMs), offering strong growth potential and alignment with future economic trends.

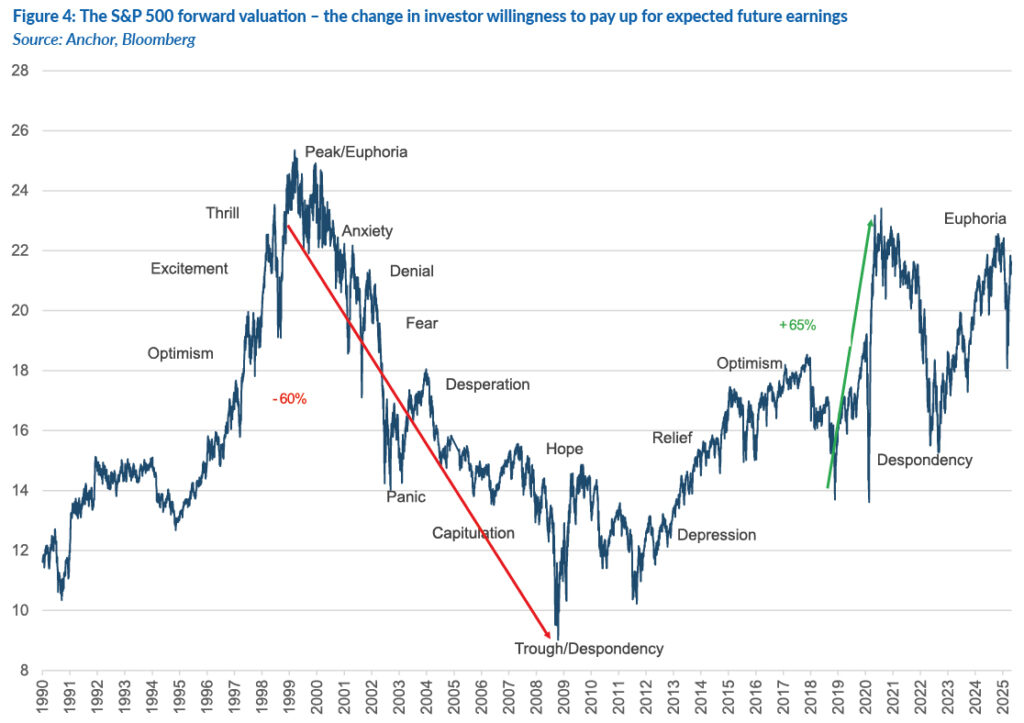

Investing in public markets can be an emotional rollercoaster

“If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to be a common shareholder, and you deserve the mediocre result you are going to get.” — Charlie Munger.

Alternative investments can help reduce the emotional strain of long-term investing.

Know the trade-offs: Risks to consider with alternative investments

While alternatives offer exciting opportunities, they also come with unique challenges. Understanding these risks is key to making informed investment decisions.

1. Less transparency: Many alternatives operate outside public markets and are not subject to the same regulations. This can make it more difficult to assess their value or risk.

2. Illiquidity: Unlike stocks or bonds, many alternative assets require long-term commitments and cannot be easily sold. Lock-up periods can last several years, making them less suitable for investors needing quick access to cash.

3. High entry points: Alternatives have traditionally been geared toward institutions or high-net-worth individuals, with high minimum investments. While this is changing, many options remain out of reach for everyday investors.

4. Greater risk exposure: Alternatives often involve niche sectors, early-stage ventures, or complex strategies. They may be more volatile or more complicated to value, requiring deeper market knowledge and professional guidance. Despite these risks, with proper due diligence and expert support, alternative assets can play a valuable role in a diversified portfolio.

How Anchor is redefining alternative investments

Working as planned

Although alternative investments are often seen as complex, at Anchor, we are actively working on changing that view. By offering accessible, well-managed fund strategies, we are helping clients diversify beyond traditional stocks and bonds.

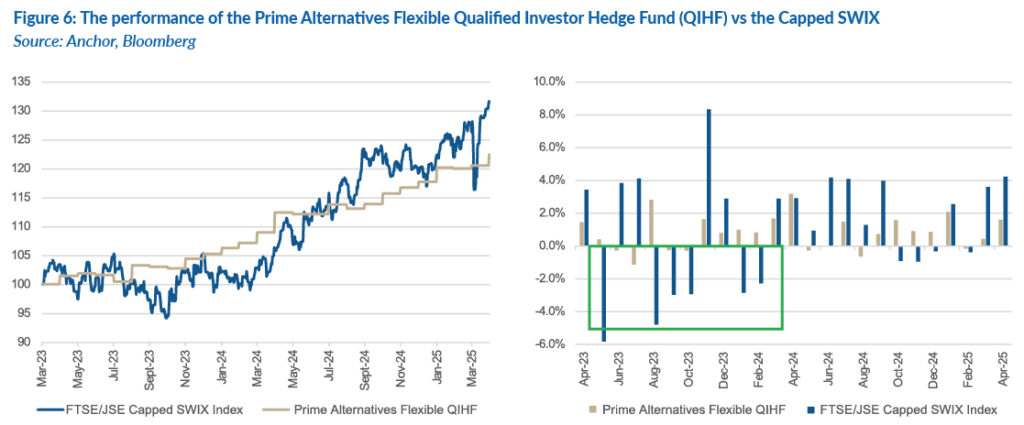

For illustration, the charts below highlight how one of our Anchor-managed alternative funds, the Prime Alternatives Flexible Qualified Investor Hedge Fund’s (QIHF) performance compares to the FTSE/JSE Capped SWIX Index. Over the past two years, the QIHF has delivered steadier growth, while the SWIX has shown greater volatility. This ability to smooth out returns and protect capital makes the QIHF a strong choice for investors seeking consistent performance, especially in uncertain markets.

Please contact Anchor with any questions you have regarding alternative investments.

Note: Past performance is not necessarily an indication of future performance. Returns provided are provisional and may be subject to change. Consult the Minimum Disclosure Document for full disclosure on fees, performance, etc. This is available at www.anchorcapital.co.za