Berkshire Hathaway’s (Berkshire’s) chairman and CEO, legendary investor, Warren Buffet released his annual letter to shareholders on Saturday (23 February). We highlight the main points below and then look at the Group’s 4Q18 results, which were released on Thursday (21 February):

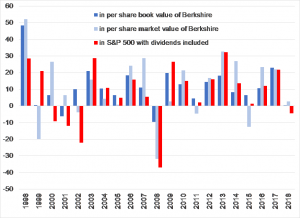

“Time to abandon” book value? For years, Buffett told shareholders that the company’s book value/ share matters to him far more than any quarterly or annual EPS results and, in the past, every year he opens with how Berkshire’s book value/ share has changed. However, this year he wrote that it was time to abandon that practice, as the metric “has lost its relevance.” Most of Berkshire’s value is in its many operating businesses, which are less accurately reflected in book value as time goes on, and as accounting rules require them to be incorporated into book value at a lower value than they are worth.

Buffet says Berkshire wants to make a “sizeable” acquisition but immediate prospects for that are not good – he described current prices as “sky-high” for those businesses possessing decent long-term prospects.

Over time, Berkshire will become a “significant” repurchaser of its own shares. Berkshire will buy back stock “at prices above book value but below our estimate of intrinsic value.”

US history has proven “those who regularly preach doom because of government deficits” wrong. Buffet writes that since his first investment in shares on 11 March 1942, through 31 January 2019, each dollar invested in the S&P 500 Index would have grown to $5,288, with dividends reinvested and before taxes and transaction costs. Meanwhile, the national debt increased c. 40,000%, during the same time period.

Following on from the above, gold isn’t a great long-term investment. Those who feared investing in shares but bought gold in 1942 saw each $1 grow to only $36 – below 1% of what they would have achieved investing in the S&P 500. Buffet added that “The magical metal was no match for American mettle,.”

The compound annual growth rate (CAGR) delivered by the S&P 500, with dividends reinvested, has been c.11.8% over c. 77 years. Reduce that CAGR by just 1-ppt p.a., to 10.8%, paying for “various ‘helpers’ such as investment managers and consultants,” and he observes each dollar invested in 1942 would have grown to only c. $2,650 now, roughly 50% the result in the no-fee example.

He lamented how the new accounting rules, the Generally Accepted Accounting Principles (GAAP) policy negatively impacted Berkshire’s bottom line in 2018, particularly during 4Q18.

Market value declines will produce mark-to-market losses, resulting in poor earnings while market value increases will generate mark-to-market gains adding to the earnings, Buffett said.

Berkshire Hathaway consists of more than 60 subsidiary businesses, including huge insurance operations, partially owned businesses, and a diverse set of wholly owned companies. In addition, the firm has a c. $200bn stock portfolio.

Buffett pointed out that Berkshire works so well as a business because its various parts complement each other – its structure “allows us to seamlessly and objectively allocate major amounts of capital, eliminate enterprise risk, avoid insularity, fund assets at exceptionally low cost, occasionally take advantage of tax efficiencies, and minimize overhead.” “At Berkshire, the whole is greater — considerably greater — than the sum of the parts,” he wrote.

At 88 years of age he made no explicit statements about plans for succession at the company.

Finally, he noted that the US economy will be fine, “irrespective of who is in charge.” US business is a powerful long-term growth engine. Since 1942, the US has had Republicans and Democrats in the White House, and “several scary economic times … including a rapid inflationary period, wars, a housing collapse, etc.”. The US made it through, and Buffett believes America will be the biggest force working in investors’ favour going forward, calling it “The American Tailwind.”

In its 4Q18 results, reported on Thursday (21 February), Berkshire posted quarterly adjusted earnings of $2.32/share, USc47 more than the consensus analyst expectation for earnings of $1.85/share. Revenue plummeted 52.1% YoY to $28.21bn (consensus analysts had expected $33.69bn). Reported EPS for the quarter was a loss of $10.31, while the firm also recorded a quarterly loss of $25.39bn and cut its dividend by 36% YoY. The $25bn loss was driven by $27.6bn in unrealised losses from the investment portfolio. Buffett has said that investors should look more at underlying operating figures, as accounting rules now incorporate unrealised gains and losses from stocks into net income (as mentioned above). He said the volatile fourth quarter featured several days where Berkshire’s stock portfolio swung more than $4bn.

As its biggest shareholder, Berkshire felt the ripple effects from the Kraft Heinz Co’s $15.4bn write-down in 4Q18, taking a $2.7bn markdown to its stake. The company, however, benefited from its railroad and energy businesses which, along with tax cuts, helped boost overall operating results to $24.8bn for FY18. The insurance businesses reported an FY18 underwriting profit of $1.57bn – rebounding from a $2.2bn loss in FY17, boosting overall operating earnings at the conglomerate by 71% YoY.

Berkshire share buybacks slowed in 4Q18, with the company repurchasing $418mn of shares, vs $928mn in 3Q18. The board’s policy on stock buybacks (implemented in July 2018), allows share buybacks whenever the price is below what they consider the intrinsic value of the share

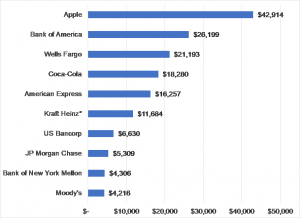

Berkshire’s top-10 holdings by value, bn:

Source: Berkshire Hathaway, Anchor

In terms of Berkshire’s top-15 equity holdings (Charter Communications, Delta, Southwest Airlines, United Continental Holdings, Goldman Sachs and USG are not shown in the chart above and Kraft Heinz is excluded by Buffet “because Berkshire is part of a control group and therefore must account for this investment on the “equity” method.”) by gains, year-end 2018 balances impressed for the 15 equity positions (among dozens of overall equity positions) which had a purchase value of $102.9bn and a marketable value at end-2018 of $172.8bn.

Berkshire’s Performance vs. the S&P 500, YoY % change:

Source: Berkshire Hathaway, Anchor