Global markets remained volatile in August as US President Donald Trump escalated his administration’s trade war with China and anxiety around a possible recession again came to the fore. On 14 August, bond yields fell across developed markets and the US yield curve inverted briefly for the first time since 2007. Historically, yield curve inversion portends a recession in the US and signifies a slowdown of economic growth. Early in the month, Trump wrote in a tweet that an additional 10% tariff would be placed on $300bn of Chinese imports starting 1 September and a few days later he accused China of currency manipulations as the yuan plummeted to levels not seen in a decade. Then, last week, trade tensions increased once again as China unveiled new tariffs on $75bn worth of US products and Trump responded by “ordering” US companies to move operations out of China and announced higher tariffs on a slew of Chinese goods.

Needless to say, all of the above weighed on global markets although there was a slight recovery moving into month-end after China’s Foreign Ministry reportedly said that negotiators from both countries are maintaining “effective communication.”

The tech-heavy, Nasdaq (-2.6% MoM) was the worst hit among the major US indices in August, although it is still up 20% YTD. The S&P 500 dropped 1.8%. MoM (+16.7% YTD), with the energy (-8.7% MoM) and financials sectors (-5.1% MoM) in the index being the worst performers. CNBC writes that overall, eight out of the 11 S&P 500 sectors fell last month. The Dow Jones Industrial Average also posted a MoM loss of 1.7% (+13.2% YTD).

In terms of US economic data, the second 2Q19 GDP reading came in slightly lower vs what was initially expected at a 2.0% annualised rate, compared to the preliminary GDP reading of 2.1% YoY. Consumer confidence also retreated slightly in August, slipping to 135.1 vs an upwardly adjusted 135.8 the month before. However, July retail sales rose by a relatively solid 0.7% MoM (the most in 4 months) vs June’ amended 0.3% MoM gain.

August saw major equity markets in Europe lose ground for the second month running, with Germany’s DAX down 2.0% MoM (+13.1% YTD), while France’s CAC retreated by 0.7% MoM (+15.8% YTD). In terms of economic data, Europe’s largest economy, Germany saw its 2Q19 GDP shrink by 0.1% QoQ, as a fall in exports dampened growth. YoY, Germany’s GDP rose 0.4%. The eurozone’s August flash manufacturing purchasing managers index (PMI) rose to a two-month high of 47 from July’s 46.5, although it remained below the 50-level which separates expansion from contraction.

In the UK, the FTSE 100 dropped by 5.0% MoM (+7.1% YTD) as fears that the country is heading towards its first recession in ten years were stoked by bleak 2Q19 GDP data. The UK economy contracted by 0.2% in the quarter on the back of Brexit uncertainty and car plant shutdowns. The fact that new prime minister Boris Johnson seems to be taking the UK towards a no-deal Brexit is likely also weighing on the economy.

Asian markets ended August broadly lower, with the Hang Seng Index plummeting 7.4% (-0.5% YTD) as Hong Kong continued to be rocked by pro-democracy protesters seeking, among other things, a complete withdrawal of the extradition bill, an independent inquiry into alleged police brutality and greater democratic reforms. Meanwhile, China’s Shanghai Composite was c. 1.6% lower (+15.7% YTD) for August. The country’s economy weakened on several fronts with the unemployment rate in Chinese cities hitting a record high in August, while factory production, consumption and property investment came in much lower than expected. However, the official PMI surprised on the upside, rising to a five-month high of 50.4 from 49.9 in July – above the 50-point mark separating contraction from expansion. In Japan, the Nikkei fell 3.8% MoM (+3.4% YTD).

On the commodity front, following the gold price’s 8.0% MoM jump in June, the yellow metal recorded a 1.1% gain in July and then soared a further 7.5% in August (+12.3% YTD). Meanwhile, benchmark iron ore prices dropped c. 27% last month on the back of worries that trade-war uncertainty will fuel a global economic slowdown and, in turn, slower raw materials demand. The oil price also closed August sharply lower (-7.3% MoM) as reports indicated that Russia overproduced in the month vs what was agreed to under a deal between OPEC and non-OPEC producers. In addition, the US-China trade row has weighed on prices, with China announcing tariffs on US crude imports last week.

The JSE’s July’s losing streak continued in August, with the FTSE JSE All Share Index down 2.7% for the month (+4.8% YTD) – its third monthly loss this year. Yet again, financials were the hardest hit sector, with the Fini-15 declining by 4.0% MoM (-7.6% YTD), and the big-four banks all recording MoM losses. Nedbank (-6.3% MoM) was the worst impacted, followed by ABSA (-3.8% MoM), FirstRand (-2.9% MoM) and Standard Bank (-1.3% MoM). The Resi-10 (-1.7% MoM; +8.1% YTD) saw large index constituents such as Anglo American, Glencore, and BHP Group dropping by 6.9%, 4.8% and 4.7%, MoM, respectively, dragging the index lower. Meanwhile, the Indi-25 remained under pressure posting a 2.9% MoM decline (+10.9% YTD) as heavyweight counters such as Richemont (-3.5%) and Naspers (-1.5%) posted MoM losses. The rand weakened c. 6% MoM against the greenback and is also 6.0% down YTD.

On the political front, the fightback campaign from compromised individuals in the ANC against President Cyril Ramaphosa’s reform agenda continued, with a newspaper publishing leaked bank records related to the CR17 campaign. Ramaphosa also secured an interdict staying the implementation of the Public Protector’s remedial action against him in her report on his CR17 election campaign. Meanwhile, National Treasury last week unexpectedly released a 77-page economic policy document entitled Economic Transformation, inclusive growth and competitiveness: towards an economic strategy for South Africa to the ire of unions. However, the private sector, for the most part, seemed to welcome the document. The public has been invited to give their comments with Finance Minister Tito Mboweni saying the strategy blueprint is expected to boost growth and create jobs. Minister of Health, Dr Zweli Mkhize, published a revised National Health Insurance (NHI) bill on 8 August, which knocked healthcare sector stocks such as Discovery and Aspen (both down12.9% MoM).

Local economic data showed SA’s July headline inflation eased to 4.0% YoY (vs 4.5% in June) – below the halfway mark of the SA Reserve Bank’s target of between 3% and 6%. Core inflation, excluding the volatile food, non-alcoholic beverages, petrol and energy categories, came in at 4.2% YoY. The latest retail sales numbers showed a 2.4% YoY rise for June vs May’s 2.2% YoY gain. SA also reported a surprise R2.88bn July trade deficit last week. This after posting a revised surplus of R5.4bn in June. Reuters consensus forecasts had expected a surplus of R2.9bn.

Top-20 August 2019 MoM performers:

Source: Bloomberg, Anchor

The price of bullion, trading at six-year high levels last week, recorded its fourth consecutive monthly gain, with investors snapping up so-called safe-haven assets in August as trade-related tensions resulted in increased concerns around global growth. This saw the top-10 best performing shares made up of several gold mining counters. Gold miner, Harmony (+50.4% MoM) was August’s best-performing share, as the stronger gold price and the firm’s impressive FY19 results (released on 20 August) buoyed the share price. Harmony reported a strong rise in gold production due to the full-year inclusion of its Moab Khotsong mine and the ramp-up of its Hidden Valley mine in Papua New Guinea, which now contributes c. one-third of production profit. YoY, revenue advanced to R26.91bn, while its diluted loss per share stood at ZAc500.0, vs ZAc1,004.0 recorded in FY18.

Two other gold producers were in the second and third best-performing spots – AngloGold Ashanti (+36.4% MoM) and Pan African Resources (+34.5% MoM). In its 1H19 results, AngloGold revealed that its revenue declined 8.8% YoY to $1.83bn, however diluted EPS stood at ZAc27.0, compared with ZAc8.0 recorded in 1H18.

Omnia Holdings’ (+32.4% MoM) share price surged after it confirmed that institutions had agreed to underwrite a R2.0bn capital-raising plan aimed at ensuring the heavily indebted chemicals and fertiliser manufacturer remains sustainable. The offer is for 100mn ordinary shares, at R20/rights offer share.

Brait SE (+26.1% MoM) recorded share price gains following press reports that it might sell its shares in Virgin Active. The investment holding company has seen its share price fall from highs of R170-plus in 2016 to around R13.21 at the end of July this year. This was, in part, due to debt concerns and struggles with its New Look brand in the UK amid Brexit uncertainty and the shift to shopping online. Brait owns 71.9% of Virgin Active.

Northam Platinum’s (+24.8%) FY19 results showed that revenue advanced 41.0% YoY to R10.6bn, while EPS stood at ZAc17.2, compared with a loss per share of ZAc201.5 in FY18. This was thanks in large part to higher platinum group metals (PGM) volumes, a higher US dollar basket price and the weaker rand.

Last week, Imperial Logistics’ (+20.6%) share price surged after the firm reported an increase in its FY19 revenue (+6% YoY) and despite posting a decline in its continuing HEPS for the same period. The logistics services provider, in its FY19 results, said revenue increased to R49.72bn from R48.57bn posted in FY18, while diluted EPS rose 8.6% YoY to ZAc1,775. The company declared a final cash dividend of ZAc109/share. The firm said that it had made “tough” calls with more than R2bn in impairments and once-off restructuring costs for the year under review. However, it added that it was in a much better shape “to weather the tough trading conditions into 2020.”

Gold Fields recorded a 19.5% MoM share price gain as it returned to profit in its 1H19 results (following a loss in the year-earlier period). The results showed that its revenue increased to $1.38bn vs $1.35bn posted in 1H18, while diluted EPS stood at ZAc8.0, compared with loss per share of ZAc44.0 in the same period of 2018.

Sibanye Gold (+14.5% MoM) also registered an impressive August share price performance. Last week, Sibanye released a 1H19 trading statement, indicating that it expects a loss per share of ZAc11.0, compared with the EPS of ZAc3.0 recorded in 1H18. The miner said it expects a headline loss of ZAc54.0/share, compared with HEPS of ZAc4.0 in the preceding year. This was due to a five-month long strike at its SA gold operations. Sibanye’s local gold mines reported a R2.9bn loss (before interest, taxes, depreciation and amortisation) following an AMCU-led strike (which started in November 2018) and this more than cancelled out the R2bn in earnings delivered by its local platinum mines. In the end, AMCU accepted the same wage increases and other terms agreed to six-months earlier with other unions.

Rounding out the top-ten, business park owner Sirius Real Estate, which is also listed in Germany, recorded a 13.3% MoM share price gain. The firm announced that it had bought a second property in Bochum, Germany. The office building covers 4,200 square metres of lettable space and was purchased for EUR6.7mn.

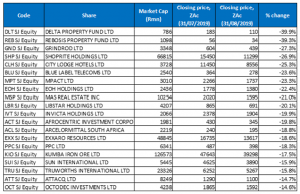

Bottom-20 shares: August 2019 MoM performance:

Source: Bloomberg, Anchor

Delta and Rebosis -B- shares were August’s worst and second-worst performing counters, declining 39.9% and 39.3% MoM, respectively. Last month, these two companies announced that their respective boards have, in principle, agreed to enter into merger discussions in order to affect a potential transaction, subject to various outstanding matters and stakeholder engagements. However, last week Redefine Properties weighed in on the proposed merger, stating that it is against the deal. Moneyweb quotes Redefine CEO Andrew König as saying that the Group is opposed to the merger because “Redefine carries some of the economic risk”. According to the report, the reason for this is because Redefine facilitated the Cornwall deal (it sold its 22.8% stake in Delta to BEE consortium, Cornwall Crescent for R1.46bn in 2017 through a loan to the consortium). König added that the merger presents an economic risk for Redefine because when the deal with Cornwall was concluded Delta’s shares were trading at c. R9/share. Delta’s share price closed August at R1.10/share. The Cornwall consortium also said it was opposed to the Delta-Rebosis merger.

The third worst-performing counter was freight and financial services company, Grindrod Ltd which declined 27.3% MoM. Grindrod reported 1H19 results in August showing that its revenue increased to R1.86bn from R1.62bn posted in 1H18, while diluted EPS stood at ZAc20.0 compared with a loss per share of ZAc55.2 recorded in the same period of 2018. However, while its continuing operations were profitable, Grindrod recorded a total loss after tax of R476.8mn in 1H19, from a profit of R2.5bn previously, because of its discontinued operations.

It was a tough financial year (FY19) for supermarket retailer, Shoprite Holdings, resulting in its share price plummeting 26.9% in August. The company reported a substantial decrease in its FY19 trading profit (trading profit declined in all its jurisdictions and hyperinflation played havoc with its Angolan business). Tax also had a significant negative impact on the results with Shoprite’s effective tax rate moving up to 32.6% from 28.9%, while the number of leases and the amount of debt the firm has in US dollar exposes it to currency volatility. FY19 revenue increased to R150.4bn from R145.9bn posted in FY18, while diluted EPS fell 18.0% YoY to ZAc767.3.

Hotel chain, City Lodge (-25.3% MoM) reported disappointing FY19 results last month, which showed that revenue increased to R1.6bn from R1.5bn recorded in FY18, while diluted EPS fell 27.0% YoY to ZAc560.7. City Lodge said last week that its R1.0bn African expansion strategy was being held up by delays to the completion of the 148-room City Lodge Hotel Maputo because of “contractor-related delays and disputes”.

Blue Label Telecoms and MPact recorded MoM declines of 23.6% and 23.3%, respectively. Blue Label Telecoms, Cell C’s largest shareholder, said in August that it expects FY19 earnings to plunge 20.0% YoY and the firm’s share price has been under pressure as concerns around Cell C continue to weigh on the Group. Last month, S&P cut Cell C’s credit rating to default after it missed interest payments due in July. MPact, meanwhile, reported disappointing 1H19 results, with revenue improving 4% YoY, underlying operating profit up 29% YoY, albeit off a low base, and diluted HEPS increasing 32% YoY to ZAc40. The paper and packaging Group said it expected difficult trading conditions in SA to continue. The trading environment for both its divisions has worsened meaningfully in the past twelve months and this is likely to see subdued FY20 volume and price improvements.

Rounding out August’s worst-performing shares, were EOH Holdings (-22.4% MoM), MAS Real Estate (-21.0% MoM) and Libstar Holdings (-20.1% MoM). In a cautionary statement released on Wednesday (28 August), EOH said it was assessing the financial impact of the findings of the investigation into tender irregularities by law firm ENSAfrica (which EOH hired 12 months ago to review all its large, historical technology contracts with government), adding that the “exact nature of each of the suspicious transactions is in the final stages of being verified and may relate to legitimate transactions, theft or bribery and corruption payments.” Investment holding company, Libstar Holdings said in mid-August it expects interim earnings to decline by up to 34% YoY, hit by new accounting standards adopted during the period. According to Libstar this will contribute to a decline in total basic and diluted EPS of between 23.7% and 33.7% YoY. However, basic and diluted normalised headline EPS from continuing operations would rise by between 4.4% to 9.4% YoY.

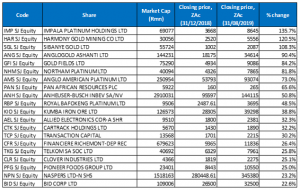

Top-20: YTD best-performing shares:

Source: Bloomberg, Anchor

Resource counters ruled amongst the YTD (to end August) best-performing shares, accounting for 9 out of the top-10 stocks (Anheuser Busch InBev being the only industrial share among the bunch). For a third month running, platinum miner Impala was the top-performing share YTD, having rocketed by an impressive 135.7%. Following an impressive performance in August, Harmony jumped the queue to hold second spot and the share is now 120.5% higher YTD. Sibanye moved back to third spot from its second-place position in the year to end July, with a 108.3% YTD gain.

Following Sibanye was AngloGold Ashanti, Gold Fields, Northam Platinum and Anglo-American Platinum (Amplats), with their share prices jumping by 90.4%, 84.2%, 81.8% and 73.0% YTD, respectively.

Finally, rounding out the ten best-performing shares YTD, were Pan African Resources, Anheuser-Busch InBev and Royal Bafokeng Platinum with gains of 65.6%, 50.8% and 48.5%.

Bottom-20: YTD worst-performing shares:

Source: Bloomberg, Anchor

For the most part, August’s YTD worst-performing shares were similar to those of July. However, Montauk, Hammerson Plc, Imperial Logistics and Steinhoff International fell out of the list of 20 worst-performing shares YTD, while Shoprite, Sun International, PPC and Sasol Ltd recorded steep enough share price drops in August to place these counters back among the YTD 20 worst-performing shares.

Rebosis -B- was once again the worst performer, with its price having plummeted by 87.4% YTD after a poor showing in August. It was followed by another property counter Delta, which is now down 75.6% YTD and was discussed earlier. Intu (-64.9% YTD), June’s worst-performing counter, was propelled from fourth position in July to third spot in the year to end August. JSE-listed UK real estate investment trusts (REITs) have come under pressure on the JSE because of a weakening pound and Brexit uncertainty with Intu being one of the worst affected. Intu also recently reported lower net rental income, and a drop in cash flows from operating activities. The firm also said it would be disposing of its underperforming assets in Spain to reduce debt and it suspended its dividend payment to retain cash in the business.

Consumer goods retailer, Massmart (-56.5% YTD) reported 1H19 results in August which revealed the Group’s first loss in c. 20 years. Massmart’s revenue advanced 5.3% YoY to R43.90bn, while its diluted loss per share stood at ZAc378.3, compared with EPS of ZAc89.0 recorded in the corresponding period of 2018. The firm suffered a headline loss of R550mn for the six months to end June, vs a R200mn-plus profit in 1H18. Among the various headwinds (loadshedding, higher municipal tariffs etc.) it is facing, the company blamed a 12% increase in costs (due to higher salaries after the introduction of minimum wage earlier this year) for the loss.

EOH Holdings, Brait and Blue Label Telecoms (all discussed earlier), are now down 55.2%, 50.4%, and 48.6% YTD, respectively.

Last month, it was announced that chemicals and fertiliser manufacturer, Omnia’s (-47.1% YTD) shareholders had resoundingly backed a contentious financial revamping plan to restructure its balance sheet and sell R2bn worth of new shares.

Finally, rounding out the ten worst performers YTD we have Invicta Holdings and Sappi – down 45.3% and 44.6% YTD, respectively. On 1 August, Sappi reported a very weak 3Q19 with the pulp, packaging and paper company saying that profit for the three months ended June plunged to $8mn from $51mn in 3Q18. Sappi also indicated that it now expects 4Q19 EPS to be down YoY, implying 4Q19 EPS of at most $0.19 (4Q18: $0.20) and FY19 EPS of at most $0.48 (FY18: $0.59).