Be afraid! Be very afraid!

That seems to be the message from the financial media and many investment houses. After living through three bear markets in six years, investors are understandably on edge, even though major equity indices trade at or near all-time highs.

This article explores four key ideas:

- I believe that most investors are too risk-averse.

- From an asset allocation perspective, the job of the equity bucket is to take risk.

- The equity market offers attractive potential rewards for risk takers.

- AI remains a generational opportunity for risk takers.

Most investors are too risk-averse

‘Risk’ is a loaded word. For some, it means volatility; for others, it means the permanent loss of capital. For fiduciaries, risk also includes career risk – poor performance relative to benchmarks and peers, and the fear of being wrong.

But risk is not only negative. Stocks carry an asymmetrically positive payoff: while an individual share can fall to zero, winners can generate returns measured in multiples (think Apple, Nvidia and Tencent).

Why, then, are so many investors conditioned to avoid risk? Fund managers now in their 40s to 60s were deeply scarred by the global financial crisis. More recent bear markets have reinforced the fear that there is always another shoe to drop. Surveys show caution among Baby Boomers, while many Millennial and Gen Z investors are also surprisingly risk-averse. More recently, institutional investors have been underallocated to equities as markets surged higher.

Retail investors, less constrained by institutional mandates, have participated in the rebound more aggressively – and been rewarded for assuming the risk that institutional investors were not prepared to take.

Playing on the law of conservation of energy, I propose the Dennis Law of Conservation of Risk: risk cannot be created or destroyed, only transformed. When a financial advisor or fund manager reduces equity exposure to avoid the reputational risk of being wrong (“How can you hold equities when tariffs are going to destroy the US economy?!”), they increase the client’s risk of not meeting their long-term financial goals.

As an investor, you do not have to take risk, but there are consequences for not doing so. In investing – as in life – the biggest risk is not taking any risk at all.

The job of the equity bucket is to take risk

Risk minimisation appears to have been pushed down to every sleeve of many portfolios. Numerous equity funds are effectively structured as “all-weather” portfolios, treating the equity sleeve as if it represents 100% of a client’s assets. That misunderstands the role of equities: to earn the expected premium for taking equity risk and to capture the market’s asymmetric upside over time.

Equities are poor hedges against themselves. A defensive, stable company like Nestlé can still fall meaningfully in a bear market and then lag the market in the subsequent recovery.

True hedges should be uncorrelated assets – bonds, gold, certain commodity strategies, or volatility overlays. Put differently: The more effective your hedges, the more risk you can responsibly take within the equity sleeve. In racing terms, the better the brakes, the faster you can drive! In portfolio management terms, better hedging can allow for a more aggressive equity allocation without an unacceptable increase in overall portfolio drawdown risk.

Equity markets offer attractive potential rewards for risk takers

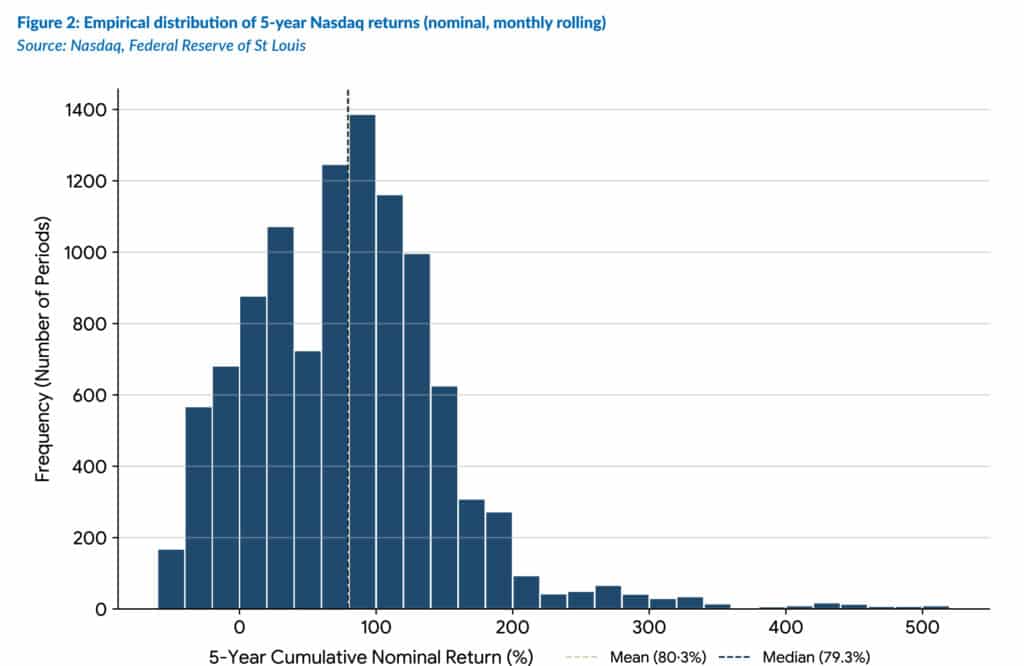

The chart below shows the distribution of rolling 5-year returns of the Nasdaq (an index that is widely believed to be high risk) based on its history. It shows that while negative outcomes over five years do occur, they are a relatively small share of possible outcomes, whereas extreme positive outcomes are possible. Over longer horizons, the skew is strongly positive.

Investors often obsess over the left tail of the distribution, without considering the upside on the right. The AI revolution means there is a greater probability of right-tail outcomes than is widely anticipated.

AI remains a generational opportunity for risk takers

Global equities are currently in a bull market, and AI has already produced massive stock market winners. The opportunity set can be divided into four groups:

- AI Infrastructure: Companies that supply the building blocks for AI (e.g. Nvidia, Taiwan Semiconductor Manufacturing Company [TSMC], and firms that build and service data-centre infrastructure).

- Native AI businesses: Firms whose core product is driven by AI (e.g. advertising platforms like Meta and Google [Alphabet]).

- AI-enhanced leaders. Companies with strong competitive positions are using AI to make their businesses even stronger. These companies are using AI to generate revenue and reduce costs – this combination will result in rising margins and returns on capital. This is the broadest and most fertile cohort.

- Scarcity and humanity plays. Companies that facilitate human connection will become even more valuable as AI agents and bots increasingly overrun the internet (e.g. Meta and Reddit).

AI poses an existential threat to many incumbents. Separating the winners from the losers will require active selection and judgement. It is not enough to simply take risks – you must take the right risks.

Conclusion

Given the generational AI opportunity and widespread risk aversion, we believe that taking equity risk — with thoughtful hedges and rigorous selection — is justified. The real question for each investor is not whether to avoid risk entirely, but whether their current allocation positions them to meet their long-term goals.

Are you taking enough risk?