Anheuser-Busch InBev (ABI) reported 2Q21 (to 30 June 2021) results on Thursday (29 July). Sales rose 21% YoY and volumes were up 28% YoY, beating Bloomberg consensus analyst expectations of 19% sales growth and 24% volume growth YoY, respectively. However, profit missed consensus forecasts as raw material costs dragged gross profit (GP) margins down.

The company maintained full-year (FY21) guidance (of 8%-12% YoY EBITDA growth), but the share price fell c. 5% in US dollar terms on the day of the results announcement, as investors were likely hoping to see guidance raised as the operating environment improved.

Leverage continued to improve (net debt/EBITDA now stands at 4.4x) as the business digests the borrowings from the SA Breweries (SAB) purchase, but it remains well above the company’s desired 2x level. Most of the Group’s debt is in hard currency (c. 52% is in US dollar and c. 38% is in euro).

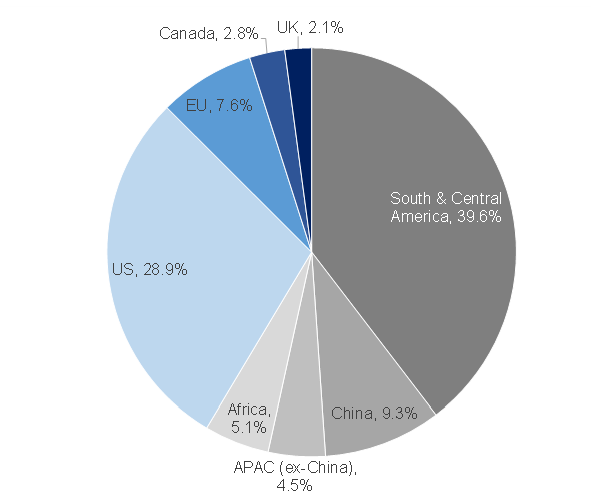

As a reminder this company is heavily reliant on emerging markets (EMs) for its earnings (c. 65% of pre-COVID-19 EBITDA), with a huge bias towards Latin America (c. 50% of pre-COVID earnings).

Figure 1: ABI revenue is skewed towards EMs, particularly Latin America

Source: Anchor, ABI

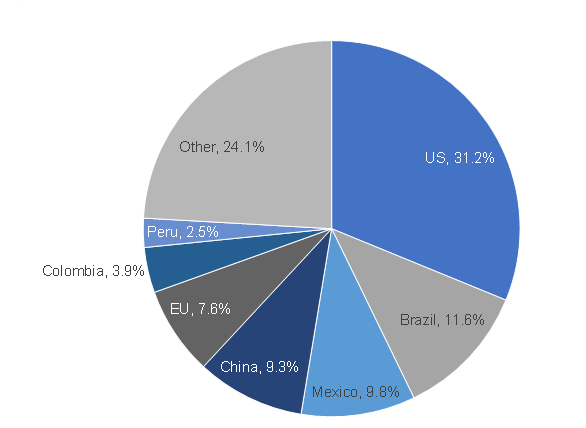

The US remains the company’s single biggest country exposure, but Brazil and Mexico are also key (see Figure 1 and 2).

Figure 2: US, Brazil, and Mexico are the most significant revenue generators for ABI

Source: Anchor, ABI

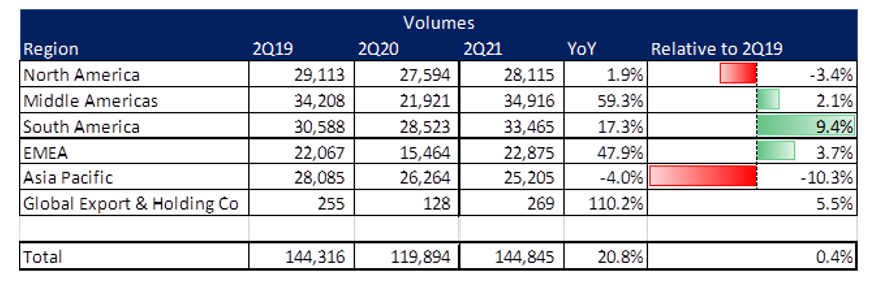

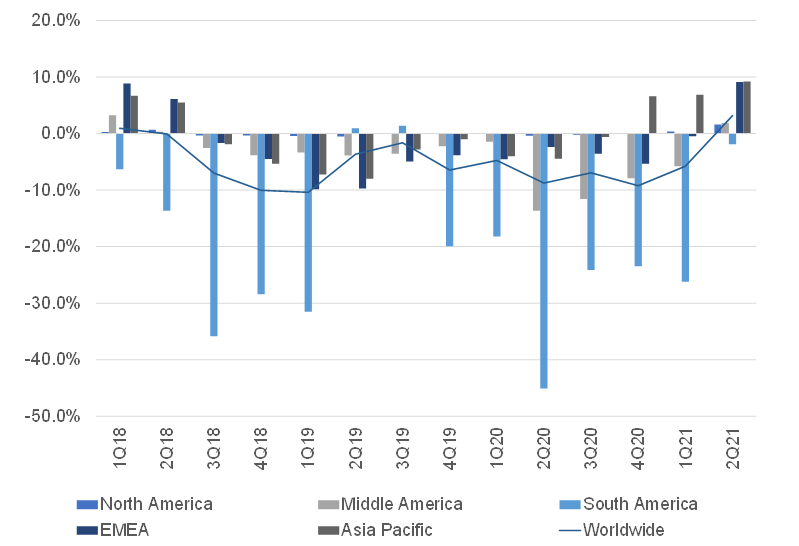

Figure 3: Group volumes are back above pre-COVID-19 levels

Source: Anchor, ABI

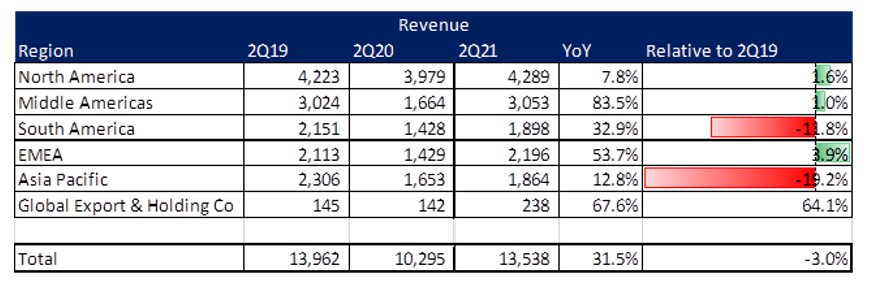

However, revenues (in the company’s reporting currency – US dollars) are still lagging, particularly in South America, where weak currencies have had a massive impact on revenue.

Figure 4: Weak EM currencies have weighed on reported revenue

Source: Anchor, ABI

For most of the past few years, currencies have been a significant headwind (a c. 5%-10% impact on EBITDA YoY), although they seem to be forming a base and 2Q21 saw a small YoY tailwind from currencies for the first time in years.

Figure 5: Weak EM currencies have been a c. 5%-10% drag on YoY EBITDA for the past few years but 2Q21 saw this impact trough and turn into a small tailwind

Source: Anchor, ABI

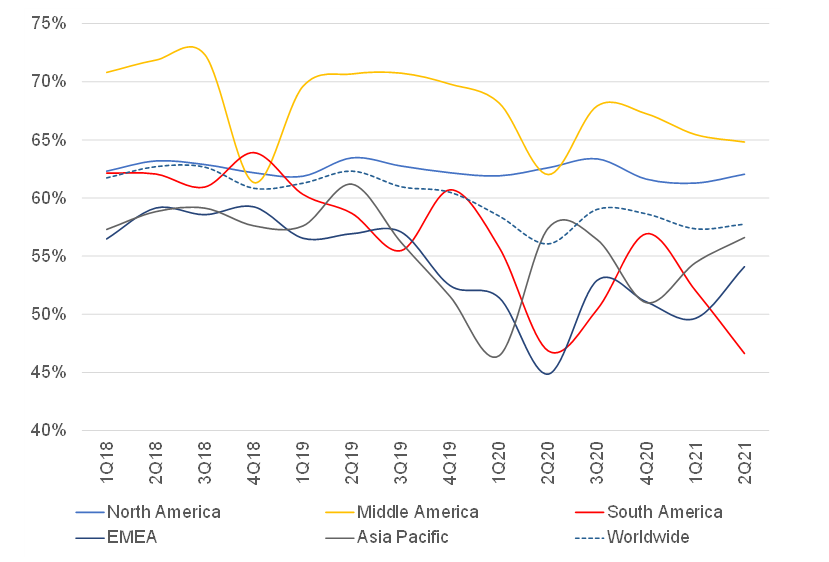

The currency headwind has weighed heavily on GP margins, particularly in the key Latin America region.

Figure 6: Weak EM currencies are weighing on gross profit margins in key EM regions

Source: Anchor, ABI

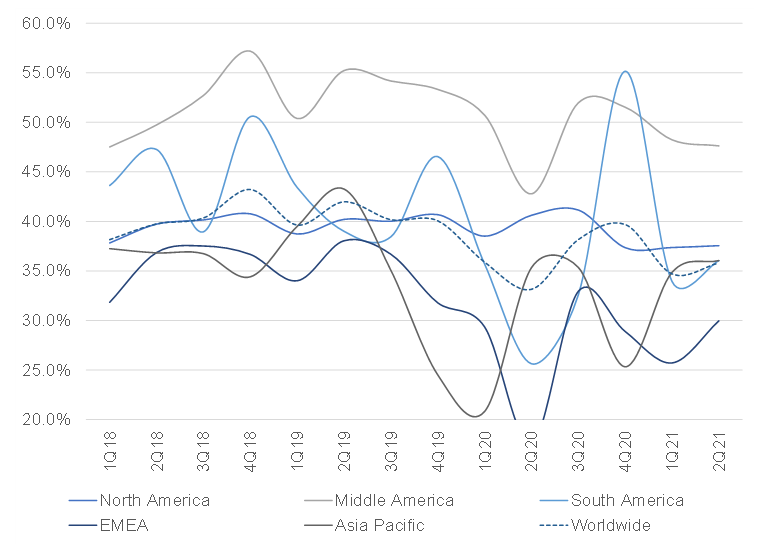

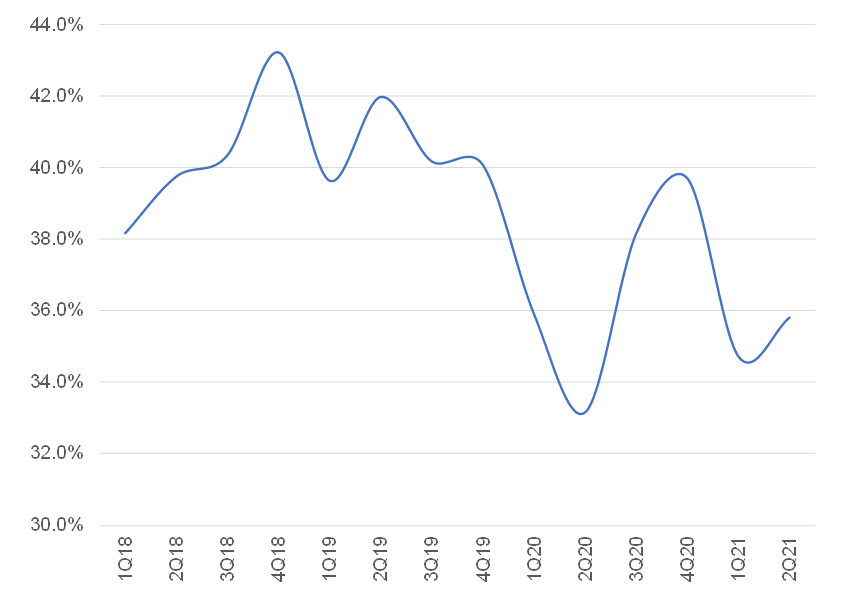

Figure 7: Gross profit margin pressure is keeping operating profit margins depressed

Source: Anchor, ABI

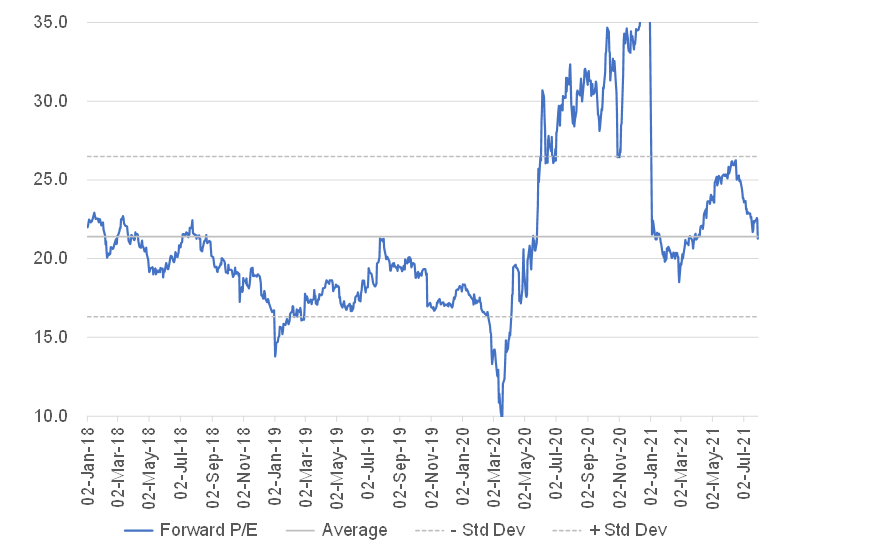

The post-earnings share price retracement has left the share trading on c. 21x next twelve months forecast earnings, which is close to the average rating it has traded on over the past few years.

Figure 8: The recent share price retracement has returned the ABI rating to around the average of its recent range

Source: Anchor, ABI

If we assume it can return to a 40% EBITA margin, that is a c. 12% tailwind to earnings growth.

Figure 9: Operating profit margins are at depressed levels and provide the prospect of a tailwind to earnings growth if margins return towards 40%

Source: Anchor, ABI

However, returning to a 40% operating margin relies heavily on a recovery in Latin American currencies (particularly the Brazilian real), which is still down c. 23% from pre-COVID levels (having already dropped c. 22% in the two years leading up to the pandemic).

Figure 10: A precipitous drop in the Brazilian real exchange rate vs the US dollar over the past few years has been a major headwind to profit margins

Source: Anchor, Bloomberg

Conclusion

With high levels of hard currency debt, the company does not have much room for error. Essentially, it remains a fairly risky play on a rally in EM currencies, with no prospect of meaningful dividends or share buybacks in the near future and, in our view, the current rating does not adequately compensate for that risk.