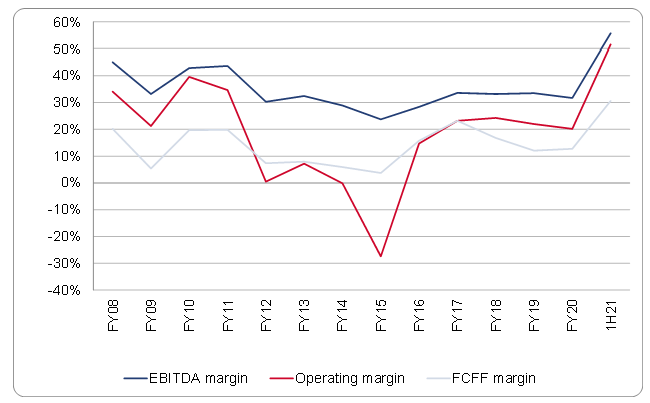

Anglo American (Anglo) reported record profit in its results for the six months ended 30 June 2021 (1H21), released on Thursday (29 July 2021). Anglo recorded six months of very strong earnings and free cash flow (FCF) generation, with the past six months of FCF generated ($6.7bn before accounting for minority interests) being higher than any annual number over the historic period of our Anglo model (going back to 2008). Similarly, Anglo’s margins over the six-month period were higher than in any year over the past two decades.

EPS totalled US$4.30/share of which US$3.31/share was paid out in dividends and the share buyback (see our comment below). Earnings before interest, tax, depreciation, and amortisation (EBITDA) totalled US$12.1bn – a record, according to Anglo CEO Mark Cutifani. The results were driven by strong platinum group metals (PGM) prices, iron ore, copper, and an improvement at De Beers. Of the US$12.1bn in EBITDA, US$7.9bn was on the back of commodity prices that were 62% higher YoY. By business segment, c. 75% of EBITDA was due to contributions from Kumba Iron Ore and Minas Rio’s iron ore businesses (US$4.91bn), and Anglo American Platinum ([Amplats] US$4.38bn). As of 30 June, net debt totalled US$2bn – down US$3.5bn or 74% YoY because of attributable FCF of US$5.4bn.

This earnings boom is allowing Anglo to do two important things:

- Reduce net debt significantly. At this run-rate, Anglo is likely to be in a net cash position soon.

- Get more aggressive on returning cash to shareholders. Anglo declared a special dividend, with its total dividend equating to just below 60% of earnings – higher than the Group’s formal dividend policy for a minimum of 40% of earnings. Anglo also announced a US$1bn share buyback which equates to c. 2% of its total market cap. Altogether, Anglo is allocating $4.1bn in dividends and share buybacks on the back of this set of results. That is 79% of 1H21 net income (after accounting for minority interests). To look at it another way, the US$4.1bn of cash returns is just over 9% of the company’s closing market cap of GBP44.8bn on 28 July.

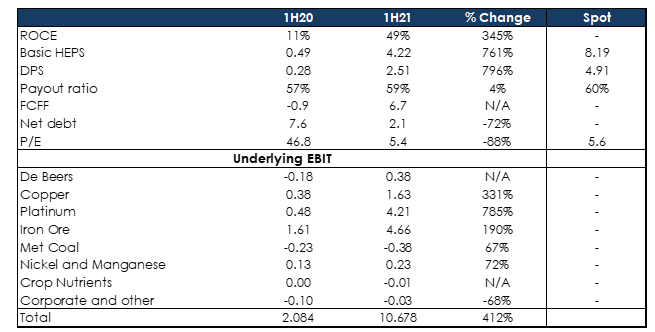

Figure 1: Anglo 1H21 results overview, US$bn except per share

Source: Anchor, Bloomberg

Figure 2: Anglo margins

Source: Anchor, Bloomberg

Given the Group’s strong FCF being generated and a balance sheet which is already in decent shape, we would expect cash returns to continue to be abnormally high if commodity prices remain strong. That is our view not just for Anglo but for the diversified mining sector in general. For that reason, we continue to own Anglo shares in our portfolios.