In this note, the Anchor investment team highlights a selection of global shares we believe are worth watching in the year ahead. These picks, presented alphabetically, illustrate our stock-picking philosophy. Please note that these individual stock ideas may not necessarily be reflected in all client portfolios, given the differing mandates and risk-return profiles.

Recent market jitters aside, which might call into question whether we will see the seasonal strength that is common at this time of year (the so-called “Santa Claus rally”), at the time of writing, 2025 is shaping up as a strong year for virtually all risk assets. Across equity markets, while tech leadership has remained a dominant theme, performance was broader than the extremely frustrating 2024 period, when it appeared to be virtually the only game in town.

At a headline level, equity markets adjusted to a materially different US policy backdrop in 2025, weathering the arrival of Donald Trump in the White House in January, who promptly set about proving that his election promises were not mere bluster. While markets have so far weathered the barrage of erratic policy emanating from Trump’s second term – tariffs that have ebbed and flowed all year with underlying trade policy an increasingly remote justification, an unpredictable approach to foreign policy around friend and foe alike and a far more transactional slant to dealings with the private sector (with a strong tinge of opportunistic self-dealing) – there are signs under the hood that this has had consequences.

Indeed, the massive investment into artificial intelligence (AI) infrastructure has been an unstoppable force that has papered over the chilling economic effect that the erratic Trump administration has had elsewhere. Many economists have argued that the US would be in recession were it not for this AI-driven investment push. Supporting this view, we have seen signs of a gradual rotation away from US-centric risk: a weaker US dollar, a remarkable rally in the gold price and the relative outperformance of European and emerging market (EM) equities all suggest a quiet and, so far, relatively orderly diversification away from the US.

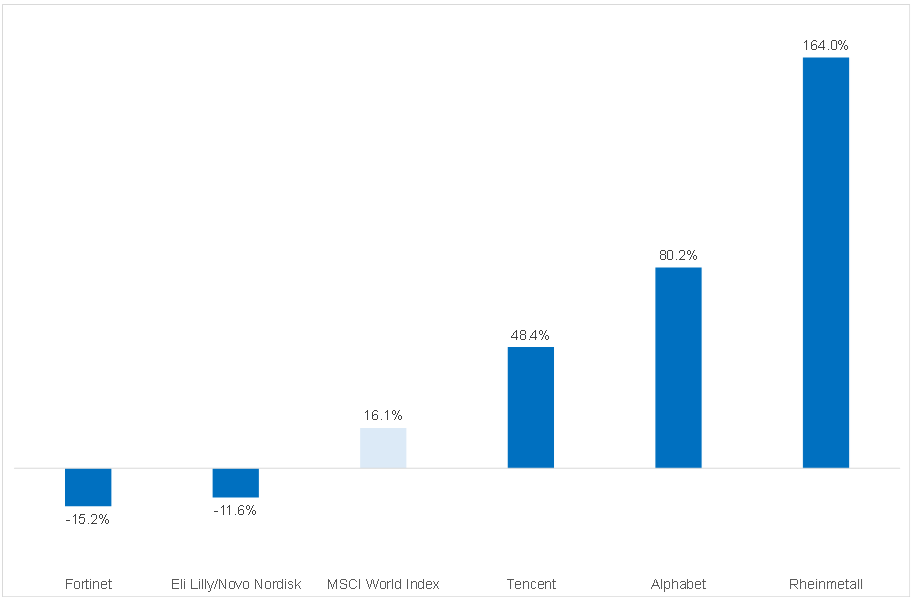

So, in this eventful year, how did our 2025 global stock picks fare? An equal weighting in each of the stocks we selected would have returned a pleasing 53% return, substantially outperforming the global developed market (DM) benchmark. However, much as strong headline returns from equity markets in recent years have concealed a minefield that has existed at an individual stock level, our outcome was thanks in large part to some pleasing outsized wins.

On the other side of the ledger, despite hedging our bets with two of the market leaders benefitting from the fast-growing Glucagon-like peptide-1 (GLP1) weight loss theme, we found there is no sure thing in pharma. The travails of Novo Nordisk suggest we should have paid up and backed the emerging winner in this space (Eli Lilly), which would have yielded a positive return of 32% if we had not hedged our bets. Fortinet, a dominant and well-run cybersecurity play, reminded us that not all technology companies are beneficiaries of the AI trade. Whether it be firms diverting capex from other areas of IT investment towards AI or growing investor unease about what AI will mean for the moats that various software applications have enjoyed to date, cybersecurity proved not to be as all-conquering as it had been in previous years.

Figure 1: Anchor’s 2025 global stock picks – US$ total return

Source: Anchor, Bloomberg

Note: MSCI World performance is from 9 December 2024 to 1 December 2025.

Turning to 2026, we enter the year with headline market valuations at similar levels to where they were this time last year – unquestionably elevated relative to history. We are mindful that, historically, significant market corrections have typically been triggered by left-field events that no one saw coming and not by the elephant standing in plain sight. A key polarising debate raging at the moment is whether current AI investment will yield the required returns and how long investors will be willing to tolerate it before demanding greater evidence of returns. A shift in sentiment there could be a source of volatility in the year ahead and, should a plurality of investors shift to the bearish side of this debate, it is difficult to envisage a positive outcome for equities more broadly in the face of mega-cap technology names aligned with AI coming under pressure.

However, for balance, it is worth remembering there are also constructive forces at play in 2026 – US interest rates appear likely to continue declining, we seem to be past the point of peak disruption from the Trump administration, with easing policy uncertainty, as US courts clarify the legislative boundaries of past executive actions. In addition, the approaching US mid-term elections will likely introduce incentives for stability and economic resilience, as self-interest, no doubt, dictates that these macroeconomic factors will be an important determinant for how the Republicans fare.

Acknowledging that we are entering the fourth year of a bull market with valuations on the demanding side and an ever-present array of possible risks to trip markets up, our 2026 global stock picks remain firmly grounded in our quality growth principles. We have avoided doubling down on the AI winners, opting instead to bet against the prevailing belief that AI is about to render alternative software developers redundant (Booking Holdings and Constellation Software), backed the proprietary nature of data that AI will not magic its way around (London Stock Exchange), capitalised on recent weakness in Meta and identified the “Capitec of Latin America” – Nu Holdings – as a compelling way to participate in renewed investor appetite in EM growth.

Booking Holdings: A quality compounder at a reasonable price

By James Bennett, Global Equity Analyst

Booking Holdings is the world’s leading online travel services provider. Operating in more than 220 countries, across 40 languages, and with c. 31mn listings, the company was founded in 1996 as Priceline.com and listed in 1999, just before the global tech bubble burst. It acquired Booking.com in 2005 for US$133mn, and rebranded to Booking Holdings in 2018. Glenn Fogel, CEO since 2017, has been with the Group since 2000. Today, it has a market capitalisation of c. US$160bn and is a member of both the S&P 500 and Nasdaq 100 (since 2009).

Although casual users of Booking could be forgiven for viewing it as primarily a website/app run by a handful of people linking travellers to hotel websites, it employs c. 24,800 people across over 70 countries. Staff verify venues, assess facilities, navigate local travel regulations, train hotel operators (on how to use their systems), and resolve traveller issues.

Booking Holdings operates five individual brands:

- Booking.com (booking accommodation, flights, rental cars and hotel shuttles),

- Rentalcars.com (booking rental cars within the Booking.com brand),

- Priceline.com (discount travel),

- Agoda (Asian-focused accommodation with a global footprint),

- OpenTable (online dining reservations), and

- Kayak (a travel search engine which directs you to book on the underlying websites).

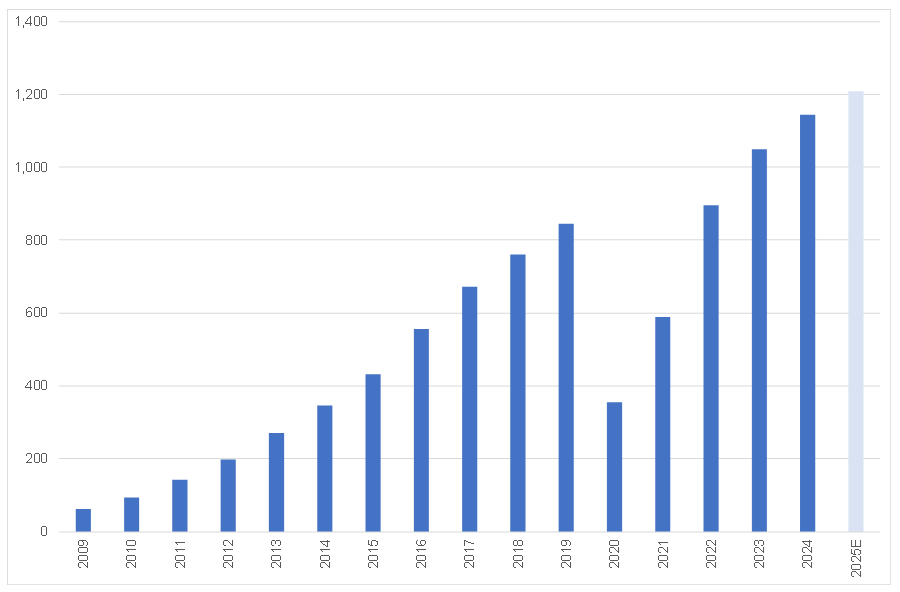

Booking is positioning itself as a one-stop travel shop. It offers travel accommodations, rental cars, airline tickets, shuttle services and local experiences. Booking uses the “connected trip” strategy to encourage users to book two or more of its different services on a single trip. The company believes that offering a wide travel platform makes users more loyal to Booking and more likely to use it for subsequent trips. Over 10% of all bookings done on its platform now use two or more of Booking’s services for a single trip, and the Group is likely to surpass 1.2bn room nights sold in 2025.

Figure 2: Booking Holdings room nights booked (mn)

Source: Company reports, Anchor

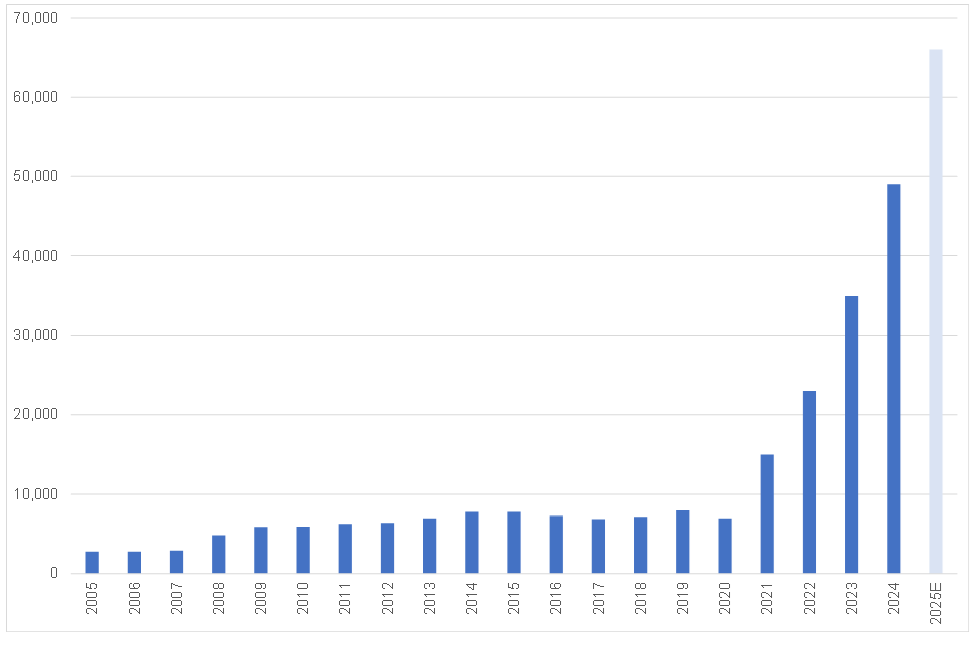

Airline tickets are not yet a major profit driver for Booking, but they increase platform engagement. Booking is on track to sell about 66mn air tickets through its platform in 2025, up materially from under 10mn five years ago.

Figure 3: Booking Holdings airline tickets processed (’000)

Source: Company reports, Anchor

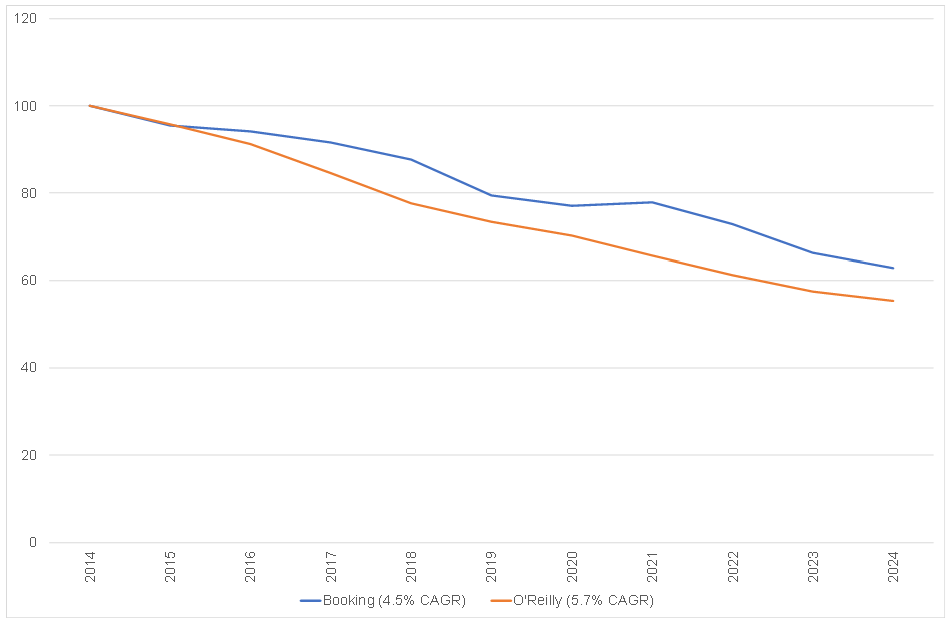

Booking has an excellent capital allocation track record. Ongoing share buybacks have reduced shares in issue at a compound annual growth rate (CAGR) of 4.5% p.a. over the past decade. This is not far off from O’Reilly, which is considered a leader on this metric.

Figure 4: Booking Holdings vs O’Reilly shares in issue (indexed to 100 in 2014)

Source: Company reports, Anchor

A key risk often cited for Booking is the rise of AI agents that can book holidays for users with minimal involvement on their behalf. However, we believe that Booking remains in a powerful position. As mentioned earlier, it has people on the ground in over 70 countries running an extensive travel network. AI agents, on their own, are unlikely to be able to replicate this. Furthermore, Booking already uses AI internally to make its own processes more efficient.

Some 70% of Booking’s sales are now done on the “merchant model” where Booking uses its balance sheet to purchase inventory upfront, guaranteeing revenue for the hotel/venue. About 55% of Booking’s sales bypass Google, where people go directly to the Booking app because they trust it. Our view is that Booking is somewhat like the rails of Visa and Mastercard. While these AI booking systems will become an increasing reality, a lot of this business will still end up going through the “rails” of Booking. In other words, there is so much more to a hotel booking network than the AI agent who goes in and physically logs the booking for you online. Booking is planning to launch its own full-service AI booking agents and already has “light touch” agents that can perform simpler tasks for users.

In our view, Booking is attractively valued. It is currently trading on a P/E of c.19x to December 2026, which materially derisks the investment thesis. It has free cash flow (FCF) margins in excess of 30% while steadily reducing its shares in issue via its ongoing share buyback programme. This is a high-quality earnings per share (EPS) compounder (12%-15% p.a.) at an attractive valuation.

Constellation Software: Opportunity amid uncertainty

By Seleho Tsatsi, Investment Analyst

We believe Constellation Software (Constellation) represents an attractive investment opportunity. Despite continuing to grow revenue and earnings at more than c. 20% p.a., the share price has come under significant pressure in 2025, falling 24% in US dollar terms vs the MSCI World Index’s c. 21% gain. We believe this underperformance largely reflects two major concerns – the stepping down of founder-CEO Mark Leonard and investor anxiety about the impact of AI on software businesses.

Constellation is a serial acquirer of vertical market software businesses. Based in Toronto, Canada, Constellation has acquired hundreds of software companies since it was founded in 1995. In contrast to private equity, Constellation acquires companies with the intention to hold them indefinitely. It also does not borrow significantly or issue equity to fund its acquisitions. Instead, earnings from previously acquired companies are used to fund future acquisitions. The results over Constellation’s thirty years in business have been phenomenal. This disciplined capital allocation has allowed Constellation to compound revenue and earnings above 20% p.a. over the short, medium and long term (see Figure 5). We do expect growth rates to moderate, given the business’s now greater size (revenue passed US$10bn in 2024). Nevertheless, if growth rates can stay in the mid-teens for the next couple of years, total returns for shareholders should be strong.

Figure 5: Constellation Software: Historical rate of compounding to 2024

Source: Company filings, Anchor Capital

In September 2025, Leonard announced his immediate retirement for health reasons. He is in his 60s, and the announcement did not specify his health challenge, but Leonard had previously said, “I love what I’m doing, and don’t want to stop unless my health deteriorates or the board figures it’s time for me to go.” He remains on the board. His successor, Mark Miller, started his career in software development, founding a transit software company – Trapeze Group, which was the first company that Constellation acquired in 1995. Miller became COO of Constellation in 2001 while continuing as CEO of Trapeze. In 2011, Miller became CEO of Volaris, one of Constellation’s operating groups. Volaris has made over 200 acquisitions since then. Given the importance of management and capital allocation to the Constellation story, it is understandable that investors would be concerned by the leadership transition. Nevertheless, Miller’s long tenure with the company and extensive experience as a software developer, founder, CEO of a software business and later as a capital allocator in the software sector is encouraging.

The second driver of the share price underperformance is concern amongst investors about the impact of AI on software businesses. Constellation acknowledges the significance of AI. Leonard stated that software development is at a fascinating, complex point in time. It is difficult to say whether programming faces a renaissance or a recession. Programmers could experience rapid demand for their services if their efficiency improves 10x. Programmers could also have a 10x increase in supply without commensurate productivity increases. Or we could land somewhere in between (or even outside of) that.

There are multiple concerns that investors have regarding AI’s impact on the enterprise software sector, including:

- Allowing more clients to develop solutions in-house increases the competition that external software providers such as Constellation face.

- AI-native software applications are reducing the switching costs that have historically protected incumbents. In some verticals, the user interface may transition from hard-to-master tools to prompts that allow less skilled users to get up to speed with the software quickly. These are valid concerns. However, several factors mitigate the risk. Many institutions, public or private, are unlikely to maintain their own software, even with the help of AI. Maintenance, debugging, data portability and switching costs from mission-critical use-cases are essential factors that remain.

- Constellation’s model is uniquely adaptable in that it reinvests close to all its earnings every year into acquisitions. This allows it to refresh its portfolio continually, apply learnings to future acquisitions and steer the business into new directions through acquisition, if it deems that to be necessary.

At a 17x one-year forward P/FCF multiple, the valuation reflects much of the uncertainty. If Constellation can maintain mid-teens earnings growth, we believe the current share price presents an attractive entry point with the potential for substantial future shareholder returns.

London Stock Exchange Group: Premium data assets at a non-premium multiple

By Keagan Higgins, CGMA, ACMA, Investment Analyst

The London Stock Exchange Group (LSEG) enters 2026 in the unusual position of being a premium financial data and analytics franchise priced as though it were a far more cyclical business. The share trades on a forward P/E of around 20x, well below its long-term average of around 25x and materially below the c. 30x multiples commanded by global peers such as S&P Global, Moody’s and MSCI.

Much of this disconnect stems from the market’s outdated perception of LSEG as primarily an exchange operator. This is despite exchange services currently contributing less than a quarter of total Group revenue. In effect, we believe the market is anchoring to the wrong part of the earnings base. The fundamental drivers of value are its data, analytics, indices and workflow platforms – businesses that are higher-quality, recurring, resilient and protected by deep competitive moats.

Fundamentally, LSEG continues to deliver. Consensus forecasts point to a c. 14% EPS (in US dollar terms) CAGR over the next three years, outpacing its global peers. The revenue line remains remarkably resilient. More than 70% of revenues are recurring, and the Group has demonstrated an exceptional ability to grow through periods of extreme volatility in markets, rates, and macro conditions.

Figure 6: A track record of uncorrelated, all-weather organic growth

Source: Company reports

This stability is best illustrated in the contrast between LSEG’s organic revenue growth, which has remained steady in a mid- to high-single-digit range largely uncorrelated with the volatility seen across major equity markets and economic indicators.

The recent derating reflects concerns that generative AI could erode the value of financial data-rich platforms. In our view, the risk is overstated for LSEG. Around 90% of its database is proprietary and sits behind licensing and permissioning, making it inaccessible to public AI models. What is publicly accessible is mostly generic public material, such as company reports and macro data, that clients do not pay LSEG a premium for.

The commercially valuable layer remains protected and difficult to replicate. This is curated, regulated information built for high-trust financial decision-making. In practice, AI is more likely to reinforce LSEG’s position than disintermediate it. Advanced models need licensed, verified datasets to function in regulated environments. Recent partnerships, including with AI startup Anthropic, underscore that AI is more likely to become a customer of LSEG’s data, not a competitor.

A significant tailwind now emerging is operating leverage. Given the largely fixed-cost nature of the platform, around 70% of incremental revenue flows through to EBITDA, allowing margins to expand even on moderate top-line growth. This is the payoff from several years of integration and platform consolidation following the Refinitiv acquisition. As the combined business scales, LSEG is steadily improving capital efficiency and growing into its enlarged asset base.

LSEG in 2026 stands out as a wide-moat, defensive compounder with resilient growth, expanding profitability, and a data advantage that AI is more likely to monetise than undermine. In a world where many portfolios are leaning into noisy, high-beta AI trades, LSEG offers a rare differentiator – a steady, trusted compounder at an attractive valuation. As operating leverage continues to build, the case for a re-rating becomes increasingly compelling.

Down but not out: Why Meta is poised for a 2026 resurgence

By Nick Dennis, Fund Management

Meta (owner of Facebook, Instagram, and WhatsApp) has been no stranger to controversy since its listing in 2012. From political misinformation concerns during the 2016 US presidential election to the Cambridge Analytica scandal of 2018, Meta and founder Mark Zuckerberg have faced no shortage of critics. Meta’s stiffest challenge came over the course of 2021 and 2022, as Apple enacted privacy changes which severely impacted Meta’s advertising targeting ability. Over the same period, the market revolted against Zuckerberg’s plans to invest heavily in the company’s Metaverse concept.

To further complicate matters, technology shares experienced a brutal bear market as the US Federal Reserve (Fed) rapidly raised interest rates to combat inflation. Nevertheless, Zuckerberg and Meta overcame these obstacles and emerged stronger. Despite several painful drawdowns, Meta shares have returned over 1,600% (more than 23% annualised) since listing.

Meta sold off 11% following its 3Q25 results, with a cumulative drop of over 25% between August and November 2025. The media and parts of the investment industry have pushed a persistently negative narrative around AI, which seems to have influenced investor sentiment. Capex-heavy businesses like Meta have borne the brunt of the market’s wrath. Meta shares de-rated from a 27x P/E peak during the halcyon days of its ‘AI beneficiary’ status in February 2025 to its current lowly 19x P/E as the market anticipates a ‘Metaverse 2.0’ phase.

We believe these fears are likely to be unfounded. Meta has shown it can monetise AI through targeted advertising. While Meta’s capex has grown from US$6.2bn in 2Q23 to a staggering US$14.4bn in 3Q25, its return on invested capital has expanded from 14.6% to 28% over the same period. In other words, Meta’s investments (particularly into its Nvidia-powered GPU infrastructure) have been highly productive. We would not be surprised to see incremental returns on invested capital drop from these lofty levels as capex (and spend on AI talent) is aggressively front-loaded. Still, we expect them to inflect higher thereafter.

Meta’s primary advantage is that it can leverage AI across platforms, reaching over 3.5bn people daily. In 3Q25, Meta noted that AI-based recommendations had led to an 8% YoY increase in time spent across its apps. End-to-end AI-powered advertising solutions already generate over US$60bn in annualised revenue, with conversion uplifts of 2% to 3% and with 14% lower cost per lead for advertisers. At Meta’s scale, even small percentage improvements can lead to billions of dollars of incremental revenue and profit.

Meta’s goal is for advertisers to initiate campaigns in much the same way that people input prompts into ChatGPT. This would democratise advertising in a way that has been unthinkable until now, substantially growing its addressable market. We would expect this to drive higher revenue, profit, and returns on capital.

History has shown that Meta’s drawdowns have been buying opportunities. We do not know how long they will last or how deep the fall will be, but we do know that Zuckerberg is among the greatest operators of his generation. As the American football coach Vince Lombardi once said, “It’s not whether you get knocked down, it’s whether you get up.”

We believe Meta, after getting knocked down in 2025, is well placed to get back up in 2026.

Nu Holdings Ltd.: A standout growth story in EM banking

By Liam Hechter, Fund Management

Nu Holdings Ltd. (Nu), the parent of Brazil-based digital bank Nubank, remains one of the world’s fastest-growing financial platforms, and we believe its momentum can continue over the next 12 months.

Nu is a 100% app-based bank, serving customers across Latin America, primarily Brazil, Mexico, and Colombia. Through the app, users can open a free digital account, access a no-fee credit card, pay bills, take personal loans, invest, buy insurance and use small-business banking – all without traditional branches. This low-cost “mobile-first” model allows Nu to offer simpler, cheaper products than legacy banks, which are still weighed down by branch networks, paper processes and fees.

Nu has scaled at a pace that traditional banks have not matched. By late 2025, Nu served about 127mn clients, up from c. 114mn at the end of 2024. Financial performance has been equally strong: in 2024, revenue grew c. 58% YoY to about US$11.5bn, and net income nearly doubled to c. US$2bn. Return on equity (RoE) – a key profitability metric for banks – reached close to 30%, already matching or exceeding many established global banks.

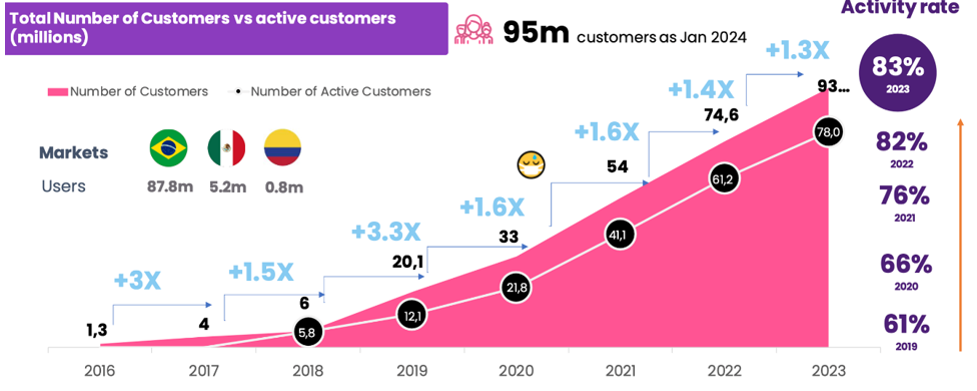

Figure 7: Nu – strong customer acquisition and sustained growth in activity rate

Source: Nu earnings presentation 4Q22, 2023 Nu Bank’s 4Q23 earnings presentation

Note: No active rate data available pre-2018.

The momentum has continued into 2025. In 3Q25, Nu delivered net income of c. US$783mn (+39% YoY on a currency-neutral basis), with revenue of US$4.2bn, and record RoE of 31%, while credit quality in Brazil improved.

The reasons why we are bullish on Nu for the next 12 months include:

- Huge, underserved markets: Nu already serves more than half of Brazil’s adult population, yet its presence in Mexico and Colombia, where traditional banks are even less loved and digital penetration is lower, is still in the early stages. Simply rolling out the “Brazil playbook” in these markets can sustain strong customer and revenue growth.

- Operating leverage and rising profits: Most of Nu’s costs are centred on technology and marketing, not branches. As more customers join and use more products, revenue can grow faster than expenses. That is already visible in the rising RoE and expanding profits, and analysts still expect Nu’s revenue to grow far quicker than the average bank over the next few years.

- An improving risk profile: For a fast-growing lender, credit quality is critical. Nu’s delinquency rates in Brazil have been broadly stable or improving even as the loan book expands in Mexico, reassuring investors that growth is not coming from reckless lending.

- Supportive valuation and sentiment: Despite a strong share price performance in 2025, market commentators and analysts remain positive, highlighting Nu as a high-quality way to play the shift to digital banking growth across EMs, with upside potential if execution stays strong.

Bottom line

Nu combines rapid growth, rising profitability and huge long-term market potential. For an investor comfortable with EM volatility, we see Nu Holdings as an attractive, growth-oriented banking story with further upside over the next 12 months as it continues to scale across Latin America.