In this note, the Anchor investment team has selected five global equities that we believe are worth keeping an eye on in the year ahead. In compiling this list, we have tried to identify shares that are not necessarily in all of our portfolios (as our portfolios have different mandates and risk-return profiles). However, we did try and find stocks that indicate how we pick our shares and that mirror our philosophy in this regard. From a market perspective, it has been an interesting year with the difficult spot being emerging markets (EMs). However, by and large, if investors had taken some equity risk, they would have had a relatively good year and, especially on a two-year view (from the start of 2020), it has been a pleasing outcome.

As we enter 2022, there are factors to be concerned about including the new COVID variant and global markets that have run very hard, and we are looking at these shares with quite some caution. If interest rates go up, then banks can benefit quite nicely and banking shares are looking like pretty good value currently, while pharma companies seem quite cheap at the moment.

We are cautious moving into 2022 and that is largely due to valuations. We sit in a complex and concerning environment where US 10-year bond yields are at 1.5% but US inflation is sitting at c. 6%. That really does have to come down during the year.

Our approach is very much bottom up.

Boston Scientific

Boston Scientific is a mid-sized, US-listed medical technology (MedTech) company that manufactures medical devices. The Group has a market cap of c. US$50bn and that compares to some of its bigger competitors such as Medtronic, with a market cap of around US$150bn. So, Boston Scientific is a nice size business but with a decent growth runway if you think about it in the context of its market cap. To give investors a sense of where it has come from, going back to 2010, Boston Scientific was a fairly slow growth, unexciting medical device maker focused chiefly on cardiac rhythm management (pacemakers and similar devices). An unexciting part of the medical field, it was also mired in various court actions related to some of its products (although we note that this is, we think, something you should see as almost a “rite of passage” in this industry, as these companies are likely more vulnerable to that type of court action than in any other industry).

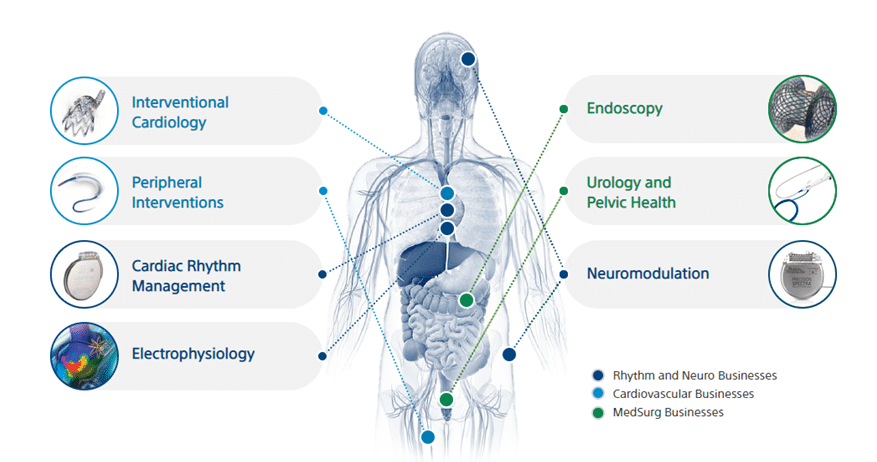

Figure 1: Boston Scientific: A diversified MedTech play

Source: Boston Scientific

Appointed in late 2012, the current CEO, Mike Mahoney, has led a transformation of this business, diversifying it into a range of new areas and particularly shifting its focus into higher-growth areas of medical intervention. Essentially, what Boston Scientific describes itself as being today is a competitor to surgery – it provides a whole range of minimally invasive gadgets that provide you with the favourable option of avoiding going under the knife. As we saw COVID-19 take hold, Boston Scientific did not escape the carnage, as elective procedures were pushed aside as hospitals filled up with COVID patients. This resulted in Boston Scientific’s share price coming under considerable pressure and we used that as an opportunity to add the share to our portfolios, believing that it was going to be a relatively temporary phenomenon. Subsequently, the company has begun recovering – both operationally and in terms of the share price.

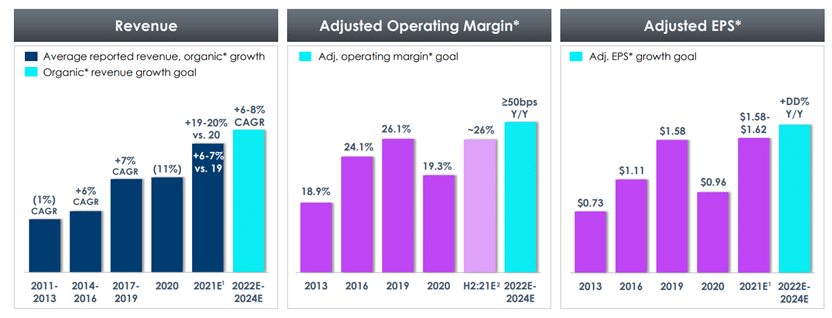

Nevertheless, with each COVID wave, it is presenting another opportunity for investors to buy the share and certainly the latest COVID wave (the fourth wave or Omicron fears) has seen Boston Scientific’s share price getting knocked again. It is our view that, although we are in the midst of a lot of uncertainty, the impact of COVID, is going to become less and less material. As much as you can defer the type of procedures that Boston Scientific provides devices for, you cannot completely cancel these so, in a sense, there is quite a lot of pent-up demand for its products. Figure 2 provides the guidance that Boston Scientific recently published at its latest investor day. You can see how the transformation of the business over the past decade has lifted into higher organic revenue growth. We note that this guidance refers to organic revenue growth. There is a very attractive pipeline of new devices in development and recent acquisitions that we would expect to add further to the growth it has already achieved.

As it integrates these businesses it has been very successful at driving steady margin expansion and positive operating leverage. When you combine that, approaching double-digit revenue growth to margin expansion, it is a business that, pre-COVID has already shown a very nice track record at solid double-digit revenue growth, so that is what investors will be buying.

Figure 2: Boston Scientific revenue, operating margin, and adjusted EPS, 2013-2024E

Source: Boston Scientific

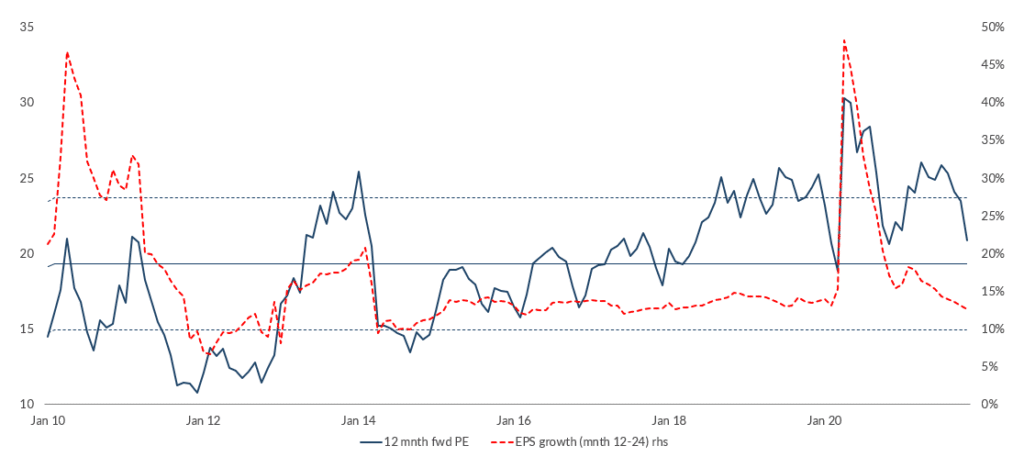

With respect to recent share price performance, the latest news around COVID, and the fourth wave, Boston Scientific has come under pressure, leading to a decline in the multiple of earnings at which it trades. It is now trading on a forward P/E of c. 21x for a business that is set to deliver steady, double-digit towards mid-teen hard currency earnings growth. We have a lot of confidence around its ability to do that, given the kind of cadence of new devices, new acquisitions and the mix of businesses that it has shifted the business towards. We see this as a real workhorse in the portfolio and a share that we would hope can compound steadily over the next number of years. It is likely to be a long-term holding for us.

Figure 3: Boston Scientific 12M fwd P/E 21x

Source: Boston Scientific

Ginkgo Bioworks

In Anchor’s global tech unit, we are always looking for new industries that look like they have enormous potential in the years ahead. Ginkgo Bioworks is a leader in a new field called synthetic biology – an area that we believe offers such potential.

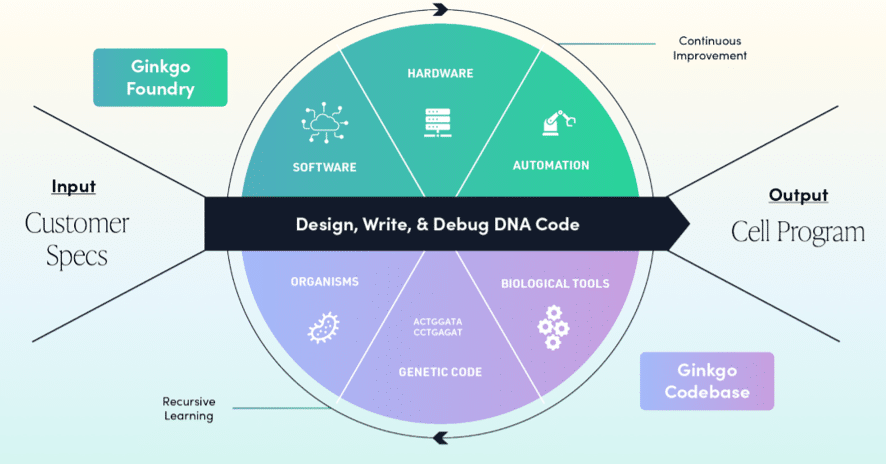

Ginkgo programmes cells (i.e., DNA base pairs) like software companies programme computers (i.e., 0s and 1s) to perform a particular function. This Boston-based business, founded over a decade ago by five MIT graduates, is a leader in the emerging field of synthetic biology, where companies change the genetic (DNA) code within cells (non-human!) to help corporate customers make products for a range of industries including agriculture, food, cosmetics, pharmaceuticals, industrial chemicals, etc. As an outcome of synthetic biology, think of the food industry’s plant-based hamburger patty which is an animal-free protein product that tastes, smells, and looks like meat (and is better for the planet!). Synthetic biology has enormous potential in a world struggling with sustainable resources.

Figure 4: Ginkgo programmes cells for its customers so they can develop new products

Source: Ginkgo investor presentation, May 2021

The opportunities are enormous – across the food, pharmaceutical, cosmetics, agricultural, and many other industries – to synthetically make products that would otherwise have been extracted from the natural world.

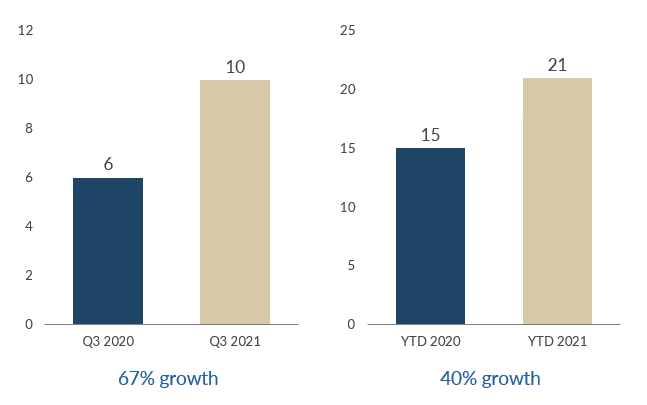

Figure 5: Ginkgo cell programming highlights total new programmes

Source: Ginkgo investor presentation, May 2021

Ginkgo has emerged from its formative years and is now expanding the number of cell programmes at a healthy rate. The customer base is expanding and so too are its revenues. For the nascent synthetic biology industry, we believe that Ginkgo is an attractive investment (market cap <US$20bn).

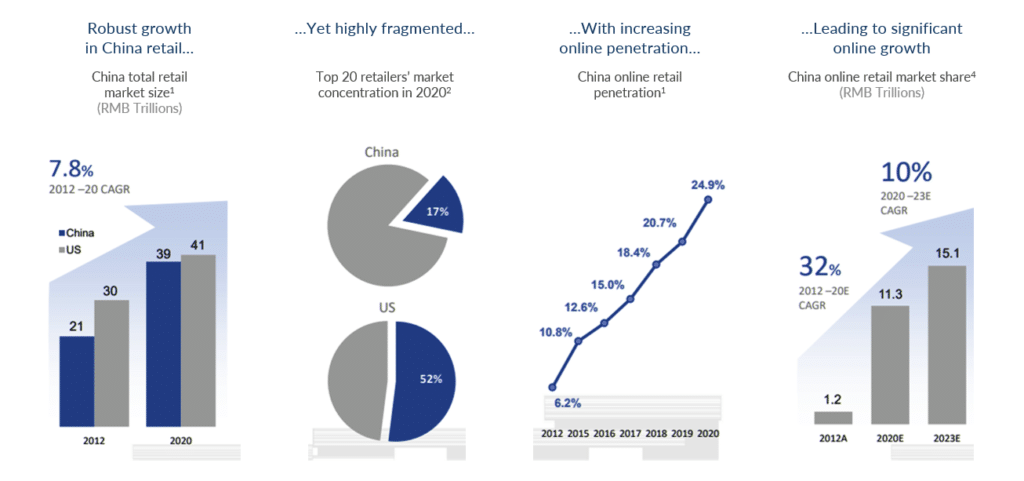

JD.com

JD.com is an e-commerce business listed in China, and it is probably also the largest Chinese pure-play e-commerce business, while Alibaba, for example, operates more like a marketplace business. Although JD.com and Alibaba have different business models, they do compete head-on in most markets. The real crux to JD.com and the share’s outperformance this year is that in January/February 2021, when Chinese regulators actioned the first round of regulations that seemed to target specifically e-commerce players in China, JD.com was a net beneficiary of certain of the changes which that brought. There were certain practices where the dominant players in China were seemingly abusing their market power – Alibaba, for example, was telling some merchants that if they were transacting on Alibaba’s platform, they were not allowed to transact with JD.com. Although it was never written in stone, it was implied, and the regulator came down hard on these types of practices. As a result, JD.com was a big net beneficiary of the tighter regulations.

So, while we saw complete turmoil across the Chinese Internet space this year and negative headlines as well as continued negative sentiment, right up until now, we highlight that some companies have benefited from the changes that were made. To try and illustrate that in numbers as an example we note that Alibaba’s core e-commerce business only grew by 3%, while JD.com was able to record 25% revenue growth over that same time.

Figure 6: JD.com snapshot

Source: JD.com

For the nine months to September, JD.com, which is not a small business, was growing its top line at about 30% – it currently has a market cap of c. US$120bn. JD.com is also a share’s whose performance for us has been a very pleasing investment case and compared to the Hong Kong Golden Dragon Index, for example, which is down c. 40% YTD, JD.com is only down 11% over the same period.

Another example with a similar kind of investment case is Netease, having outperformed remarkably relative to Tencent. It is a similar scenario to that of JD.com that has played out, where the regulations have negatively impacted the dominant player and protected some of the peripheral players. JD.com’s excellent execution and great revenue momentum have seen it maintain its growth rate and we will continue to hold the share as one of the core Chinese internet pillars in our portfolios.

Meta (Facebook)

Facebook recently renamed itself Meta, a new name to better reflect the company’s strategy to displace our reality with a virtual one – a concept called the metaverse. The name change/concept was mentioned in just about every tech company’s earnings call last quarter and perhaps the crowning endorsement here was Microsoft’s announcement that it would be integrating its business communications platform, Teams into Facebook Workplace over the coming months.

Below we discuss what we believe to be Meta’s biggest near-term opportunity, which we see as being a far more tangible (and obviously commercial) opportunity than the metaverse. If you think about Facebook as being a triple-pillar business (see Figure 7), with its legacy advertising business on the left and the metaverse opportunity on the right – you have the more commercially obvious e-commerce opportunity in the middle which, for some reason, nobody seems to be talking about and which we think the market may have forgotten about – which we believe has created an opportunity.

Figure 7: Understanding the strategy – the 3 pillars of Facebook

Source: App Annie Intelligence

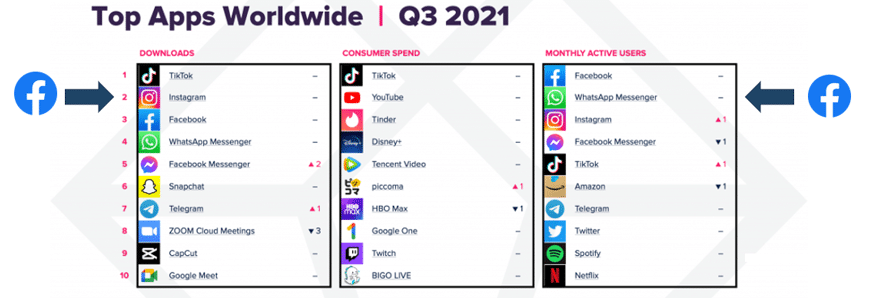

We have previously written about how Meta continues to command more of people’s attention daily than any other platform on earth (see Figure 7). The average person spends, on average, 58 minutes per day across the collective Facebook properties, which is a phenomenal statistic. Facebook remains a highly relevant platform as we can see from the download statistics in Figure 2 below – whether you are looking at the number of monthly downloads or the number of monthly active users – Facebook commands four out of the five top spots globally across the two dominant operating systems (Apple’s iOS and Alphabet’s Android). We believe that translates into some incredibly valuable advertising space and, of course, advertising which advertisers are hoping will convert into sales.

Figure 8: Facebook still dominates app store download rosters

Source: App Annie Intelligence

On that basis, for a long time it has made sense that the next logical phase in Meta’s evolution would be to become a “storefront”, thus giving its users the ability to make a purchase at the very same time that it has captured their attention. And this is what is happening right now, with the recent launch of Facebook Shops (in partnership with Shopify) – a mobile-first shopping experience where businesses can easily create an online store on Facebook and Instagram for free. In our view, we are witnessing what could be the birth of a legitimate competitor to Amazon’s third-party marketplace, a massive business that today processes in the region of US$300bn in gross merchandise value (GMV) on behalf of its third-party merchants.

However, we highlight that there are a couple of key differences which we believe give Meta the competitive advantage. The first is that Meta will be charging a much lower take from merchants of c. 5% vs Amazon’s take at an average of 15%. Second, Meta is what we call a benign host, in other words it is not interested in competing with merchants, it simply wants to provide a platform for them to sell their goods, whereas Amazon might start competing with a merchant if that merchant has a successful product category. This is also a reason why third-party merchants are more likely to prefer working with Meta than Amazon. Third is the so-called influencer strategy, which we think is a very powerful tool for Meta. People are more likely to spend a higher dollar value on a product that is used by people they follow or by people that influence them via social media, so it is significant strategically, and it makes sense for Meta, but we also highlight some numbers below to quantify this opportunity for investors.

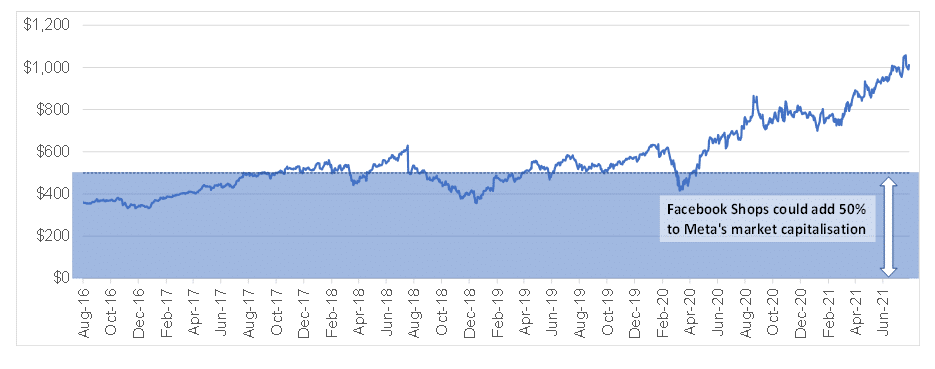

Figure 9: Facebook – an ecommerce opportunity, market cap over 5 years

Source: Bloomberg, Anchor

We have started by assuming that Facebook Shops can achieve a similar critical mass to Amazon marketplace, which we think is a reasonable assumption, especially given that ecommerce penetration rates globally are still only sitting in the late-teens to the early-20s depending on the product category you are looking at. By our calculations that would translate into c. US$300bn in annual GMV and applying Meta’s take rate of 5% to that that would equate to a revenue opportunity of roughly US$15bn p.a. Now, you might think that does not sound like a significant number for a company that will report over US$100bn in revenue this year, but we highlight that the important consequence of changing Meta into a storefront is also that its advertising inventory becomes significantly more valuable.

Looking at the Amazon model as a comparison again, Amazon generates c. USc15 in advertising sales for every dollar in GMV that it processes. Applying that same principle to Meta means that its yield on GMV will likely be closer to 20% and not 5%, which would mean US$300bn in GMV, which would, in turn, translate into US$60bn in incremental revenue for Meta and that starts to sound like a serious opportunity, doesn’t it?

From a valuation perspective, if you apply a price to sales ratio of roughly 9x, which is where Meta tends to trade at over time, it could add c. 50% to Meta’s market cap and we think that this is a serious opportunity for shareholder value creation over the coming years.

So, how will the market start to price this in? That is difficult to predict but we believe that it will probably happen in a gradual fashion as the company starts to report progress on that front. However, here the important point to make is that we continue to believe that there is a longer runway for growth for Meta from here and it will come in the form of a second wind driven by the ecommerce opportunity.

In conclusion, we believe that with Meta, investors have a great combination where you are paying a very reasonable price for the business today (investors are paying roughly 22x next year’s earnings) and second you have a significant commercial opportunity that the market is not attributing much value to YET, so we really like that as a play going into 2022.

Tesla

The Anchor BCI Global Equity Fund currently holds a significant position in Tesla. In time, we believe that Tesla could surpass Apple as the world’s largest company by market cap. Apple has integrated hardware and software to create highly desirable, differentiated products in an otherwise commoditised industry, leading to staggering profits, cash flows and value creation. Tesla has taken a similar path in terms of integrating hardware and software but has taken the concept even further with its approach to vertical integration. This is in stark contrast to legacy automakers, which have outsourced the bulk of their parts supply in the name of efficiency. This makes complete sense in a mature industry; however, when there is a new paradigm reshaping the consumer experience, then integration makes sense to the extent that it results in a differentiated consumer product and experience. As a small but highly relevant example, Tesla even makes its own seats, whereas for other companies these are a mere line item. This insight likely came from Elon Musk’s practice of thinking from first principles, “which is…you boil things down to the most fundamental truths you can imagine, and you reason up from there.” Musk has applied this thinking throughout Tesla (and SpaceX and The Boring Company and DeepMind…and previously PayPal) such that the company is reimagining every part of designing, building, and selling cars. Tesla even designs the machines that make the cars. Musk believes Tesla’s ultimate competitive advantage will come from manufacturing (which incidentally is not the case for Apple, which outsources production).

In creating an integrated solution and producing electric vehicles (EVs) at scale (which is not the same as putting the existing body on a different drive train) Tesla has probably had to solve 10,000 (or more) different, but co-dependent, problems. This problem set is more like a mesh than a linear time series progression; once you solve problem 732 you discover problems 5,002 and 7,234, which means you have to resolve problems 54 and 2,125 and so on. By outsourcing vast chunks of its supply chains, legacy automakers face a co-ordination problem, which makes solving the 10,000 problems almost impossible. Not that they will not be able to produce an EV; rather, that they will struggle to do so 1) profitably; and 2) at scale.

While many automakers (and investors) are in a state of denial, Volkswagen recognises the threat posed by Tesla. At a recent internal meeting, VW brand CEO Ralf Brandstatter reportedly commented that the future competition with Tesla’s new Gigafactory will be brutal…that the electric car pioneer would set new standards in car production…and that Tesla is in a different dimension in terms of productivity and profitability.

Arguably the most interesting challenge that Tesla is working on is autonomous driving – i.e., cars that drive themselves. Once again, Tesla’s approach is to design its own hardware and software, including custom chips and the supercomputer that trains the software. Tesla has also taken a different conceptual approach to other companies that are trying to solve self-driving. Tesla’s approach is to install self-driving hardware (cameras, sensors) and software in every car it sells, using driver interventions as inputs (i.e., the driver takes over because the car is doing the wrong thing) which the supercomputer uses to re-train the software in an iterative loop. Software updates are sent over the air, in the same way that you update apps or your operating system on your mobile phone. Tesla is attempting to solve an extraordinarily difficult problem which, once done, can immediately scale to every Tesla on the road. By contrast, companies like Waymo (which are software focused and do not manufacture cars) are trying to solve much smaller problems in a handful of cities, requiring expensive lasers and high-definition mapping as a starting point. Waymo’s approach will show easier wins early on, but by design, will be incredibly difficult (and expensive) to scale later.

Tesla calls its autonomous software ‘full self-drive’ (FSD), which is somewhat misleading because at this stage ‘partial’ is a more appropriate term than ‘full’. Tesla has not rolled out FSD to the public yet but is releasing each updated version on a beta basis (i.e., trial) to a limited subset of drivers. Tesla’s software assesses drivers in terms of various safety factors (e.g., hard braking, unsafe following distance etc.) and drivers with a perfect score of 100 have been the first in line to try out FSD. The initial goal was to enlist 1,000 drivers in the first round. Thereafter, the beta will be further extended to drivers with scores of 99, 98 etc. The more drivers using FSD on the road, the better, as there will be more ‘edge cases’ to train the software – these are driving scenarios the supercomputer has not seen yet, where the driver takes corrective action.

Tesla publishes statistics which demonstrate that driving with Tesla Autopilot (its driving software which is several notches below FSD in terms of functionality) is safer than regular unassisted driving by a factor of almost 10x (one crash for every 4.41mn miles with Autopilot engaged vs the national average of a crash every 484,000 miles). And driving with FSD is likely to be an order of magnitude safer than that. However, here comes the tricky part. Because FSD is not yet perfect, and although it will probably save a lot of lives even early on, some drivers are likely to die that would have otherwise survived had they been driving unassisted. Tesla faces an ethical dilemma: do they take a zero-tolerance approach, not making the software available until it is perfect, even if in the interim it means 1) thousands or even millions of preventable deaths occur, and 2) it will never reach full autonomy, because the software will never get the edge data it needs to learn? Or does it push ahead, believing that it will probably save some lives today and potentially millions of lives over time, with the downside that it will be castigated in the press and vilified by politicians when the inevitable fatalities occur?

Musk recently had the following to say when posed a similar question: “Someone once told me, even if you reduce fatalities by 90% with autonomy, the 10% that do die are going to sue you. The 90% won’t even know that’s the reason they’re still alive. Nonetheless, I’ve had many conversations with the Tesla autonomy team, who are an outstanding group of people, and saying, listen guys, the reality is doing the right thing matters more than the perception of doing the right thing and so long as we’re confident we’re doing the right thing, even though we’re getting criticised and sued and all that, we should nonetheless do the right thing and not care about the perception of the right thing.” In doing the right thing, Tesla the company and Tesla the stock are going to face severe pressure in future. Holding Tesla shares will be perceived to be the wrong thing and shareholders will come in for criticism. Going further, the fund’s strategy (and holdings) will not always be perceived to be right by a lot of people, a lot of the time. Rest assured that we will do what we believe is the right thing, even if it is perceived to be the wrong thing!