If you subscribe to the idea that markets efficiently discount investors’ collective attitudes and expectations about the future, it should come as no surprise that subsequent investment outcomes, or at least those experienced in the short term, are influenced to a large extent by the degree to which events unfold differently to those expectations, albeit positive or negative.

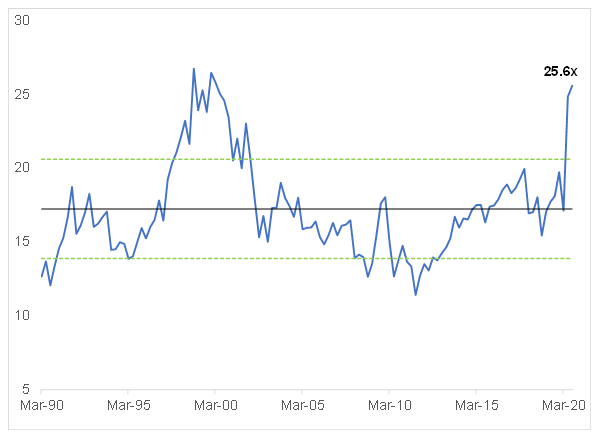

Buoyed by unprecedented stimulus injected to counter the economic consequences of the COVID-19 pandemic and almost non-existent yields available on riskless assets, the recovery in the US equity market from the COVID-induced panic in late March has been something to behold. With reference to Figure 1 below, this has pushed valuations to levels not seen since the dot-com bubble at the turn of the millennium.

Figure 1: S&P500 price as a multiple of expected earnings in 12 months’ time

Source: Bloomberg, Anchor

There are plenty of arguments being made currently in support of why high valuations in equity markets are justified and can be sustained. However, considered from the point of view of our opening observation, you might well conclude that current valuations imply the bar of expectation about the future is set very high. The recent IPOs of DoorDash and AirBnB, which rallied 86% and 115%, respectively, on their first day of trading, despite IPO prices being set at the top end of advisors’ ranges, provides further evidence of the current market exuberance.

Even if events do unfold largely according to the rosy script that current valuations paint – more conventional US engagement with the world under President-elect Joe Biden, still abundant liquidity thanks to further stimulus, a steady return to normality as vaccines are rolled out and a V-shaped recovery in corporate earnings – if that is indeed what is priced in, returns from the overall market could well be rather subdued. Of course, if 2021 does not live up to these lofty expectations, things could get a lot tougher for investors. Either way, we think active stock selection will need to play a prominent role in driving returns from here. With that in mind, we briefly discuss a selection of global stocks that we believe are worth keeping an eye on.

Boston Scientific

Boston Scientific is a mid-sized (market cap of US$50bn), US-listed medical technology (medtech) company that manufactures medical devices. These are used in “minimally invasive” procedures, which are often an alternative to surgery. Although Boston Scientific’s devices are used to treat a relatively wide range of medical conditions, cardiac rhythm management (pacemakers among other things), cardiovascular and urology devices are among its major contributors. Defensive, and with ageing populations providing a structural tailwind, the medtech sector has provided few opportunities for investors when valuations have appeared attractive.

However, the ban on elective procedures in hospitals due to COVID-19 has hit this sector particularly hard. In the case of Boston Scientific specifically, COVID struck at a particularly inopportune time, as it had just concluded the second-largest acquisition in its history (UK-based, BTG) in December 2019, which had increased its debt levels. In recent years, Boston Scientific has shown consistent delivery of high single-digit organic revenue growth, with margin expansion driving double-digit core earnings growth. While its recent quarterly results have been severely impacted by the lack of medical procedures, the recovery in recent months is encouraging and the company is guiding to a return to YoY growth by the final quarter of 2020 – most of the conditions it treats are deferrable to varying degrees but will still require treatment. In recent weeks, the share has come under further pressure following the company’s decision to recall and retire its Lotus arterial valve replacement system from the market. Although likely to have minimal earnings impact next year, owing to its low margin and due to be superseded by Boston Scientific’s other horse in this race – the Accurate neo2, busy making its way through regulatory approval – the announcement has nonetheless unsettled investors.

From a valuation perspective, Boston Scientific trades at a multiple of 22x its projected earnings in 12 months’ time. This compares with 25x-26x in the two years prior to 2020. A steady cadence of new products scheduled to come to the market over the next few years, pushing into higher growth adjacencies and increasing its presence in emerging markets (EMs), which currently account for a relatively small 12% of revenue, are among the features that we expect to drive double-digit earnings, growth and rapid degearing of the balance sheet, over the next few years. This is a high-quality compounder which we expect to bounce back strongly as activity normalises over the course of 2021.

The Walt Disney Co.

Just five years ago, investors began to worry that The Walt Disney Co. (Disney) was losing relevance in an entertainment economy that was going digital. Its tv networks business was losing subscribers to Netflix, its studio entertainment division was tied to the uncertain fate of movie theatres and its theme parks now had to compete with the iPad for precious family downtime.

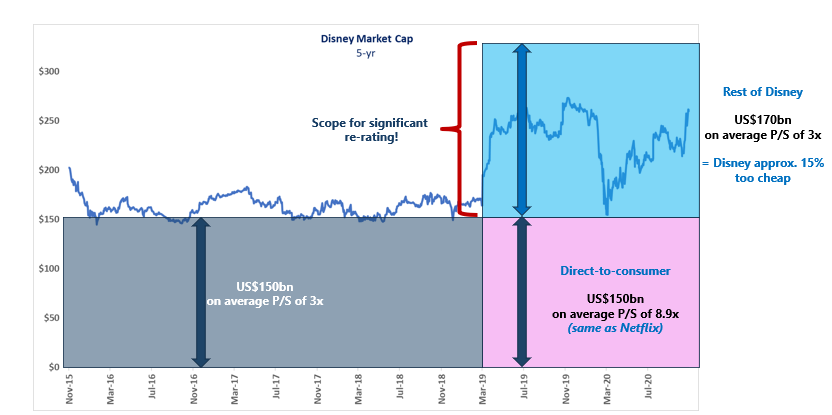

Despite growing earnings consistently, the company would trade at a market cap of around US$150bn for almost 4 straight years while technology stocks multiplied in value. That was all about to change, however, after a pivotal investor day held by the company in April 2019.

Although Disney management could certainly be accused of dragging their feet, the new “direct-to-consumer” strategy announced last year – which would include Disney’s answer to Netflix – looked set to catapult Disney to the forefront of the digital entertainment arms race. Almost overnight, investor skepticism turned to optimism as they added US$100bn (c. 66%) to Disney’s market cap (see Figure 2 below).

As we progressed into 2020, Disney would find itself in a rather peculiar set of circumstances – with the pandemic temporarily euthanising the theme parks business, while simultaneously injecting the new Disney+ streaming service with a shot of adrenaline. As the streets of the Magic Kingdom stood empty, Disney+ would add 75mn subscribers in under 12 months – a shockingly successful launch and a figure that both threatens Netflix’s base of 200mn and embarrasses HBO Max’s base of just 13mn subscribers.

Figure 2: Disney’s market cap vs Anchor’s fair value estimate

Source: Anchor, Company data

In our view, Disney’s newly formed direct-to-consumer busines is worth in the region of US$150bn, using comparable investment metrics to Netflix. Adding to this, our estimated valuation of US$170bn for the rest of the business, we arrive at an estimated fair value of US$320bn for Disney. Although you might conclude that Disney, with a current market cap of c. US$278bn, trades at just a modest discount (15%) to fair value – we believe this is only part of the story.

Our view is that the company’s direct-to-consumer services strategy will evolve into something far more significant than just a comprehensive streaming service. Disney+ has laid the foundation for a new type of relationship between Disney and its customers – a continuous, recurring monthly transactional model, which will eventually bundle in products and services from across the Disney landscape into one “super service”. Not only will this likely drive a higher level of spend per customer, but it will create a more consistent and predictable revenue stream – and herein lies the real opportunity.

Recurring, predictable revenue streams are – from an investor’s perspective – far more valuable revenue streams. On average, recurring revenue business models trade at 2x–4x the value of conventional businesses, which need to reinitiate the customer relationship with every transaction.

As Disney starts to tap into this opportunity, so the business will start to become intrinsically more valuable. There are numerous examples of how other similar transformations have rewarded shareholders – Adobe, Microsoft, Peloton, Amazon or Restoration Hardware to name a few – and we think Disney is likely next.

Nintendo

Nintendo has been a clear winner during the COVID-19 pandemic. Sales and operating profit grew by a stunning 73% and 209% YoY, respectively, in 1H21 (Nintendo has a March year-end) spurred, in part, by the escapist hit, Animal Crossing: New Horizons. It would be easy to conclude that Nintendo’s best is past, as market participants look beyond the pandemic and rotate into traditional value and cyclical stocks. Additional scepticism may be warranted given the holiday season launch of next generation consoles from Sony (PS5) and Microsoft (Xbox Series X). However, we have a different perspective – 2021 could be the year that Nintendo’s underappreciated strengths are finally recognised by the market. Nintendo historically had a boom-and-bust console cycle that rebased to zero every few years, as games could not be played across different console generations. We believe that the latest generation Switch console is more analogous to the iPhone, which will allow owners to play their old games on next generation Switch devices. In other words, much like the iPhone, there is every reason to believe that Nintendo’s installed base of users will keep growing and buying Nintendo’s much-loved games. If this dynamic plays out, then Bloomberg consensus estimates of declining revenue over the next several years are likely to be materially off base. Further, just as Apple shares rerated as the market began to appreciate the annuity nature of its revenue stream, we believe this phenomenon could repeat with Nintendo.

What about competitor launches? We see the PS5 and Xbox Series X as complements, rather than substitutes, for the Switch. Indeed, hard-core gamers who own these consoles frequently own the Switch as a second console. One of the Switch’s main attractions is its portability, which makes it a useful on-the-go alternative. There is a good chance that Nintendo will launch a higher-spec Switch Pro in 2021, which will enhance its appeal for these gamers. Finally, demand for Nintendo’s consoles has largely been driven by the quality of its games and depth of intellectual property, which is unparalleled. While Nintendo has kept its 2021 game launch cards close to its chest, we are confident that gamers will not be disappointed.

Nintendo trades on an undemanding forward PE of 19.4x, well below Activision Blizzard’s 23.4x and Electronic Arts’ 22.8x (all based on Bloomberg consensus). Note that this ignores Nintendo’s cash balance, which equates to over 15% of its market cap. All told, Nintendo is well placed to deliver a few surprises in 2021. Game on!

Becton Dickinson

Becton Dickinson (BD) is a global leader in medical supplies, devices, and diagnostic systems. All perfectly suited to take advantage of an ageing global population and a growing EM customer base. Among the investment options in the medical field, we like medical device providers because:

- Doctors and hospitals are reluctant to switch to cheaper alternatives once a specific brand is established in their workplace. And customers are not going to select sub-standard equipment to be inserted in their bodies based on price (if they are even given the choice).

- Medical device manufacturers do not receive as much public criticism and controversy around their pricing structures as pharmaceutical firms tend to attract. This is because medical devices are typically paid for by a medical aid or by the hospital, which in turn pass the expense on to their customers.

- Medical devices have far less exposure to patent cliffs and legal battles compared to pharmaceutical companies.

Geographically, 55% of BD’s revenue comes from the US, 21% from Europe, 15% from the Asia Pacific region, and the remaining 9% from the rest of the world. Since China is the company’s fastest-growing market, Biden’s victory in the US Presidential Election should ease geopolitical tensions between the US and China in the coming years.

BD’s biggest segment is its medical delivery systems in the form of IVs and needles, which accounts for 52% of total revenue. Its business model can be compared to a razorblade model, where the business has a lower margin on the actual devices sold to hospitals but a far better margin on peripherals and disposables, which are used to operate the company’s devices. The company has already received commitments from several governments for 800mn disposable needles for the COVID-19 vaccines as BD has for decades been the supplier of choice for previous global vaccines.

Its second-biggest segment is specimen analysis and diagnostic equipment (25% of revenue). Other than growth from testing for COVID-19, this segment as a whole has suffered as the Group’s non-COVID-19 tests have been sidelined during the pandemic. We expect that non-COVID-19 testing will return to normal over the coming months as delayed tests cannot be put off indefinitely and we should see significant growth in this segment as the pandemic subsides.

Surgical and related devices such as hernias, tissue repair, grafts, urological catheters etc. account for c. 23% of revenue. This division has also suffered because of COVID-19 since many elective surgeries (deemed to be non-life threatening) have been put on hold due to the pandemic. Again, these are all temporary issues, and it should return to normal with time as these types of surgeries have to be carried out eventually.

We believe BD’s temporary setbacks brought about by COVID-19, present an opportunity to invest in a world-class, defensive company that is well placed to recover in a post-vaccine world. From a valuation perspective, the company is currently trading at a one-year forward PE of 19.5x, which compares to a range over the past three years of 17.2x and 23x. For its year ending September 2021, revenue is expected to grow by 11%-13% YoY and earnings per share by 24%-27% YoY (albeit off a low 2020 base) and then taper off to longer-term growth rates of mid-single digits. In normal times, the Group’s earnings are usually highly dependable, and some analysts believe that the company’s earnings could surprise to the upside.

Constellation Software

Constellation Software is a Canadian-domiciled software company – think of it as a technology holding company. Constellation owns businesses in a variety of sectors but these companies have the commonality of being software businesses. As an acquirer, Constellation offers potential software company acquisitions a permanent home (it generally buys for keeps), management autonomy (management can continue to run the business), and access to hundreds of peer companies with similar challenges and opportunities.

Constellation’s capital allocation has proven very shrewd – it has compounded earnings per share at 26% p.a. over the five-year period from 2014 to 2019. Importantly, this has been achieved without taking on significant debt (Constellation is currently in a net cash position) or issuing any shares, and earnings are realised in cash. The type of business that Constellation focuses on is generally capital-light and cash-generative. This has allowed Constellation’s growing earnings stream to be available for reinvestment. We believe that Constellation’s growth runway has not come to an end. The vertical market software business remains very fragmented. At 30x forward earnings, with the potential to compound earnings at a mid-teens rate over the next few years, we believe Constellation Software is an attractive business to own.

Merck

Merck is a large, US-based global pharmaceutical company that sells a range of human and animal health products. In recent years, Merck’s strong roots in innovation and science have been on display through the success of its foundational cancer therapy, Keytruda. Drug research at Merck has been restored under the leadership of Merck’s Head of Research Roger Perlmutter, who will retire at the end of 2020.

Keytruda, along with many other exciting products, points to several years of growth ahead for this great company. Unfortunately, our positive sentiments on Merck are not shared by the wider market, but we note that management are adamant that the market is underestimating the company’s growth prospects – an assertion with which we would agree. More broadly, we also believe that the large pharmaceutical companies are offering good value in a market where high growth is typically well rewarded and lesser growth is often disproportionately penalised.

Merck is expected to grow its earnings per share by double-digits p.a. over the period to 2024. The share price is, however, currently trading at c. 14x earnings to December 2020. Our discounted cash flow (DCF) valuation indicates a value closer to $110/share, which is well above the current share price. This provides a healthy risk-return profile for investors. We also highlight that Merck’s cancer therapy, Keytruda only faces patent risks in 2028.

Ping An Insurance Group

As the world’s largest insurer by market cap, one would think that China-based Ping An Insurance Group (Ping An) has reached a stage in its business cycle characterised by a maturing growth profile as opposed to one still representing a secular growth opportunity. However, this is not the case and, as with most industry champions in China, its growth opportunity remains one of the most compelling for any insurer we have come across globally. While Ping An is a leading Chinese long-term insurer, the business has ultimately become an integrated financial services play, with lines into banking, wealth, and asset management among other consumer-facing, financial services products.

In addition, it is operating in a country with a large emerging middle class and in an industry that provides a necessary service (insurance), which remains underpenetrated when comparing China to many other more developed nations – a gap we expect to close over time. The Chinese savings and insurance market remains a powerful long-term thematic which we have backed in our portfolios and the recent operating trends at Ping An (operating profit growth of 12% YoY, with core life insurance growth of 16% YoY) confirm the reasons for our enthusiasm. To add to the attractiveness of the growth opportunity inherent in the Ping An investment thesis is the share’s undemanding valuation, with a dividend yield above 3% and many years of double-digit growth in operating income ahead.

PayPal

It is always clear with hindsight, but today’s most successful companies are those same firms who took a view of the future 15 to 20 years ago and then set about preparing for it. Much like the story of Noah and his Ark, these companies generally face much investor skepticism as they embark on years of aggressive spending and innovating to address what seem like far-fetched assumptions around a future addressable market. Of course, as the rains start to fall – or as the evidence of market changes start to show – that same investor skepticism turns into a deluge of optimism as market participants wake up to a reality that the founders foresaw so clearly all those years ago. There are many such parables in the tech sector in 2020, but today we are looking at one of the more legendary examples – PayPal.

Initially intending to facilitate payments between the handheld PCs that were so common in the late 1990s (remember Palm Pilots?), PayPal would evolve into the default payment clearing platform on eBay – itself one of the earlier success stories in the ecommerce space. After visionary active shareholder, Carl Icahn successfully lobbied for PayPal’s spin-off from eBay in 2015, PayPal would rapidly become the most popular default payment mechanism on most ecommerce shopfronts on the internet.

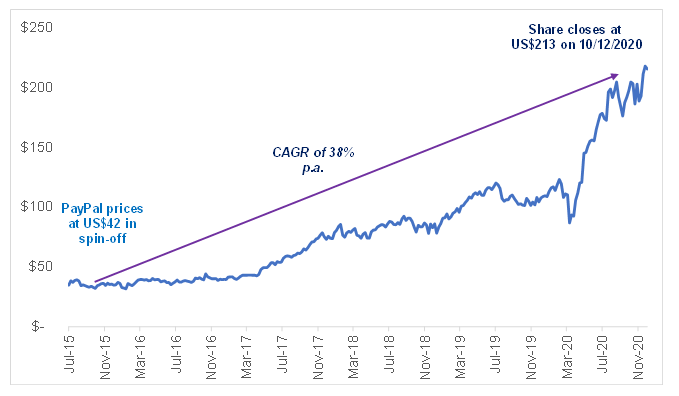

Just five years later, the company will likely close the books, having processed just shy of US$1trn in transactions – a compound annual increase of almost 30%. Naturally, investor sentiment has followed suit with the share rising from US$42 in 2015 to US$213 today – a similar compound annual increase of 38%.

Figure 3: PayPal’s share price performance since its spin-off in 2015

Source: Bloomberg, Anchor

After such a strong run, one might be tempted to take profits – however, we still think the growth story has room to run. PayPal’s strategic decision to pursue payment volume growth at lower margins, while working with global payment processors such as Visa and Mastercard, is working well. We expect growth in its total payment volumes (TPVs) to continue at 25%-30% for the next few years, with our estimate of 2030 TPVs being around US$6.4trn (in line with Visa’s current TPV).

Should this play out, we still think PayPal is around 50% too cheap. Naturally, after a YTD run-up of 95%, the share is likely due a period of consolidation but, as is the case with so many tech shares, much of the upside comes through rapidly in the later years of the growth story.

One may well have the opportunity to enter at better levels over the next 12 months, but we remain resolute holders of the share and we maintain our view that the counter will continue to deliver market-beating returns over the next 5 years from current levels.

To summarise, at the moment a great deal of debate among investors is focused on the likelihood of a rotation out of “growth” stocks and into “value” stocks. Momentum driven by investors crowding into what has been performing well (think Robin Hood), combined with growth stocks proving more operationally defensive (or even benefiting) in a pandemic world, drove dramatic relative outperformance of growth over value in 2020. Recently, and particularly since the announcement of successful vaccine results have given investors reason for hope that 2021 may see a rapid return to normal, there has been a notable rotation back into the left-behind value areas of the market. There is a good case to be made that this could have further to run in the months ahead.

Looking at the performance of Anchor’s Recovery Portfolio, which we put together soon after the sell-off in late March, most of those shares have recovered strongly, leading us to conclude that one must likely venture further up the risk curve in the hope of finding significant further upside from a portfolio based on the world returning to normal in 2021. Rather, our selection of stocks to keep an eye on in 2021, fall mainly in the camp of quality compounders, which we expect to win over the longer term. We hope our suggestions spark some lively debate among friends and family over the Festive Season. On that note, from all of us in the Anchor investment team, here is wishing that 2020 ends on a high note for you, and we look forward to navigating the twists and turns of the markets with you in 2021!