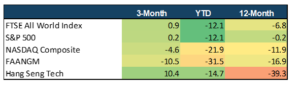

It has been a tough 2022 for the tech sector with red ink across the board. There are rare exceptions such as Activision Blizzard, the gaming company, which Microsoft wants to buy. However, after years of superior performance, the Nasdaq and the FAANGMs (Meta [Facebook], Apple, Amazon, Netflix, Alphabet [Google], and Microsoft) have declined more than the broader market in 2022 YTD.

With US inflation at its highest level in c. 40 years and no longer expected to return to normal in the short term, the tech sector’s greatest attraction – growth (and monopoly!) – has stiff competition from surging old-world sectors including energy, commodities and, of course, the shrinking effect of rising interest rates. An added complication for many tech companies in 2022, is that if they were COVID-19 beneficiaries (e.g., Zoom, Netflix) in 2020 and 2021, they are now lapping very high comparable numbers from prior years. Suddenly the growth has dried up.

Figure 1: Major global indices performance in 2022, % change

Source: Bloomberg, Anchor. *Data as at 7 June 2022.

Chinese tech, long in the doldrums, has outperformed the Nasdaq in 2022 YTD (albeit still in negative territory – the Hang Seng Tech Index is down 14.7% vs the Nasdaq’s 21.9% YTD decline). The derating of large Chinese tech shares over the past twelve months has however been particularly severe, and far worse than the performance of tech elsewhere. In China, a combination of tech policy uncertainty, putting politics before economics, having no mRNA vaccines, enforcing overly strict COVID lockdowns, and supporting Russia in the tragic war against Ukraine, has made the country feel like purgatory for global investors. The big question is – will the fog clear once China’s leadership conference is settled in November this year? Or, has pragmatism been lost in China?

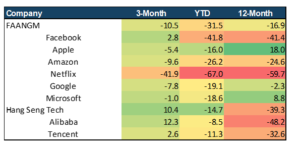

Figure 2: The performances of the FAANGM stocks in 2022, % change

Source: Bloomberg, Anchor. *Data as at 7 June 2022.

Despite a resilient performance in 1Q22, large-cap tech has now finally succumbed to the broader market weakness, resulting in a weaker performance YTD than the S&P 500 Index. Over twelve months, however, Apple (demand for its products exceeds supply) and Microsoft (cloud is showing robust growth) have stood tall while Netflix, Meta Platforms (Facebook, etc.), and Amazon have been the clear laggards.

Apple, the integrated hardware and software giant, remains a tricky business to analyse (we tend to underestimate the power of the business). With 5G smartphones still underpenetrated as a share of the installed base of smartphones, 825mn paid subscriptions, and growing, success with its M1 chip-driven Macs, Apple seems unstoppable. For now, however, Apple is facing some supply constraints, which will be reflected in its 3Q22 results (due to be reported in July 2022) as well as pandemic-related impacts on demand in China, due to that country’s zero-COVID policy which resulted in strict lockdowns and which was only recently been lifted.

Netflix, despite a strong line-up of new content, did not meet subscriber growth expectations when it released its 1Q22 results in April. It appears that the video streaming market is maturing sooner than expected, and this is partly because the less-penetrated Asian region is a more difficult and time-consuming market to crack. The rising cost of living in Western markets is also likely to lead to some subscriber cancellations in existing strongholds. Netflix has shifted from high-growth to low-growth, and the share price reaction has been brutal.

Meta has been hurt by competition from rival TikTok, the short-form video app, and is also struggling to adapt to the privacy changes introduced by Apple to the iOS software that powers its smartphones – impacting Facebook’s advertising revenue. A general slowdown in economic growth – and the advertising cycle – may add to these problems.

Lastly, Amazon is lapping very high (COVID-19-related) revenues from 2021. The comparable numbers will become easier in 3Q22 and beyond, as the pandemic boost vs prior periods dissipates. The question is – what impact will high grocery inflation have on e-commerce sales of general merchandise (NB for Amazon)? And, even if Amazon Prime customers are not as price-sensitive as those at Walmart, are they likely to divert more spending to travel and other services instead. As you can see, the near-term outlook for Amazon’s e-commerce operation is somewhat cloudy and this is reflected in the share price. Nevertheless, we believe that the long-term prospects remain good. E-commerce penetration in the US and Europe is relatively low compared to countries like China. And Amazon’s cloud business, Amazon Web Services (AWS), continues to show consistent strong growth.

We note that the outlook for cloud platform revenues remains strong which is reassuring for major players such as Amazon (via AWS) and Microsoft (via Azure), and Alphabet’s fast-growing cloud business (not yet a major contributor to the advertising giant’s Group revenues).

Mid-to smaller-cap tech was where most of the action was in 2022 YTD. The rout in loss-making tech and biotech that began in November 2021 continued through to mid-May 2022, before staging a partial recovery in the last week of May and early June. The declines were brutal and reminiscent of the global financial crisis (GFC) and the tech bubble of 2000. By end-May, the worst affected sectors were biotech, food delivery, ridesharing, fintech (including the BNPL firms and PayPal), e-commerce, social media, etc. The best performers were the online travel companies, and large companies in sectors like credit cards (Visa and Mastercard) and value tech (Oracle, IBM, etc.).

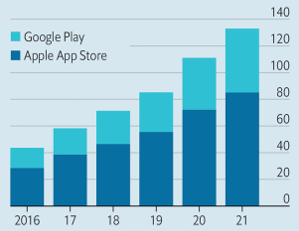

Figure 3: Appy customers – worldwide app-store revenues, US$mn

Source: Sensor Tower, The Economist

Regulatory activity is gaining momentum across the world. This will make life more difficult for the major tech platforms. Amazon, Alphabet, and Meta have drawn the most ire to date. Apple’s App Store is increasingly facing scrutiny (it accounts for c. 20% of Apple’s operating income), while Microsoft is less of a focus for authorities. All the attention, for now, is on the EU’s Digital Markets Act (DMA) and the Digital Services Act (DSA), which are expected to come into force in 2023 and 2024, respectively – with wide-reaching implications for how the tech giants do business in that region. Meanwhile, in the US, the Biden administration is in favour of what the EU is doing, and we also expect pressure to build back home on these tech platforms – from Congress, the Federal Trade Commission (FTC), and the US Department of Justice (DoJ). In the US, 2022 to 2024 will be key years for tech regulation before a potential change in the administration in Washington. The FAANGMs remain very powerful businesses and we are investors in many of them, but we will be monitoring these developments closely to see what impact they may have.

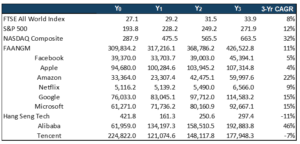

Figure 4: Various global indices and FAANGM stocks’ earnings forecasts, US$mn (Unless otherwise indicated)

Source: Anchor. *Data as at 7 June 2022.

Conclusion

Removing liquidity from the global economy was always going to cause problems in financial markets, particularly for highly-priced growth companies in the tech sector. And we are only part way through this process – US inflation has some distance to fall from its current 8%-plus level. The US Federal Reserve (Fed) is under pressure to bring this under control as quickly as possible before inflation expectations shift to higher levels.

The Nasdaq Composite Index is down significantly this year. This has helped to reduce the huge gap between the valuations of growth (i.e., tech) and value shares. What happens from here? To paraphrase Bloomberg’s John Authers, if the interest rate hikes from the US Fed force the US economy to roll over swiftly and bond rates drop accordingly, then tech shares and other growth shares will shine again. If not, then the pain will continue for tech shares and value shares will continue to eat into the valuation gap. In the short term, we do not know which way this will go. In the long term, however, tech shares will continue to provide superior returns because of higher-growth prospects (see Figure 4 above).

For now, we are focused on finding companies where earnings prospects look more secure. To date, consumer-facing tech companies have been the most brittle with downgrades to earnings in sectors such as online advertising, e-commerce, and streaming, while other sectors such as smartphones and other tech hardware have been more resilient (partly helped by persistent supply shortages). Enterprise (i.e., corporate) tech is yet to show signs of pressure on earnings (e.g., cloud, online security), but if the US economy does roll over, that situation will change.

In conclusion, our theme for tech investing in 2021 was ‘adjusting for risk’ (i.e., reducing risk in the portfolio). Considering the sell-off we have seen this year, the theme was well on target. We could have been more ruthless in following our own advice though. In 2022, our theme for tech investing is ‘sifting through the wreckage’ (i.e., finding shares that have been dumped indiscriminately by investors). By June 2022, there are several shares that have fallen dramatically, and we are sifting through them to identify opportunities.

It has been a tough start to the year for the tech sector – and there may be more wreckage to come – but for the first time in a while, we are beginning to see some opportunities for tech investors. We remain firmly of the view that having an appropriate part of your investment in a well-diversified portfolio of global tech shares will produce significant benefits over the long term.

If you have any questions or would like to discuss the subjects raised in this article with someone at Anchor please email us at info@anchorcapital.co.za.