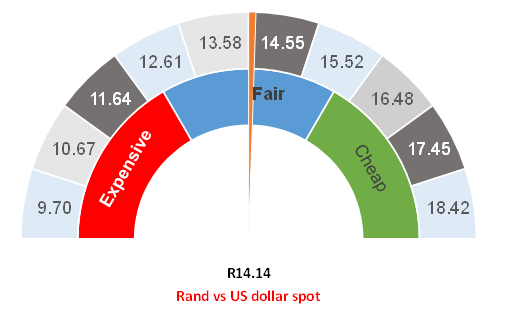

Figure 1: Rand vs US dollar

Source: Anchor

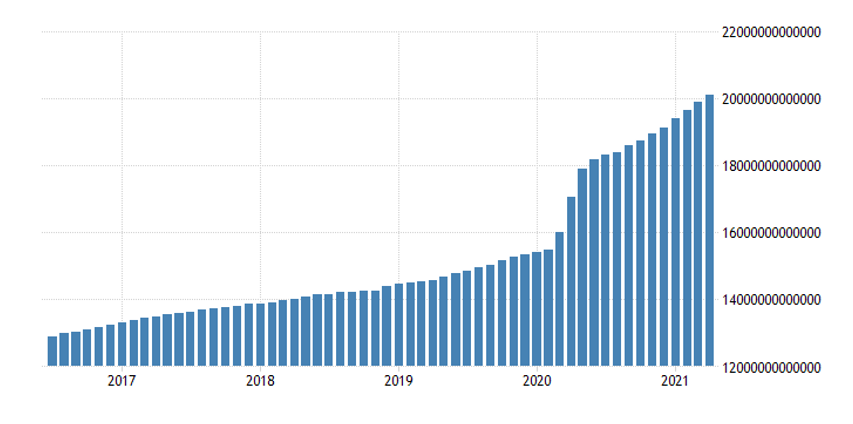

US money supply data were released on 24 June and in Figure 2 below we highlight US M3 money supply data from 2017 to 2021. Figure 2 shows how US money supply has slowly been increasing over time. What also caught our attention was the amount of money being printed because of the pandemic. Essentially, out of every $100 currently circulating in the US, c. $25 was printed at some point in the past 18 months. The amount of US dollars currently in circulation is also 33% more than before the COVID-19 pandemic.

Figure 2: US M3 money supply over time, US$

Source: tradingeconomics.com

In our view, this amount of money cannot be printed without consequences for the economy and this does partially explain the weakening of the greenback over the past few months. While the US Federal Reserve (Fed) tapering and other central bank news may slow down the US dollar’s devaluation, it seems to us that, for now, the dollar’s weakening trend will continue.

The key theme for 2021 has been whether printing this amount of money is inflationary. In short, the answer is yes. Why else would house prices in the US be 16% higher during a pandemic? Copper and other commodities are also seeing price inflation. However, not all of this money being printed is inflationary since some of it is sitting in money market funds (causing other economic imbalances on short-term interest rates), while some found its way to investment portfolios thus inflating bond and equity prices rather than the prices of real goods.

The main point is that everyone’s experience of inflation is different, and it all depends on which goods and services an individual consumes. The US Fed has defined the basket of goods and services that it believes are representative of the broader populace’s consumption habits and it predominantly focuses on these goods and services. However, house prices, for example, do not form part of the Fed’s basket of goods, while lumber and copper prices are also negligible in their impact. Thus, the Fed is merrily printing money as it does not see inflation in those goods and services that it looks at. Meanwhile, financial markets are beneficiaries of quantitative easing (QE) and are cheerfully absorbing most of the benefits as markets remain strong.

This will continue until the Fed sees a reason to slow down (and eventually stop) the current stimulus measures. Notably, there are currently no discussions around reversing money supply growth and markets are instead basically watching each economic data print to see whether inflation has spilt over into the basket of goods the Fed monitors, which, at this stage, has not happened. Therefore, the US market continues to rise. Each upcoming new data print brings new trepidation that we might see signs of inflation that will spook the Fed, making for choppy markets where investors are on edge and volatility remains high as equities and bonds inch ever stronger. We know that the Fed will likely announce tapering within the next three months bringing an end to the support. In the long run, this is good news as the US economy should be strong enough to run without support, by now.

However, some inflation will inevitably spill over into the basket of goods that the Fed watches and therefore this cycle will probably be characterised by higher core inflation, higher interest rates, and more pedestrian (although still attractive) returns than the last cycle, when investors were spoilt with lower volatility. This time it is going to be more exciting.

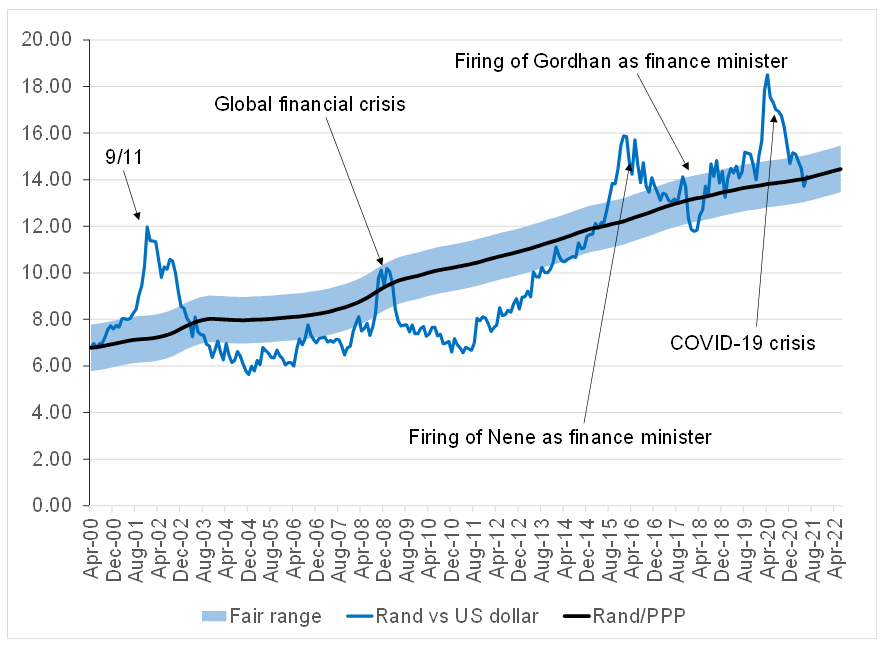

Overall, this also means that the US dollar probably still has some weakness ahead. The most recent Federal Open Market Committee (FOMC) announcements spooked markets as it was implied that rate hikes would be implemented sooner than initially expected. At the16 June post-meeting press conference, Fed Chair Jerome Powell indicated that initial discussions around when the Fed should talk about tapering bond purchases have now started. The ensuing bout of risk-off sentiment saw a retracement of South African (SA) bonds and a weakening of the rand. We do not think that this will be sustained and we therefore see the currency (and bonds) gradually clawing back some of those losses. We think that the local currency’s strengthening momentum might persist for just a little while longer.

Longer term, our fair value for the rand remains in the R14.50-R15.00/US$1 range, with the rand appearing to be close to being fairly valued at present. Therefore we believe that now is a good time to take advantage of the stronger rand to externalise a portion of your wealth if you have not already done so. We have reduced the hedges in our portfolios prior to the Fed meeting and we are comfortable remaining at a neutral US dollar weight.

Figure 3: Actual rand/US$ vs rand PPP model

Source: ThomsonReuters, Anchor