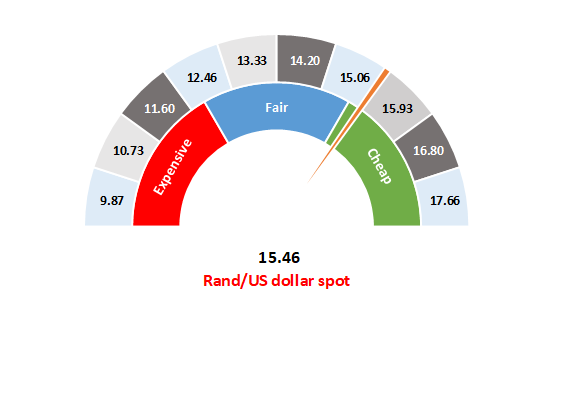

Figure 1: Rand vs US dollar

Source: Anchor

The South African (SA) rand, along with most emerging market (EM) currencies came under extreme pressure last week as global financial markets adjusted to the impact of the novel coronavirus (COVID-19, Wuhan flu or 2019-nCoV). Meanwhile, on the domestic front, the market is still digesting the surprise 2020 Budget speech by the minister of finance and its implications.

The novel coronavirus continues to spread, having infected people in 49 different countries. There are numerous articles discussing the infection rates, cure rates and, unfortunately, mortality rates. However, our role is to consider the possible impact of the virus on the value of investments and on the economy. While there are a number of different forces at play, how they converge will determine the likely outcome for investments over the next while. It is too early to take strong views one way or the other, although there are some eventualities for which we must prepare and adjust.

- The World Health Organisation is still pursuing a quarantine and shutdown strategy to curb the spread of the virus. This means that schools and factories are closed for the next two weeks in many regions of the world. Unfortunately, the virus struck in China’s industrial heartland and, as a result, the country’s factory production has been greatly diminished. Factories that are closed are unproductive and we expect that this will be a speed bump for China’s economy.

- Factories that are closed also do not consume raw materials. China doesn’t need to import iron ore or coal from SA, while the country’s factories are closed. Thus, we expect that demand from China for a number of imports will slow down for a period. This will result in some of the economic impact being felt by other regions. We are, in particular, seeing mounting concern about the impact on China’s import of oil, which has slowed. Brent crude oil is currently trading at around $52.30/bbl – c. 25% lower than where oil prices started 2020. While it is great for SA, which imports oil, it will have a profound negative impact on oil companies and oil-exporting nations.

- Industrial companies have been pushing towards greater efficiency. This means that they carry smaller stockpiles of their manufacturing components. Let’s use the example of a car: If China stops producing one component for a car that is assembled in the US, then the US assembly plant will run out of inputs. This means that the assembly plant for the car shuts down temporarily. Even more dramatically, the assembly plant will now reach out to all its other suppliers asking them to postpone orders and delay shipments. Consequently, suppliers of each and every component for the car also shuts down for a period. The global integration of the economy is such that a problem in China will likely result in a cascading effect throughout the globe as various parts manufacturers slow down production. In our example, a ship would take about five weeks to move parts from China to the US. This means that the impact on production lines have not been felt yet in the US and that we should probably expect to start seeing these headlines in about two weeks’ time.

- If we look at streets in Milan, China and a few other major holiday and business destinations, they are incredibly quiet. Consumers are nervous to go out and are cancelling travel plans and spending less. Thus, we expect global retail sales figures to decline. Various economies are also going to be impacted by a short-term decline in demand. A vast amount of value has been wiped off global stock markets in the last week and the negative wealth effect of this means that the slump in demand might linger for a while.

- Against all of this, we see central banks readying their stimulus packages, which will soften the impact. If there is one thing that we know then it is that monetary stimulus is good for financial asset prices.

Domestically, the 2020 Budget Speech was not enough to prevent a downgrade, in our view. In short, we are very positive on the budget and we think that the SA government is now finally looking at addressing the real problems impacting our economy rather than just fighting the symptoms. We accept that government may not be able to achieve all that it is hoping, however, we believe that the paradigm shift towards acknowledging the real issues and starting to address these is immensely positive. This may, in time, prove to have been a turning point for the economic tide in SA. Unfortunately, fiscal dynamics are such that more needs to be done and our national debt levels will continue their upward march. As things stand, we are still staring into a downgrade by Moody’s – maybe next month, maybe later. Either way the rand is nervous.

Currently, the rand exchange rate is at R15.46 vs the US dollar. This is on the weak side of fair. We have been using the sell-off over the past few days to marginally reduce our exposure to US dollars because we think that the sell-off is overdone. That being said, the effects of the novel coronavirus and the budget may linger for a while yet and so, we will continue gradually reducing our US dollar holdings.

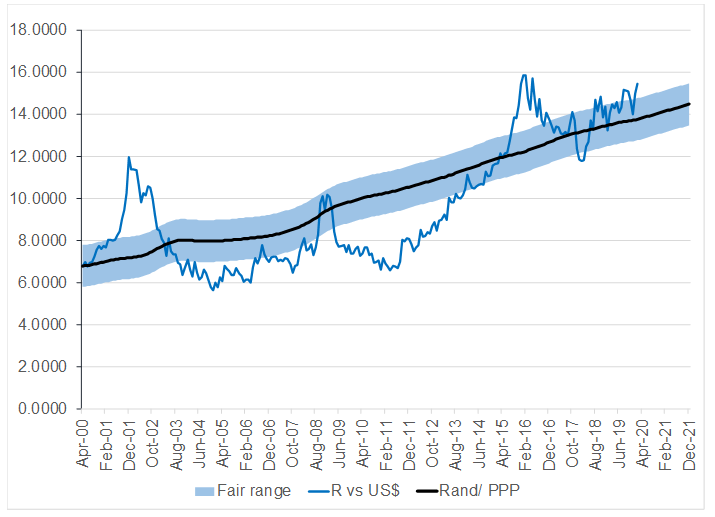

Figure 2: Actual rand/$ vs rand PPP model

Source: Bloomberg, Anchor