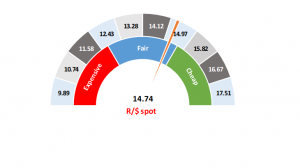

Figure 1: Rand vs US dollar gauge

Source: Anchor

The rand has been trading in tight ranges against the US dollar over the last few days, while we await the outcome of several key events. On Tuesday morning (22 October), the rand was trading at R14.74/$1 which we note is within our fair range.

The market is currently in a wait-and-see mode. Among the reasons for this are the following:

- The South African (SA) Medium Term Budget Policy Statement (MTBPS) is being tabled on 30 October. In our view, there is unlikely to be much positive news from Finance Minister Tito Mboweni and the question really is whether the market is sufficiently pricing in the bad news.

- Shortly after the MTBPS, we expect Moody’s to update its rating view on SA. We think that a downgrade is unlikely. Instead, we are debating whether the rating outlook will be changed to negative or whether the current rating will be affirmed. In our view, this is a 50/50 call and we are hopeful that the current rating will be affirmed.

- It appears that, contrary to our initial expectations, a Brexit deal might be sewn up over the next few days. Unless of course the British Parliament throws a spanner in the works again. According to Bloomberg, UK Prime Minister Boris Johnson will find out Tuesday evening (22 October) whether he has any chance of pushing his Brexit deal through Parliament ahead of a 31 October deadline. Johnson’s Withdrawal Agreement Bill was only published on Monday (21 October) and MPs are set to vote on it this evening in what is known as the Second Reading vote (basically deciding if Parliament agrees with the bill’s general principles). Should Johnson lose this evening’s vote it will kill the bill. However, if it passes and Johnson loses the subsequent Program Motion (setting a timetable for the rest of debate), it would simply make it very hard to hit his deadline. So, the next three days are crucial for Johnson’s deal. A completed deal will likely be somewhat rand positive.

- The US and China seem to be on friendlier terms, although we do not think that a trade deal will be completed in the near term. Nevertheless, at least the current armistice is giving markets some calm and risk assets (whether equities or emerging market currencies) a chance to rally.

Longer-term views depend significantly on how the abovementioned factors play out. A Brexit resolution and a softer US economy could see the US dollar come under pressure and the strengthening trend of the last few months might run out of steam.

In the context of positioning client portfolios, we previously reduced our US dollar exposure when the rand was trading above R15 to the dollar. We will maintain our slight underweight dollar positions while the rand is in the fair zone but we note that near-term events can easily push the currency in either direction.

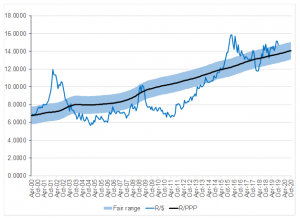

Figure 2: Actual ZAR/$ vs rand PPP model

Source: Bloomberg, Anchor