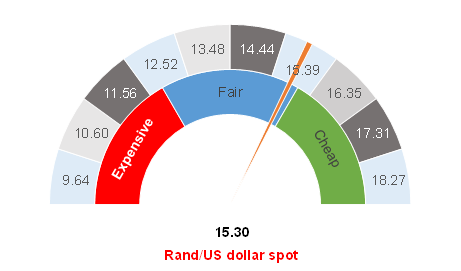

Figure 1: Rand vs US dollar

Source: Anchor

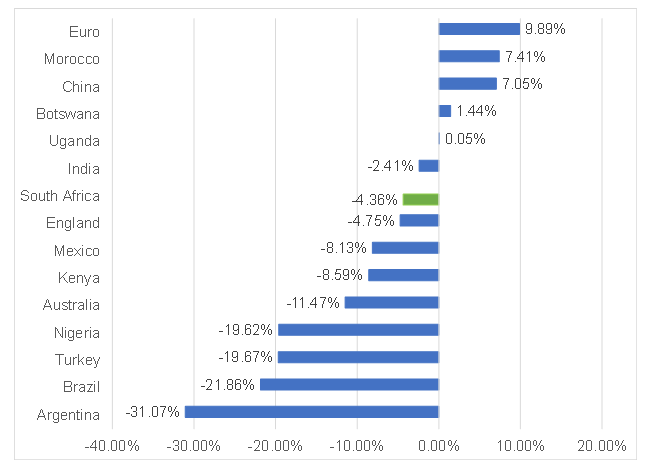

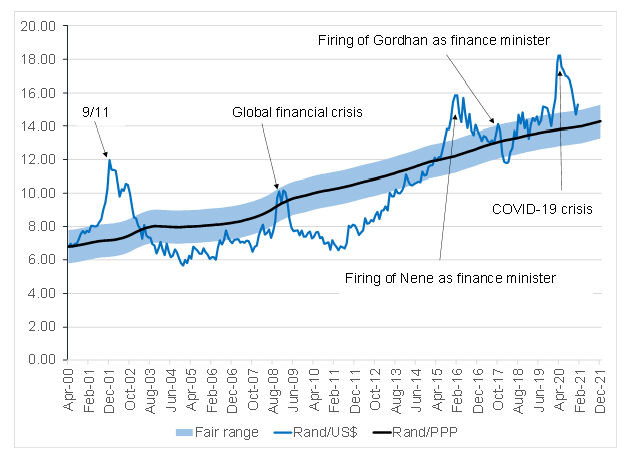

The rand was trading at R15.30/US$1 on Thursday morning (28 January). In this note, we start by looking at Figure 2 below, which shows how the rand has weakened against the greenback over a one-year period to 28 January 2021, relative to the currencies of a select number of other countries. As per Figure 2, the rand has weakened by just over 4% against the US dollar for the year, which is less than the weakness experienced in the Australian dollar and the British pound. The rand’s performance also compares favourably to the Brazilian real and Turkish lira over a one-year period. Our purchasing power parity (PPP) model (Figure 3) suggests that the local unit should, on average, weaken by between 2.5% and 4% each year and, over time, the rand is expected to be close to our upper band.

The rand is thus doing what it should. Throughout the one-year period, however, the rand has been volatile, and it set a new record of R19.36/US$1 as its weakest ever level. In the short term, the reputation of the rand as being the world’s most volatile currency is well deserved.

Figure 2: Rand and other select currencies’ movements vs the US dollar over a one-year period, 28 January 2020-28 January 2021

Source: Thomson Reuters, Anchor

The future performance of the rand against the US dollar is a function of both the strength of the dollar as a currency and the strength of the rand. Looking ahead to 2021, the broad perception is that we are likely to see some structural US dollar weakness. The three factors that are perceived as most likely to weaken the US dollar are:

- a broad-based global economic recovery should take hold after the rollout of vaccines. This will see a cyclical upturn in markets and investors are likely to prefer higher-beta investment destinations (than the US) which have, historically, favoured emerging markets (EMs);

- stimulus packages, which are generally negative for one’s own currency, particularly monetary stimulus, thus by prolonging existing programmes or increasing US stimulus measures may result in the greenback coming under pressure; and

- stock markets outside of the US are currently preferred, as US equities are arguably expensive, which means that we may see investment flows away from the US towards other, cheaper markets.

We can debate the merits of each of these arguments for a weaker dollar, although it is fair to say that the slower-than-initially-anticipated rollout of vaccines globally has halted US dollar weakness, at least for now. We think that US dollar weakness will probably be a theme for 2Q21 and 3Q21. For 1Q21, we are neutral on the greenback at current levels. This provides for a stable near-term outlook, although the key risk to our view is a resurgence of the COVID-19 pandemic, further lockdowns globally, and a risk-off period. Similarly, a mini correction in stock markets might see some risk-off reaction and a stronger dollar.

Turning to the rand, the political situation, and the dire fiscal position within national government are taking centre stage. This year will be all about the government’s ability to reign in expenditure. Clearly its failure to budget for buying vaccines has (rightfully) rattled the markets. Our base case is that the government can find the additional cash from a few revenue overruns last year and from other savings. South African (SA) tax as a percentage of GDP is close to 24%, while the global average is close to 14%. In short, SA does not have room to raise taxes and the government is acutely aware of this. Therefore, we expect the focus to remain on government’s ability to achieve cost savings on its wage bill.

The stark reality is that the SA government does not have a choice but to deliver on this promise. We are positively surprised at government’s resolve to embark on this battle to reduce its wage bill and the fact that it has been prepared to go to court against the labour unions. The tough decisions seem to have been made although the outcome will only be known once the Constitutional Court case has been heard and the wage negotiations for the next three years is complete. We can expect an active strike season in 2021, as government engages in a battle with the unions which it cannot afford to lose.

We are aware that the country cannot cut costs sufficiently to address imbalances within government – we also need economic growth. In this regard, we are all very focused on the growth initiatives that have been announced. It is imperative that government continues to action these with haste. We need to reignite private sector growth and investment activity.

Overall, our base case is that the fiscal situation will improve this year. Whether it improves enough to avert the fiscal cliff remains to be seen but we are also hopeful in this regard. SA has benefitted from a significant improvement in our terms of trade, where oil imports are cheaper and commodity exports are more expensive. This has seen us generate significant positive trade balances. These positive trade balances have also been supportive of the rand, although our view is that the size of the positive trade balance will gradually diminish throughout 2021. Nevertheless, for now, the trade balance will also keep the local currency well supported.

Consequently, we expect that the rand will continue to perform in-line with our PPP model. Our fair range for the rand is between R14.50/US$1 and R15.00/US$1. We note that the rand has just pushed above our fair range, with global factors providing slight US dollar strength, for now. Still, the rand is not meaningfully above our fair range and we remain neutral on the local currency at Thursday’s (28 January) levels.

Figure 3: Actual rand/$ vs rand PPP model

Source: Bloomberg, Anchor