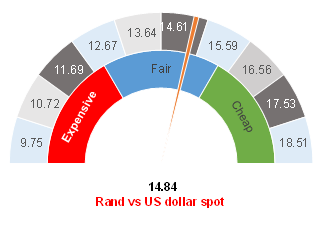

Figure 1: Rand vs US dollar

Source: Anchor

We started Wednesday morning (11 August), with the rand trading at around R14.84/US$1, which is nicely within Anchor’s fair range. While the trade balance continues to hold up, both local and global developments have put the rand under pressure recently.

Domestically, President Cyril Ramaphosa last week announced his long-awaited Cabinet reshuffle. We have several familiar faces in new positions as the ANC simply does not have a deep bench of substitutes or skills. Many in the country are calling for sweeping changes, which the party just cannot deliver. Nevertheless, there does seem to be a sense that those being ousted or demoted were the underperformers and therefore at least some level of accountability is being created. We also note that the size of the Cabinet is unchanged. The State Security Agency (SSA) will now report directly to the president, which is a worrying centralisation of power and sets a concerning precedent, in our view.

From an investment perspective, the big news is that Tito Mboweni is bowing out as finance minister and being replaced by Enoch Godongwana, currently chair of the Development Bank of South Africa (SA) and head of the ANC’s Economic Transformation Committee. The new finance minister arrives with a checkered past and is reflective of the limited number of choices that were available. Godongwana has been at pains to make statements about economic growth, policy reform, and building social infrastructure. This is all positive and he is clearly trying to calm markets. However, Mboweni was notoriously tight with spending limits and maintaining the budget and the market is nervous that Godongwana may prove to be more liberal when it comes to spending. Any attempt to dip into the kitty for increased spending is likely to be swiftly punished by the currency and the bond markets. The markets are nervous of this and have increased the risk premium that is being applied to SA and the rand.

Meanwhile, in the US, the president of the San Francisco Federal Reserve (Fed) recently stated that the tapering of bond purchases could begin later this year or early next year. Anchor has for a while touted the view that the taper will begin towards the end of 2021 and this completely aligns with our view. The market has been pushing this out a little further and was caught slightly off guard. As a result, we have seen US bond yields creep a little higher and the dollar is about 0.5% stronger, which in turn has weakened the rand by c. 1%. Anchor is of the view that the taper of bond purchases is very much expected and that moving the start date by a month or two, one way or the other, does not really matter that much to the eventual outcome. The market is fully aware that the taper is coming and therefore we expect a milder market reaction to the inevitable start of tapering. We continue to hold that the market should have a decent road map of how this is likely to play out by the end of September, with the start of tapering towards the end of 2021.

The abovementioned factors have given the rand a slight negative outlook for now, which is counteracted by the support from the commodity cycle and the positive trade balance. We think that the local unit may continue to trade with negative undertones for the next while, though we also remain of the view that massive spikes weaker are unlikely. Towards the end of the year, clarity from the announcement of the taper and, locally, the Medium Term Budget Policy Statement (MTBPS) on 2 November, will hopefully alleviate some of the negative pressures on the currency. Until then, we are keeping our portfolios neutrally positioned with regards to their currency exposures.

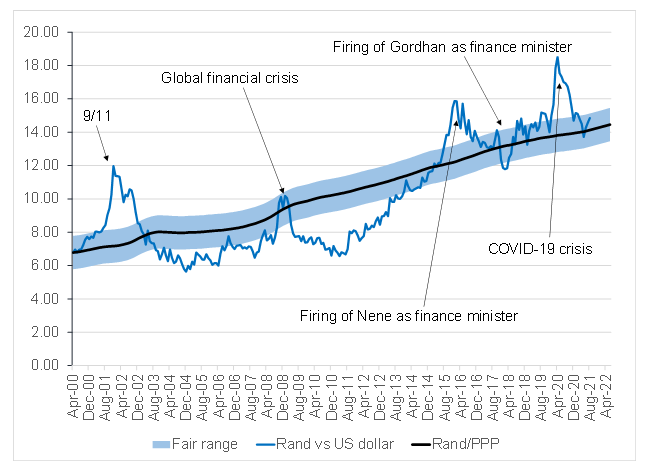

Figure 2: Actual rand/US$ vs rand PPP model

Source: Thomson Reuters, Anchor