Global environment

As 2021 starts, COVID-19 continues to vie, together with US politics, as top-of-mind for investors. We expect that US politics will calm down with the transfer of power to incoming President-elect Joe Biden’s administration. We note that the Democrats have won both seats in Georgia and therefore now control both the House of Representatives and the US Senate. For now, that control is by the slimmest of margins. In our view, following recent unrest and the storming of the US capitol on 6 January by supporters of current US president Donald Trump, Biden will need to start his presidency with a message of unity. This means that his administration will likely pursue those policies that the Democrats campaigned on, but in a watered-down form. We are also likely to see further US fiscal stimulus and some tax hikes, but, importantly, we expect to see the US participating more in international affairs and having a less erratic relationship with the rest of the world than it did during the Trump administration.

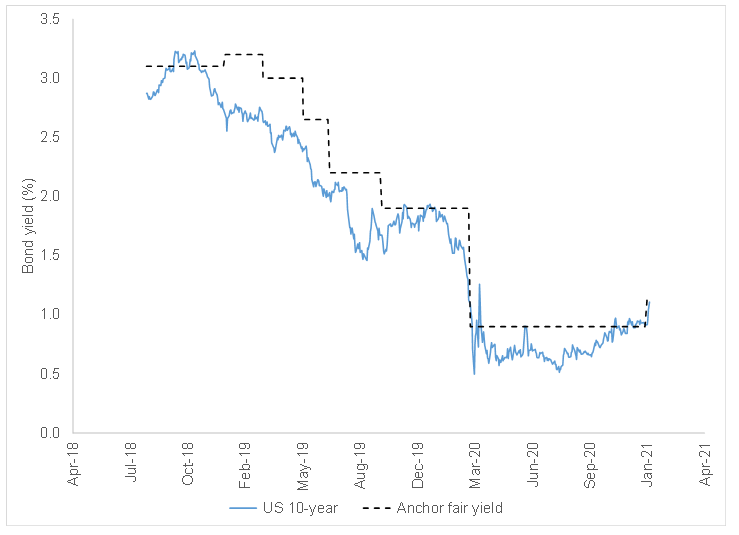

This probably also means that US bond yields will rise a little over the course of this year. We expect that the US Federal Reserve (Fed) will continue with its bond buying programme and that short-term interest rates will remain at zero, thus keeping rising bond yields in check. Accordingly, we have increased our target yield for the US 10-year bond from 0.90% to 1.15%. This relatively modest risk reflects both the fractured nature of US politics and the Fed’s supportive stance on the economy.

Figure1: Anchor US bond yield monitoring – yields on the US 10-year

Source: Thomson Reuters, Anchor

South Africa

In South Africa (SA) the COVID spike and the country’s desperate fiscal situation will remain foremost in our thoughts. We expect that the current COVID spike will persist and accelerate for much of January. The pandemic is keeping people at home (with or without lockdown restrictions) and therefore also acting as a speed bump for the local economy. We note, however, that the spike in infections appears to be abating in the Eastern Cape and the Garden Route, and we expect the rest of the country to follow this trend over the coming weeks. Therefore, while there will be some economic fallout from this second wave of the pandemic, in our view, the long-term impact will be minimal and the economy should show some growth this year, with an element of a recovery.

The market is also hypothesising about the possibility of a further 0.50% interest rate cut from the SA Reserve Bank (SARB), possibly as soon as the SARB’s Monetary Policy Committee (MPC) meeting on 20-21 January. However, we do not buy into this view and we think that rising inflation rate (watch the petrol price over the coming months), and the SARB’s already accommodative stance will mean that it will rather stay on hold – for now. We expect the first interest rate hike is more likely to be in 2022 than this year. The primary risk to our view is that should further lockdowns become necessary; we might see more interest rate cuts in 2021.

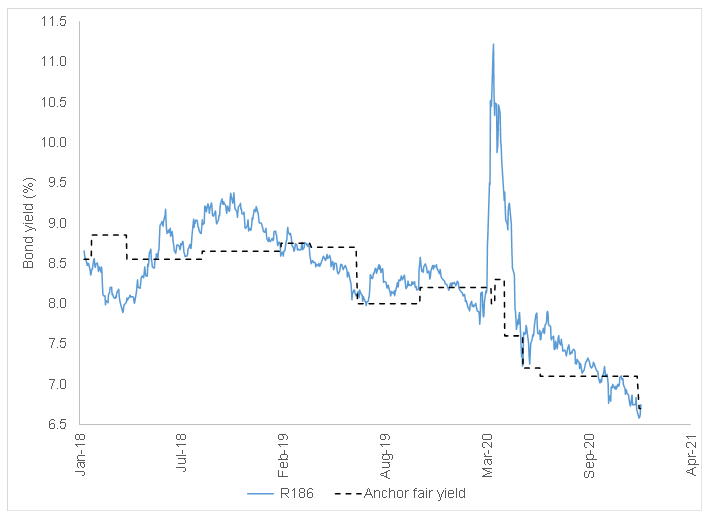

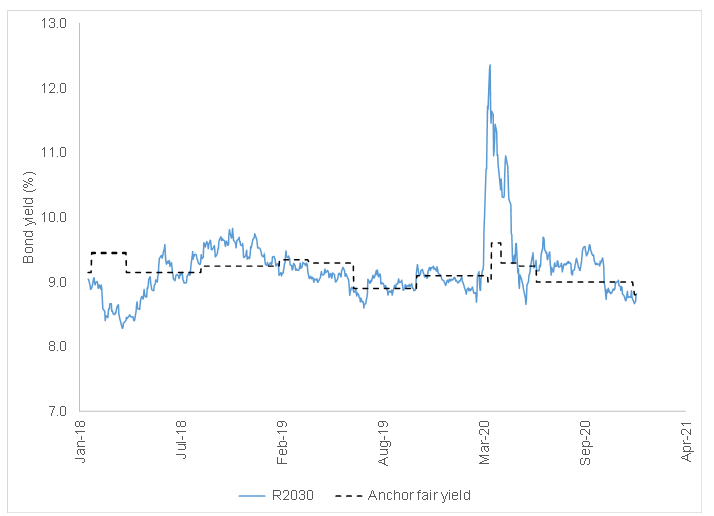

The fiscal situation within the SA government remains dire and will be under pressure for a while still to come. The government remains committed to fiscal discipline and clearly some progress has been made on this front. Unfortunately, this progress has not been enough, and we expect that 2021 will be telling, as government will need to take firm and difficult steps to deal with the wage bill and the rot at state owned enterprises (SOEs). Overall, however, we think that these risks are priced into bond yields and that the global search for yield will result in our bonds being well supported. We have therefore shifted our yield targets modestly lower to 6.7% for the R186 5-year bond and to 8.8% for the R2030 10-year bond.

Figure 2: Anchor SA bond yield monitoring – yields on the 5-year R186

Source: Thomson Reuters, Anchor

Figure 3: Anchor SA bond yield monitoring – yields on the 10-year R2030

Source: Thomson Reuters, Anchor

The implications for fixed income funds

Anchor BCI Core Income Fund

Our target 2021 net return is for just under 5% (net of fees).

The core income fund is designed as a portfolio that takes very little market risk and it should therefore be a stable income provider. This is ideal for corporates with significant cash reserves as the fund should generate appreciably more than these corporates are able to earn on bank accounts, with very little additional risk.

Anchor BCI Flexible Income Fund

Our target 2021 net return is 5.4% to 6.0% (net of fees).

The Anchor Flexible Income Fund is designed to be a low-risk fund that takes advantage of some duration positions to increase the yield, giving the portfolio some slight exposure to market risk. This is ideal for the low-risk portion of retail investors’ portfolios. It is also an attractive option for investors that are looking to outperform inflation (which is expected to average about 4% in 2021) without taking much risk.

Anchor BCI Bond Fund

Our target 2021 net return is 8.8% (net of fees).

This portfolio invests in longer-duration bonds, which offer more attractive yields. The portfolio will be volatile over the short term, however, long term, it is likely to offer an attractive interest outcome. This fund is ideal for those investors that need to generate income but are unlikely to sell their investment for long periods of time (e.g., as part of an investor’s regulation-28 fixed income component). This fund is also ideal for those investors that can tolerate slightly higher risk in the short term and want to earn more attractive interest yields.

Anchor BCI Africa Flexible Income Fund

Our target 2021 net return is 9% (net of fees).

This fund is ideal for those investors that want to diversify their fixed-income holdings away from SA. The portfolio is 50% US dollar-denominated and is diversified throughout the African continent, thus allowing investors to spread their fixed-income risks away from just SA, without giving up yield.

Anchor BCI Global Flexible Income Fund

Our target 2021 net return is 1.4% (in US dollar terms, net of fees).

The portfolio holds several corporate bonds (generally these are from the US and Europe and are rated around BBB, which is stronger than SA’s rating). These bonds are subject to the risk of the US yield curve rising, although we endeavour to retain the duration below 5 years, which should keep risks in check. The portfolio is 98% US dollar-denominated and the fund is ideal for those investors that want to retain their US dollar exposure, but with reduced equities exposure.

This portfolio is a BCI fund and it can only be bought by investors with domestic rand. We then convert the rand into US dollar within the portfolio.

Conclusion

The volatile investment landscape continues to be supportive of fixed income as an asset class. South Africans are still in a position to take advantage of positive real yields, while much of the developed world is facing negative or zero yields.