We have seen an uptick in global economic activity relative to the low expectations that pervaded a quarter ago. We are also seeing a more stable environment as investors fret less over political actions. Risk assets have performed well over the last quarter, and our starting points for asset prices are higher than previously. Overall, we still favour risk assets, though our expected returns are reflective of the higher starting prices. You will see that we continue to favour alternatives both domestically and abroad.

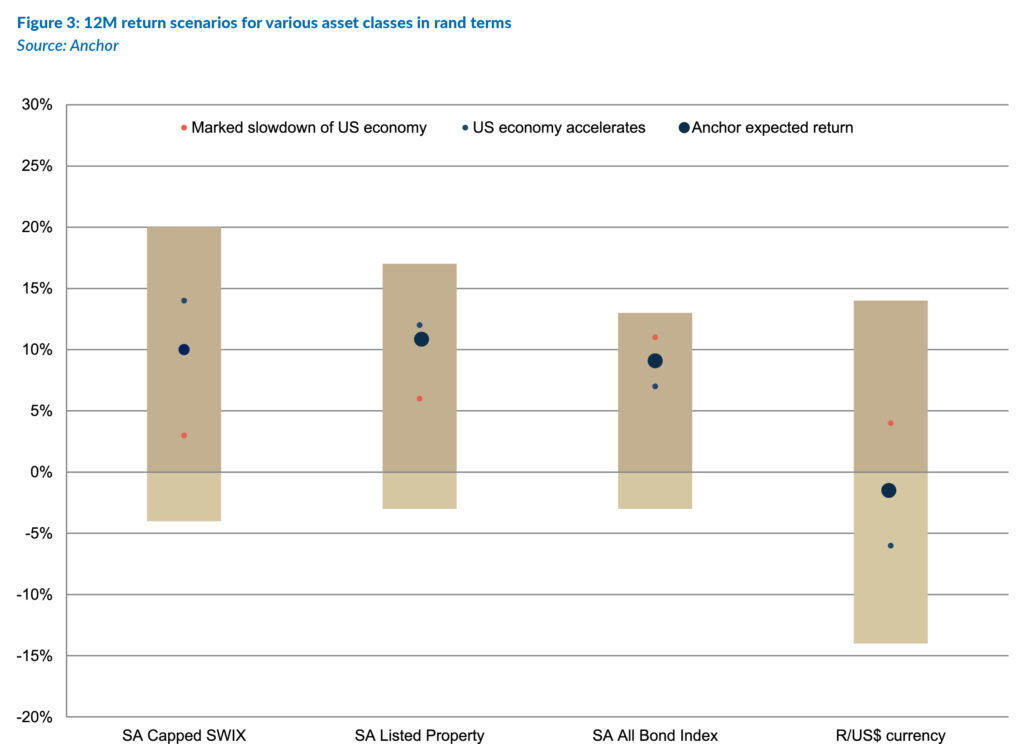

Figure 1 below highlights the US dollar return outlook for the various global asset classes. The bar in Figure 1 indicates the reasonable range of possible outcomes, with the dots representing our estimated outcomes in the various scenarios. All asset classes have attractive expected returns, though we find global alternatives (not shown) to be the most appealing.

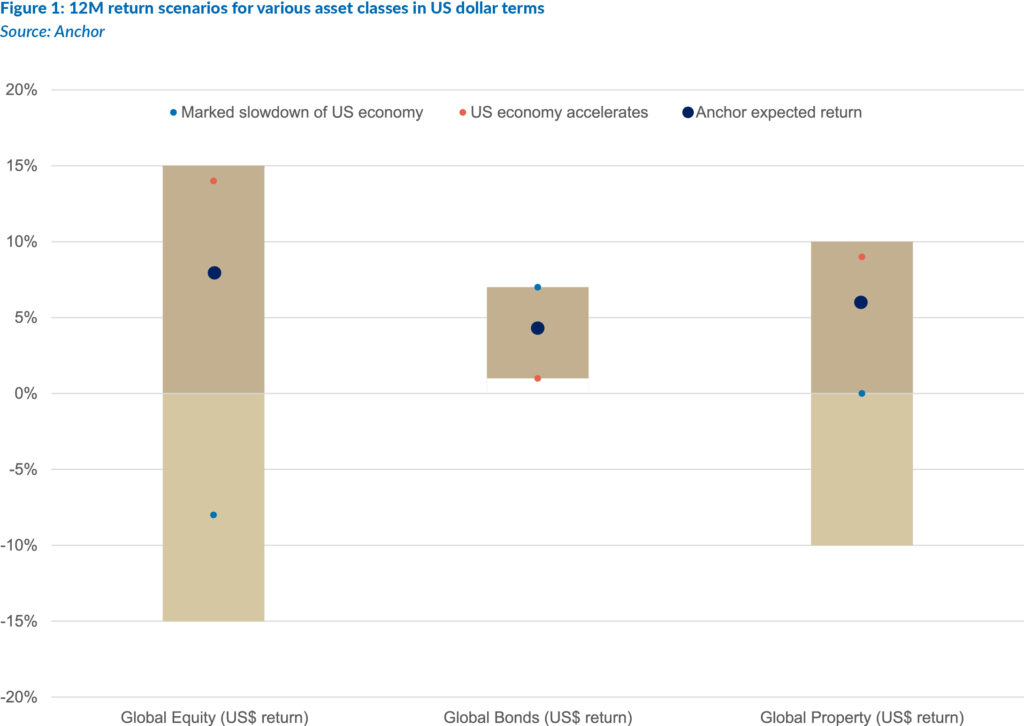

Figure 3 below outlines the rand return outlook for several domestic asset classes. The bar represents the reasonable range of possible outcomes, with the dots indicating our estimate of the outcome under various scenarios. From a domestic perspective, we anticipate a modest recovery in the rand from stressed levels as the US dollar weakens a little further. We are most positive on alternatives (not shown), which allow investors to diversify beyond traditional assets and help reduce overall portfolio volatility, smoothing returns across market cycles.