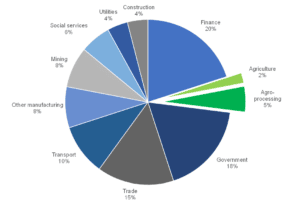

A strong and vibrant agriculture sector is of vital strategic importance to any economy, particularly for a developing nation such as South Africa (SA). It remains one of the primary drivers of economic growth. This sector also accounts for a significant portion of SA’s gross domestic product (GDP) – collectively the primary agriculture and agro-processing sectors contribute c. 6% to SA’s GDP. This overall contribution to the economy is comparable to that of the mining and manufacturing sectors, and nearly double that of the construction industry. However, the sector’s contribution to the local economy is more than its simple percentile contribution to GDP. Agriculture has strong linkages to input suppliers and the agro-processing sector, which magnifies these opportunities through significant upstream and downstream employment and economic multipliers.

If exploited equitably, agriculture has the potential to be the engine of inclusive growth in many less-developed rural areas and towns in SA. In these parts of the country, agriculture is typically the biggest employer and contributor of capital. Yet, whilst investors readily invest in other key sectors of the local economy, there has been limited private capital investment in the agriculture sector. One of the reasons for the lack of private capital flows to the agriculture sector is that it is fragmented and consists of many individually managed farms, producing a wide variety of produce. This makes it difficult to invest in the sector on any meaningful scale.

Figure 1: SA economy – GDP contribution by sector

Source: BFAP, Anchor

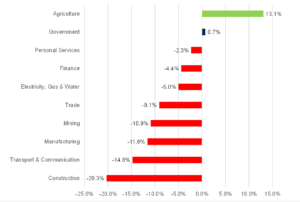

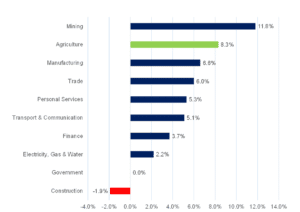

Agriculture, forestry & fisheries was SA’s fastest-growing sector in 2020 and 2021. The sector grew its gross value-added by 13% YoY in 2020 and by 8.3% YoY in 2021, underscoring its value as a sector that can deliver growth and is not correlated to the fortunes of most other sectors of the economy. It was one of only four sectors that realised any growth over this period. In 2021, strong 4Q21 growth of 12.2% contributed to seasonally adjusted, annual agriculture GDP increasing by 8.3% YoY – almost double the growth of the national economy. What makes this level of growth in agriculture more impressive is that it follows a 13.4% YoY expansion in 2020, making agriculture the strongest-performing sector since the start of the COVID-19 pandemic. Amidst the various restrictions imposed to curb the spread of the COVID-19 virus, the SA economy contracted 6.4% YoY in 2020, yet agriculture was the only sector, other than government services, to contribute positively. The sector has been remarkably resilient during a challenging period, contributing hugely to growth and food security. The pandemic also highlighted the sector’s broader footprint, its complex interlinkages with the rest of the economy, and the often-underrated contribution of the informal sector.

Figure 2: SA industry growth rates, 2020

Source: Stat SA Anchor

Figure 3: SA industry growth rates, 2021

Source: Stats SA, Anchor

This level of growth is relatively unsurprising, as the 2020/2021 agricultural season was one of the best in SA’s recent agricultural history, with near-record harvests in some crops. Primary grains such as maize and soybeans saw production reaching 16.3mn and 1.9mn tonnes, respectively. For maize, this is the second-largest harvest in history, along with a record soybean harvest. Other field crops also generated large yields in 2020/2021 compared with the previous year. Within the horticulture subsector, the SA Wine Industry Information and Systems (SAWIS) reported the 2021 wine grape crop at 1.5mn tonnes – 9.0% higher than the 2020 harvest. Citrus, deciduous fruits, and various horticulture products also recorded large harvests (and a record export volume in the case of citrus).

The livestock industry was hit by biosecurity challenges, such as foot-and-mouth disease outbreaks and high feed costs, towards the end of the year. Nonetheless, the livestock subsector held up relatively well and benefited from an improvement in the grazing veld. At the core of the favourable agricultural performance was the conducive weather conditions, with relatively frequent higher rainfall, which boosted yields and encouraged farmers to increase area plantings. Additionally, 2021 experienced an unusual period of generally higher commodity prices, in a year of a large harvest, which was beneficial to farmers – particularly for grains and oilseeds. However, these higher commodity prices were a global phenomenon and not unique to SA. Grains and oilseeds prices were primarily driven by the relatively poor harvest in South America and the strong demand from China and India.

As we move further into 2022, SA’s seasonally adjusted GDP grew by 1.9% QoQ in 1Q22. The agricultural sector in turn grew by 0.8% QoQ, as sharp increases in input costs negated most of the revenue gains. Nonetheless, the agricultural sector continues to contribute positively to the overall SA economy. In comparison to 1Q21, the agricultural sector expanded by 3.6% YoY. Although the GDP growth rates per agricultural sub-sector are not published, the disaggregated gross value of production (GVP), as compiled by the Department of Agriculture, Land Reform and Rural Development (DALRRD), provides some indication of the main drivers behind the agricultural sector’s performance in 1Q22. All three subsectors contributed positive revenue growth, with the fastest growth rate attributable to field crops at 11% YoY, followed by horticulture (+5% YoY), and animal products (+2% YoY). While the revenue generated by field crops grew faster, it was a very small contributor in 1Q22, as the winter harvest (mostly wheat) is typically completed, and summer crops are harvested predominantly in the second and third quarters of a year.

Growth in field crops was supported by price gains across most of the sector, resulting from international market dynamics. Supply constraints and declining stock levels in the international market, which had already pushed prices higher over the past 18 months, were exacerbated by Russia’s invasion of Ukraine in February 2022. Both Russia and Ukraine are important exporters of maize, wheat, and sunflowers, hence the ongoing war further accelerated the rise in international prices. Revenue also benefitted from increased output volumes, with additional early deliveries of yellow maize compared to 2021 and a bumper wheat harvest being the major contributors.

Gross income in animal products for 1Q22 grew slower than other subsectors at 2% YoY, but it remains the biggest contributor to absolute growth in GVP at this time of year. Despite rapid meat price increases since mid-2020, livestock slaughter volumes have been decreasing, thus limiting revenue growth. In the horticulture sub-sector, revenue increased by 5% YoY in 2Q22. Despite this positive revenue growth, the sub-sector faces several challenges that have brought profitability under pressure including extreme freight cost increases, challenges in both domestic and global ports that continue to hamper trade, and drastic increases in production costs. The sub-sector is also hit by the added challenge of fruit earmarked for the Russian market, which is naturally not currently trading as per the norm. It is worth bearing in mind that changing market destinations is not as simple as merely loading a container to another port, as consumer trends are country-specific, and thus produce earmarked for the Russian market cannot simply be absorbed by another destination.

Whilst the agricultural sector has been one of the strongest performers in the SA economy in recent years, growth is expected to slow in 2022. While prices are high, production costs increased quite sharply and continue to rise with the ongoing war in Ukraine. Logistical constraints are another factor that will bring profitability under pressure. The heavy rains experienced at the start of the season will likely lead to a somewhat lower harvest than the 2020/2021 production season, although it will still be above the long-term growth harvest size. The slight annual decline in yield, combined with the higher 2021 base, will likely contract agriculture’s gross value-added in 2022. Nonetheless, despite challenges facing the sector, it still had a positive start to the year and remained an important contributor to SA’s overall, national economic growth.