Alibaba Group reported lower-than-expected 2Q19 revenue on Friday (2 November) – revenue rose 54.5% YoY to RMB85.2bn (c. $12.39bn; at an exchange rate of $1: RMB6.87) compared with the Refinitiv consensus analyst estimate of RMB86.51bn. Net income attributable to ordinary shareholders rose 13% YoY RMB20.03bn, or RMB6.78/share. Adjusted EBITDA was 6.7% YoY, while non-GAAP net income rose 6.1% YoY.

In terms of segments, its core e-commerce segment saw revenue increase by 56% YoY contributing RMB72.48bn ($10.5bn), while its cloud computing business recorded a 90% YoY revenue jump to RMB5.67bn ($825mn). Digital media and entertainment advanced by 24% YoY to RMB5.94bn ($865mn) and innovation initiatives and other grew revenue by 20% YoY to RMB1.06bn (R155mn).

Mobile monthly active users (MAUs) rose by 21% YoY, while annual active customers were up 23% YoY. Management cited weakness in consumer durables – consumer electronics and autos – which was largely sentiment related. Staples, cosmetics and apparel remained relatively immune.

Looking ahead, Alibaba cut its full-year 2019 revenue forecast to between RMB375bn and RMB383bn ($54.4bn-$55.6bn), a 4%-6% YoY drop.

Below we include a table showing the segmental breakdown of the results. Note how the “non-core commerce” divisions are a heavy drag on margins.

Alibaba: 2Q19 Segmental breakdown

Source: Alibaba

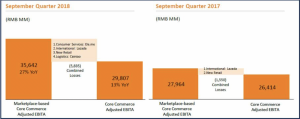

Within the Core Commerce segment, adjusted EBITA (operating profit) was weighed down by investments in the local services business Ele.me (the closest comparison to this business is Uber Eats), International, New Retail and Logistics.

Alibaba: EBITA in Core Commerce – new initiatives weigh on margins:

Source: Alibaba

Key takeaways:

Our key takeaways from the results are the following:

1. The Alibaba story is the inverse of the Amazon story: investing incrementally for growth in (mostly) lower-margin businesses in pursuit of large addressable markets. The revenue story is getting better, the profit story is getting worse – for now.

2. The trade war and economic slowdown in China have added a fly to the ointment. Management decided to hold off on fully monetising all advertising inventory, in order to give merchants some breathing room. Management also lowered FY19 revenue guidance as a result.

3. Alibaba is trading roughly one standard-deviation cheap on a PE basis.

4. The actual discount on Alibaba’s core marketplace business is higher than first appears, given that Alibaba’s forecast earnings include growing losses from its investments in payments (Ant Financial), cloud, media, New Retail (brick and mortar), Logistics and International (primarily South East Asia). Not all of these ventures will be successful, but the potential payoff in each makes the pursuit worthwhile. In China, the competition in nascent markets is extremely fierce and appears almost irrational, in typical venture capital style. Once the market decides on the winner(s), the competition becomes more rational and sustainable; usually when there are only one or two main players remaining.

We believe that Alibaba has material upside, however patience is needed, as a number of the prevailing headwinds could take some time to dissipate.