Accenture Plc (ACN_US) is a phenomenal business which has eye-watering financial metrics and an excellent track record. This is, justifiably, reflected in a share price which has doubled in the last four years. With a compound return of 19% p.a., this is well ahead of earnings growth of 12% p.a. We expect the business to continue to grow meaningfully (+/- 9-10% p.a.) but it is unlikely that the share price will maintain historic compound growth rates given the extent of the re-rating that has already taken place. The potential for future operating margin growth is less than what has been achieved historically. Developed markets (DMs) have been in a momentum phase where increasingly high multiples have been attributed to growth businesses. This has seen Accenture re-rate to a forward 23x PE multiple and 1.7% dividend yield, which represents a 50% premium to the overall market. The share appears to be priced for perfection and any misstep in execution could be costly for the share price. Assuming a solid earnings outlook, annual share price performance is likely to be closer to earnings growth of 9%-10%, with the risk of a de-rating when the market becomes more circumspect about the valuations ascribed to growth shares.

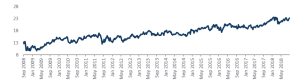

Accenture Plc traces its roots back to the days of Arthur Anderson when Anderson Consulting, an IT-focussed consulting agency, spun out from the greater Anderson business. The consulting arm focused primarily on consulting on the information technology (IT) needs of their clients as the 4th industrial revolution, or “IT age”, started gaining traction and IT integration became a way of staying relevant for companies at a minimum. Every business needed to incorporate IT in some way or another to stay relevant and Anderson Consulting was there to assist larger corporates with complex IT needs. Since listing, investors in Accenture have been richly rewarded, with shareholder returns compounding at more than 19% p.a. for the last ten years. Interestingly, c. 40% of this return, or 8% p.a., has come in the form of a continuous, and consistent, re-rating of the counter over this time.

Figure 1: Accenture Plc PE ratio (12m blended forward)

Source: Bloomberg

A good thirty years on from the mass adoption of information technology globally, the IT industry is at the beginning stages of another mass movement; the protection of data and usage of cloud storage. These two key themes are shaping the needs of global corporations. Brick-and-mortar companies are focused on improving or establishing a digital presence, companies are moving important data from internal data centres to the cloud and enterprises are investing heavily in cyber-security defences as hackers become more sophisticated and dangerous. As transacting is moving away from the storage of physical documentation, the need to keep data protected is as in demand as ever and the value placed on protecting that data means that consulting firms like Accenture are well positioned to benefit from this demand.

For IT consulting firms, like Accenture, forecasts by global IT association CompTIA (The Computing Technology Industry Association) put the growth in the overall IT service economy at 5% p.a. over the medium term.

In making the assessment of whether a business will make a good investment, our internal processes at Anchor look for key pillars of a business. We then make a call as to whether this would make a sound investment, essentially tying the business and investment case together. Our fundamental approach earmarks high and stable or rising return on capital employed, quality brands, pedigreed management and sustainable competitive advantages as some of the vital qualities that will ensure the ongoing success of a business.

While we regard ourselves as bottom-up investors, we typically overlay our bottom-up view with a macro view – considering secular trends impacting the industry and markets in which they operate. From the bottom-up, Accenture looks like the high-quality business we like to look for. Brand recognition in the corporate world remains very high with confirmation of this coming through via the servicing of more than three quarters of the Fortune 500 companies (and 95% of the top 100). It is also impressive that all of Accenture’s top-100 clients have been clients for more than five years and 98 out of the top-100 have been clients for 10 years or more. With annual revenues of $40bn, 150 clients account for c. 30% of this, on retainer. That is an average of $267mn p.a. for each of the top-150 clients. The concentration around these clients would be a concern as the relationship with the key personnel at Accenture and the client would give rise to the risk of those key individuals leaving and taking the clients with them. However, we would imagine the IT needs to be so complex for those clients that the risk of leaving and disrupting the status quo becomes very low.

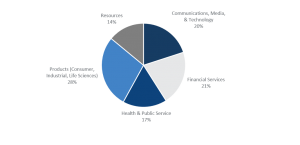

Accenture’s revenue streams are well diversified across the types of services it offers, the industries it serves, and the locations in which it operates. The company’s five service areas are Accenture Strategy, Accenture Consulting, Accenture Digital, Accenture Technology, and Accenture Operations.

Figure 2: Divisional revenue split

Source: Bloomberg

Emphasis on the NEW

Since 2016, Accenture has been placing increased focus on what the business has phrased the “new” strategy. This is, essentially, the rotation of the business to new higher growth areas of IT needs being digital, cloud and security services, which grew revenues at 30% in FY17 and now accounts for more than 50% of Group revenues. Over time, the IT consulting industry has become largely commoditised and Accenture has had to become a leader in innovation and scale as it was becoming increasingly difficult to differentiate the service.

This is where the movement to digital (largely marketing and app-based services), cloud (service providers to Microsoft, SAP etc.) and security was established. The decision to focus on these areas of IT consulting needs ties into our outlook on the increased demand for data protection and cloud storage. The ability of management to innovate and execute as well as Accenture is a quality on which we are continuously placing increased emphasis.

In a recent interview Accenture CEO Pierre Nanterme had this to say on his take of the last 35 years at Accenture; “Accenture has changed a lot during that time, probably undergoing a new wave that drove significant changes to the business every ten years. We evolved from management consulting to systems integration and technology. Ten years after that came a new wave – outsourcing. Now we’re facing the next wave, which I’ll call global security and the digital revolution. Indeed, each reinvention of Accenture was based on the new technology waves that occurred. This revolution is a technology disruption, with many more tech disruptions ahead and coming at an accelerating pace. First, there’s the digital marketing revolution, then mobile apps, then analytics and the A.I. revolution, then there’s the cloud revolution, and then the cybersecurity and the encryption revolution.”

It is clear from the above statement that Accenture has identified the need to pivot in an industry that never seems to stop changing with the next evolution of Blockchain technology and AI looming on the horizon.

Simple operating model, low capital requirements and IP heavy

Accenture’s operating model is that of a service provider; revenue and new business is contract based and the largest capital investment is human capital (expensed through the income statement). Costs are largely variable in nature with staff costs the biggest expense – total employees are in excess of 429,000. The real competition in the industry is that of skills and the cost effectiveness of those skills. Competitors with most staff in low-cost jurisdictions (such as India) have the upper hand when it comes to pricing on projects. As a result, Accenture has had to relocate 70% of the workforce to these areas to remain competitive. This is a trend we do not foresee reversing over the short-to medium-term.

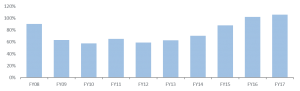

The capital-light nature of the business has allowed Accenture to compound shareholder returns at alluring rates. By simply managing treasury effectively (share buybacks) and steadily growing earnings, the return on capital employed has continued on an upward trajectory.

Figure 3: Return on capital employed

Source: Bloomberg

By our calculations, the business has consistently returned close to 100% of free cash flow to shareholders in the form of buybacks and dividends, making total shareholder returns look attractive.

At this stage, the focus needs to shift to sustainability of the continued upward return on capital trajectory. With costs largely variable in nature, the business needs to shift up a gear in revenue growth to achieve this and while the industry growth has a robust outlook, Accenture already has the leading position and would need to squeeze out the majority of the competition to experience a step change in the growth achieved. We would caution against betting on further rerating , especially so late in the economic cycle where asset prices are already looking fully valued at best.

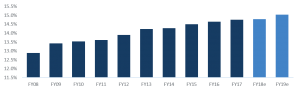

Figure 4: Operating margin

Source: Bloomberg

The cyclicality of the industry is difficult to quantify at this point, largely because of the unknown nature of the current IT spending cycles. Traditionally, IT spend would be a key focus area for corporates to cut back on during times of contracting top lines (recessionary conditions) but with the increased effectiveness of data thieves (hackers), corporates would likely view data security as a necessity as opposed to a value-added service, the effective use of IT has become an existential issue. In addition, the shift to the cloud brings with it operating efficiencies that corporates could use to protect margins in tough trading conditions. There is, however, no doubt that conversations become far tougher with clients when they are struggling and the ability to increase contract pricing during a recession is likely to be very low. As the client set is so diverse we would expect to see the overall growth in revenue to be impacted by the broad-based global economic climate in the event of a cyclical downturn and with most costs variable in nature, the margin leverage would not be too severe.

As the world is currently moving towards the later stages of the current economic cycle, the recessionary risks would be key for us, although, other key risks we would pay special attention to would be:

- Talent retention and staff turnover.

- Competitor pricing trends, if margins start dropping for major competitors.

- Disruptive technologies reducing the need for major outsourcing arrangements.

- Single event risk. One wouldn’t need to look beyond the firm that originally housed Anderson Consulting for an example of how fragile these firms are to large single events that can damage the integrity of the brand.

The above risks are risks for the sake of identifying them. A global recession will likely hit more than three quarters of the global investable universe (there will be no place to hide) and should not take the shine off the exceptional business that Accenture represents. The decision as to whether, at this stage, it would be prudent to have more than a few percentage points of a portfolio in Accenture is a difficult conundrum. The continuous repricing of the share leaves it vulnerable to any form of operational misstep or external shock. At the same time the share will likely retain a premium rating for as long as the company outperforms peers (a trend we expect to continue) and industry fundamentals remain supportive. Should current conditions persist, we expect earnings to compound at 10% for the next three years. At a share price of $168, the forward PE multiple of 23x leaves little room for further upside to the valuation and would lead us to conclude that, at best, the share will likely deliver 10% – in line with the expected earnings growth.

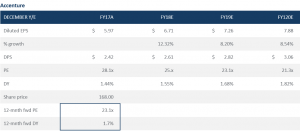

Earnings outlook

Accenture

Source: Bloomberg

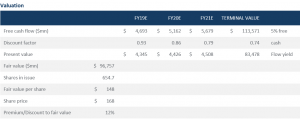

Valuation

Source: Anchor

A method we would typically use at deriving a fair value for a service business like Accenture would be to capitalise the year-3 free cash flow at an appropriate free cash flow yield and discounting that value back to today. Using this methodology, the share appears 12% overvalued. Although, we concede that the model is very sensitive to the 5% fair free cash flow yield assumption.

Accenture ticks all the boxes we like to look for in a business, however, our job is to continuously look for the next Accenture – before the repricing takes place. The structural compounder we do not need to overpay for and when one has the luxury of investing anywhere around the world, these opportunities present themselves all the time.