September was a brutal month for global markets. China headwinds, less accommodative monetary policy, deepening inflation, the spectre of slowing growth, the COVID-19 pandemic’s deadlier Delta variant, and a possible US government shutdown dampened risk appetite and weighed on investor sentiment, resulting in most major world equity markets closing the month in the red. The liquidity crisis at China’s second-largest property developer, Evergrande, shook global markets after reports emerged earlier in the month that it was having severe cashflow problems with a very real risk that it will default on repaying what it had borrowed from China’s shadow banking system (underground financial activity that takes place outside of traditional banking regulations and systems).

Evergrande’s financial issues were a catalyst for investors to start asking questions about the health of China’s economy. In addition, China’s regulatory overhaul continued unabated as an aggressive and unpredictable flurry of regulations were created over several disparate industries to align the private sector with China’s social development objectives and acting as a handbrake on economic growth and worrying investors. We also saw contagion spread to most EMs with a sense of risk-off sentiment being created which, in turn, strengthened the US dollar and weakened EM currencies, resulting in the rand and bonds coming under pressure.

There were no major surprises from September’s US Federal Reserve (Fed) meeting with the Fed now expected to announce tapering at its next meeting on 3 November, with the goal of being done with balance sheet expansion by mid-2022. This suggests that the Fed will shrink its current US$120bn/month quantitative easing purchases by c. US$10bn-US$15bn/month. The release of updated forecasts from the Fed members now shows that the median member believes that it would be appropriate to start hiking rates next year (3 months ago they thought 2023 was most likely time for rate hikes). Forecasts have revised inflation higher for the next few years, apparently reflecting the lingering impact of supply chain bottlenecks.

Major US indices were not saved in September’s turmoil, with the blue-chip S&P 500 ending its seven-month winning streak to close the month 4.8% in the red (+14.7% YTD/+0.2% in 3Q21), while the tech-heavy Nasdaq fell 5.3% MoM (+12.1% YTD/-0.4% in 3Q21) and the Dow Jones retreated by 4.3% MoM (+10.6% YTD/-1.9% in 3Q21) – both indices’ worst month YTD.

In terms of US economic data, the Conference Board’s consumer confidence index recorded its third-straight monthly decline, falling to a seven-month low in September – to 109.3 from 115.2 in August. This on the back of a continued rise in COVID-19 cases, caused by the more contagious Delta variant, which deepened concerns about the US economy’s near-term prospects. However, August MoM retail sales unexpectedly increased by 0.7% from a revised 1.8% MoM drop in July, while 2Q21 GDP data were also revised upward to a 6.7% annualised pace (from 6.6% previously), according to the Bureau of Economic Analysis’ third revision of GDP.

In Europe’s largest economy, Germany, the DAX declined by 3.6% MoM (+11.2% YTD/-1.7% in 3Q21), while in the eurozone’s second-biggest economy, France’s CAC Index ended September 2.4% lower (+17.4% YTD/+0.2% in 3Q21). Following Germany’s elections on 26 September, results showed that the country’s centre-right alliance of the Christian Democratic Union-Christian Social Union (CDU/CSU) bloc, was beaten by the narrowest of margins by social democrats, the SPD. The party of outgoing chancellor, Angela Merkel, who has been at the helm in Germany since 2005, was beaten with a swing of slightly more than five percentage points. On the economic front, the latest preliminary flash estimate of seasonally adjusted quarterly GDP in the eurozone showed growth of 2.2% QoQ in 2Q21. Meanwhile, S&P Global reports that the fully vaccinated population in the eurozone has nearly doubled in the past three months, reaching 65% by mid-September.

The UK’s FTSE 100 Index closed September 0.5% down (+9.7% YTD/+0.7% in 3Q21). In UK economic data, after growing 1.0% MoM in June, UK GDP growth slowed significantly to only a 0.1% MoM rise in July as a surge in the Delta variant forced workers to self-isolate and consumers spent less.

In Asia, Evergrande, which ultimately poses a significant risk to China’s growth, power cuts, ongoing concerns around that country’s regulatory clampdowns and disappointing economic data weighed on Chinese markets in September. Data from the World Steel Association also showed weakness in the country’s steel production, which fell 13.2% YoY in August. This is concerning since China produces over 50% of global steel, much of which is used in the country’s manufacturing and construction industries and weakness in steel production is equivalent to an indication of softness in China’s manufacturing and construction base. Nevertheless, China’s Shanghai Composite Index closed marginally higher (+0.7% MoM) in September (+2.7% YTD/-0.6% in 3Q21) although Hong Kong’s Hang Seng Index dropped 5.0% MoM (-9.8% YTD/-14.8% in 3Q21).

In economic data, China’s official manufacturing purchasing managers’ index (PMI) recorded a surprise slowdown, contracting to 49.6 in September, from 50.1 in August (the 50-point mark separates expansion from contraction). This, as high raw material costs and power cuts, put pressure on manufacturers in China. However, the official non-manufacturing PMI (which measures morale in the services and construction sectors) rose to 53.2 in September, from 47.5 in August.

In Japan, the Nikkei closed 4.9% higher MoM (+7.3% YTD/+2.3% in 3Q21), while on the economic data front, revised GDP data released in September, showed the country’s economy grew faster than initially estimated in 2Q21 – up by an annualised 1.9% following a revised 3.7% slump in 1Q21.

On the commodity front, the Brent crude oil price had a strong run, even rising above the US$80/bbl level for the first time in c. 3 years, before taking a breather and falling back towards month-end. MoM, the oil price rose 7.6% in September (+51.6% YTD) on the back of investor concerns about tighter supplies due to rising demand in parts of the world. After closing August basically unchanged (-0.03% MoM), the gold price was down 3.1% in September (7.4% YTD). Iron ore fell by c. 23.7% MoM (-23.6% YTD), while the price of platinum and palladium remained under pressure, dropping by 4.8% and 22.6% MoM and down by 9.8% and 21.9% YTD, respectively.

On the JSE, South Africa’s (SA’s) FTSE JSE All Share Index declined for a second month running (-4.7% MoM/-3.0% for 3Q21), although the index is still 8.2% higher YTD. Most sectors were down for the month, but commodity, industrial metals, and materials counters were the worst affected with the Resi-10 dropping 12.5% MoM (+0.9% YTD/-8.1% for 3Q21). The Indi-25 fell 1.8% MoM (+5.2% YTD/-6.0% for 3Q21), while property counters declined 2.3% MoM (+19.9% YTD/+3.8% for 3Q21). Financials (+21.3% YTD/+11.6% for 3Q21) managed to eke out a small gain of 0.8% for September. Looking at the JSE’s biggest shares by market cap, Prosus was down 5.2% MoM, although Naspers managed to close 0.5% in the green. Still, the combined performance of the two counters was once again a drag on the index as the shifting regulatory landscape in China remained a headwind for the two companies. Anglo American Platinum (Amplats), Anglo American, and BHP Group plummeted 20.9%, 13.1%, and 9.9% MoM, respectively, while Glencore, a big winner from soaring coal prices, swam against the tide and posted an 8.7% MoM gain. Anheuser Busch InBev, Richemont, and British American Tobacco, and declined by 3.4%, 3.1%, and 2.5% MoM. The rand closed the month 3.7% weaker against the greenback and on a YTD basis, the local unit has declined by 2.5% against the US dollar.

In local economic data, August annual headline inflation, as measured by the consumer price index (CPI), came in at 4.9% YoY vs July 4.6% print. The CPI rise was largely driven by increased food costs and the ZAc91/litre petrol price hike at the beginning of August. Overall, the print had little impact on the SA Reserve Bank’s (SARB’s) interest rate decision on 23 September, and there were no real surprises with regards to the latest interest rate decision by the Monetary Policy Committee (MPC), although we noted a slightly more hawkish tone than we have seen of late. Whilst there were only minor upward revisions to the inflation outlook, the SARB assessed risks to the short-term inflation outlook to be on the upside because of rapid global producer price and food price inflation having surprised to the upside in recent months, along with a volatile oil price and the ever-present, short-term risks posed by electricity and other administered prices. Furthermore, a weaker currency, higher domestic import tariffs, and escalating wage demands present further longer-term upside risks to the overall inflation forecast. Whilst the 2021 growth outlook was raised significantly higher to 5.3% (largely due to the recent historical base revisions and stronger 1Q21 and 2Q21 GDP prints), of concern is the SARB’s downward revision of 2022 and 2023 GDP growth to 1.7% (down from 2.3%) and 1.8% (down from 2.4%), respectively, which is indicative of the inherent structural weaknesses still present in the SA economy.

On the pandemic front, the country moved to adjusted Level -1 of lockdown restrictions on 1 October, as SA continued to experience a decline in daily COVID-19 cases. According to the latest Department of Health data, as at 30 September, c. 17.5mn vaccines have been administered, while the total number of confirmed COVID-19 cases since the start of the pandemic stood at 2.9mn vs 2.8mn as at 31 August.

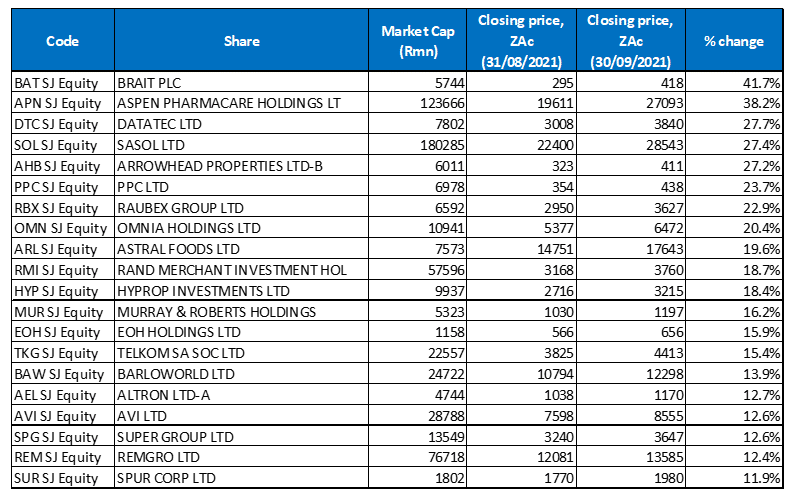

Figure 1: September 2021’s 20 best-performing shares, MoM % change

Source: Anchor, Bloomberg

Investment company Brait Plc, a share price laggard for months now, finally turned a corner in September, emerging as the month’s best-performing share with a 41.7% MoM gain (albeit from a very low base). This after media reports that a consortium led by Brait has revived its plans to exit glass bottle manufacturer, Consol Glass, possibly via an initial public offering (IPO). This comes c. three years after a previous failed attempt, when the plan to list Consol in 2018 was pulled due to “challenging market conditions.” Brait has a 29.7% stake in Consol.

In second spot, Aspen Pharmacare’s (Aspen; +38.2% MoM) share price leapt after Aspen released a cautionary announcement stating that it had received two material unsolicited offers for its active pharmaceutical ingredient (API) business (excluding its French manufacturing facility). The manufacturing business has operations locally as well as in the Netherlands and the US. Aspen’s entire API business, which contributes about two-thirds of its manufacturing business revenue, generated R6.4bn of Aspen’s total R37.8bn in FY21 revenue.

Datatec (+27.7% MoM), in third spot, saw its share price shoot higher on upbeat earnings guidance. The tech company flagged double-digit half-year sales growth due to increased demand for networking software for remote workers, which offset the impact of the global shortage in microchips. Over the past 18 months or so, growth in technology use and disruptions in supply chains have seen demand outpace supply of microchips which are critical components of modern electronics and vehicles. Datatec has operations in over 50 countries.

Datatec was followed by Sasol, Arrowhead Properties, and cement company, PPC Ltd with MoM gains of 27.4%, 27.2%, and 23.7%, respectively. A buoyant oil price boosted Sasol, while PPC’s upbeat operational update on its restructuring and refinancing buoyed its share price. PPC said last month that its SA lenders have agreed to review the need for the company’s capital raise should its SA businesses continue to de-gear towards a sustainable debt metric of 2x EBITDA. It also said that it has signed non-binding term sheets with SA lenders to refinance its existing debt obligations and remove the undertaking for a capital raise subject to the completion of the disposal of PPC Lime by 31 October 2021.

PPC was followed by construction and materials group, Raubex (+22.9% MoM). In its 1H21 trading statement, Raubex said that it has returned to profit for the six months to end-August, with a record order book underpinning a more-than-doubling of headline earnings per share (HEPS) from pre-pandemic levels – it expects its HEPS to be at least ZAc117.00, vs a headline loss per share of ZAc26.60c in 1H20.

Rounding out the top-10 performers were Omnia Holdings, Astral Foods, and Rand Merchant Investment Holdings (RMI), which recorded MoM share price gains of 20.4%, 19.6% and 18.7%, respectively. In its FY21 trading update, poultry producer Astral said that it expects its HEPS to be 25.0% lower as compared with R14.41 in FY20. However, this is an improvement on the 37% YoY decline the company suffered in 1H21. RMI’s share price jumped following the announcement that it will unbundle its shareholding in Discovery and Momentum Metropolitan to existing RMI shareholders during 2022. RMI is looking to focus more on its short-term insurance business, which it believes “will unlock material shareholder value”. This will leave it with two core assets – 89% of OUTsurance and 30% of the UK’s Hastings.

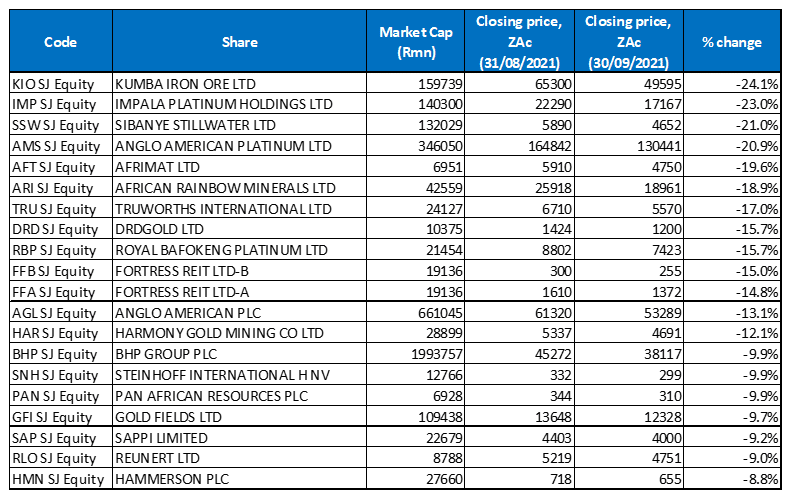

Figure 2: September 2021’s 20 worst-performing shares, MoM % change

Source: Anchor, Bloomberg

Much like in August, most of last month’s worst-performing shares came from the resources and precious metals sectors as commodity prices remained under pressure in September. The price of gold, platinum, palladium, rhodium, and iron ore fell by 3.1%, 4.8%, 22.6%, 23.3%, and 23.7% MoM, respectively, dragging the share prices of mining and commodity counters lower. China has reportedly stepped-up curbs on its steel production to meet its environmental goals, which has weakened demand for iron ore, sending its price down to below US$110/t, from a high of c. US$230/t in May this year. Considering this, it is not at all surprising that the major price declines in platinum, palladium, rhodium, and especially iron ore have sent the valuations of miners that produce these minerals plunging over the past two months or so. This resulted in Kumba Iron Ore (Kumba) losing 24.1% of its value in September and laying claim to the title of last month’s worst-performing share.

Kumba was followed closely by Impala Platinum (-23.0% MoM), another victim of commodity price declines, while Sibanye Stillwater was in the third spot, with a 21.0% MoM drop in its share price. Sibanye, which is listed in New York and on the JSE, announced in mid-September that it is investing US$490mn (R7.1bn) for a 50% stake in a lithium/boron mining project in Nevada, which is mooted to become the largest lithium mine in the US. The miner said that this will step up its presence in the battery materials supply chain and is a joint venture with Australian-listed, Ioneer.

Behind Sibanye was another platinum miner, Amplats (-20.9% MoM), which was in turn followed by minerals and construction supplier Group, Afrimat (-19.6% MoM), African Rainbow Minerals (ARM; -18.9% MoM), Truworths International (-17.0% MoM) and DRDGold (-15.7% MoM). Shares in Truworths recorded their worst day since the company listed in 1998 on 3 September, plummeting c. 15% on the day (and wiping out c. R3bn in shareholder value). This after Truworths reported earnings that showed the retailer is continuing to struggle in the UK and that its sales in SA were hit by the riots that took place in July. Truworths said that the violence hit 57 of its stores, or c. 7% of its SA store base.

Rounding out September’s worst-performing shares were Royal Bafokeng Platinum and Fortress REIT -B-, with MoM declines of 15.7% and 15.0%, respectively.

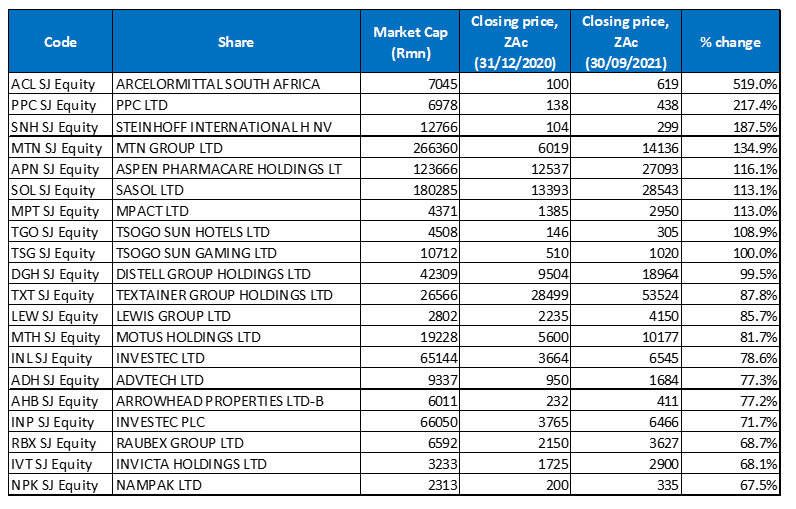

Figure 3: Top-20 September 2021, YTD

Source: Anchor, Bloomberg

Sixteen out of September’s top-20, YTD best-performing shares were unchanged from those in the year to end August, with Aspen (+116.1% YTD), Arrowhead Properties Ltd -B- (+77.2% YTD), Raubex (+68.7% YTD), and Nampak (+67.5%) replacing Truworths, Pepkor, Imperial Logistics and Accelerate Property Fund in September.

Despite a 5.2% decline in its share price last month, Arcelor Mittal SA (+519.0% YTD) remained by far the best-performing share YTD, followed by PPC (+217.4% YTD) in second spot, after the latter’s sterling September performance. Steinhoff moved from its second position in the year to end August to the third spot in the year to end September, with its share price now 187.5% higher YTD. Business Report writes that Steinhoff came a step closer to regaining stability last month after the company’s R25bn settlement was given the go-ahead by claimants, which means most of the claimants in SA and the Netherlands have approved the process and the next step will be for the Group to apply to the Cape High Court for an order approving the proposal.

Steinhoff was followed by MTN (+134.9% YTD) and new entrant, Aspen (+116.1% YTD). Then came Sasol (+113.1% YTD), MPact (+113.0% YTD), and Tsogo Sun Hotels (+108.9% YTD), with Tsogo Sun Gaming (+100.0% YTD) closely behind it.

Brewer, Distell Group (+99.5% YTD), rounded out the top-10 performers YTD. Distell’s share price rose 5.7% MoM in September, and the company is still in takeover talks with the world’s second-biggest brewer, Heineken. Distell said last week that “satisfactory progress” had been made regarding the potential transaction following the Heineken bid to acquire full control of the Group.

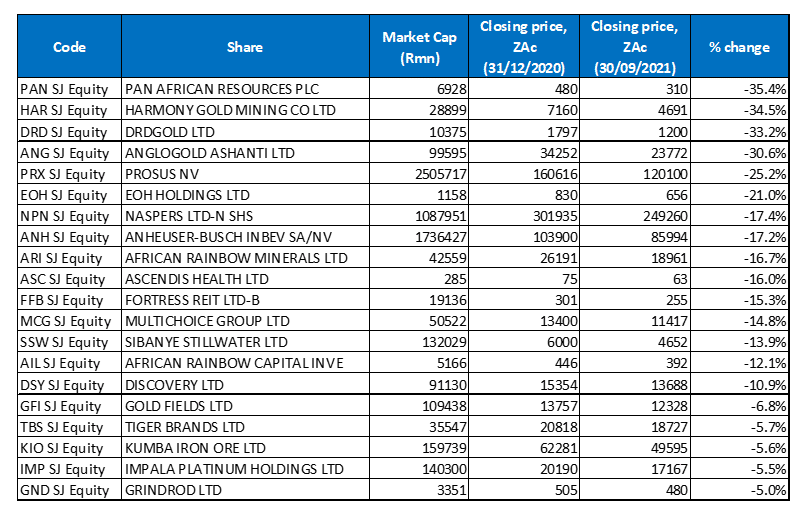

Figure 4: Bottom-20 September 2021, YTD

Source: Anchor, Bloomberg

Looking at the YTD worst performers, 13 of the 20 worst-performing shares for the year to end August again featured among the 20 worst performers for the year to end September, with many newcomers from the mining sector. The newcomers in the YTD worst-performing category were African Rainbow Minerals (-16.7% YTD), Fortress Reit -B- (-15.3% YTD), Sibanye Stillwater (-13.9% YTD), Gold Fields (-6.8% YTD), Kumba (-5.6% YTD), Impala Platinum (-5.5% YTD), and Grindrod (-5.0% YTD). Apart from Grindrod, all of these shares were also among September’s MoM worst-performing shares. These counters bumped Brait, Hyprop, Brimstone, JSE Ltd, Altron, Northam, and Santam out of the September YTD worst-performers list.

Pan African Resources (-35.4% YTD), took back the title of the worst-performing share YTD after giving it up to EOH Holdings in August. Pan African Resources’ share price fell 9.9% MoM in September, weighed down by a lower gold price. This was despite the mining company reporting good FY21 results last month, which showed that its revenue rose c. 35% YoY to US$368.91mn from US$274.11mn posted in FY20, while its diluted EPS stood at ZAc3.87, compared to ZAc2.30, reported in the previous year.

Pan African was followed by three other gold miners – Harmony (-34.5% YTD), DRDGold (-33.2% YTD), and AngloGold Ashanti (-30.6% YTD). Prosus was the fifth worst-performing share (unchanged from the year to end August), with a 25.2% YTD decline, while the aforementioned EOH Holdings (-21.0% YTD) was now in the sixth position. Prosus and Naspers (-17.4% YTD) have been weighed down by the ongoing regulatory crackdown in China and that country’s increasingly interventionist stance. In late August, China said it will limit online gaming by minors to three hours per week and in September it was reported that China’s government would be stepping up efforts to limit online gaming. With its c. 28.9% stake, Prosus is the biggest shareholder of Chinese gaming and internet group, Tencent.

EOH was followed by Naspers, with Anheuser-Busch InBev (-17.2% YTD), ARM (-16.7% YTD), and ongoing underperformer, Ascendis Health (-16.0% YTD), rounding out the ten worst-performing shares YTD. Ascendis’ share price gained 1.6% in September with the company’s shareholders set to vote on Monday (4 October) on a deal from lenders that will likely result in the company going private, and possibly ceasing to exist, according to Business Day. Shareholders must decide on a restructuring plan that will result in the Group giving up its most profitable assets, leaving it with three businesses in SA – a local consumer brands business, its pharmaceutical business, and parts of its medical device business.